Problem 6-7AA (25 minutes)

Part 1

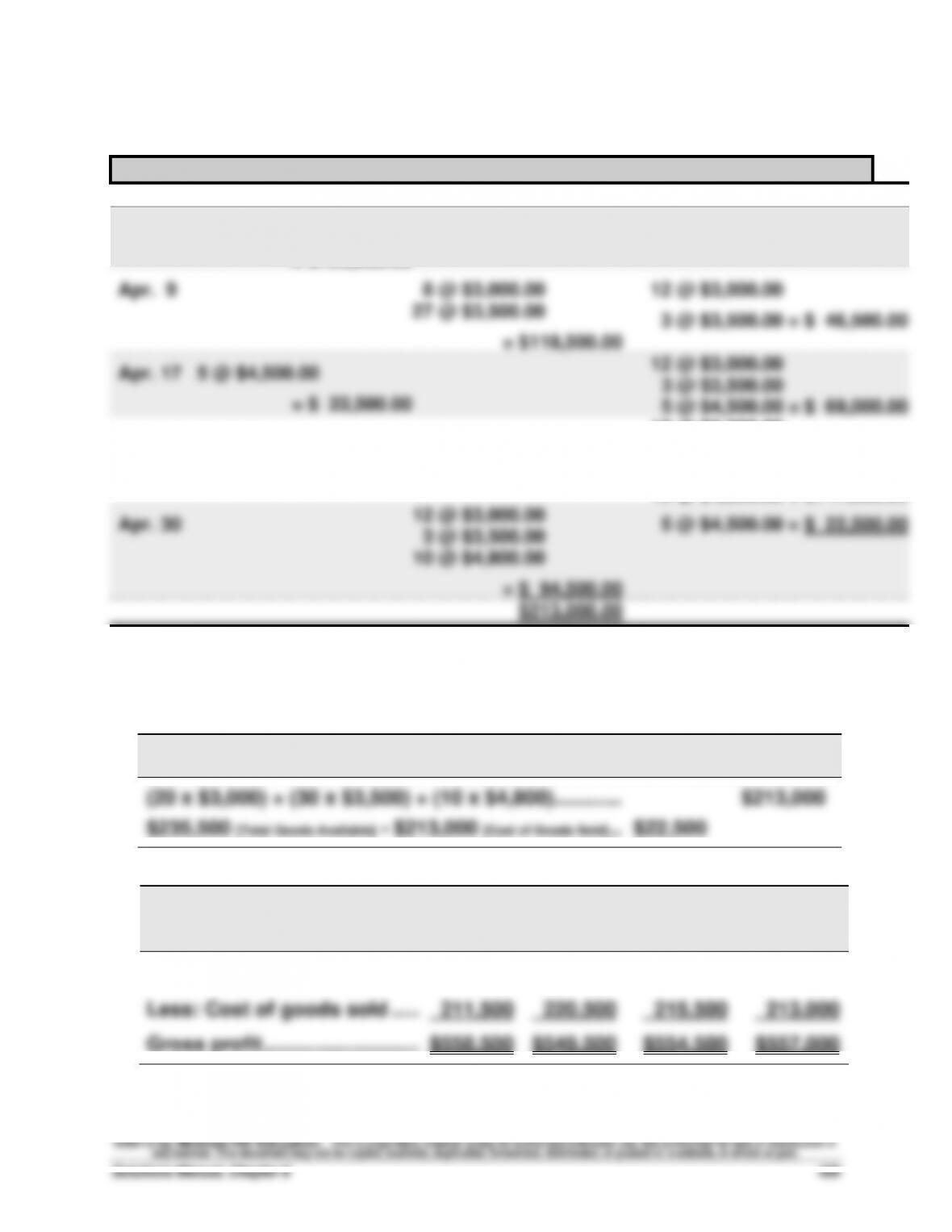

Number and total cost of units available for sale

23,000 units in beginning inventory @ $15 .......................... $ 345,000

30,000 units purchased @ $18 ............................................... 540,000

39,000 units purchased @ $20 ............................................... 780,000

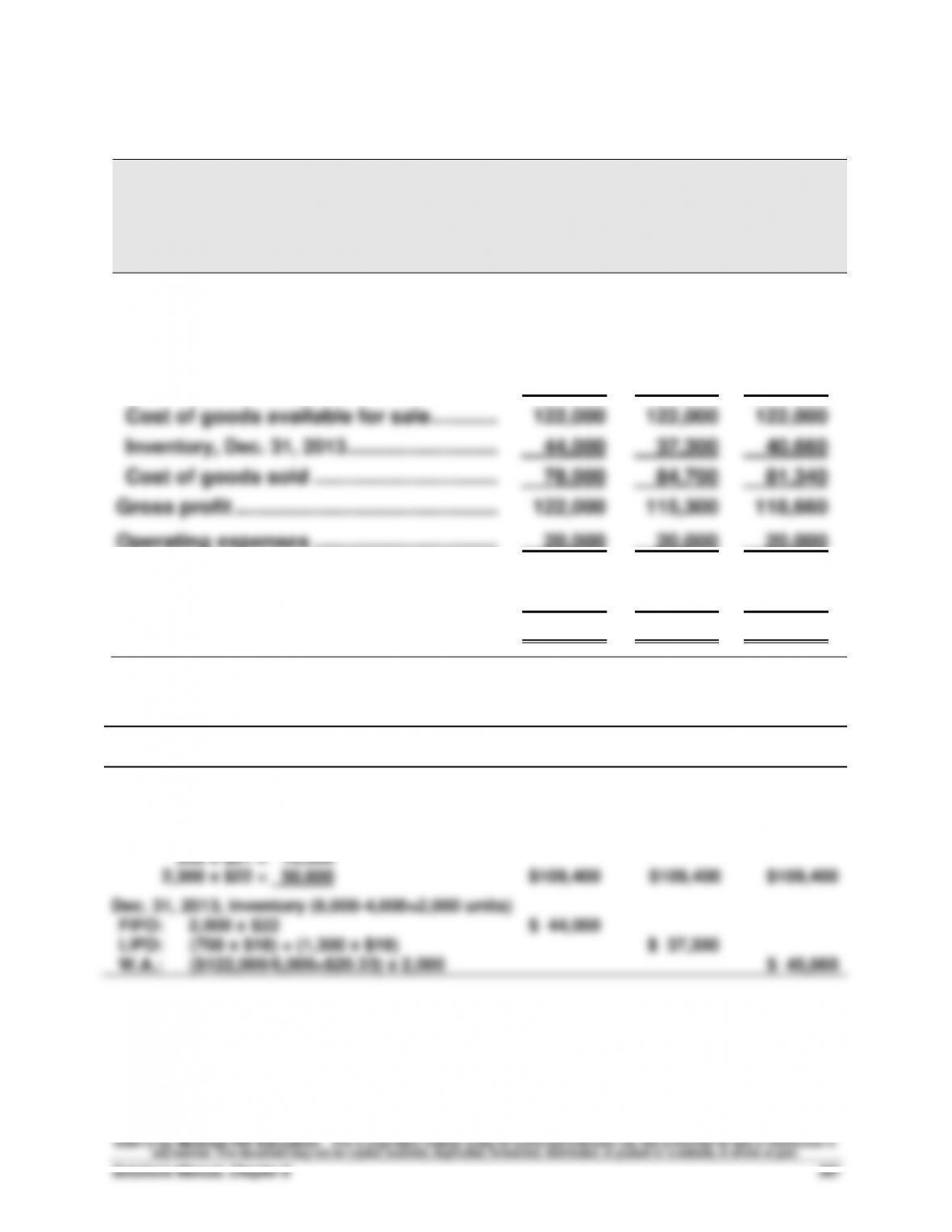

Part 2

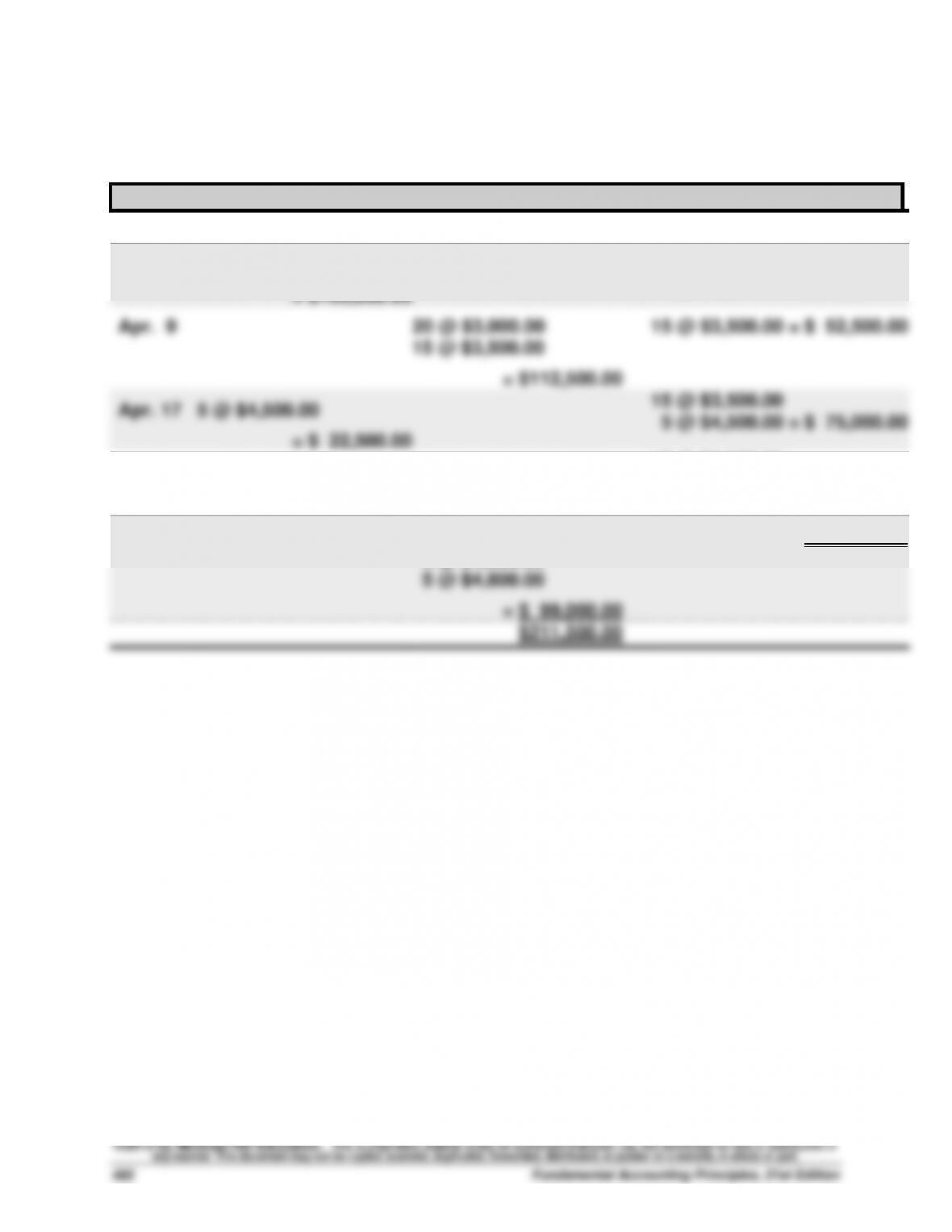

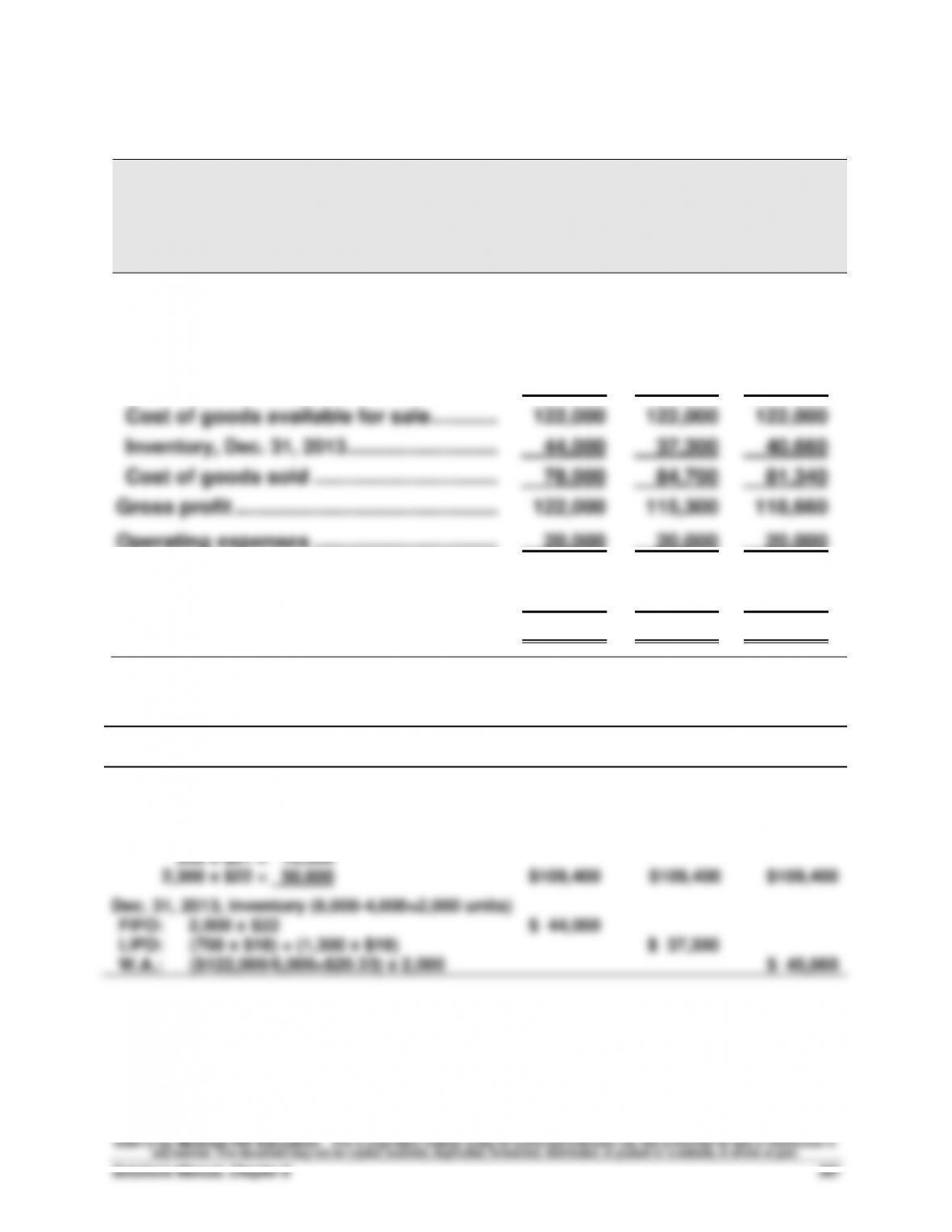

a. FIFO periodic

Total cost of 150,000 units available for sale ...................

Less ending inventory on a FIFO basis

35,000 units @ $26 ...........................................................

5,000 units @ $25 ...........................................................

Cost of goods sold ..............................................................

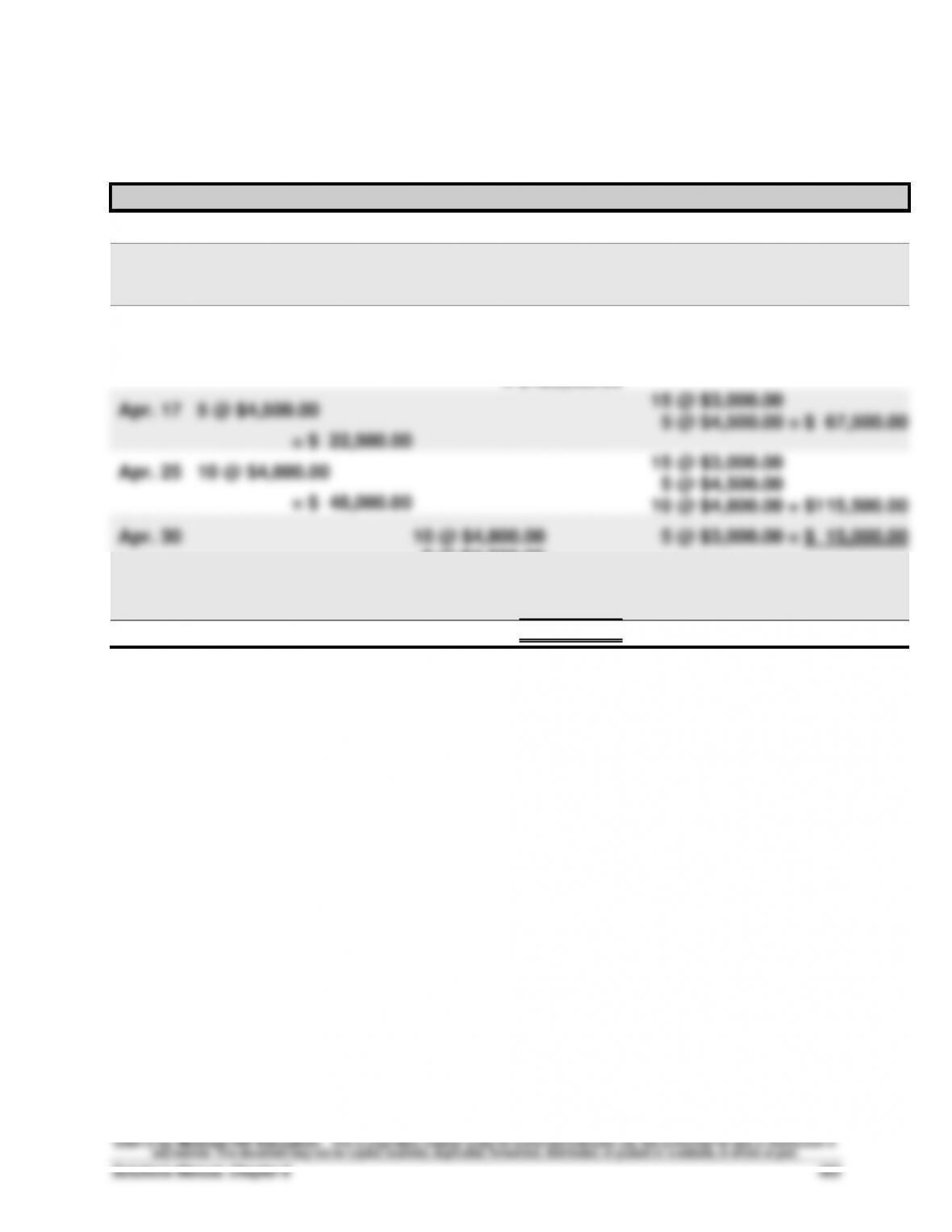

b. LIFO periodic

Total cost of 150,000 units available for sale ...................

Less ending inventory on a LIFO basis

23,000 beginning inventory units @ $15 ........................

17,000 units @ $18 ...........................................................

Cost of goods sold ..............................................................

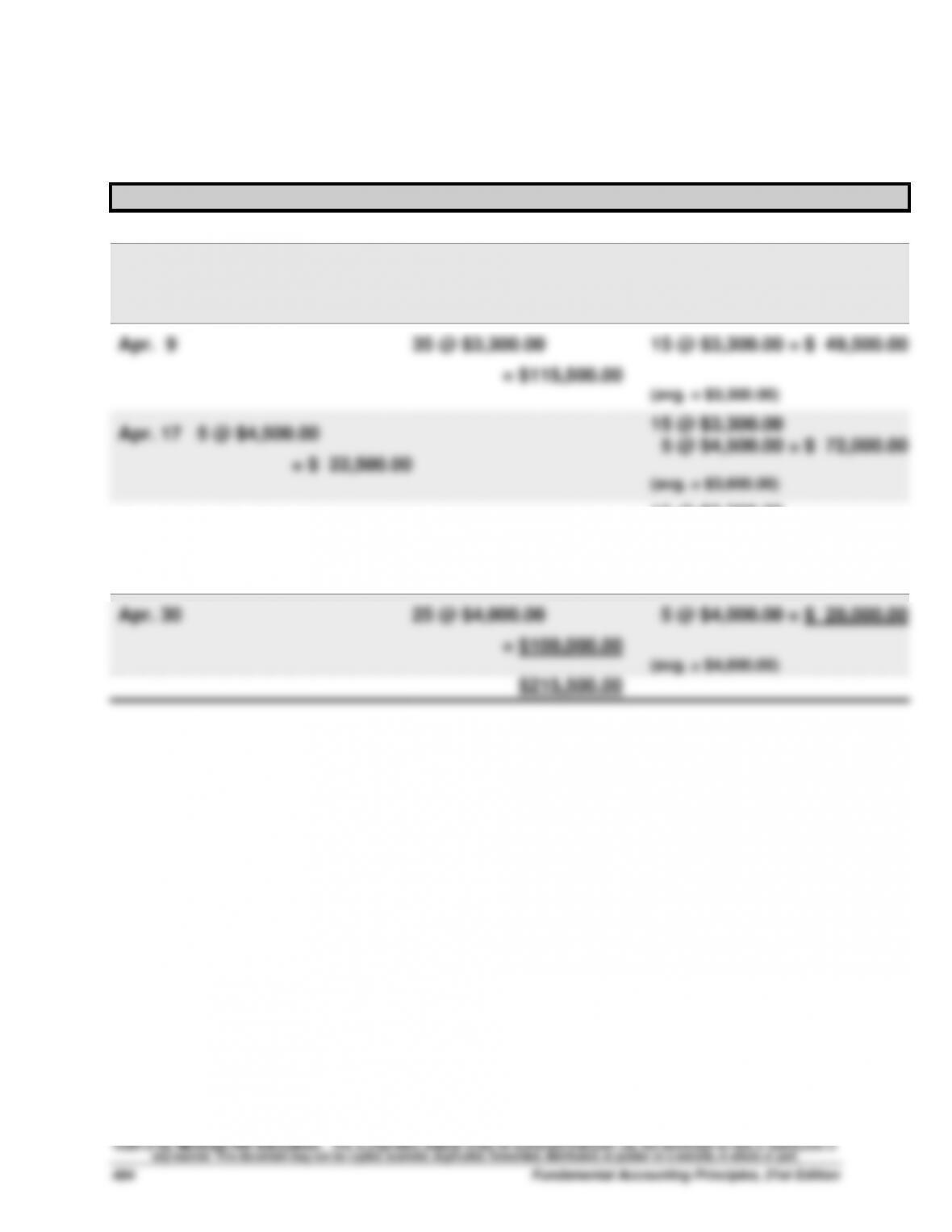

c. Weighted average periodic

Total cost of 150,000 units available for sale ...................

Less ending inventory at weighted average

($3,150,000/150,000) x 40,000 ................................

Cost of goods sold ..............................................................