Fundamental Accounting Principles, 21st Edition

Problem 23-3A (Continued)

Part 3

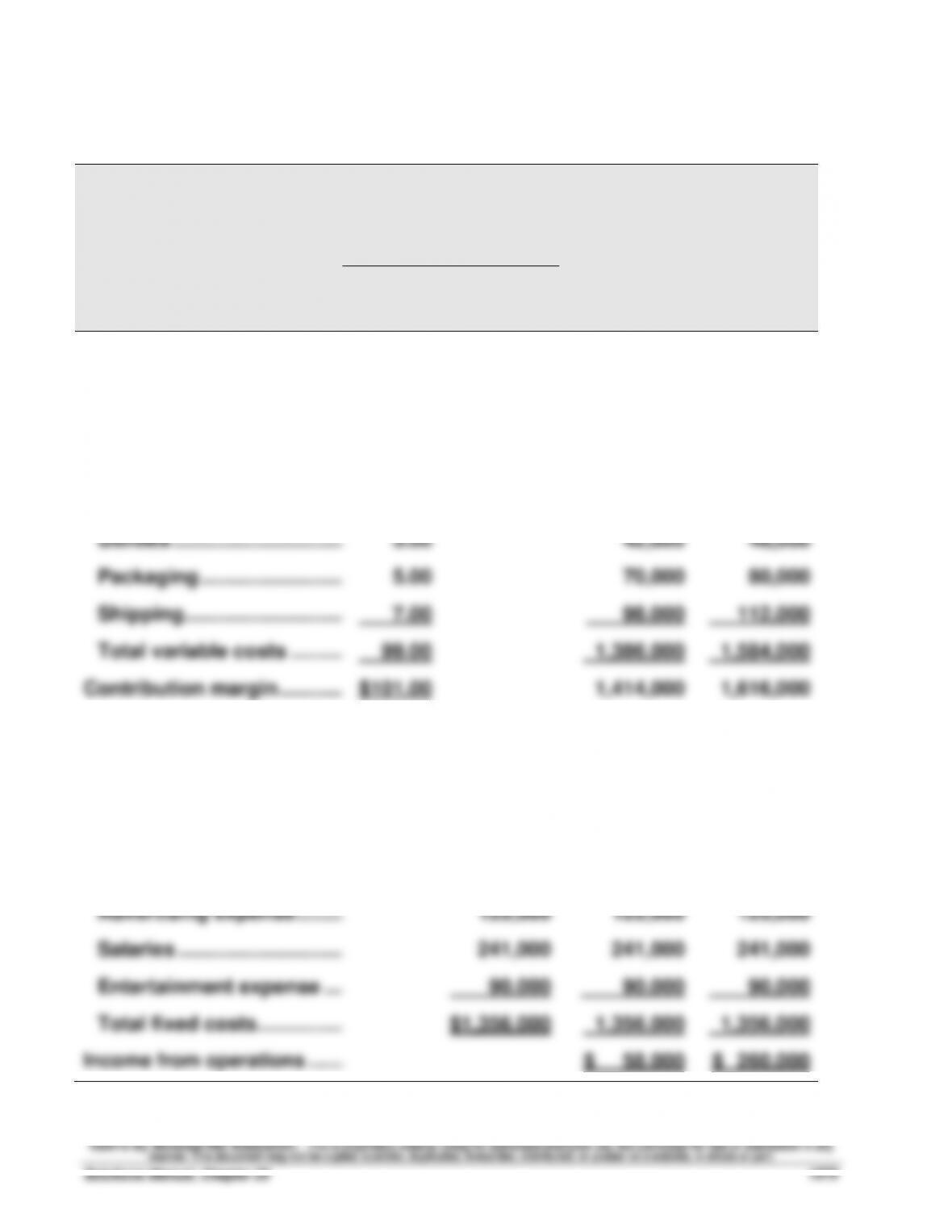

Operating income increase for a 15,000 to 18,000 unit sales increase

Possible sales (units) ...............................................................

Contribution margin per unit ...................................................

Total contribution margin ........................................................

Less: Fixed costs ................................................................

Potential operating income .....................................................

vs. Budgeted income for 2013 ................................................

Increase .....................................................................................

*Alternate solution format

Unit increase ...........................................................................................

Contribution margin per unit ................................................................

Increase in contribution margin .............................................................

Since there is no increase in fixed costs, the expected increase in operating

income is the same $303,000.

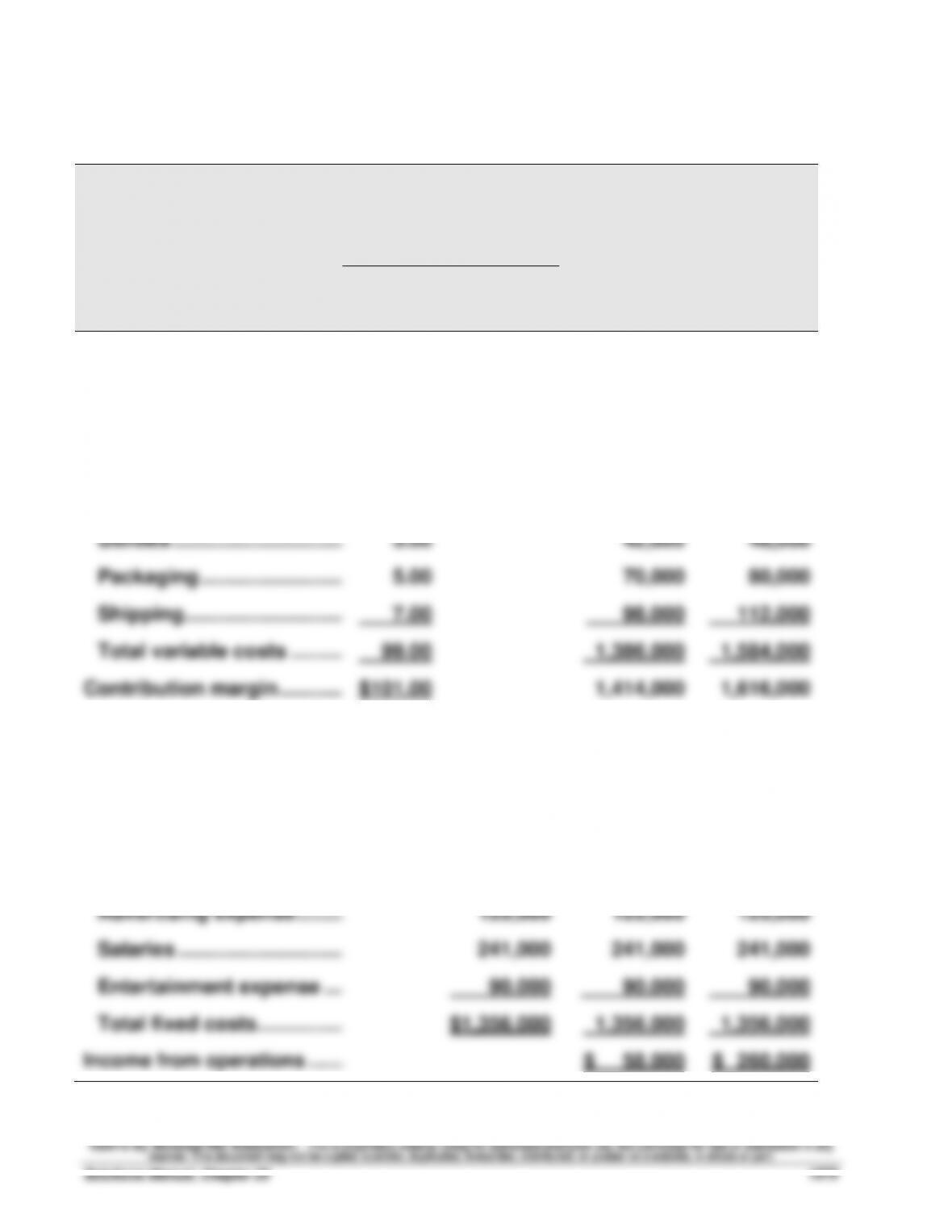

Part 4

Operating income (loss) at 12,000 units

Possible sales (units) ...............................................................

Contribution margin per unit ...................................................

Total contribution margin ........................................................

Less: Fixed costs ................................................................

Potential operating loss ...........................................................