Fundamental Accounting Principles, 21st Edition

8. Standard costs are used to establish a basis to assess the reasonableness of actual

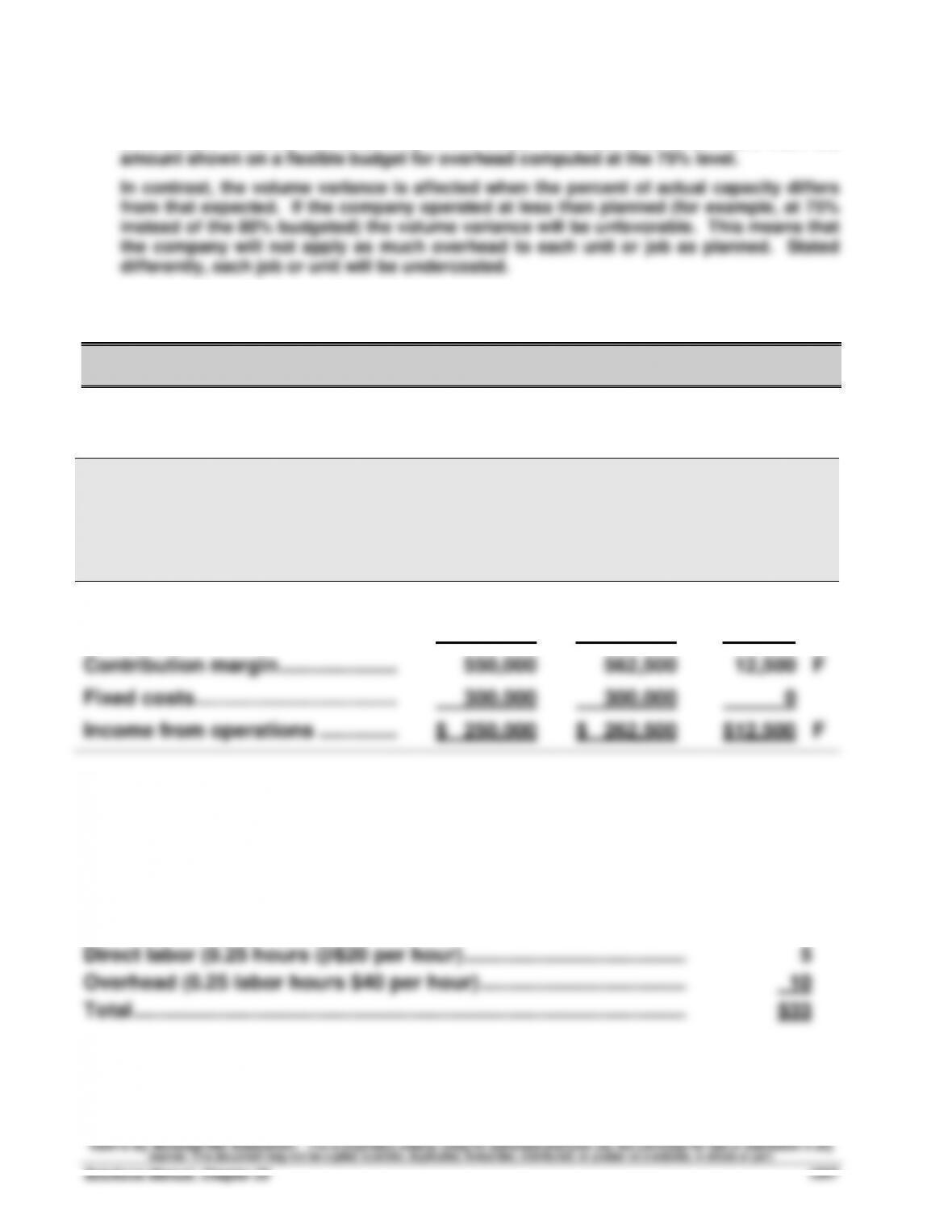

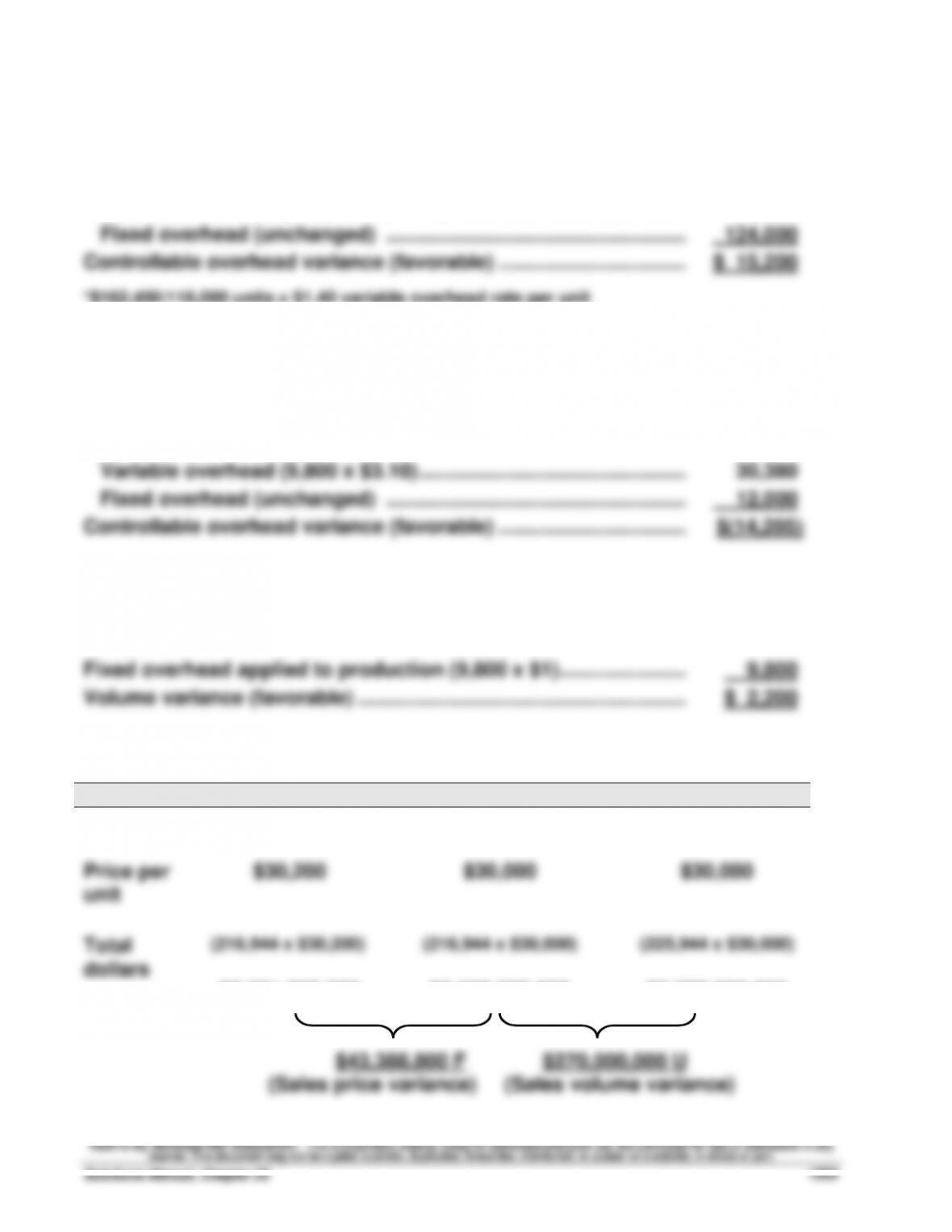

9. An overhead volume variance is the difference between (a) the amount of (fixed)

overhead that would have been budgeted at the actual operating level achieved during

10. A predetermined standard overhead rate is a measure computed and used in a standard

cost system to assign overhead costs to products. Before the period begins, budgeted

total overhead costs (variable and fixed) at the expected volume are divided by the

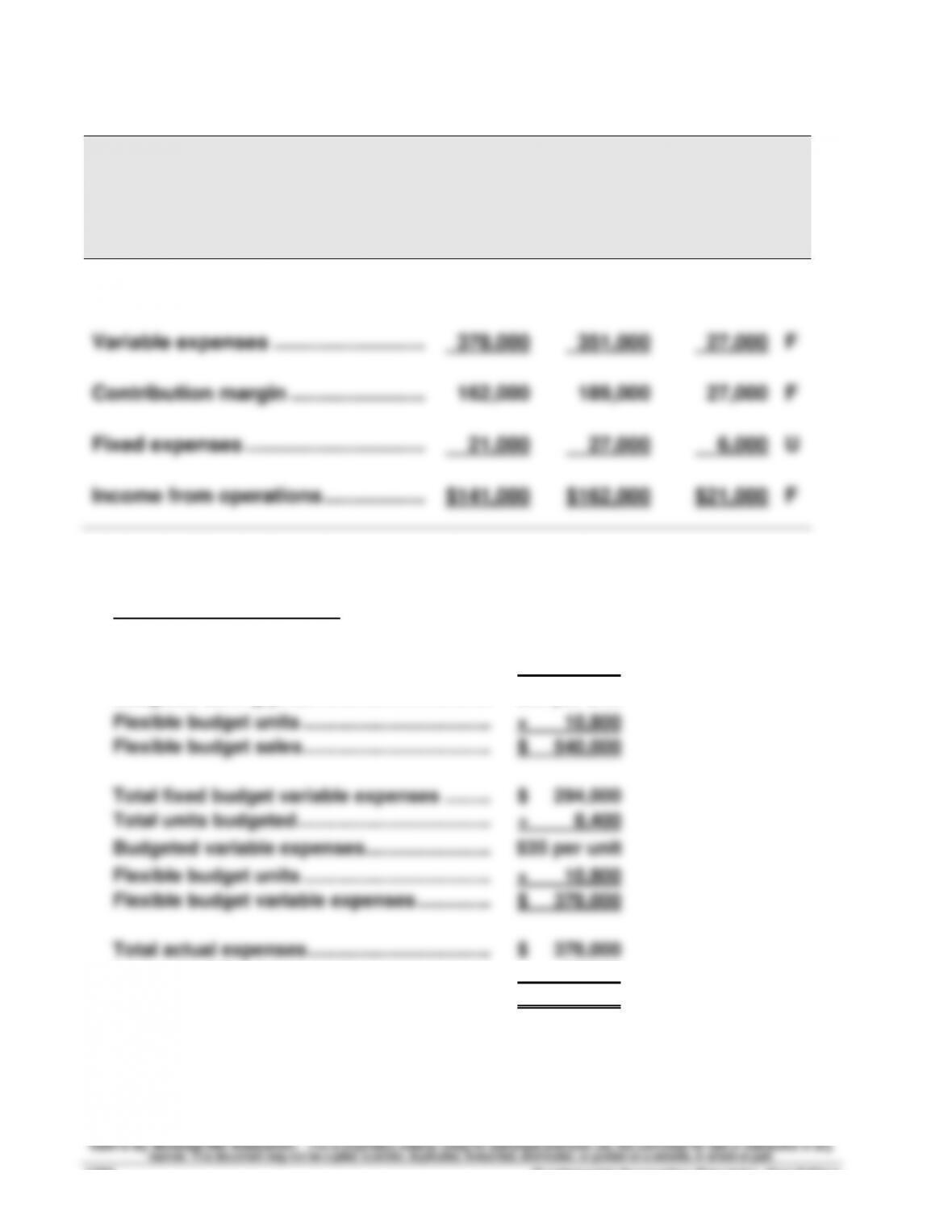

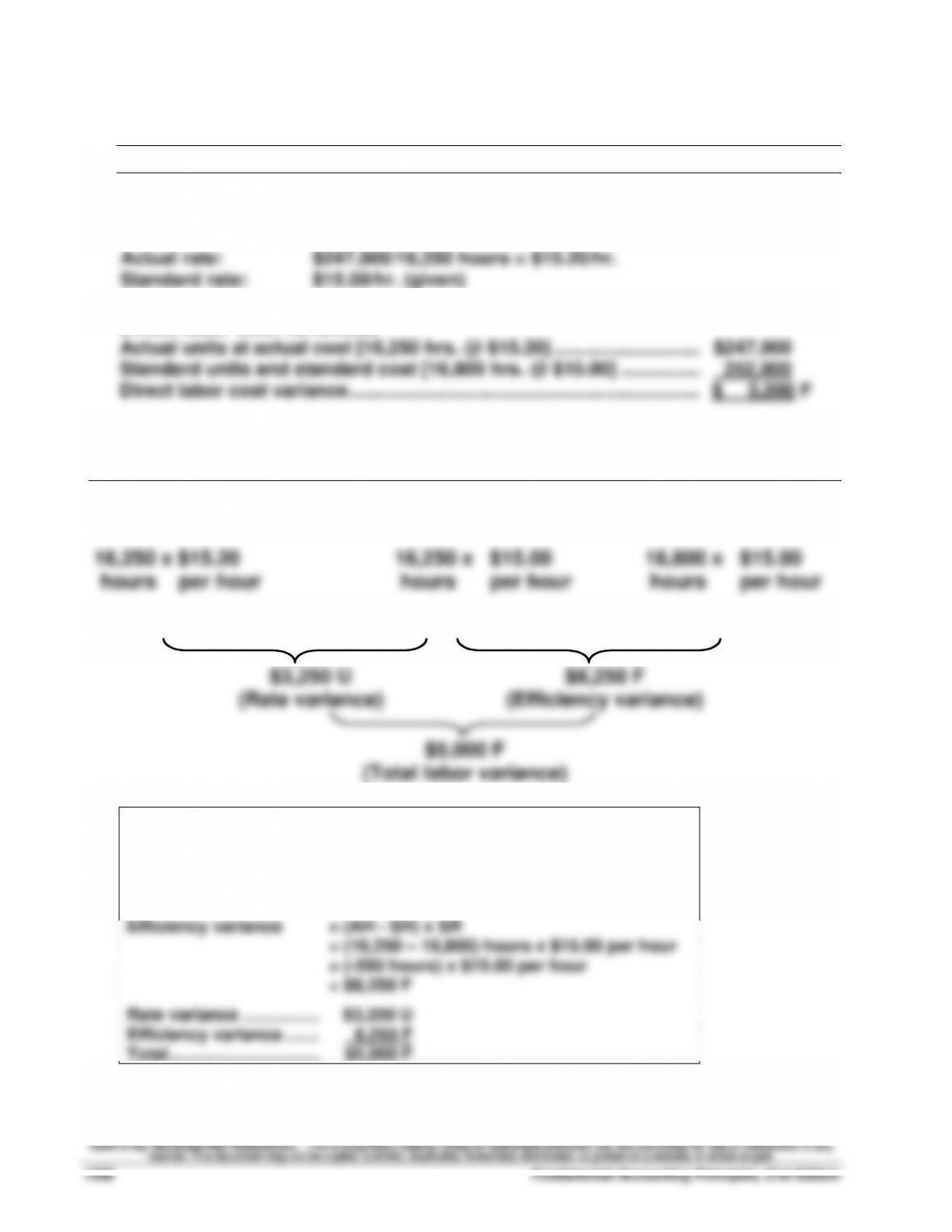

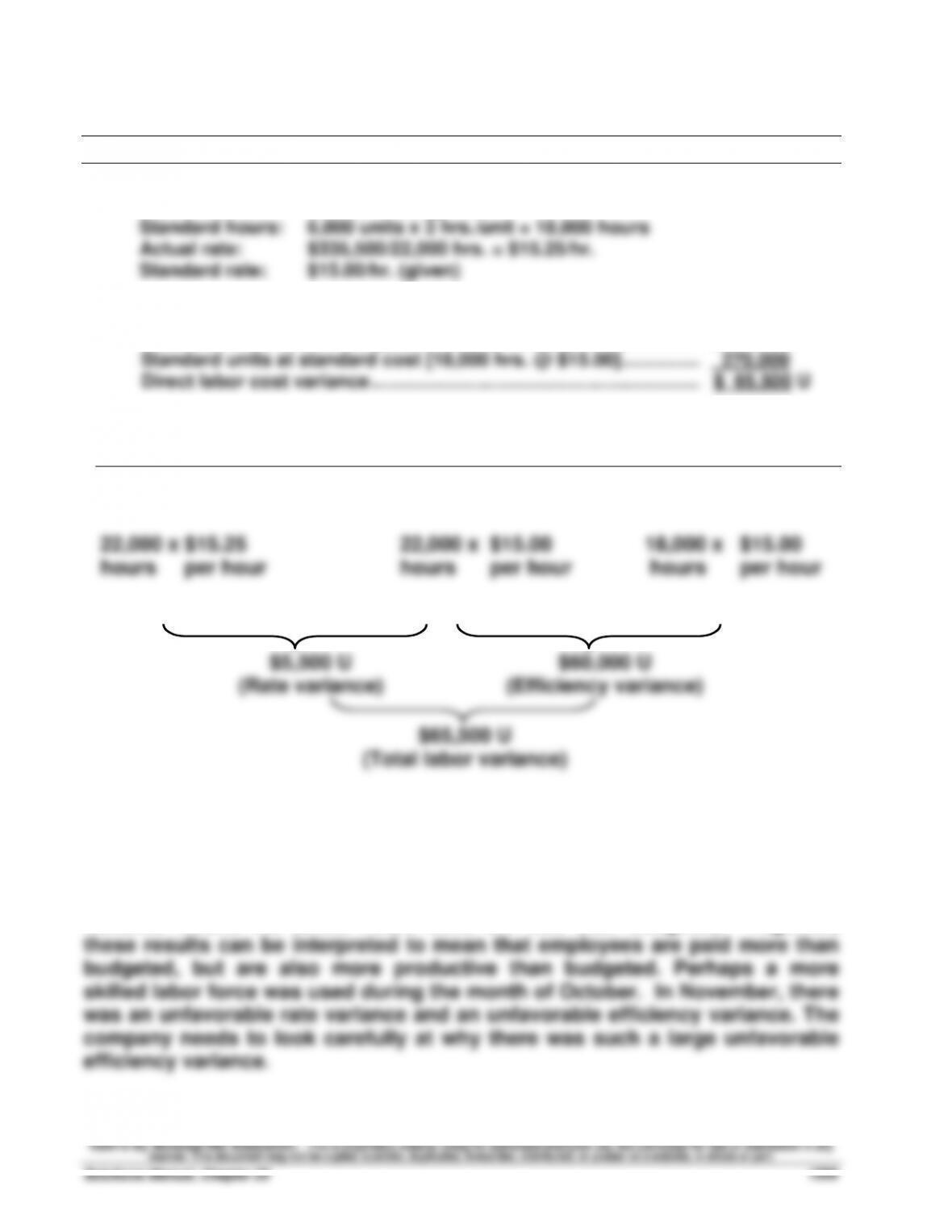

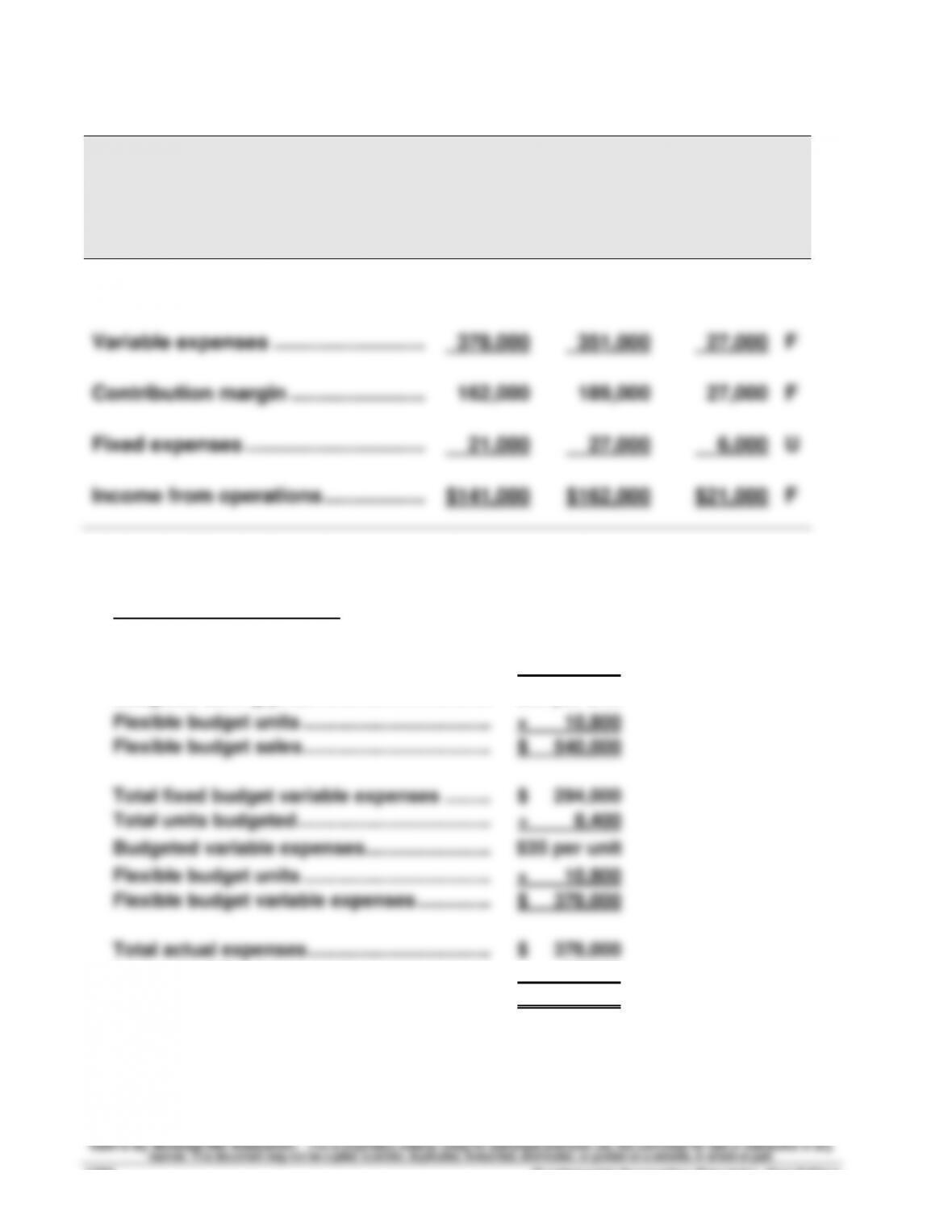

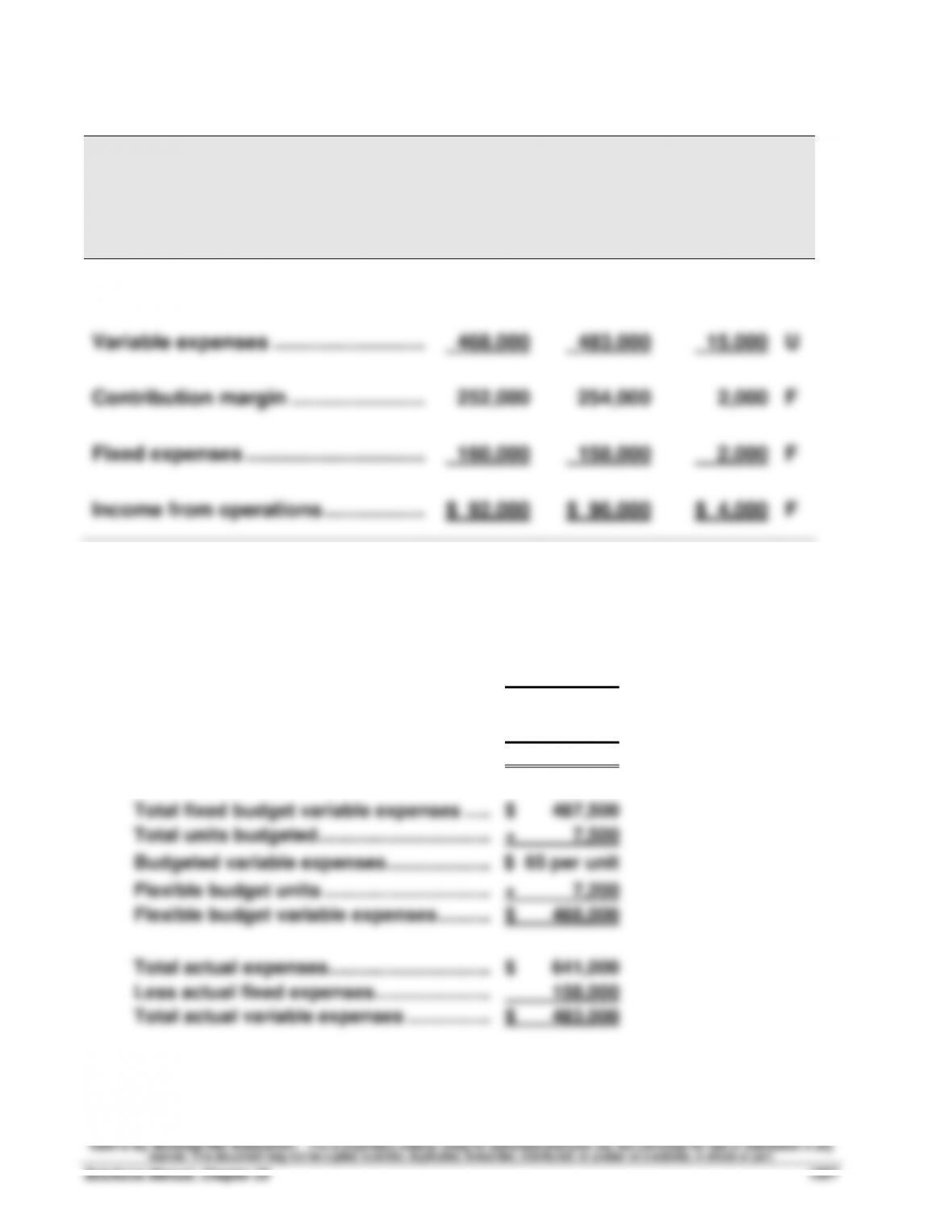

11. In general, variance analysis is said to provide information about price and quantity

variances.

12. A controllable variance is the difference between (a) the total overhead cost actually

incurred in the period and (b) the total overhead cost that would have been budgeted at

13. Standard costs provide a basis for evaluating actual performance. Summary

information comparing actual costs to budgeted costs is captured and reported in a

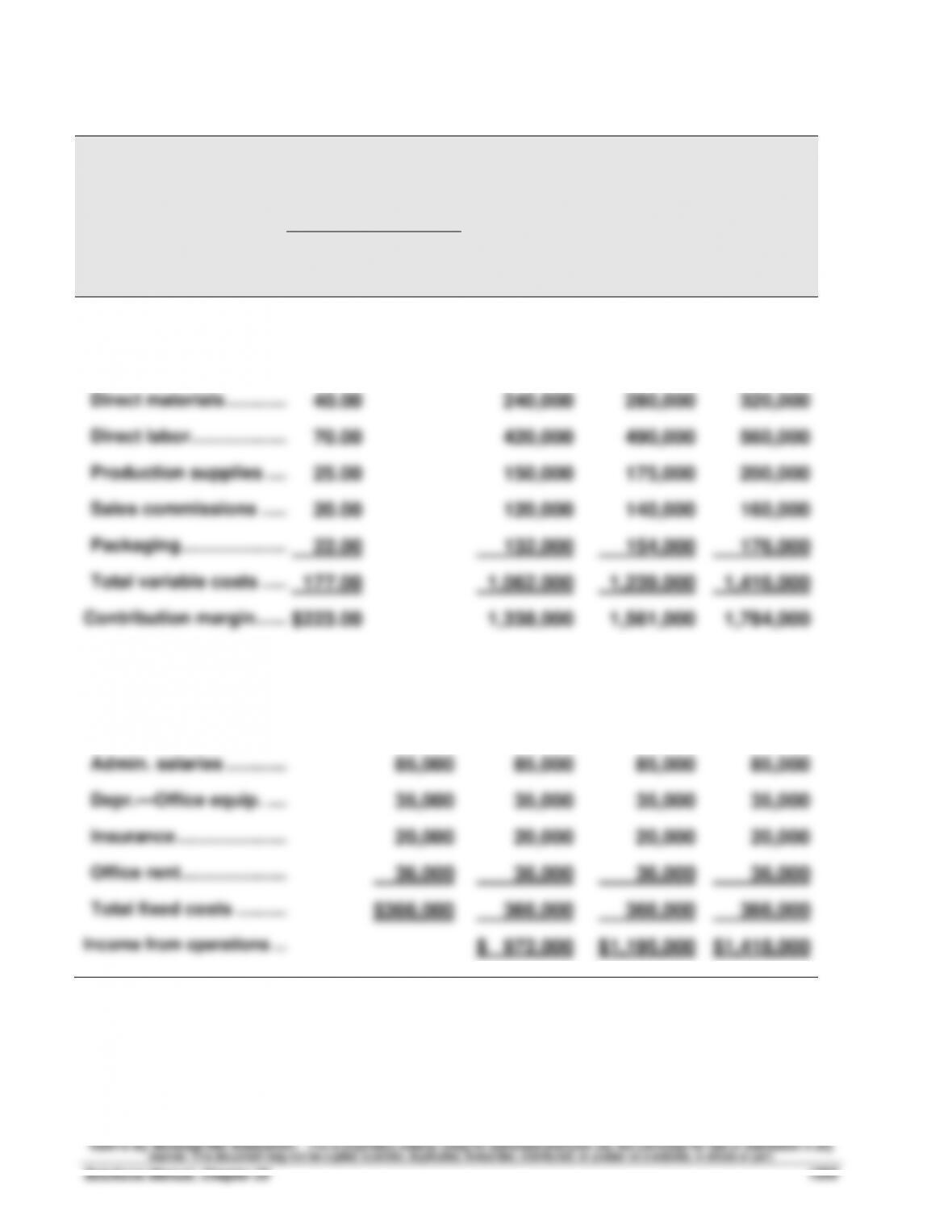

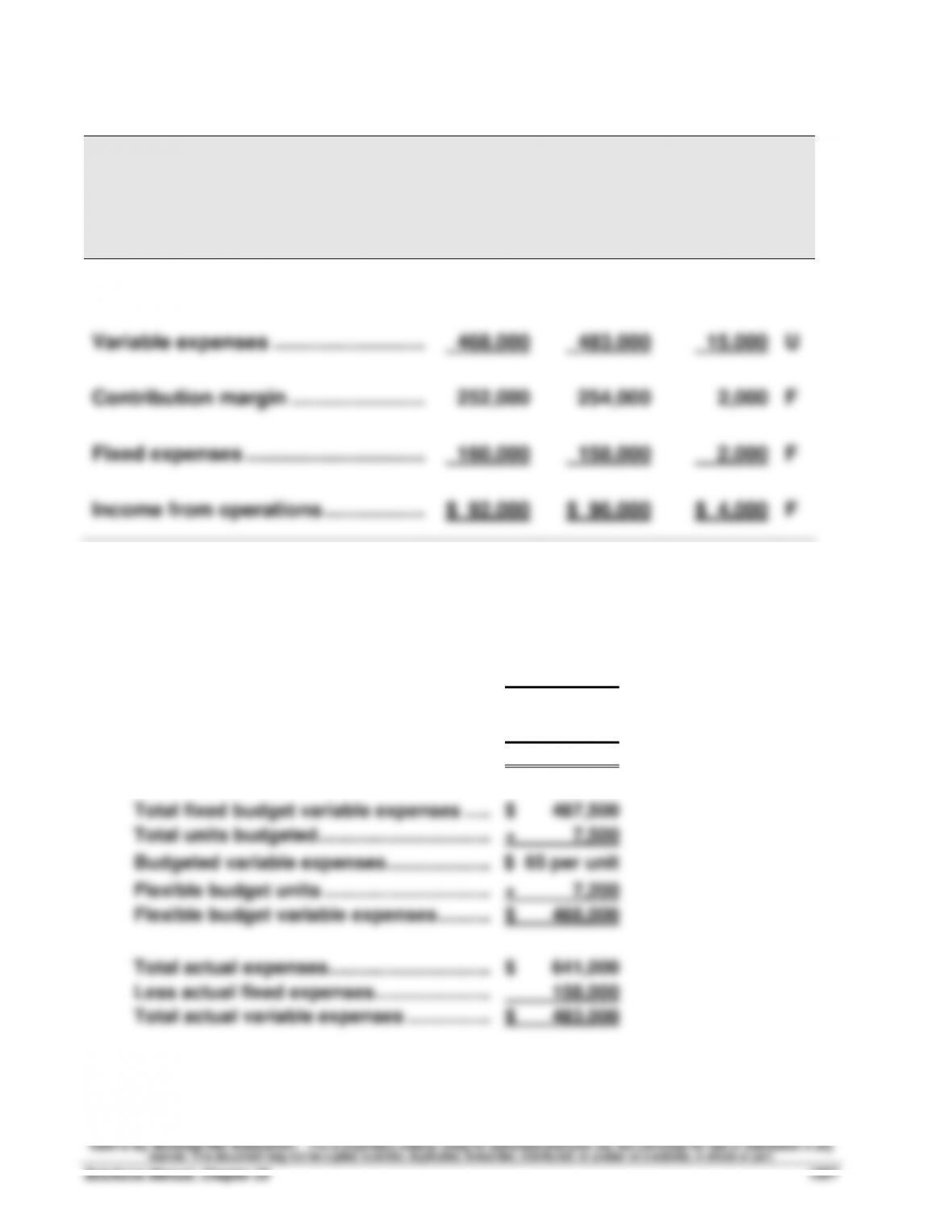

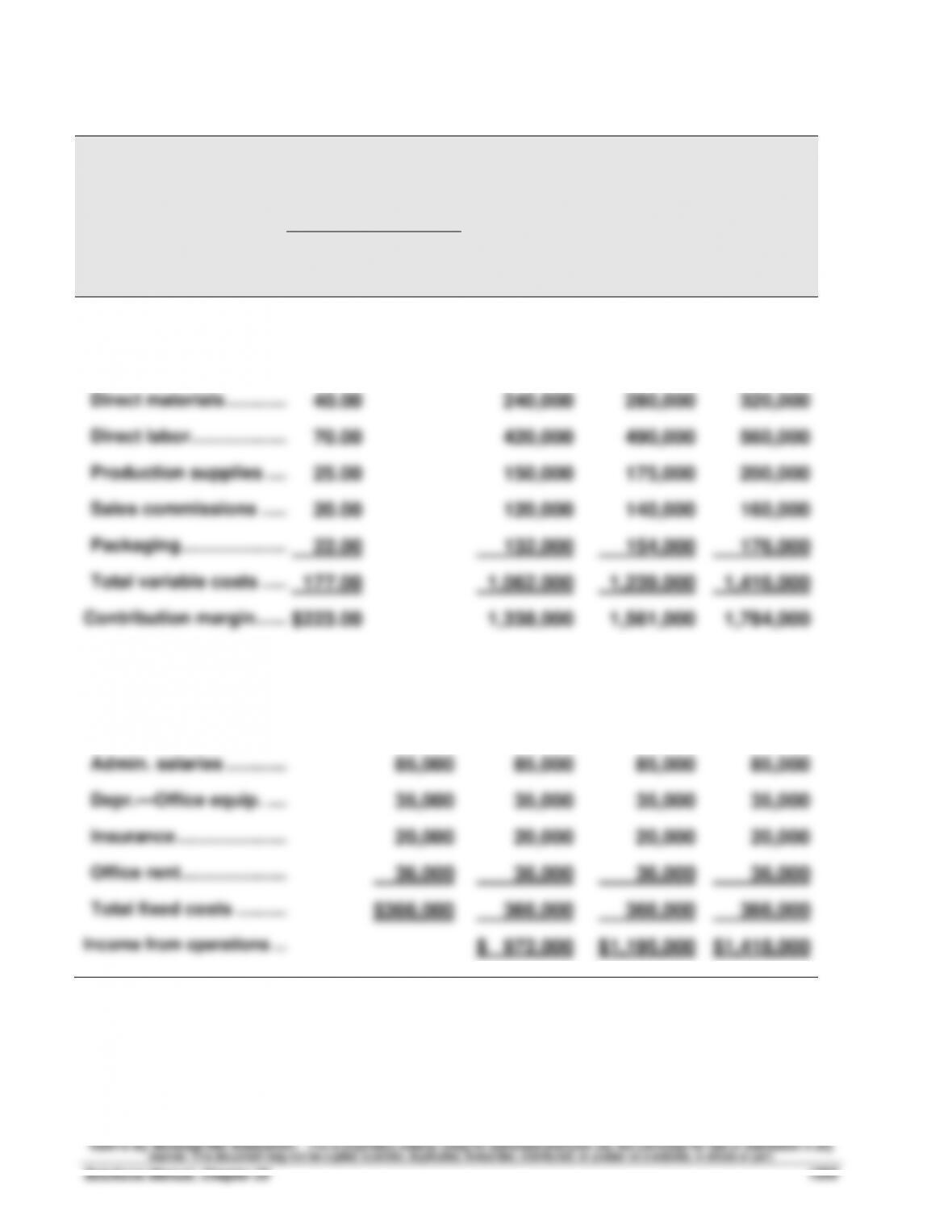

14. Before a period starts, the manager can prepare flexible budgets for the various types of

snowmobiles. Then, she could estimate both the best and worst case scenarios for the

15. Apple schedules appointments with customers to service Apple computers, iPhones,

iPods etc. These service appointments require standard hours at standard rates to