Problem 2-2A (90 minutes)

Part 1

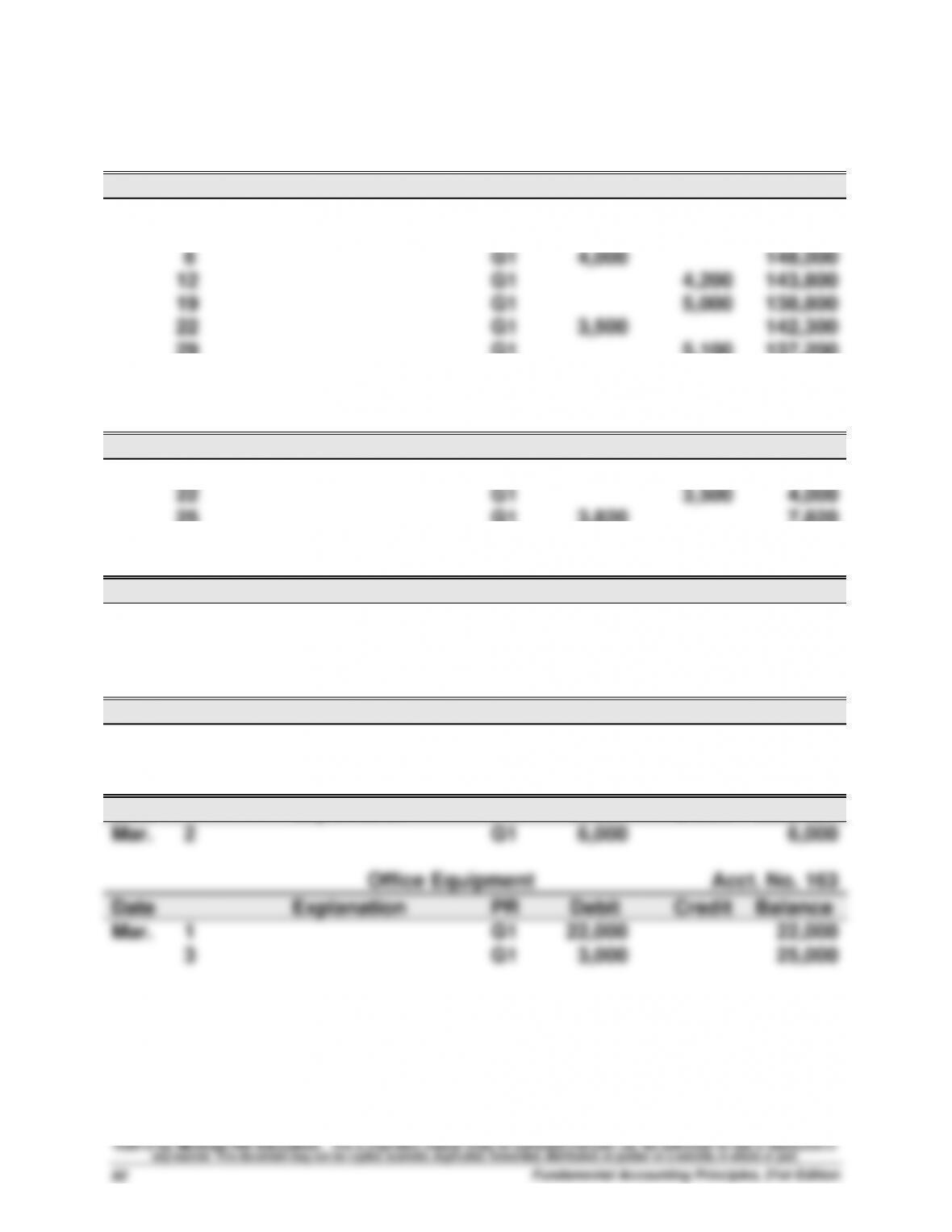

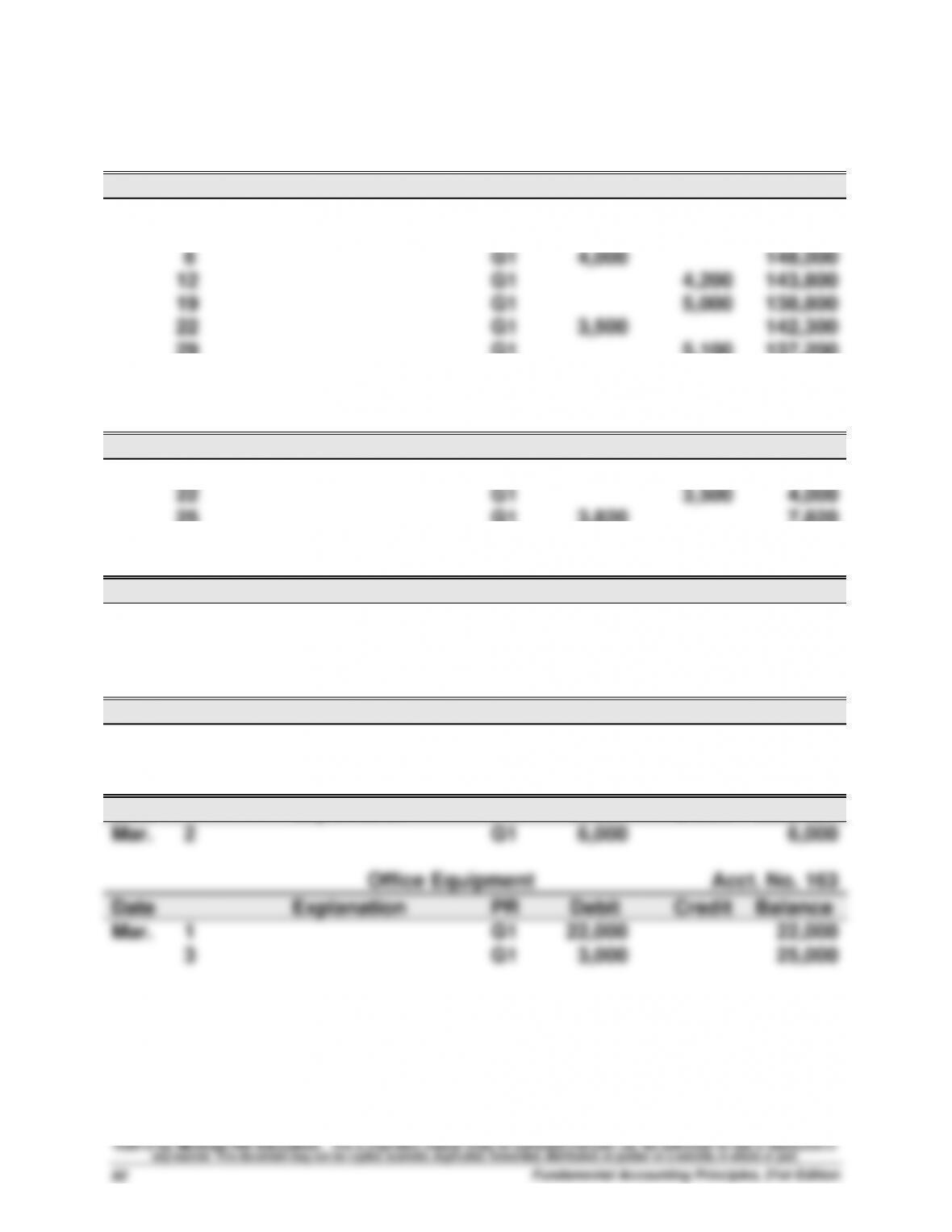

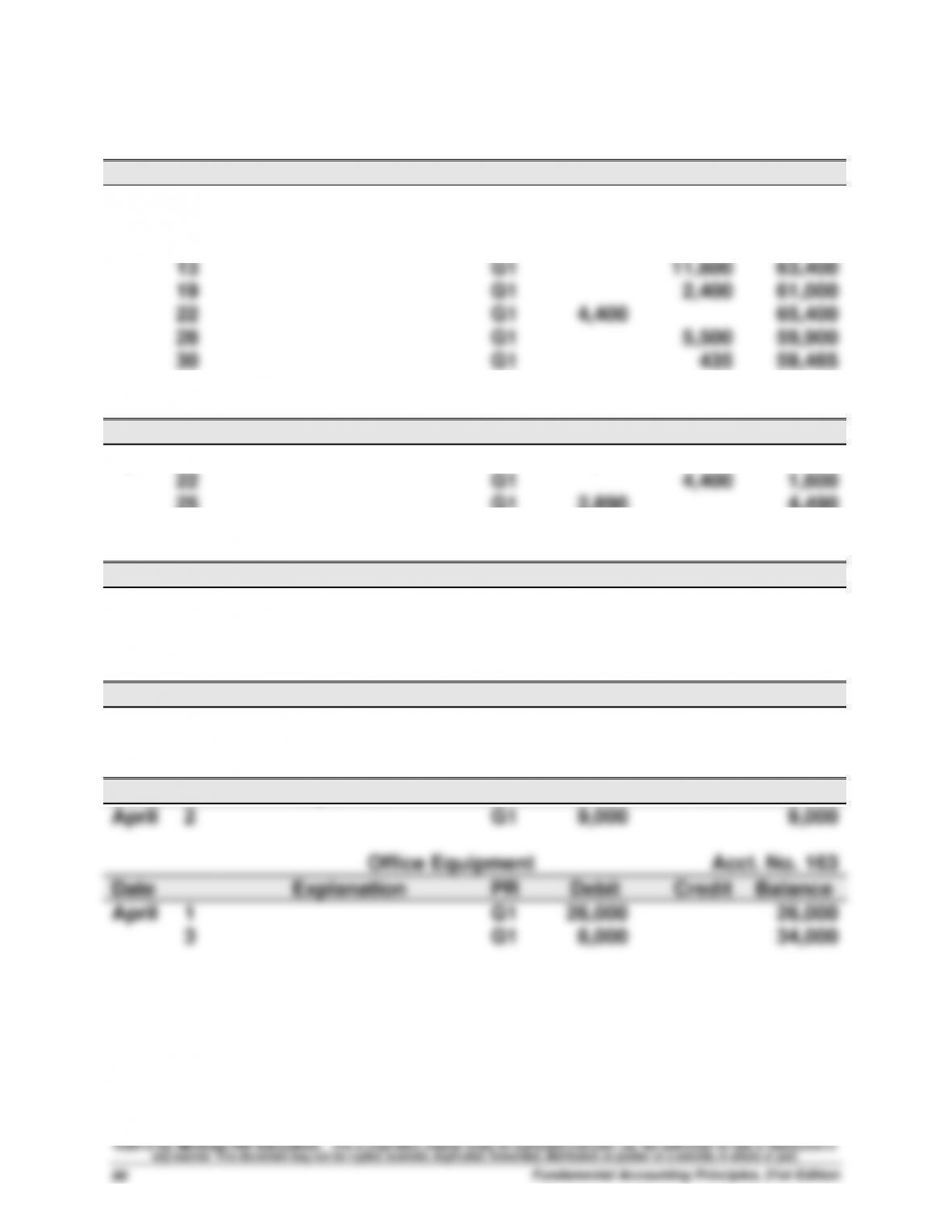

Mar. 1 Cash............................................................. 101 150,000

Office Equipment ........................................ 163 22,000

D. Brooks, Capital ............................... 301 172,000

Owner invested cash and equipment.

9 Accounts Receivable ................................. 106 7,500

Services Revenue ............................... 403 7,500

Billed client for completed work.

12 Accounts Payable ...................................... 201 4,200

Cash ..................................................... 101 4,200

Paid balance due on account.

29 D. Brooks, Withdrawals ............................. 302 5,100

Cash ..................................................... 101 5,100

Owner withdrew cash for personal use.

30 Office Supplies ........................................... 124 600

Accounts Payable ............................... 201 600

Purchased supplies on account.