Problem 18-2B (60 minutes)

Instructor note: There can be more than one right answer to this problem. Students can

experience some challenges in completing this assignment. Their reaction is normal and a part of

the process in learning how difficult it is to make estimates of opportunity costs.

A good answer to this problem should show estimates for:

A good answer would also show that purchasing a higher-quality product

component at a greater cost will result, under the conditions specified in

this case, in losing money in the long run. Specifically, the answer should

appear similar to the following:

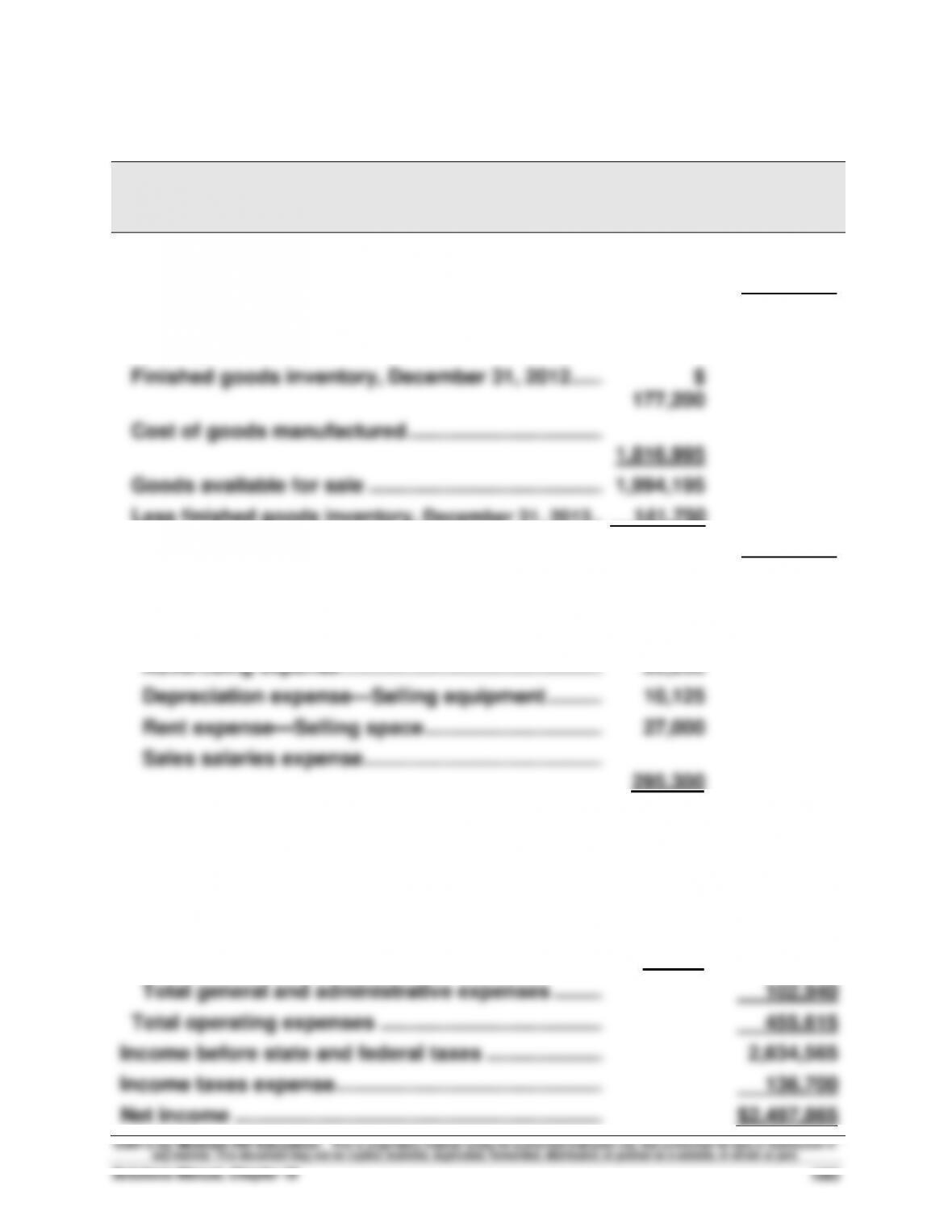

From the data available in Decision Maker, the company saves $30,000,

computed as 1,000 motorcycles multiplied by $30 per seat ($145 - $115).

(2) Estimates must be made of opportunity costs (and revenues):

(3) Recommend to buy from Supplier (B) based on the following: