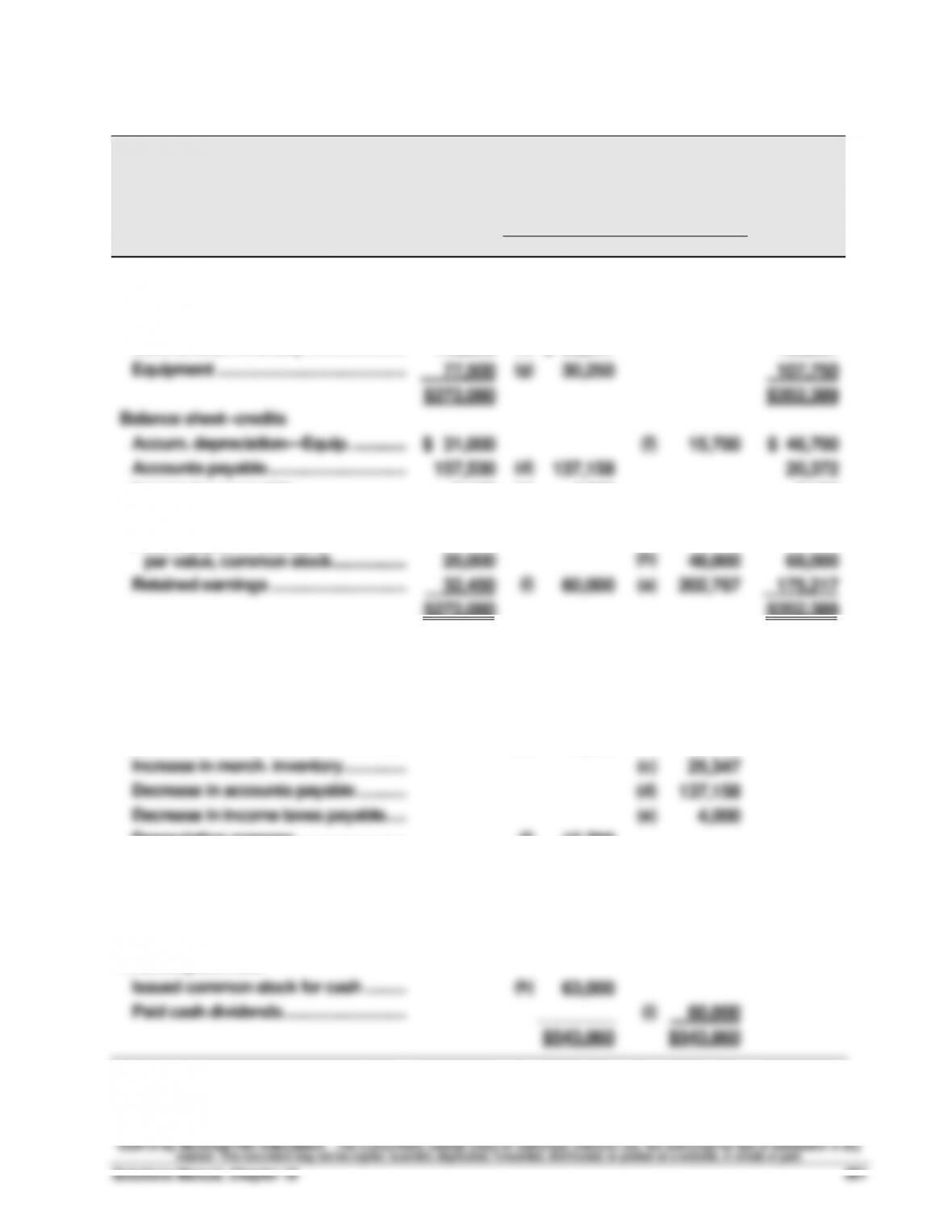

Fundamental Accounting Principles, 21st Edition

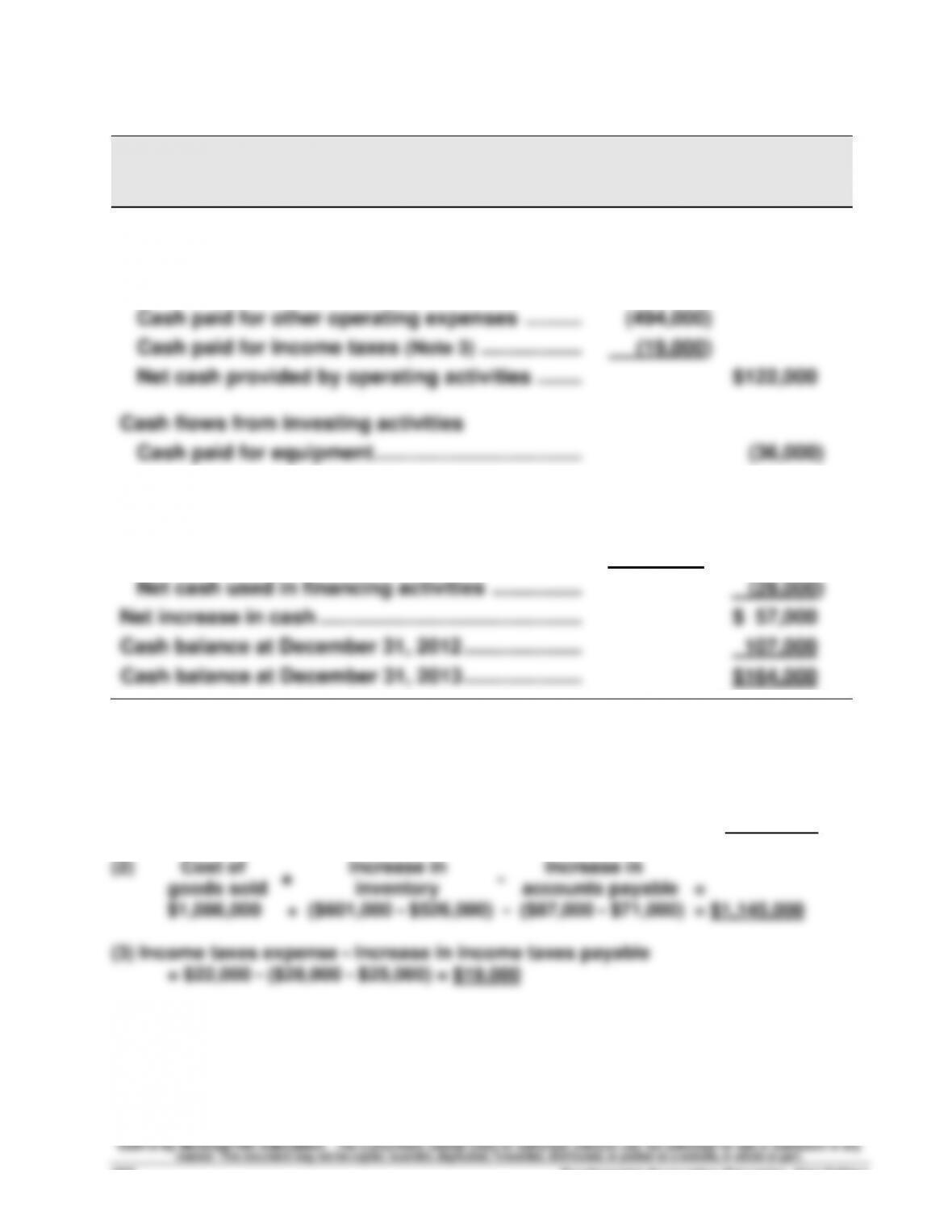

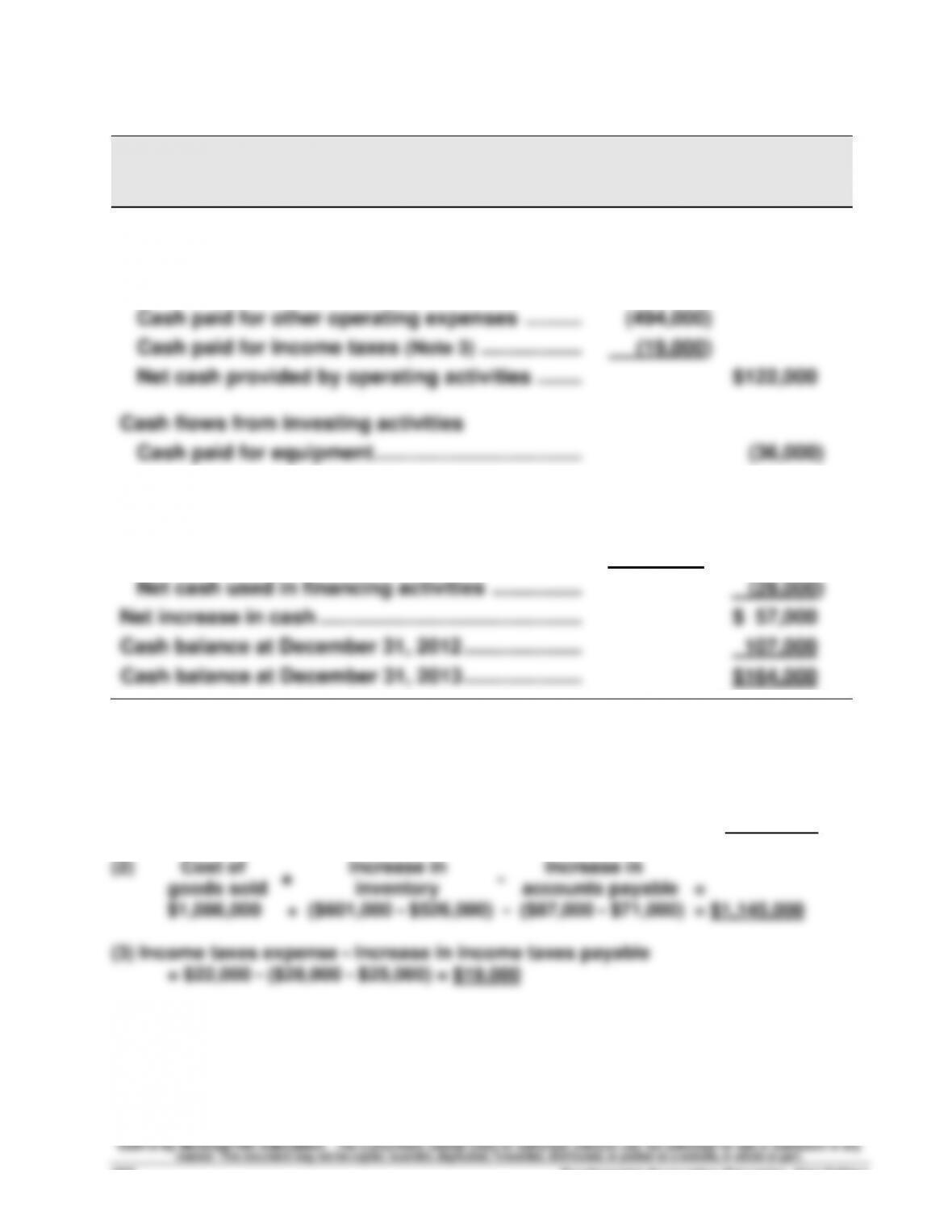

Problem 16-2BA (Concluded)

For Year Ended December 31, 2013

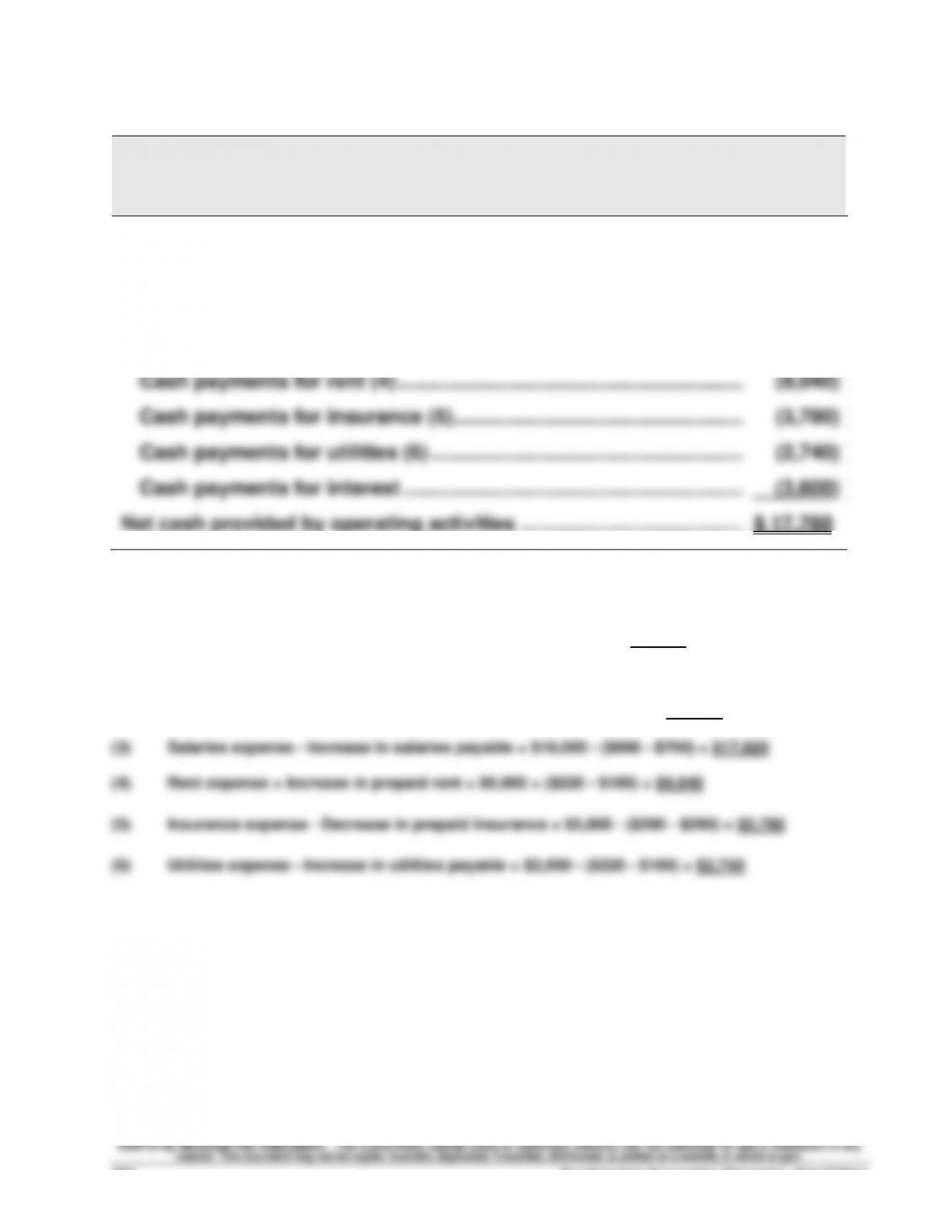

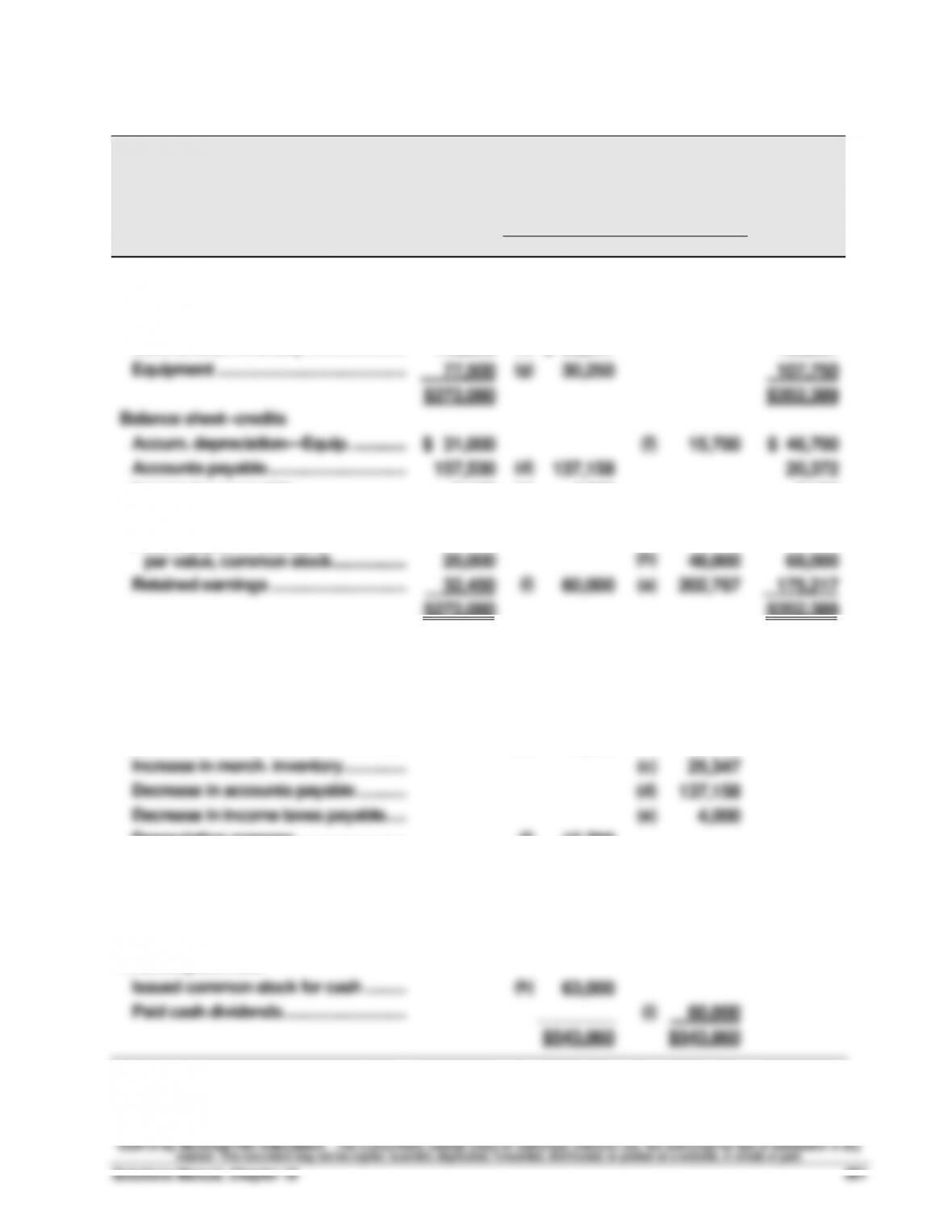

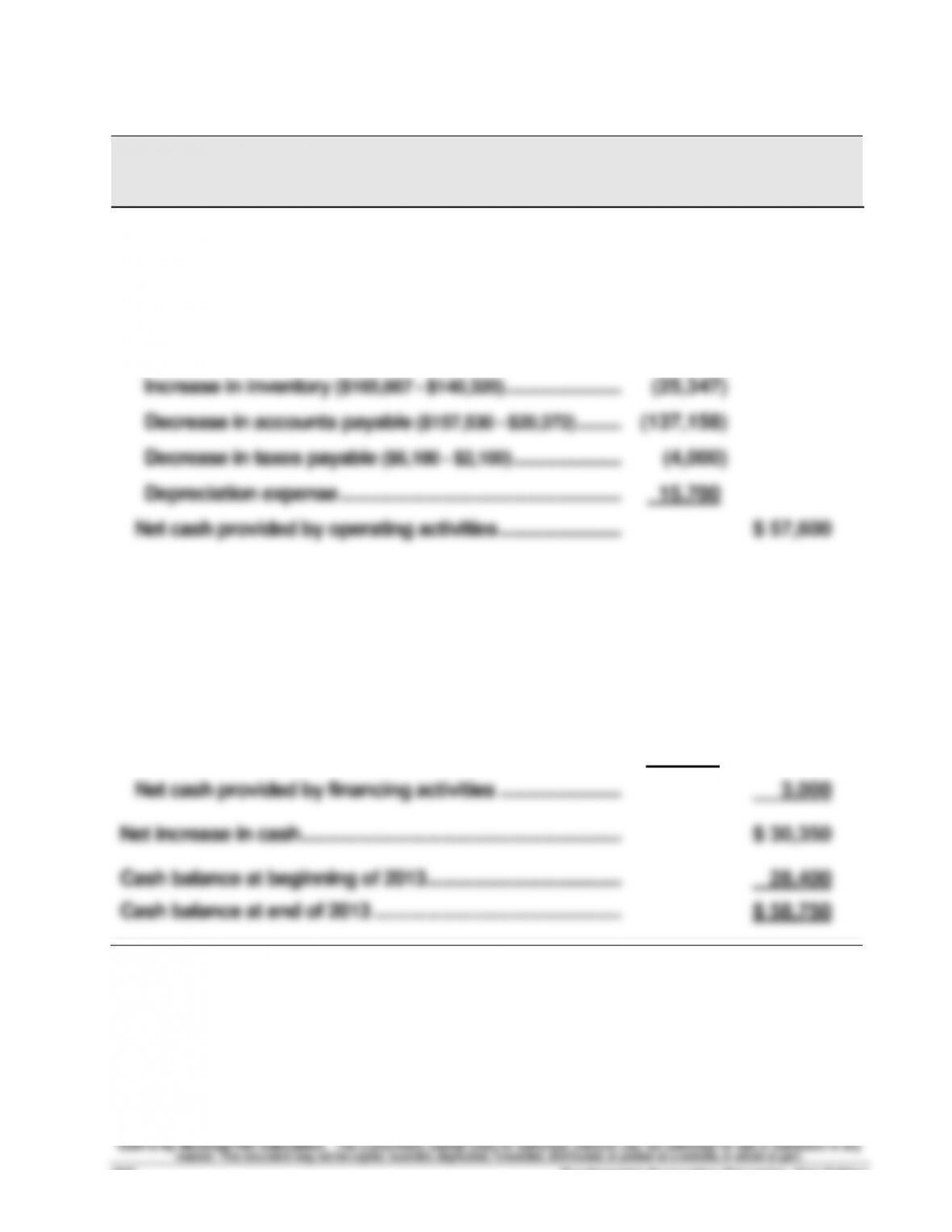

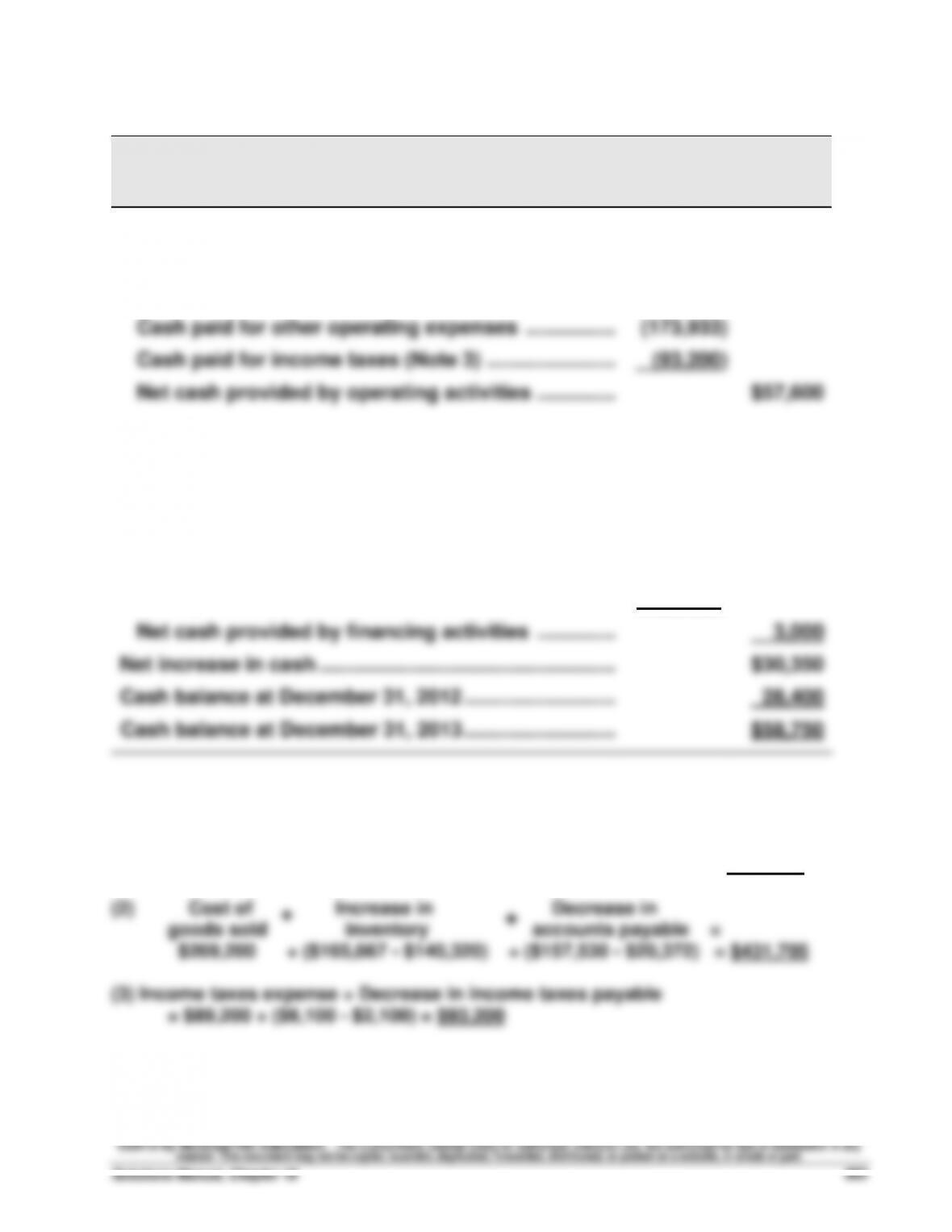

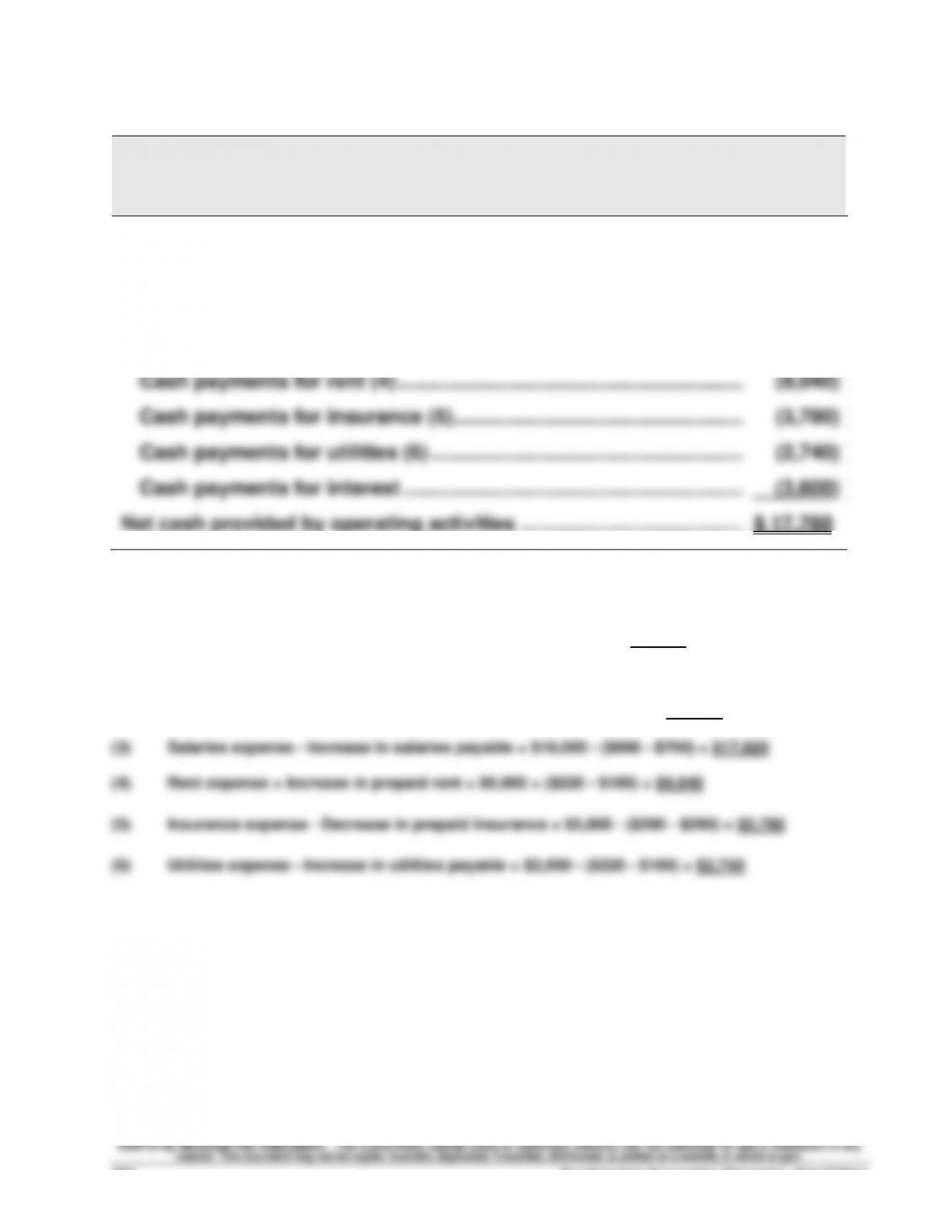

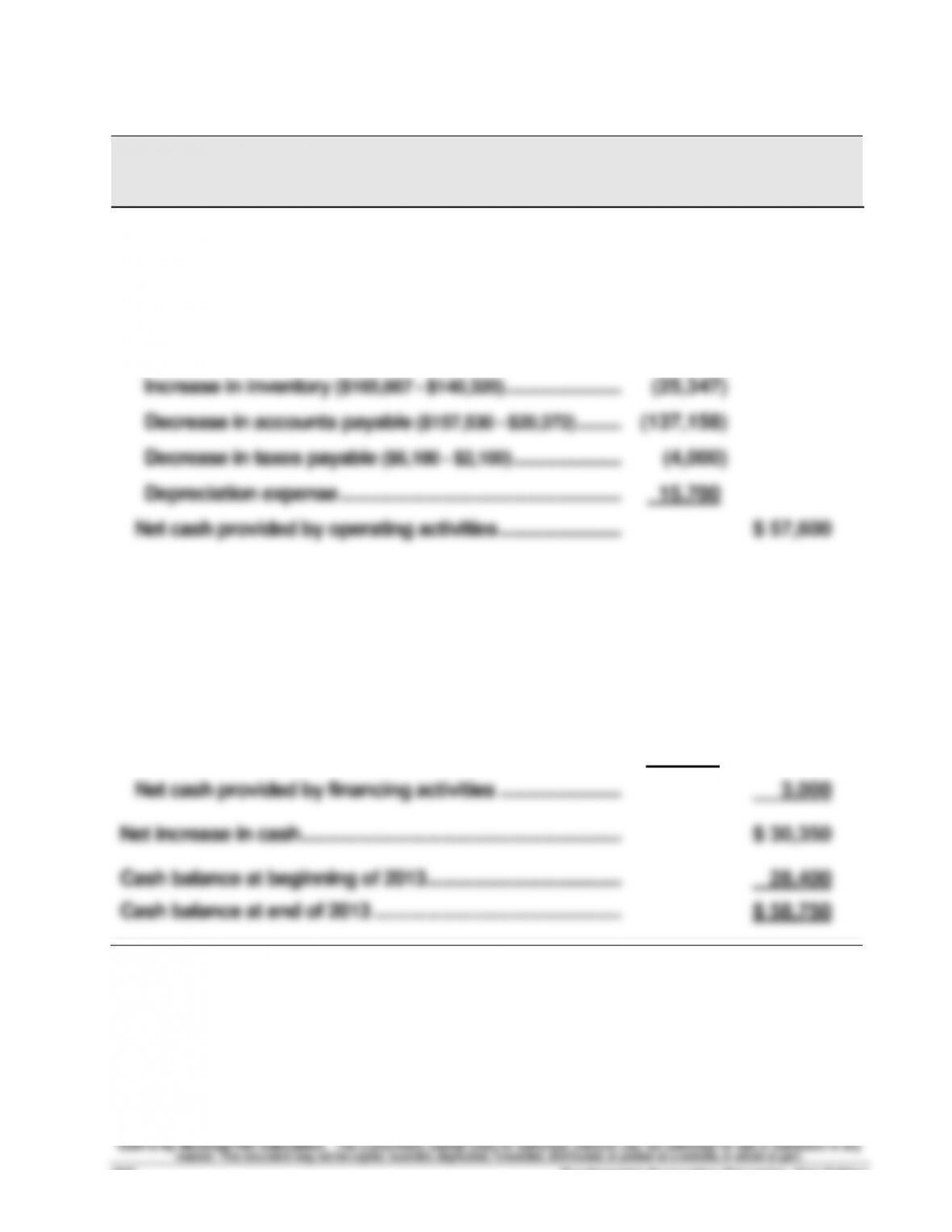

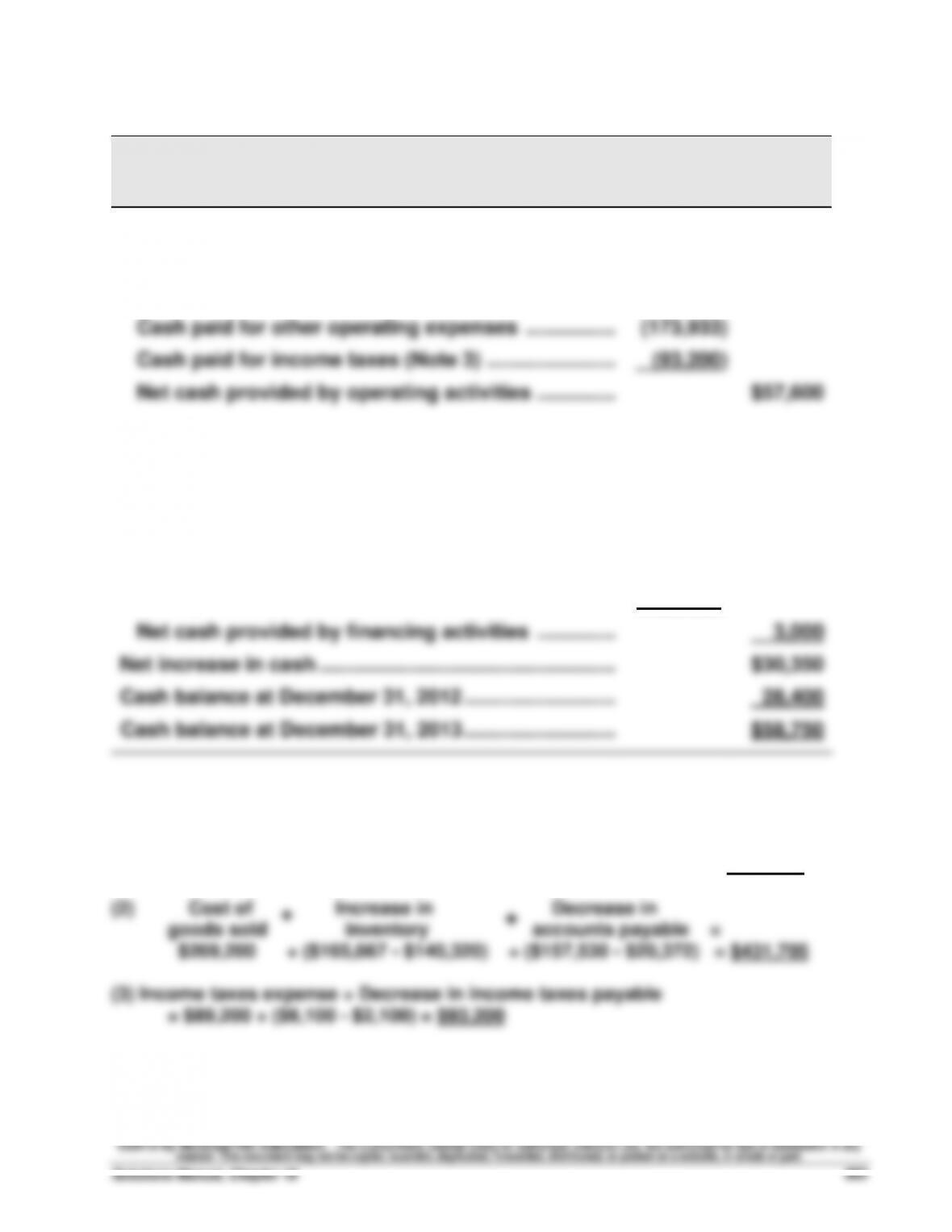

Cash flows from operating activities

Net income ..........................................................................................

Adjustments to reconcile net income to net

cash provided by operating activities

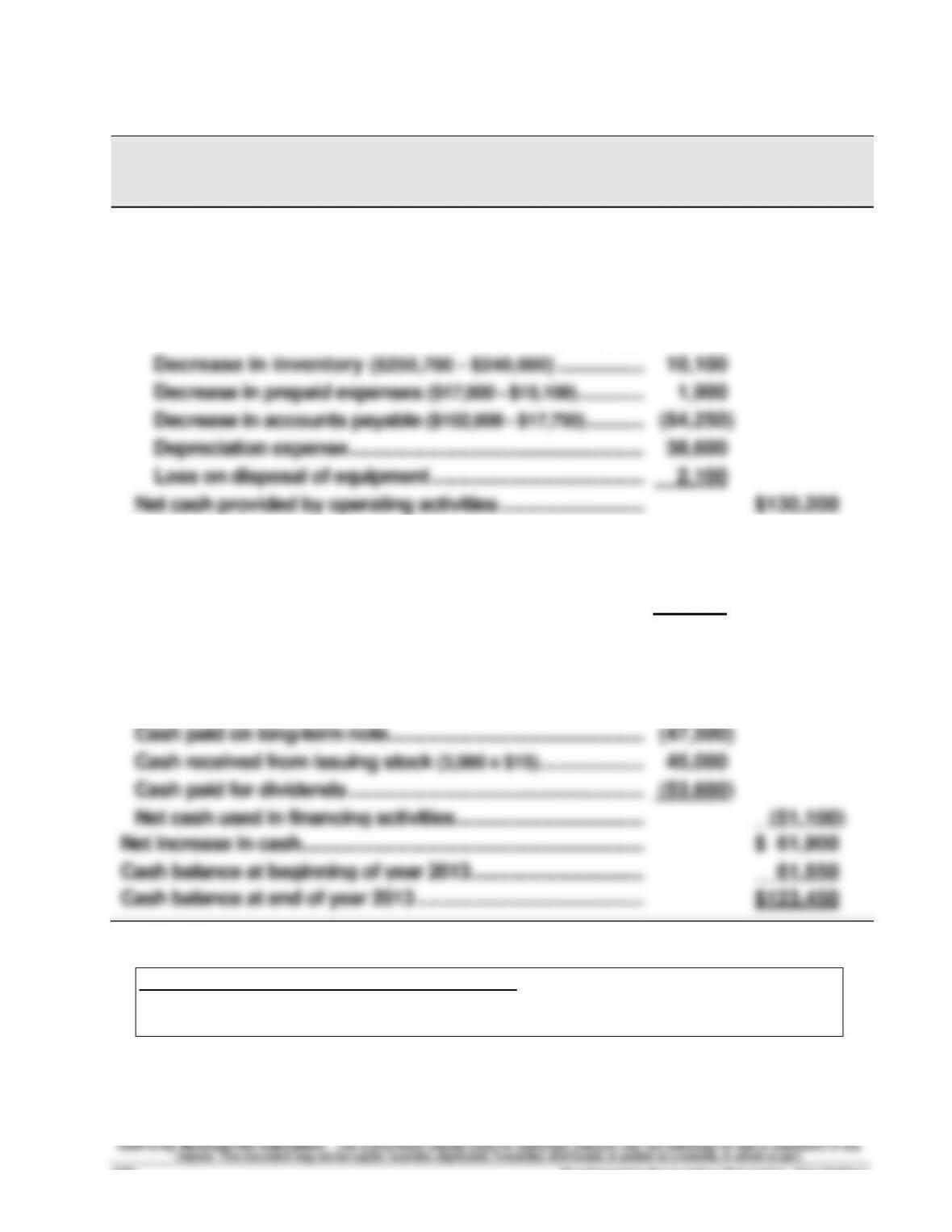

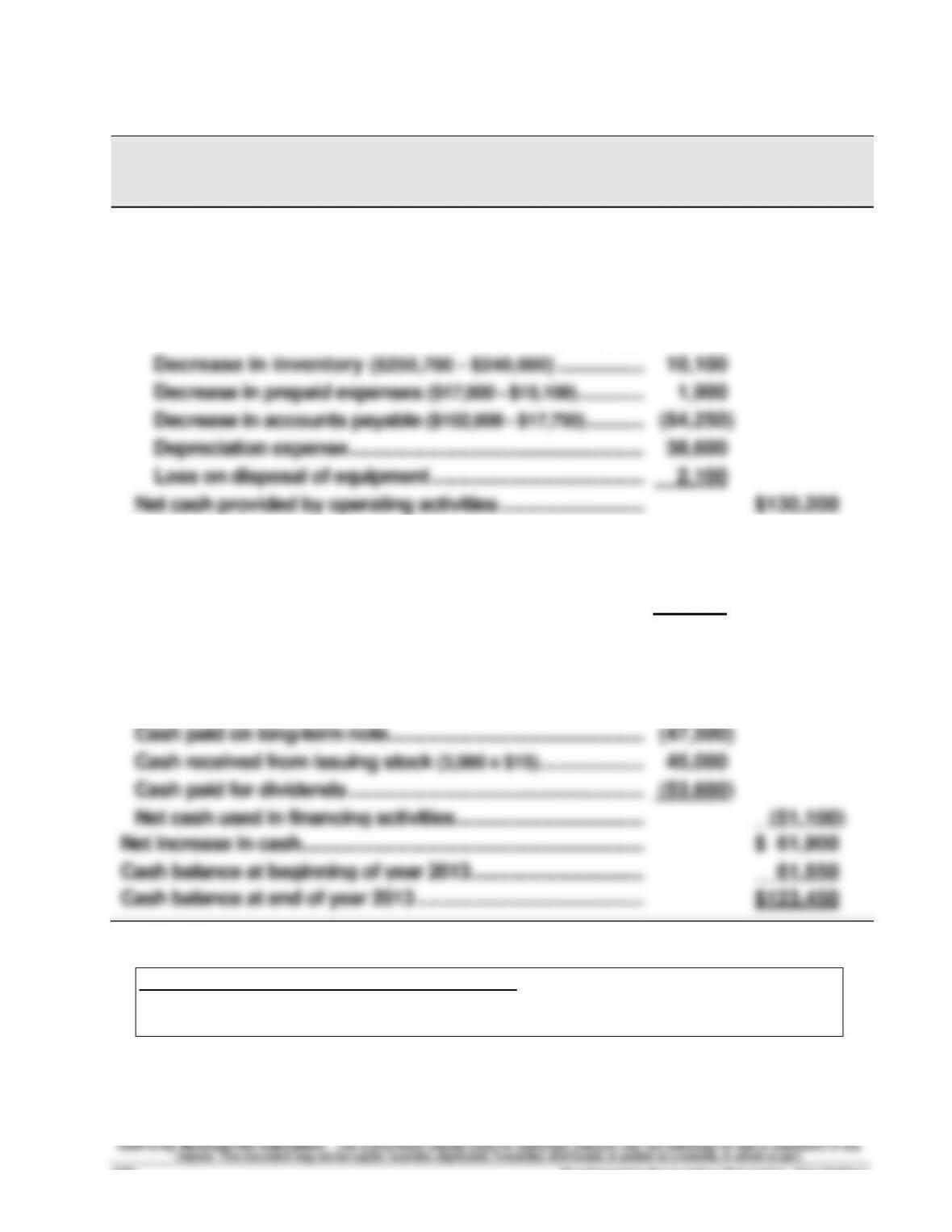

Decrease in accounts receivable ($80,750 - $77,100) ................

Decrease in inventory ($250,700 - $240,600) ........................

Decrease in prepaid expenses ($17,000 - $15,100) ....................

Decrease in accounts payable ($102,000 - $17,750) ..................

Depreciation expense ................................................................

Loss on disposal of equipment ..................................................

Net cash provided by operating activities ................................

Cash flows from investing activities

Cash received from sale of equipment .........................................

Cash paid for equipment ................................................................

Net cash used in investing activities .............................................

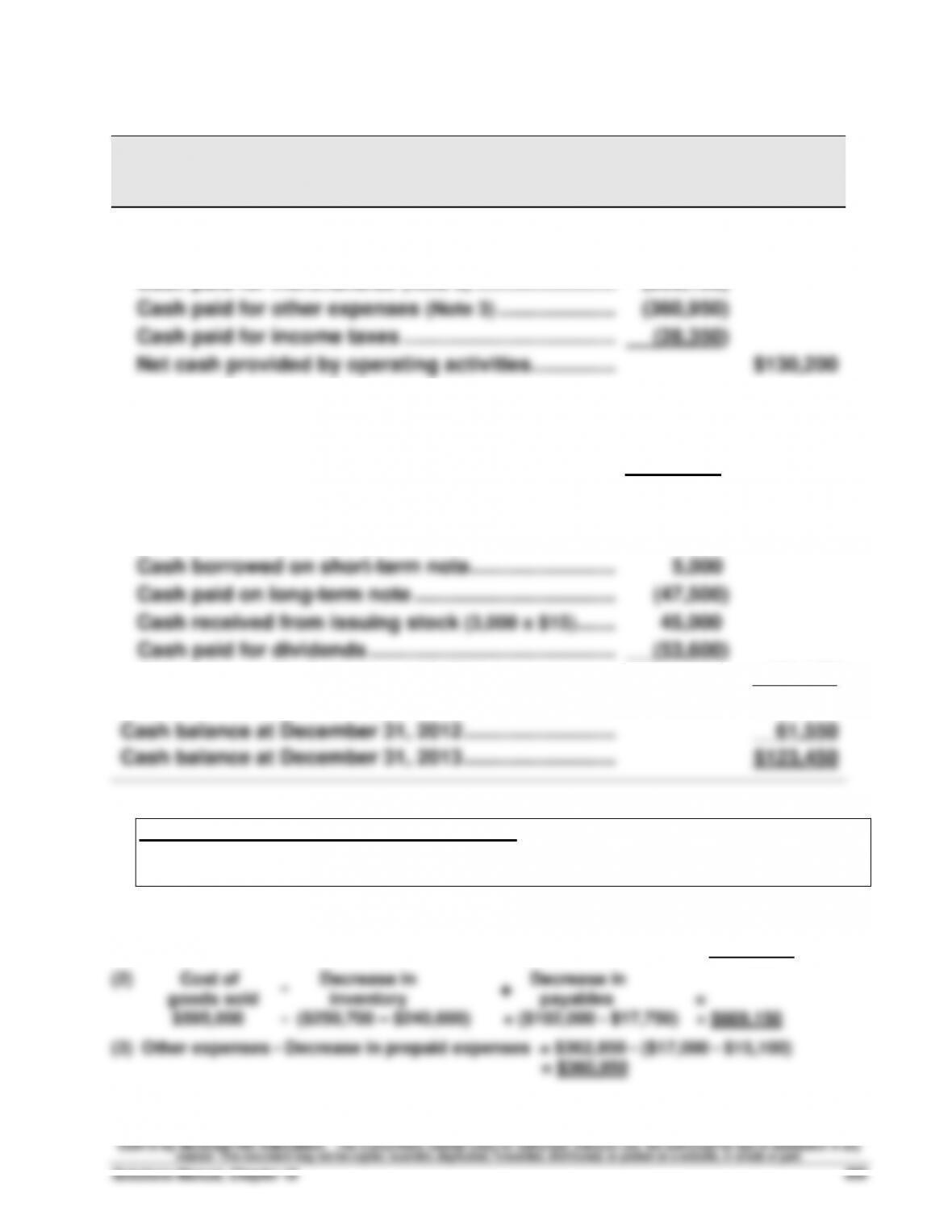

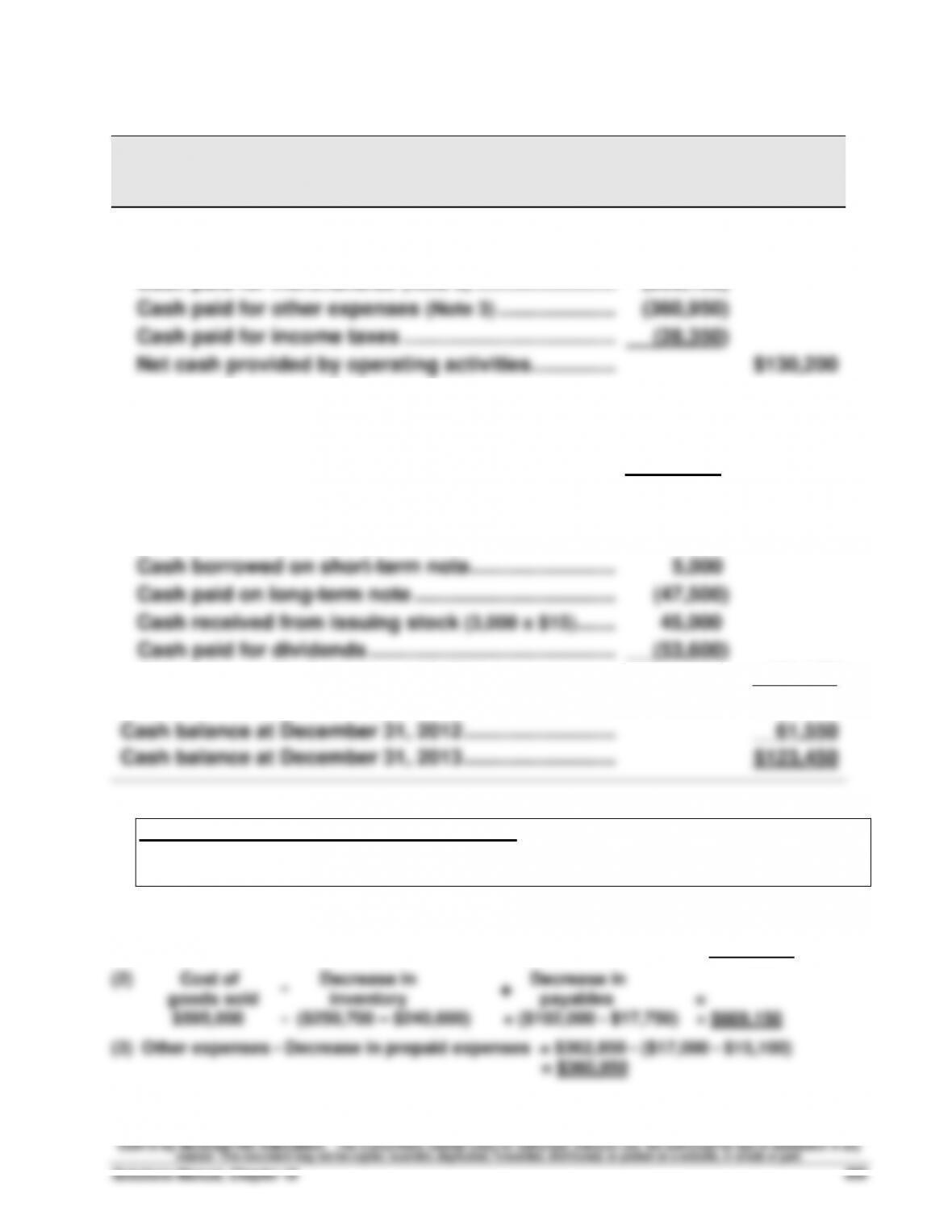

Cash flows from financing activities

Cash borrowed on short-term note ...............................................

Cash paid on long-term note ...........................................................

Cash received from issuing stock (3,000 x $15) ............................

Cash paid for dividends ................................................................

Net cash used in financing activities .............................................

Net increase in cash.............................................................................

Cash balance at beginning of year 2013 ..........................................

Cash balance at end of year 2013 .....................................................

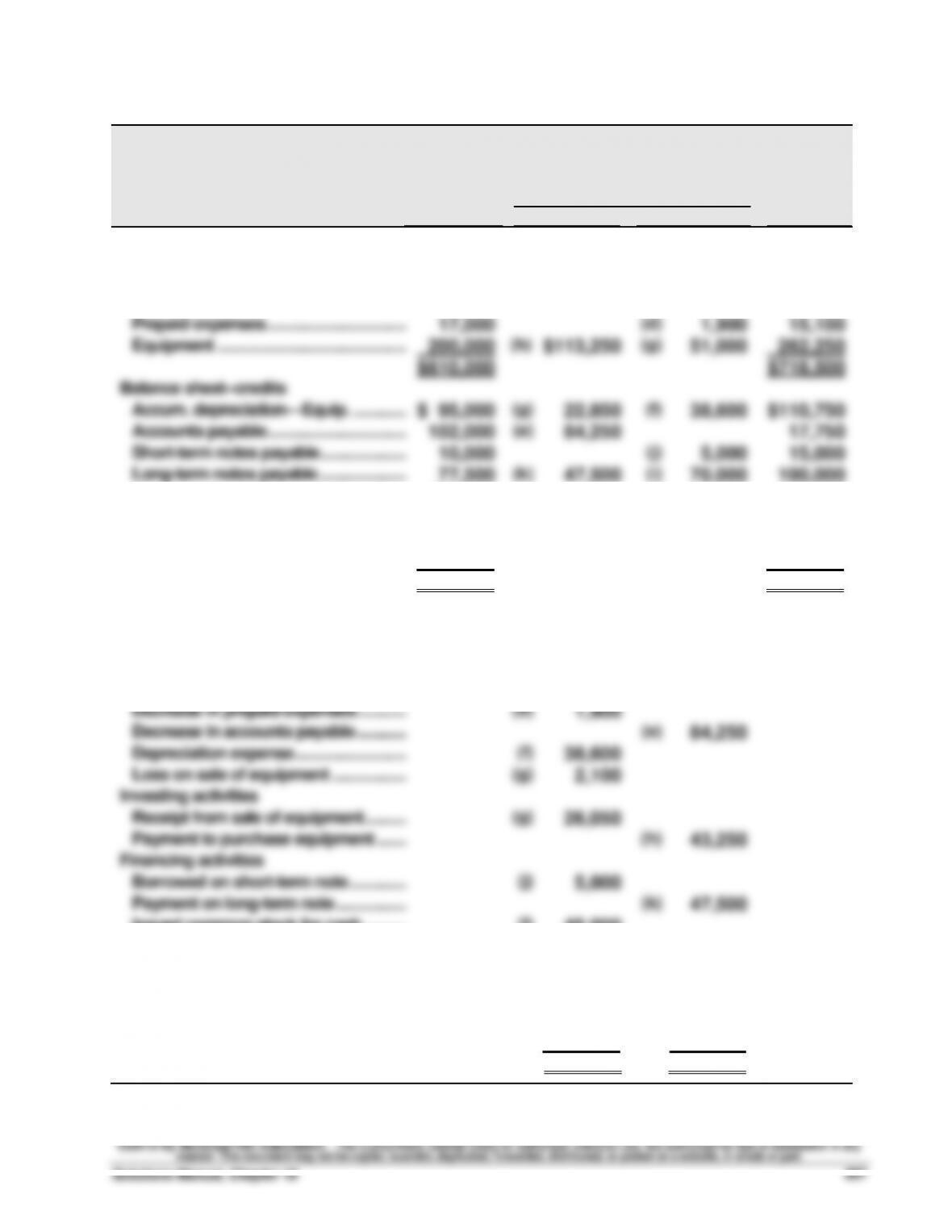

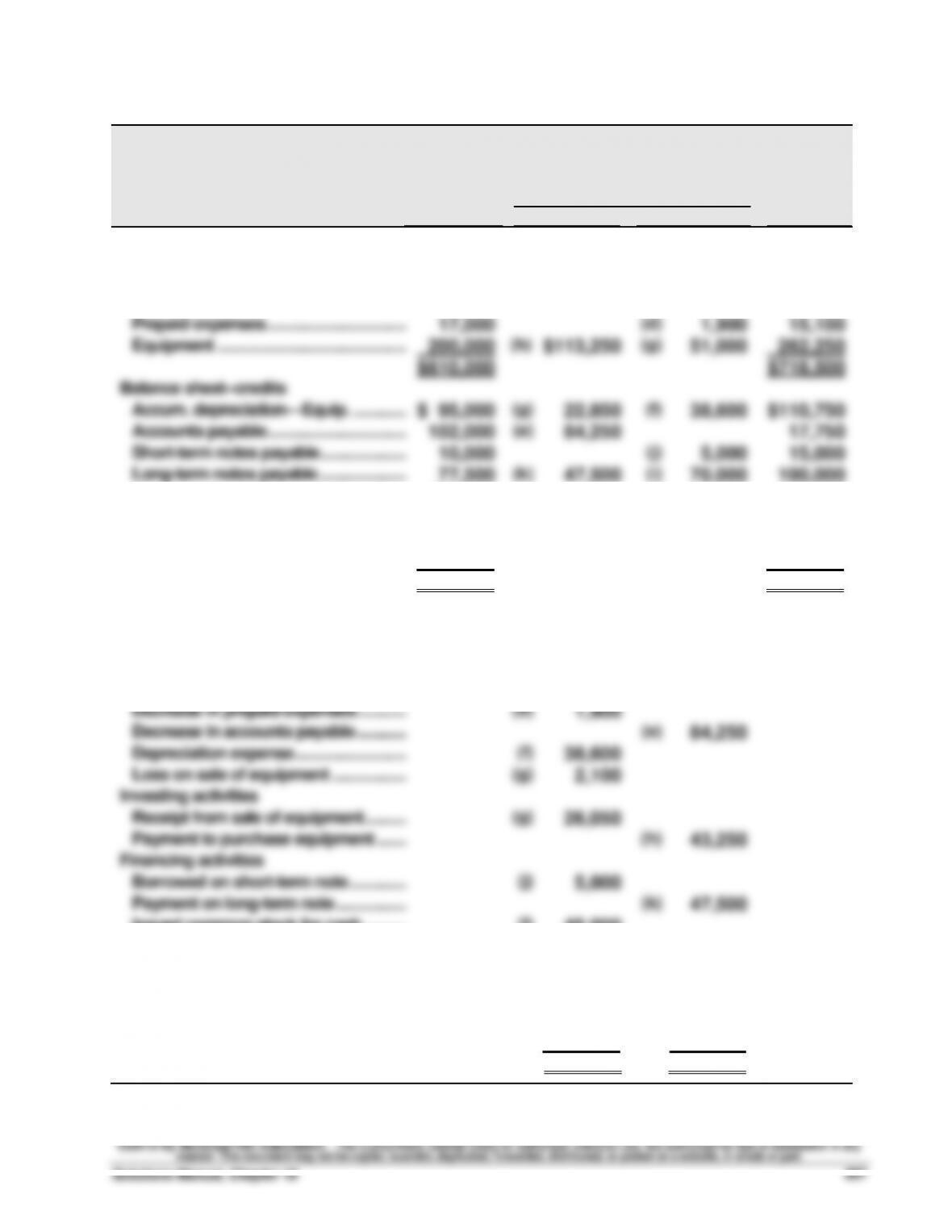

Noncash investing and financing activities

Purchased equipment for $113,250 by signing a $70,000 long-term note

payable and paying $43,250 in cash.