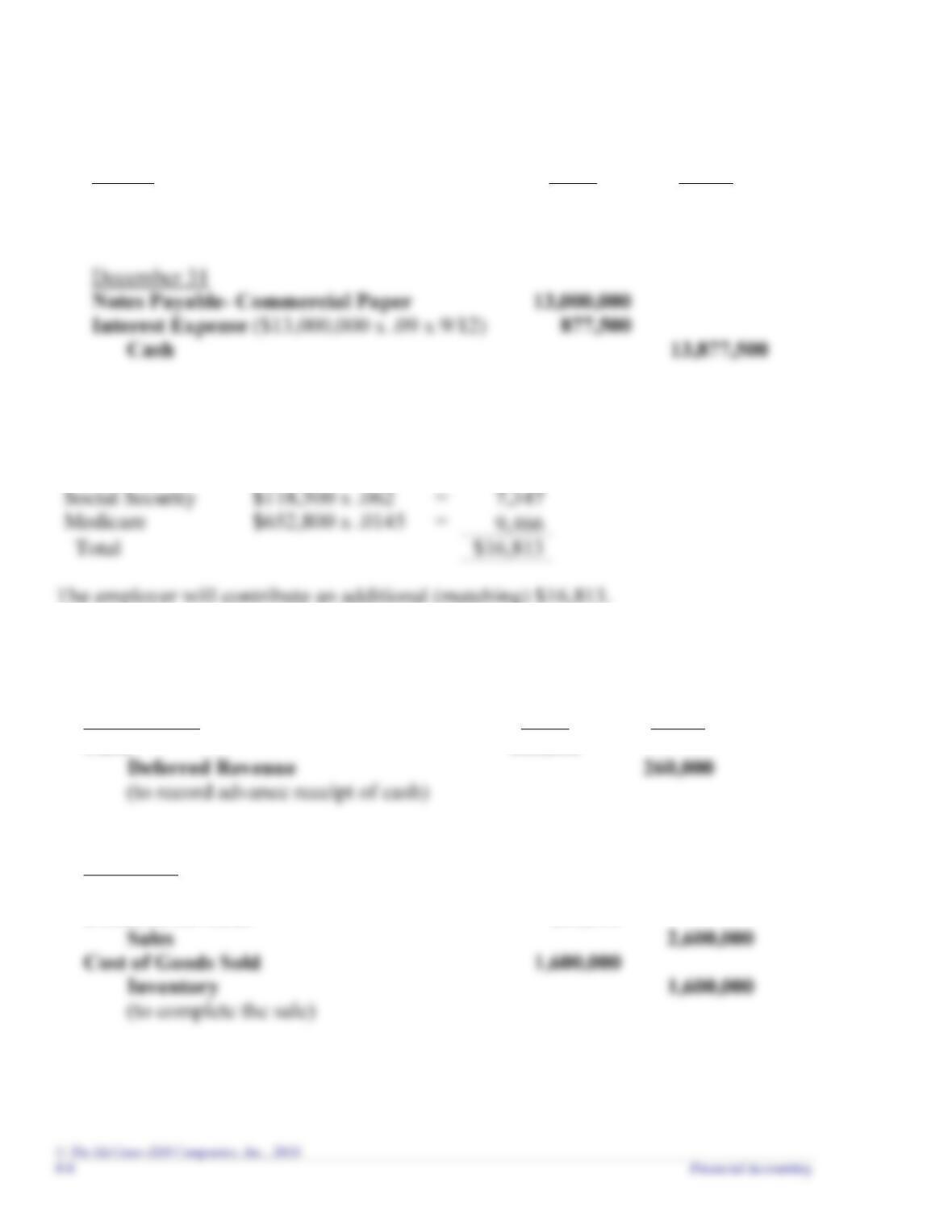

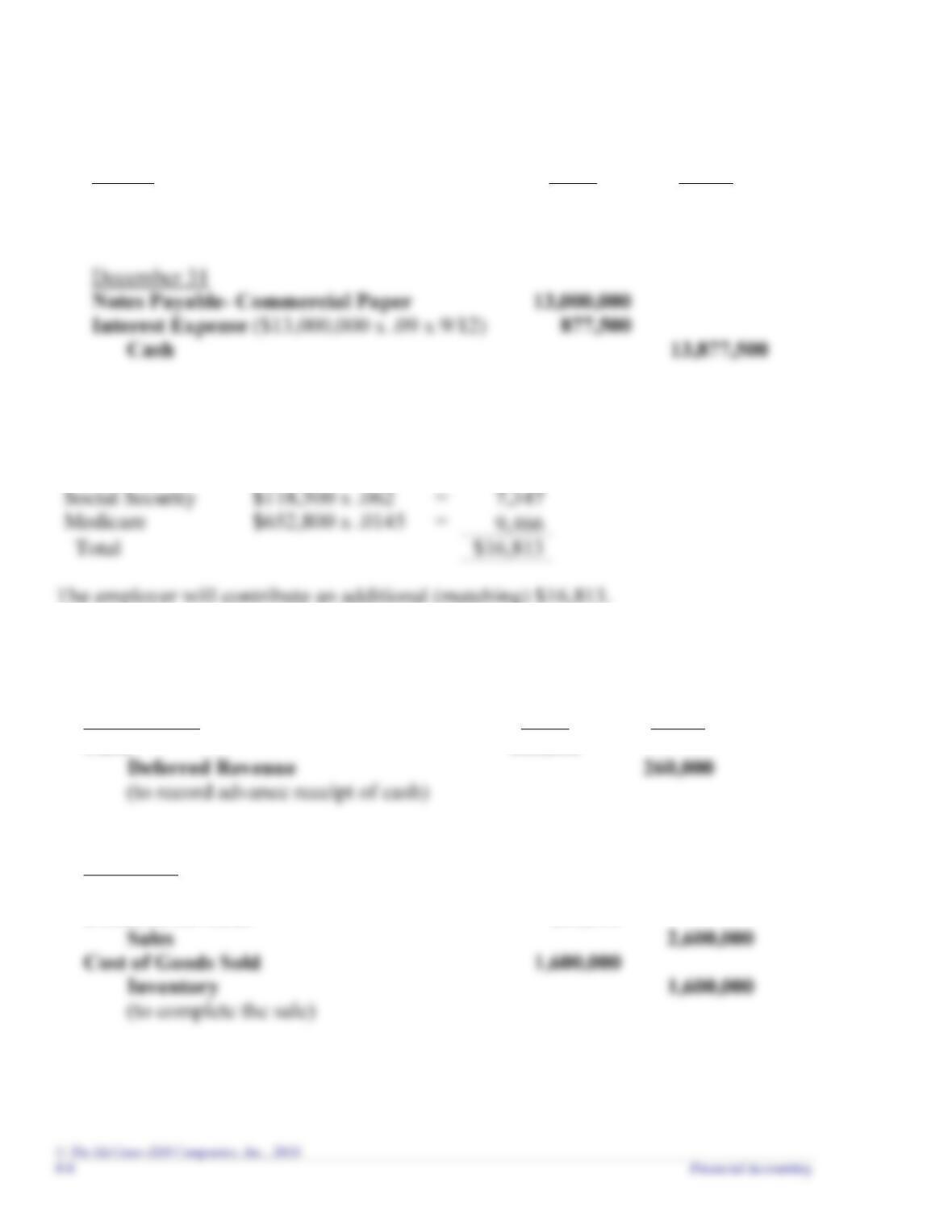

answers to Questions (continued)

Question 8-7

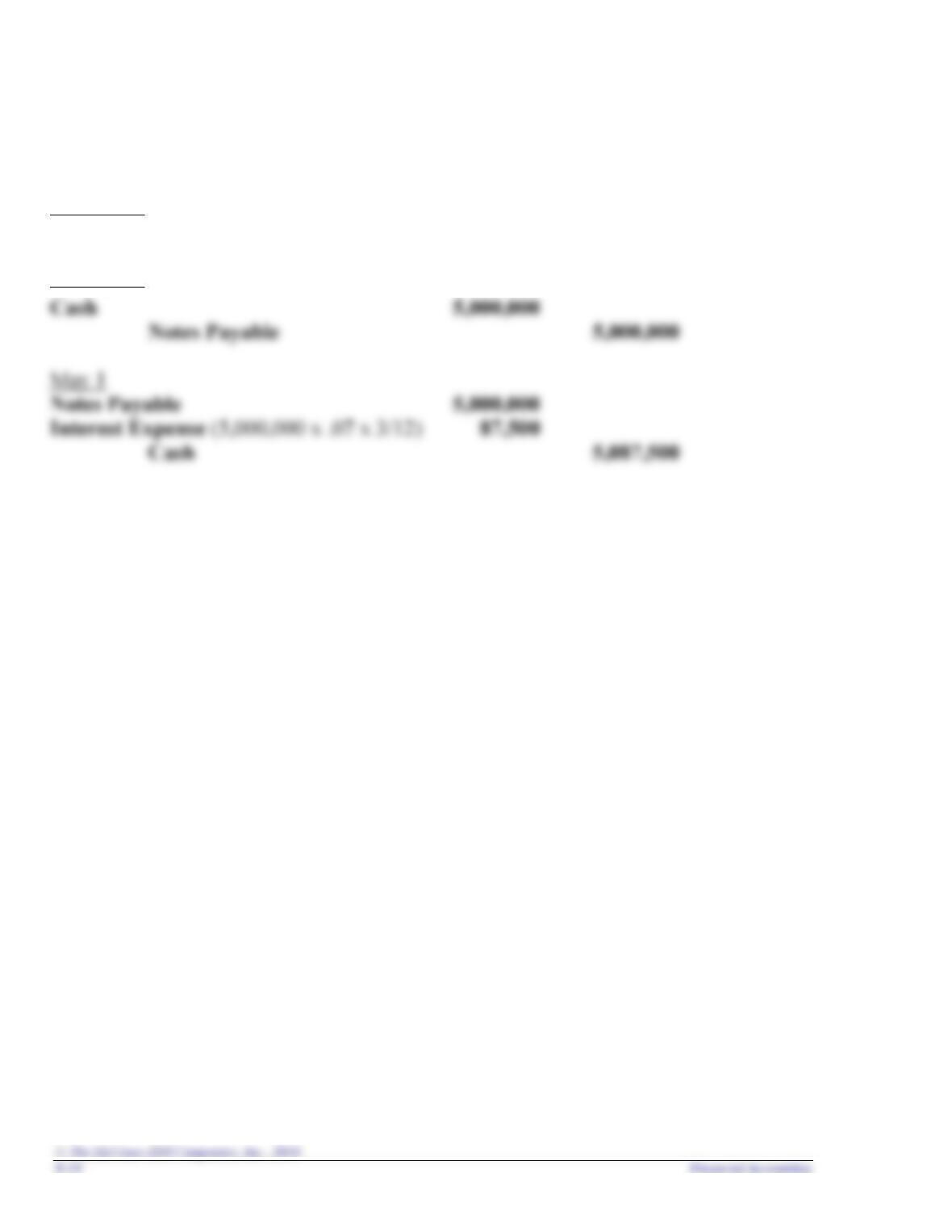

If a company borrows from another company rather than from a bank, the note is referred to as

Question 8-8

Four items commonly withheld from employee payroll checks include (1) federal and state

income taxes, (2) Social Security and Medicare, (3) health, dental, disability, and life insurance

Question 8-9

Four common employer costs in addition to the employee’s salary include (1) federal and state

unemployment taxes, (2) the employer portion of Social Security and Medicare, (3) employer

Question 8-10

Both the employer and the employee pay equal portions of social security taxes. Employers

withhold from employee paychecks a 6.2% Social Security tax up to a maximum base amount and a

Question 8-11

When a company receives cash in advance through the sale of gift cards, it debits cash and

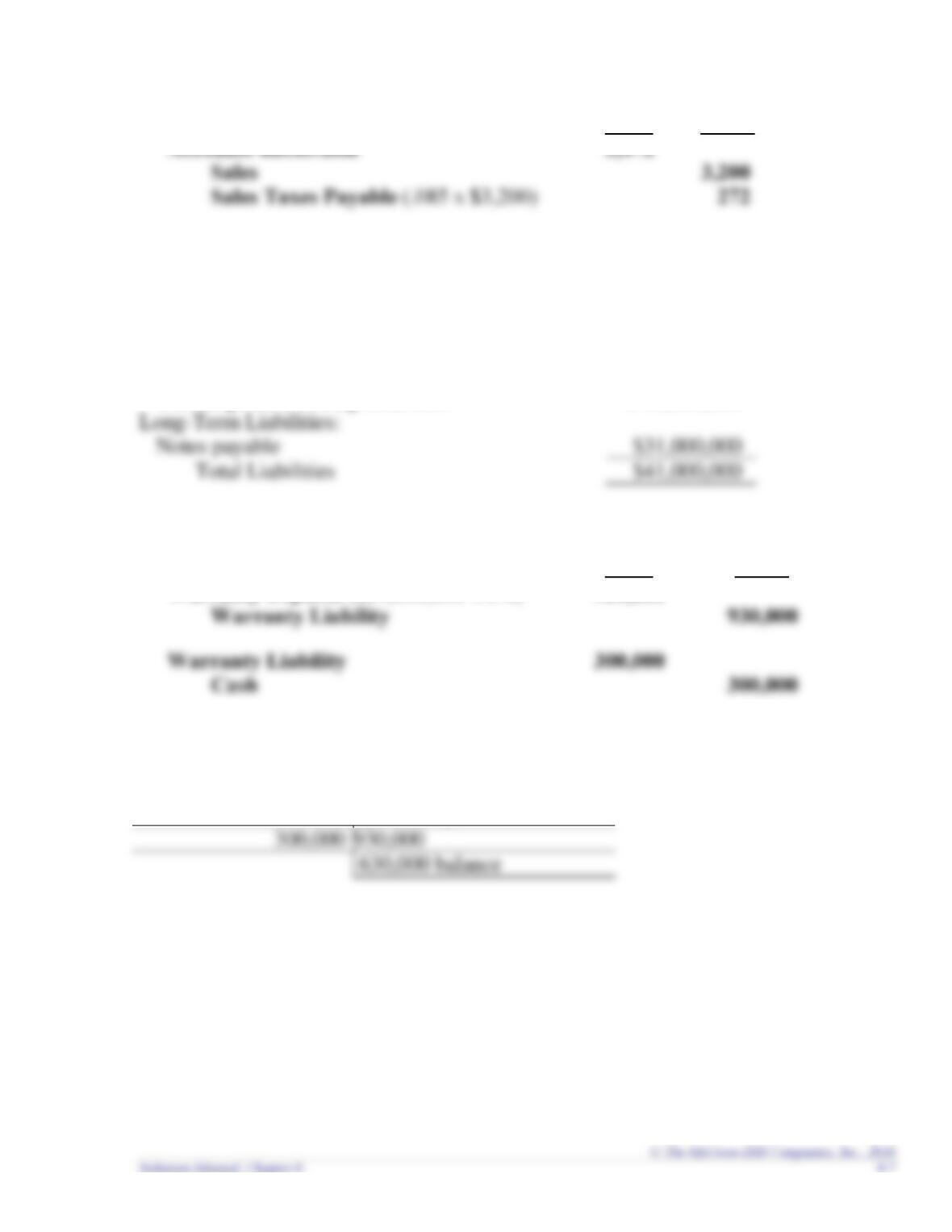

Question 8-12

(a) When Business Week sells magazine subscriptions, they debit cash and credit deferred