CHAPTER 6 Accounting for Merchandising Businesses

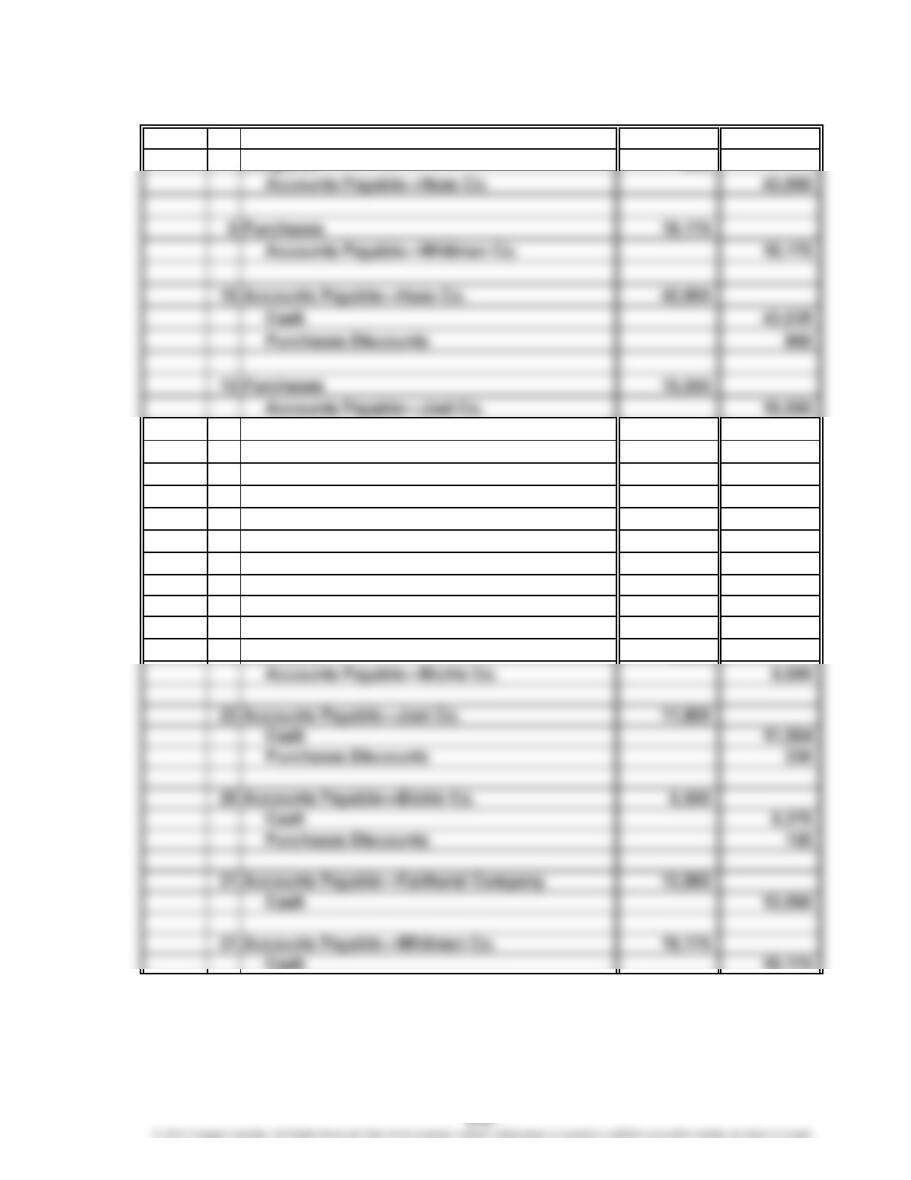

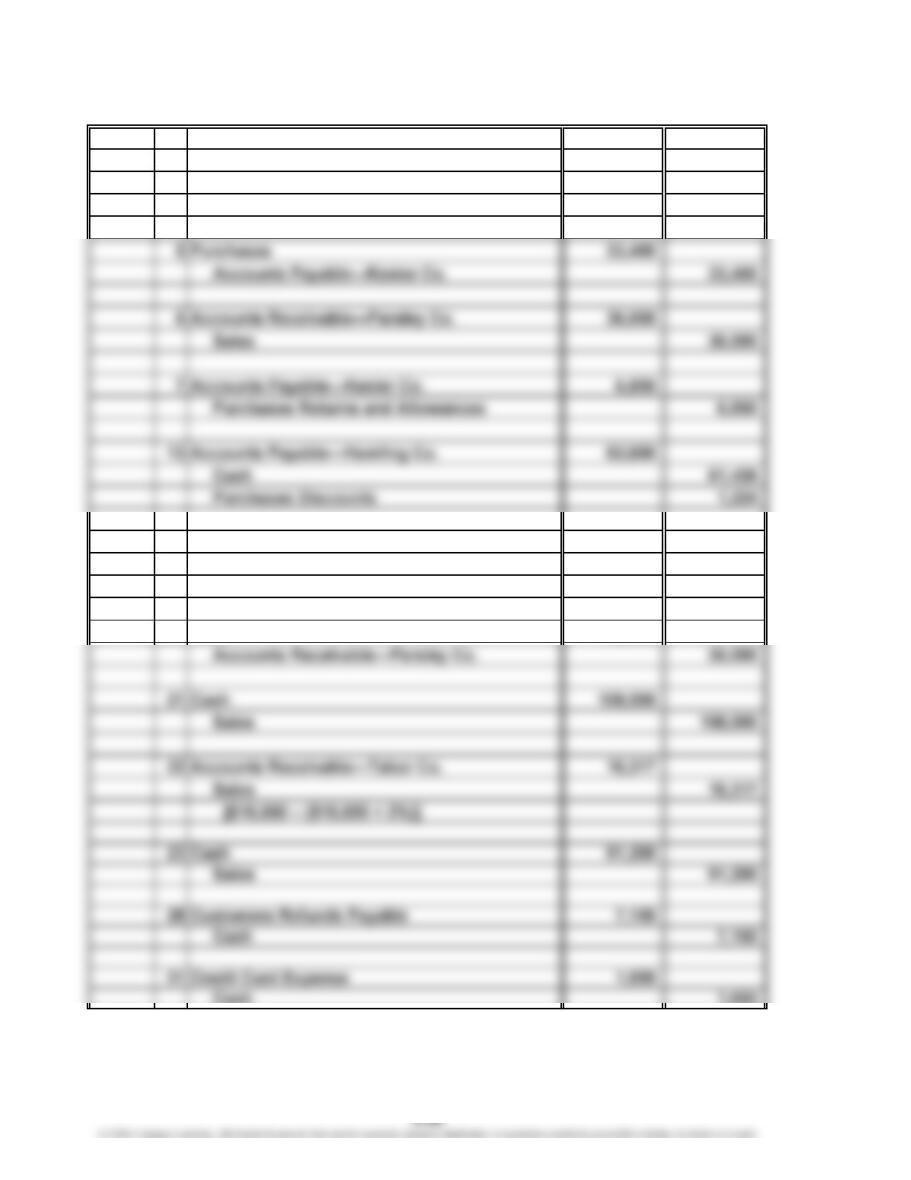

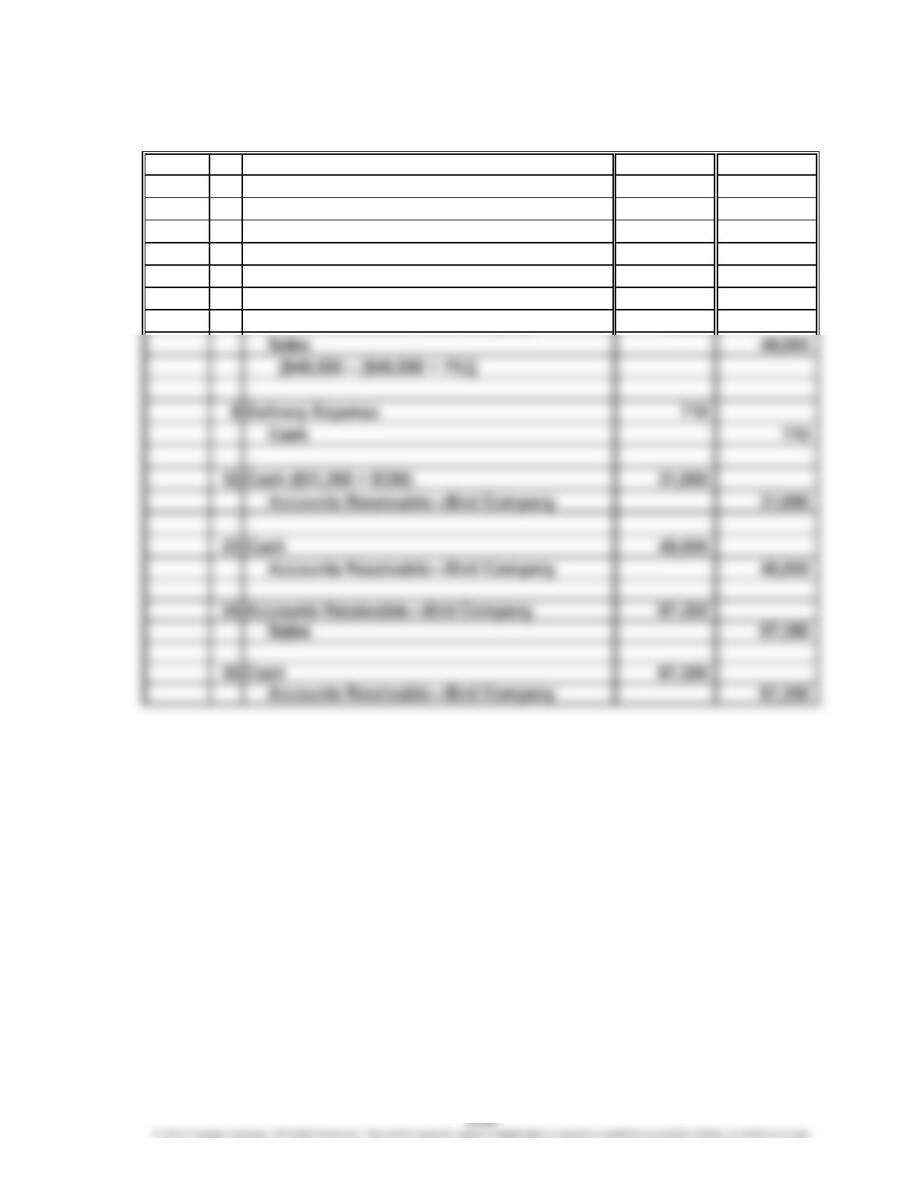

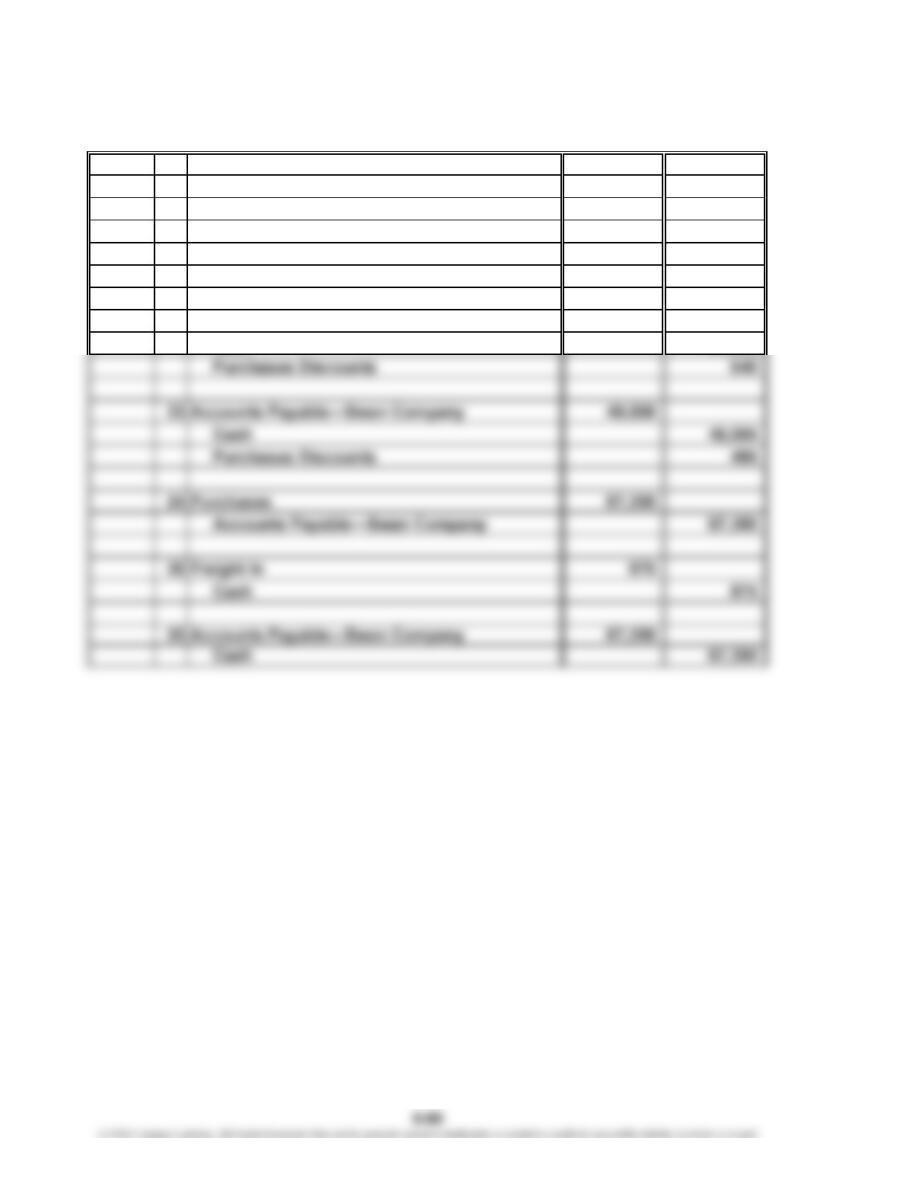

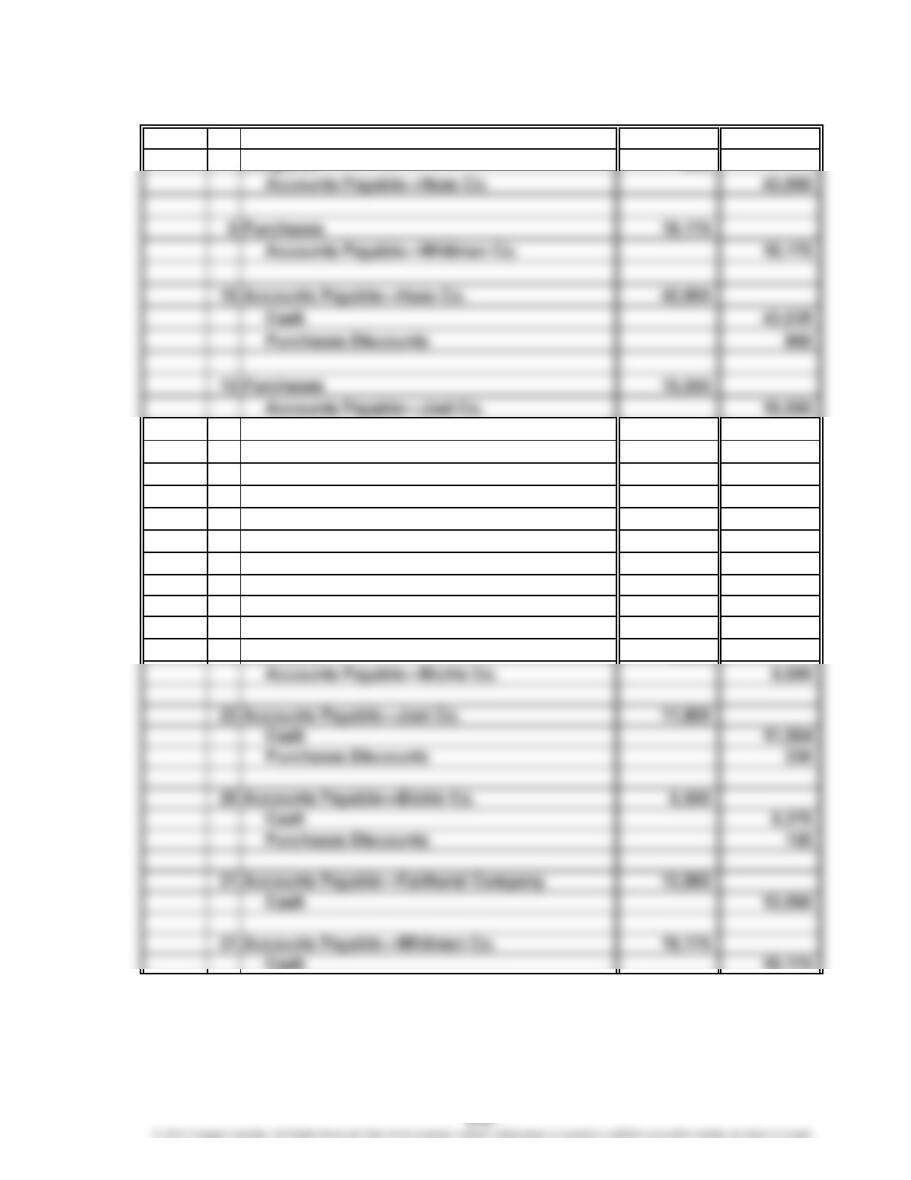

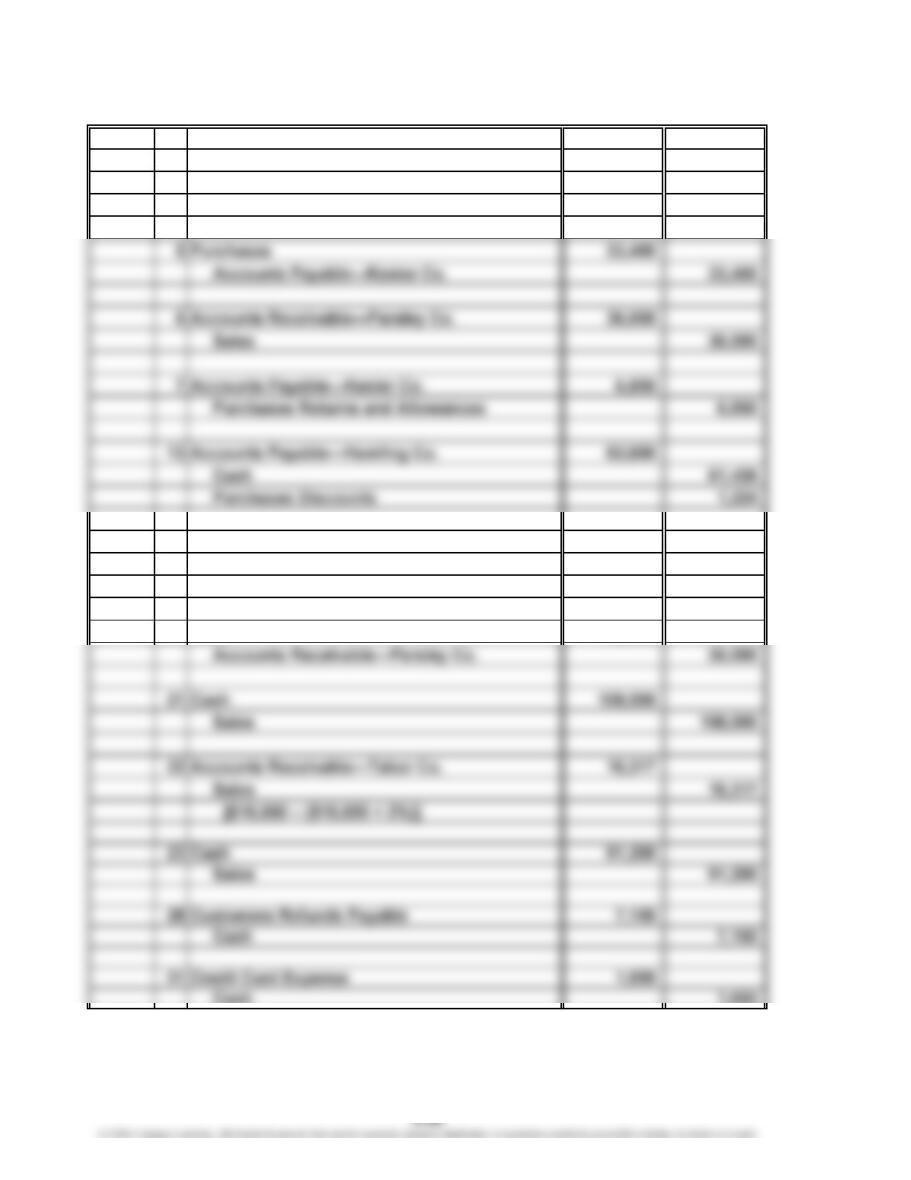

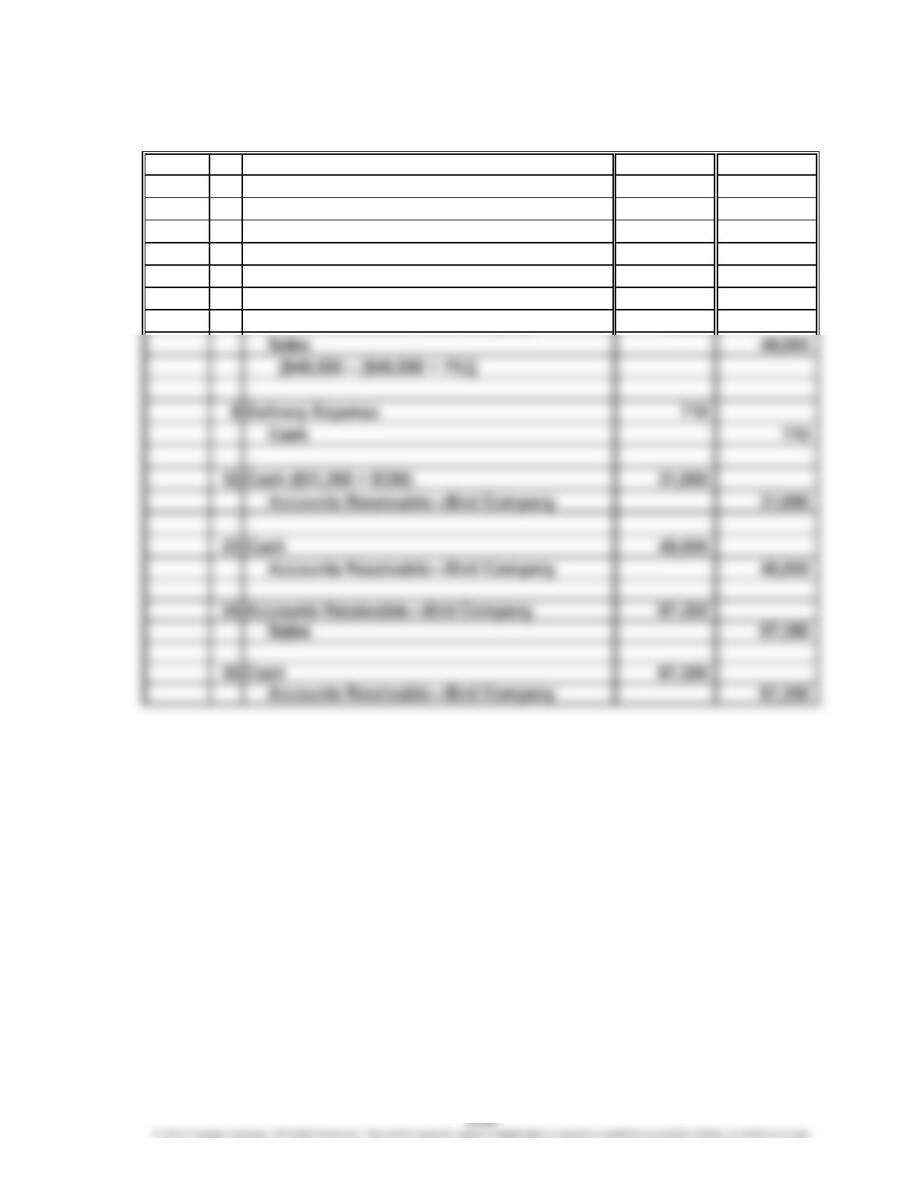

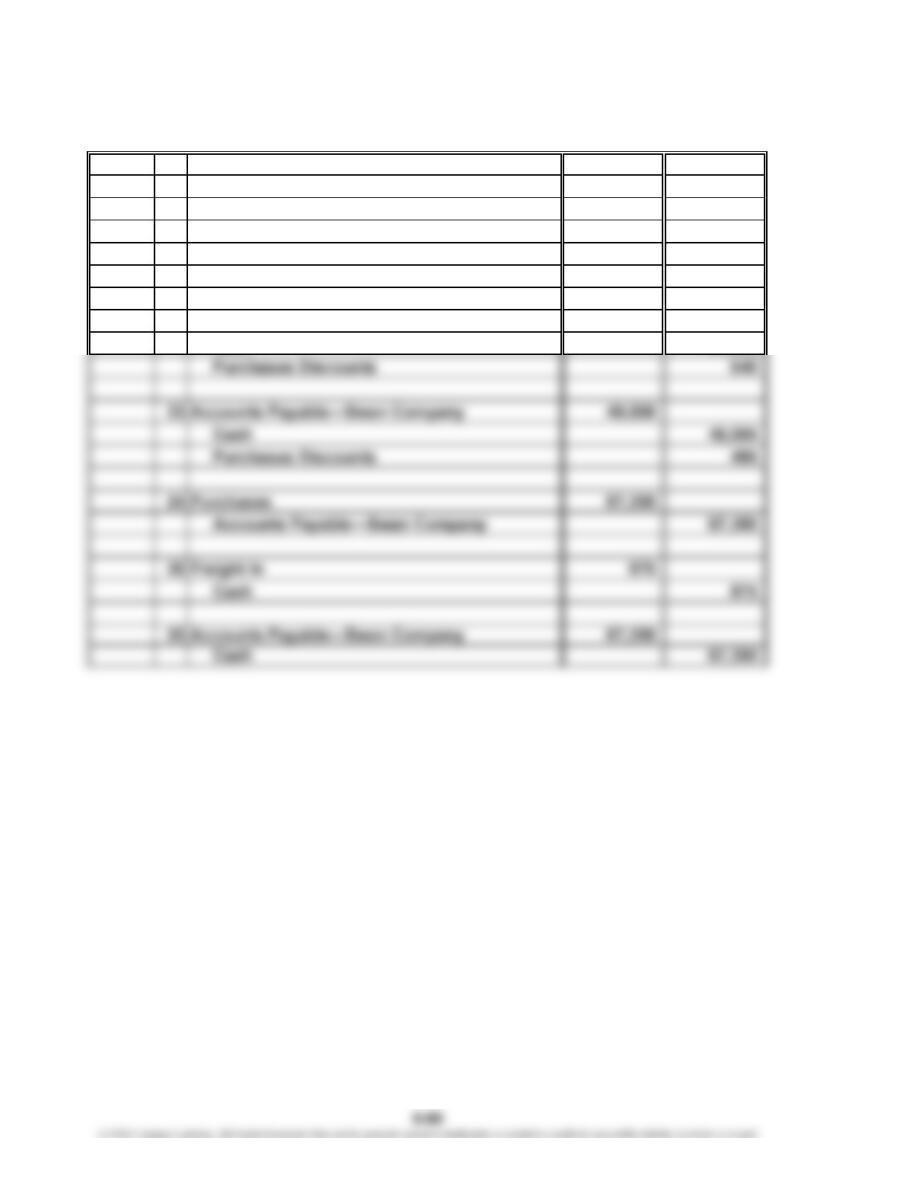

Prob. 6–10A (Continued)

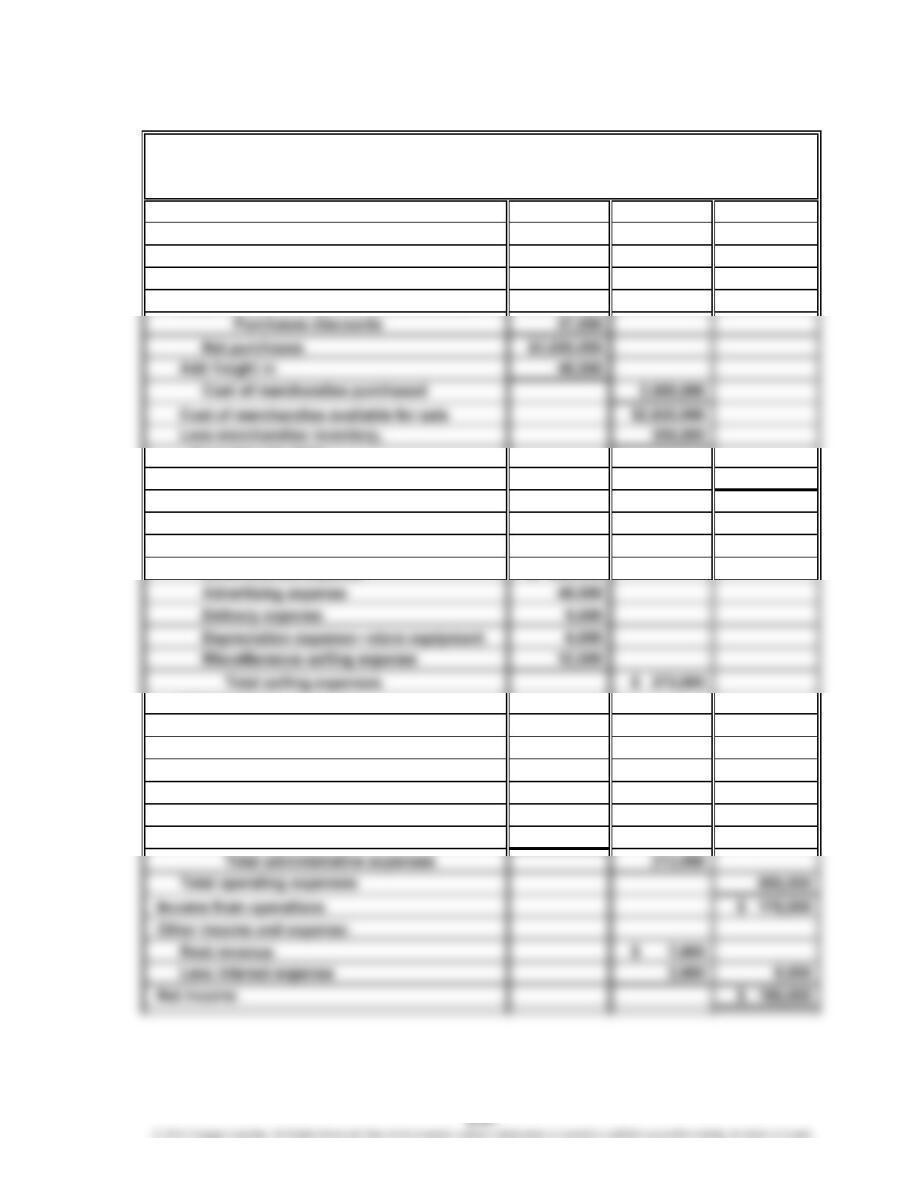

2.

Sales $3,280,000

Cost of merchandise sold:

Merchandise inventory, January 1, 2016 $ 257,000

Purchases $2,650,000

Less: Purchases returns and allowances 93,000

December 31, 2016

Cost of merchandise sold 2,520,000

Gross profit $ 760,000

Expenses:

Selling expenses:

Sales salaries expense $ 300,000

Administrative expenses:

Office salaries expense $ 175,000

Rent expense 28,000

Insurance expense 3,000

Office supplies expense 2,000

Depreciation expense—office equipment 1,500

Miscellaneous administrative expense 3,500

WYMAN COMPANY

Income Statement

For the Year Ended December 31, 2016