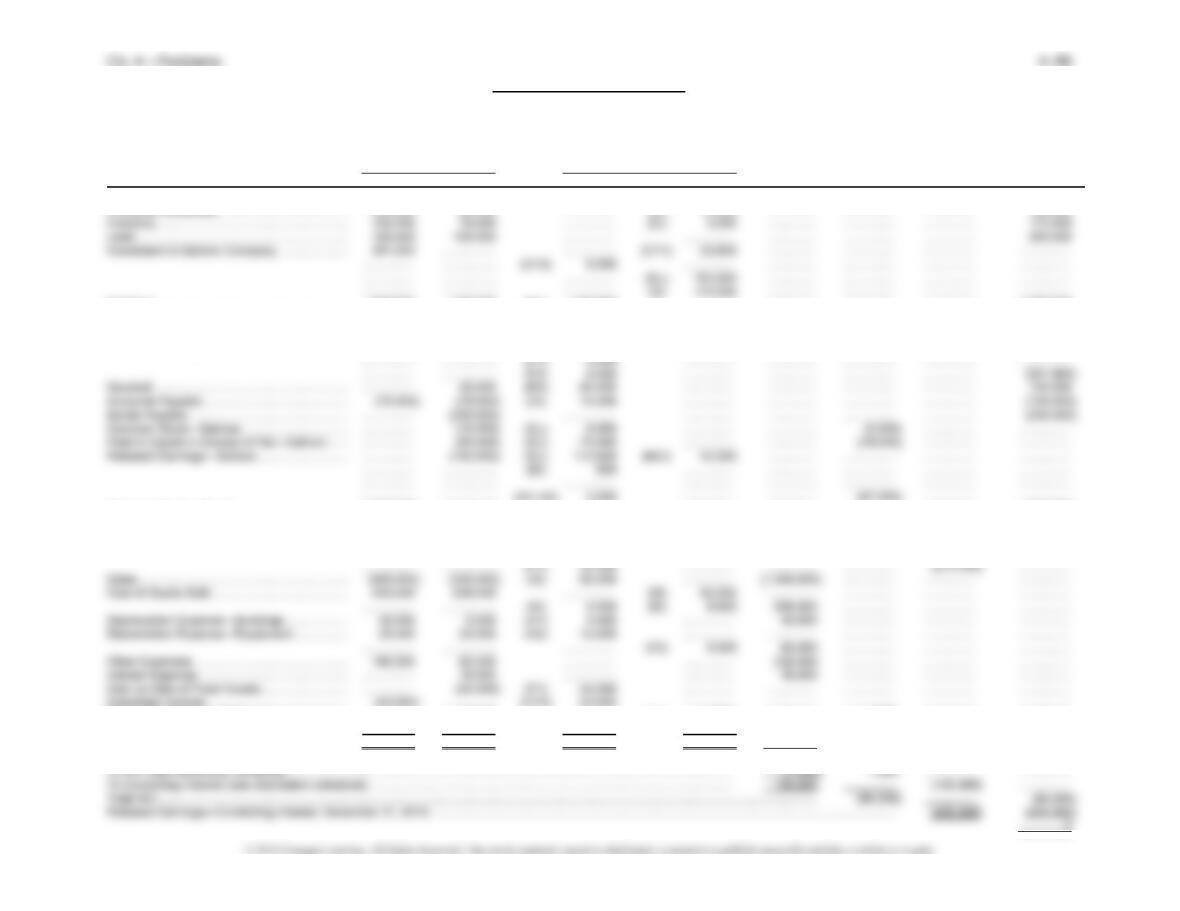

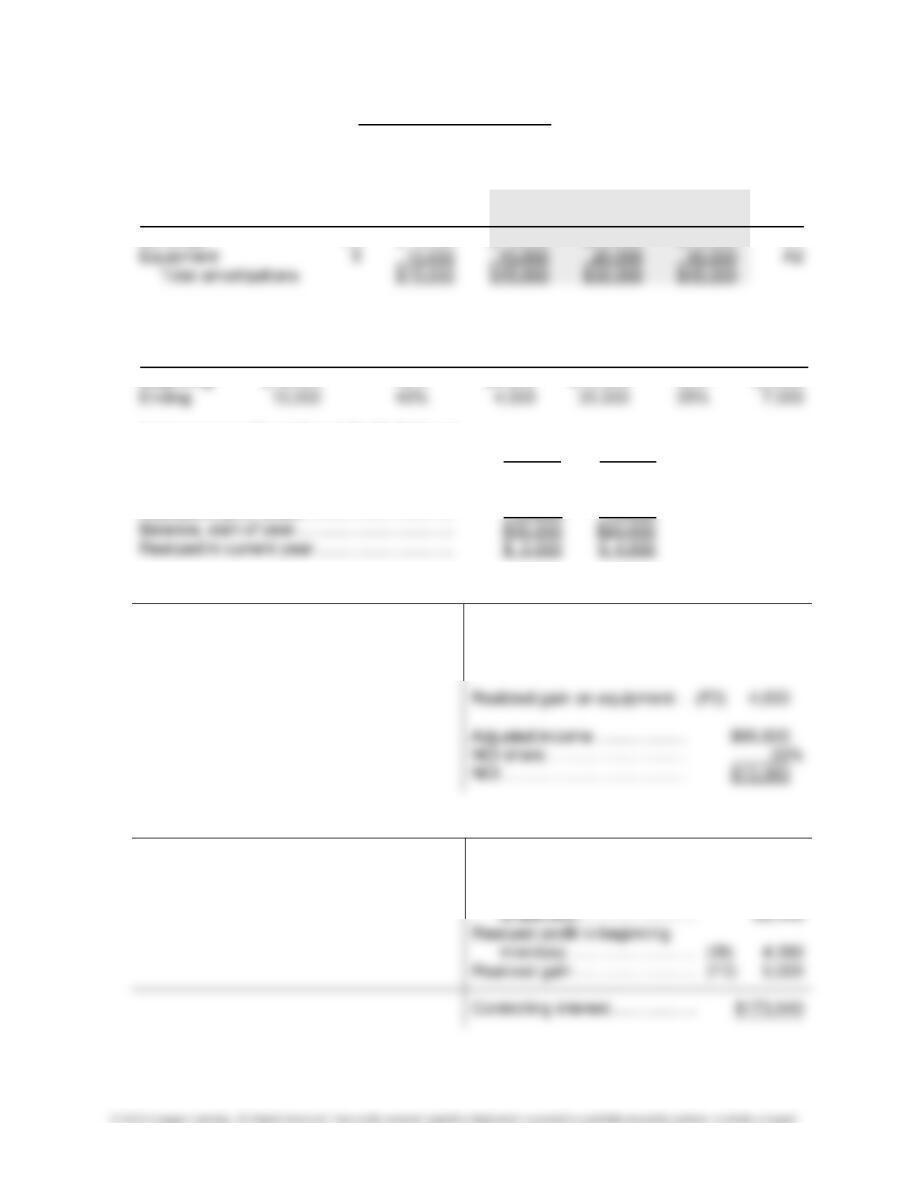

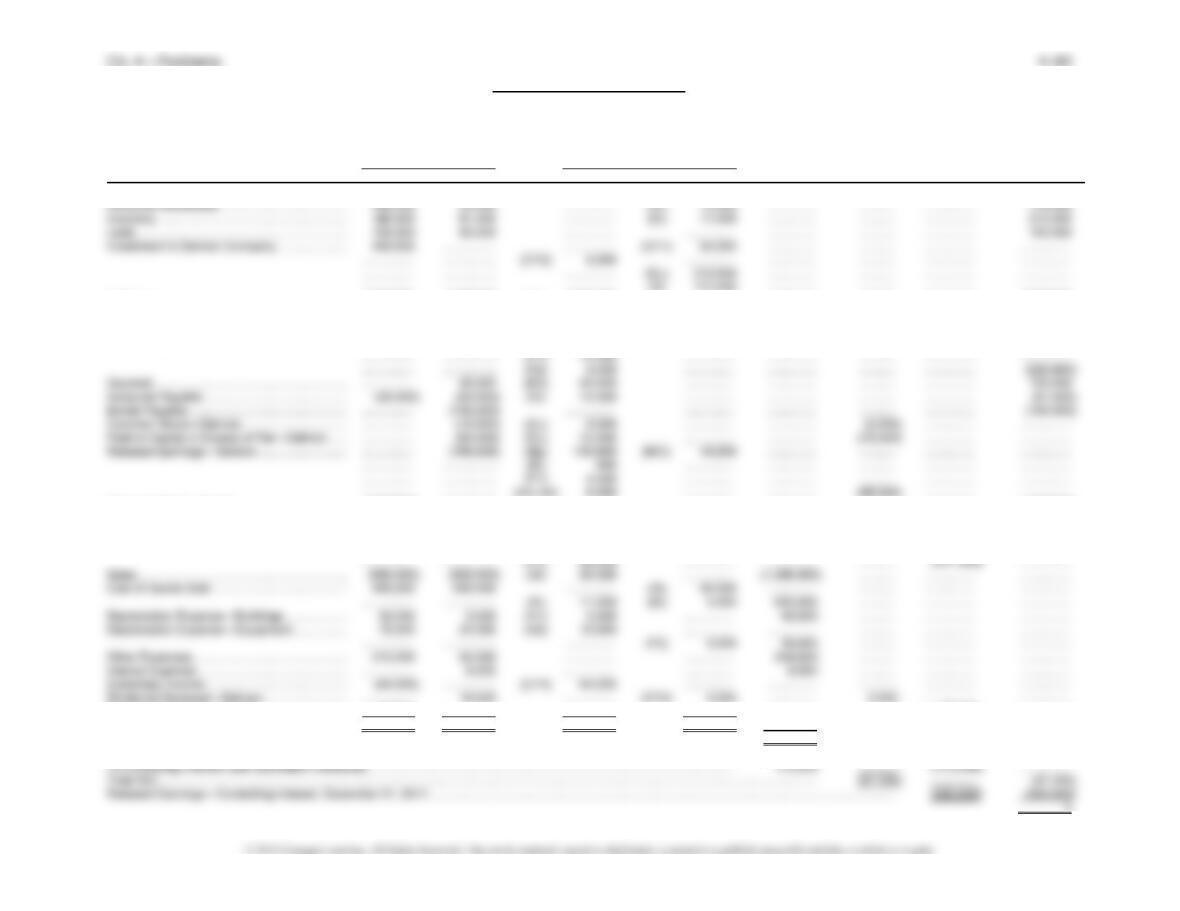

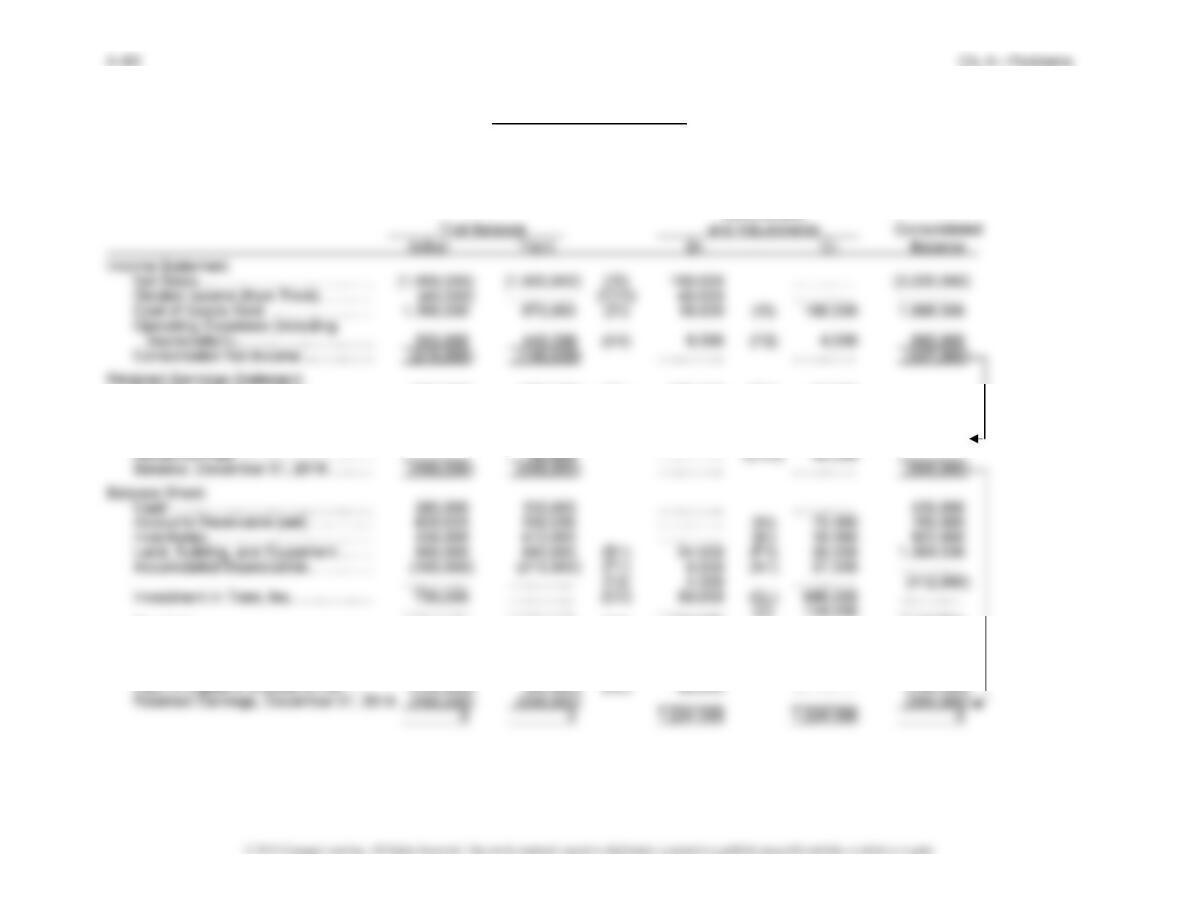

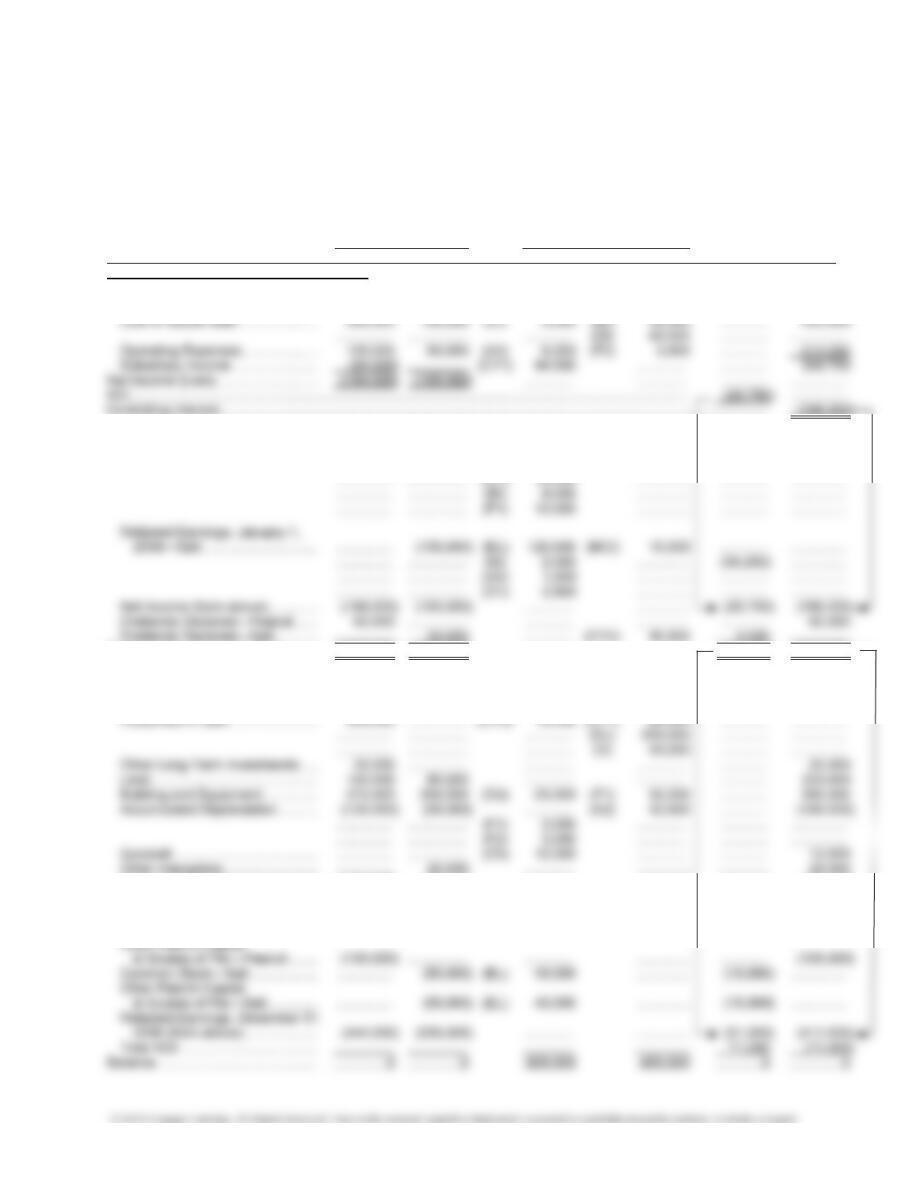

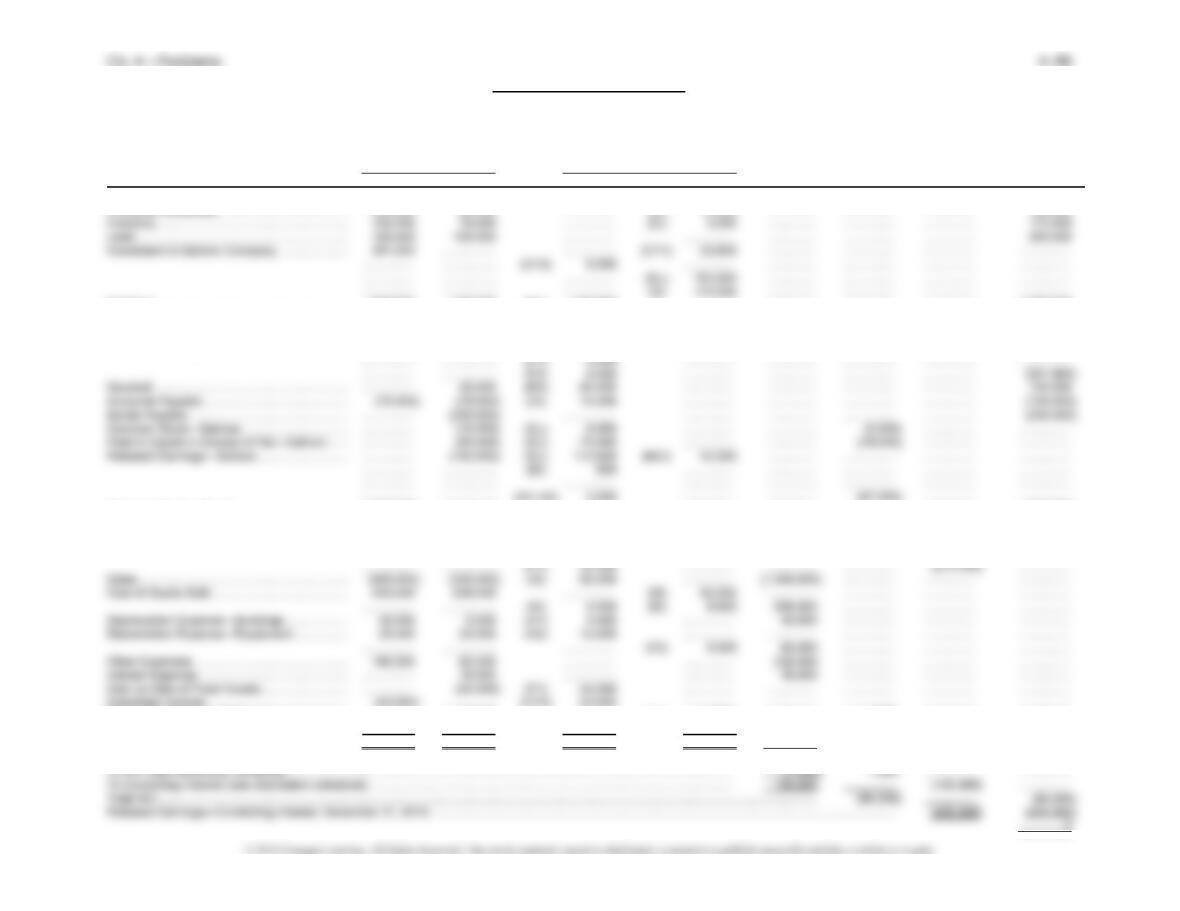

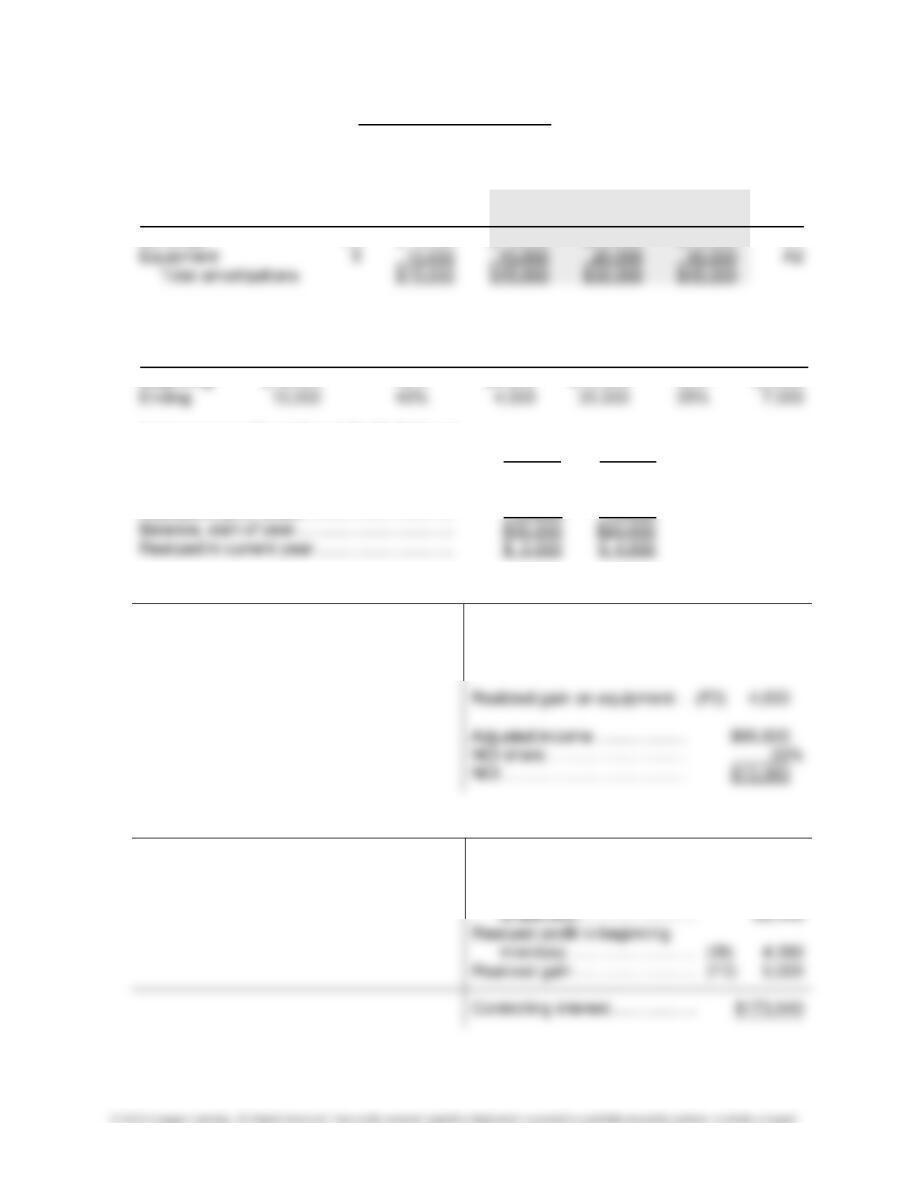

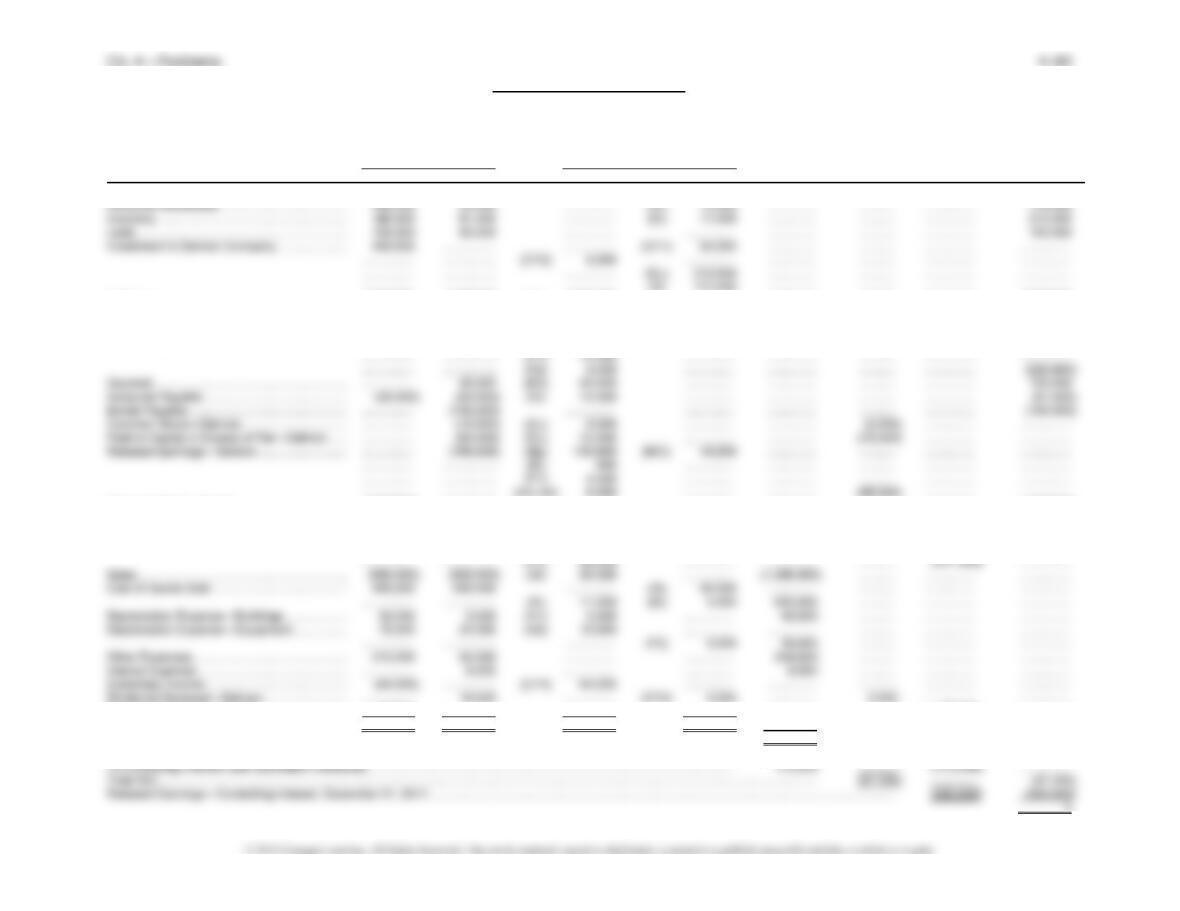

Problem 4-13, Continued

Purple Company and Subsidiary Salmon Company

Consolidated Income Statement

For Year Ended December 31, 2016

Eliminations Consolidated Controlling Consolidated

Trial Balance

and Adjustments Income Retained Balance

Purple Salmon Dr. Cr. Statement NCI Earnings Sheet

Cash ................................................................ 92,400 57,500 ............... ............... ............... ............... ............... 149,900

Accounts Receivable ...................................... 130,000 36,000 ............... (IA) 14,000 ............... ............... ............... 152,000

Buildings ......................................................... 800,000 150,000 (D1) 100,000 ............... ............... ............... ............... 1,050,000

Accumulated Depreciation .............................. (250,000) (60,000) ............... (A1) 10,000 ............... ............... ............... (320,000)

Equipment ....................................................... 210,000 220,000 (D2) 50,000 (F1) 64,000 ............... ............... ............... 416,000

Accumulated Depreciation .............................. (115,000) (80,000) ............... (A2) 20,000 ............... ............... ............... ...............

Common Stock—Purple ................................. (100,000) ................ ............... ............... ............... ............... ............... (100,000)

Paid-In Capital in Excess of Par—Purple ....... (800,000) ................ ............... ............... ............... ............... ............... (800,000)

Retained Earnings—Purple ............................ (325,000) ................ (A1–A2) 12,000 ............... ............... ............... ............... ...............

............... ................ (BI) 8,000 ............... ............... ............... ............... ...............

Dividends Declared—Salmon ......................... ............... 10,000 ............... (CY2) 8,000 ............... 2,000 ............... ...............

Dividends Declared—Purple ........................... 20,000 ................ ............... ............... ............... ............... 20,000 ...............

0

0 664,800 664,800 ............... ............... ............... ...............

Consolidated Net Income ..................................................................................................................................................... (154,100) ............... ............... ...............