5. Optional (Appendix)

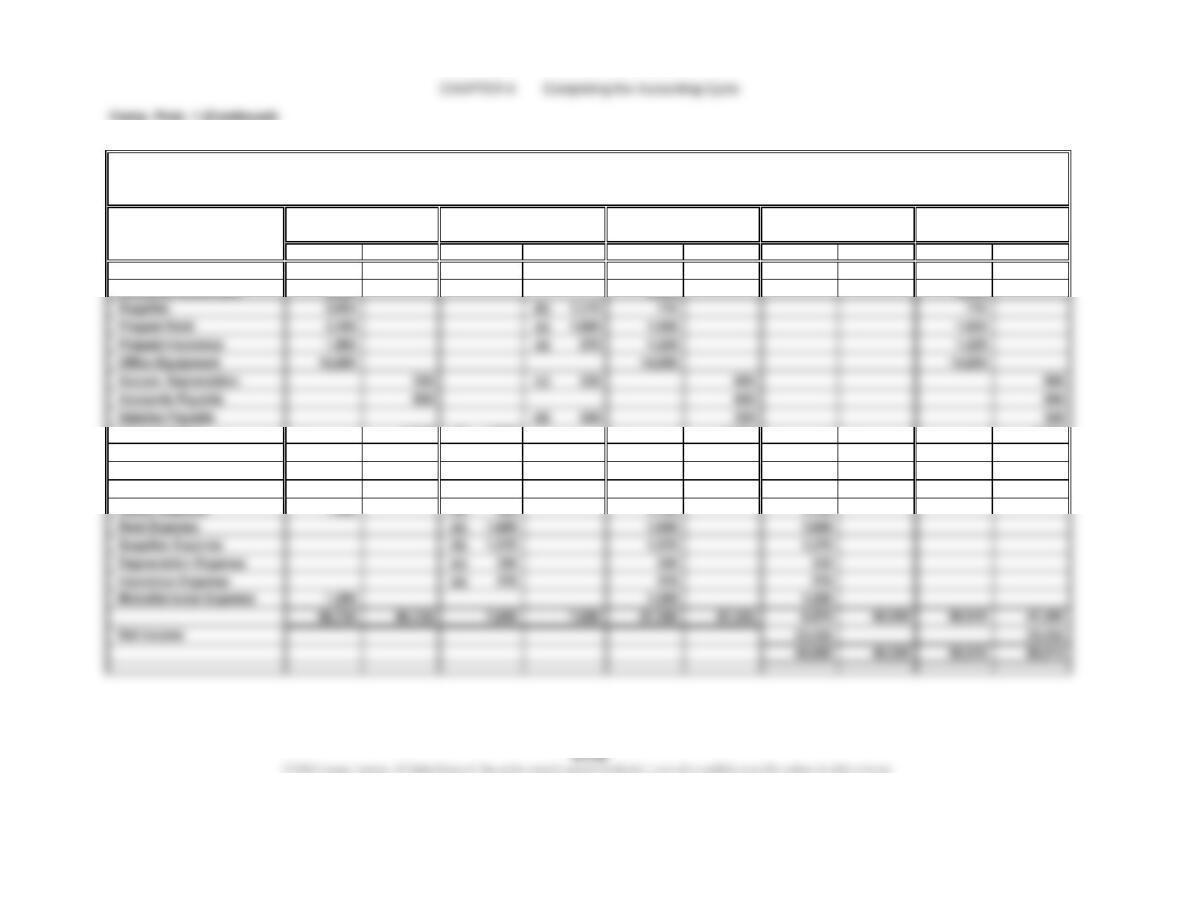

Account Title Debit Credit Debit Credit Debit Credit Debit Credit

Cash 44,195 44,195 44,195

Accounts Receivable 8,080 8,080 8,080

Unearned Fees 7,000 (f) 3,790 3,210 3,210

Kelly Pitney, Capital 42,300 42,300 42,300

Kelly Pitney, Drawing 10,500 10,500 10,500

Fees Earned 36,210 (f) 3,790 40,000 40,000

Salary Expense 1,380 (d) 325 1,705 1,705

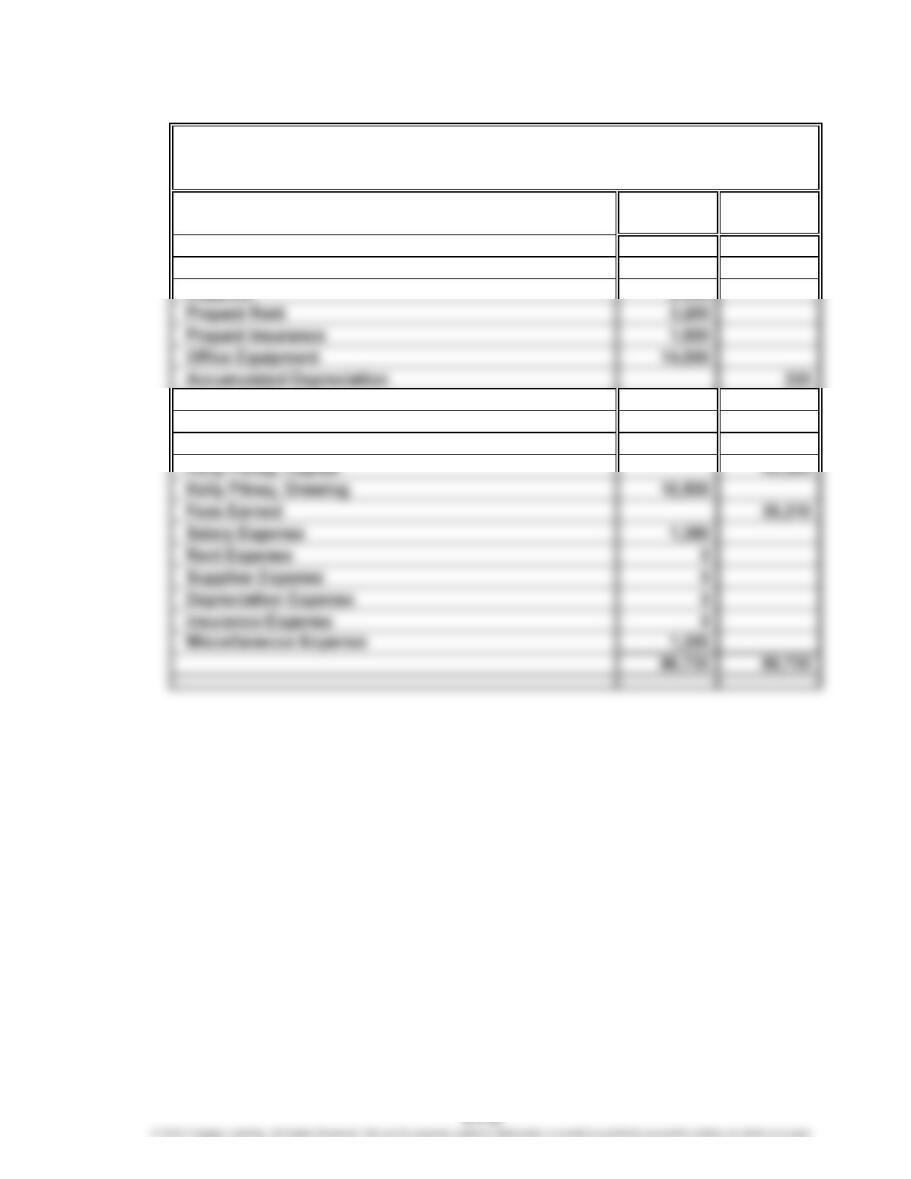

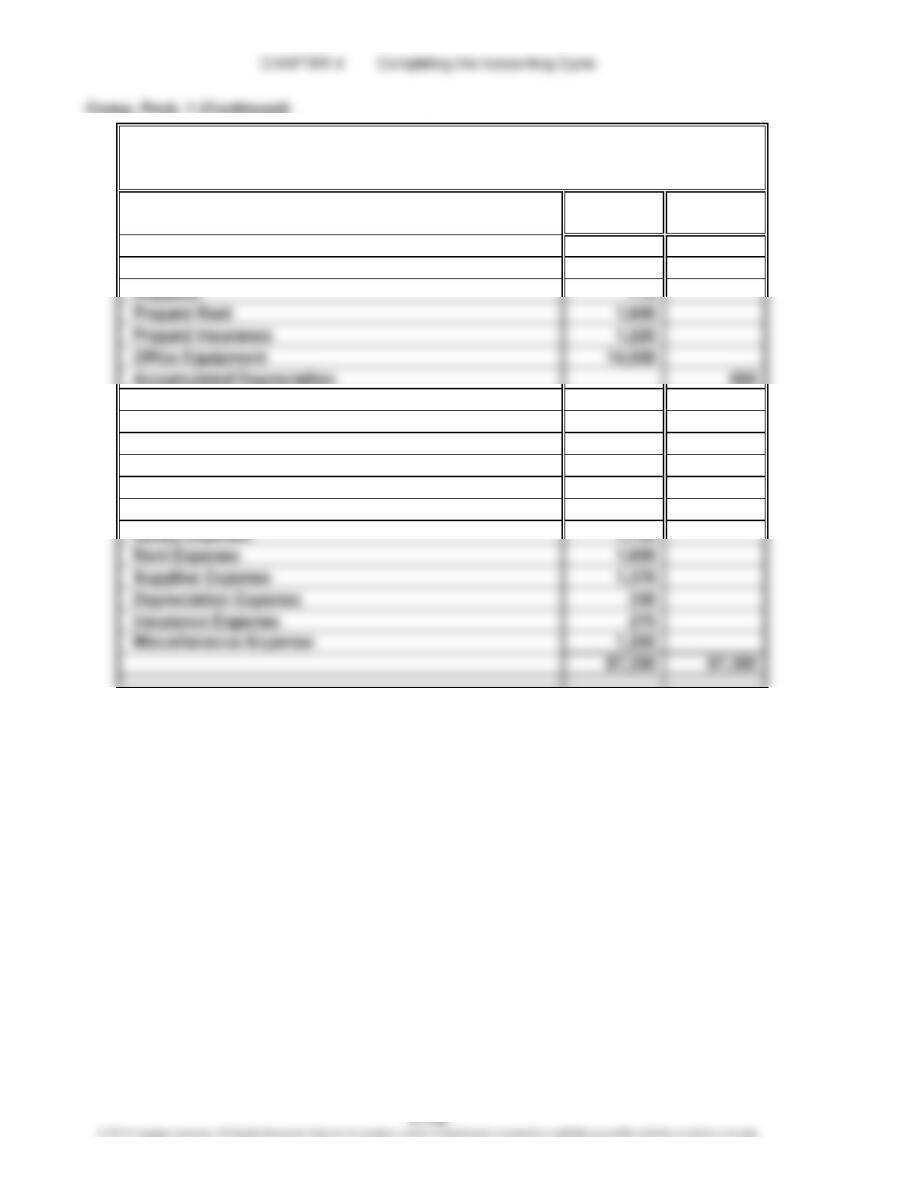

KELLY CONSULTING

End-of-Period Spreadsheet (Work Sheet)

For the Month Ended May 31, 2016

BalanceUnadjusted Adjusted Income

SheetTrial Balance

Debit Credit

Trial Balance StatementAdjustments