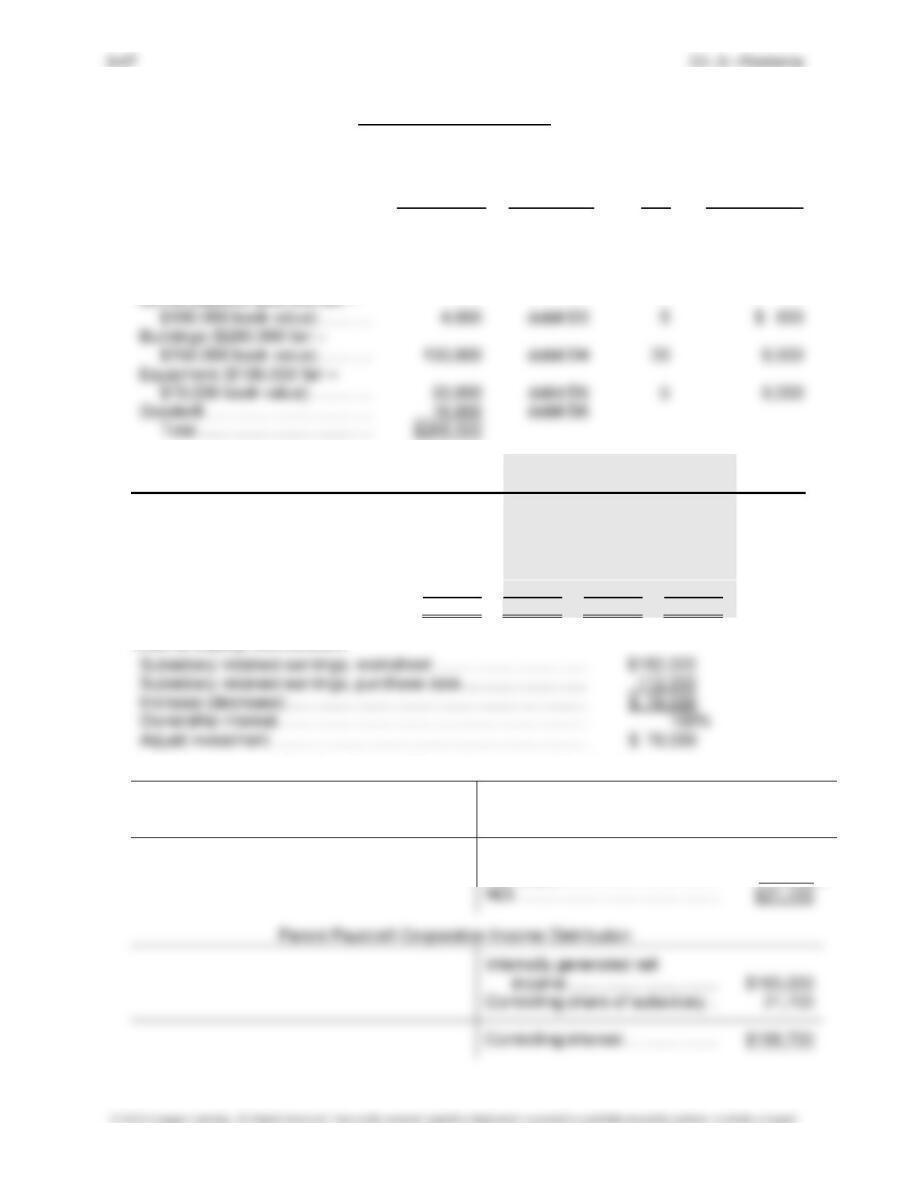

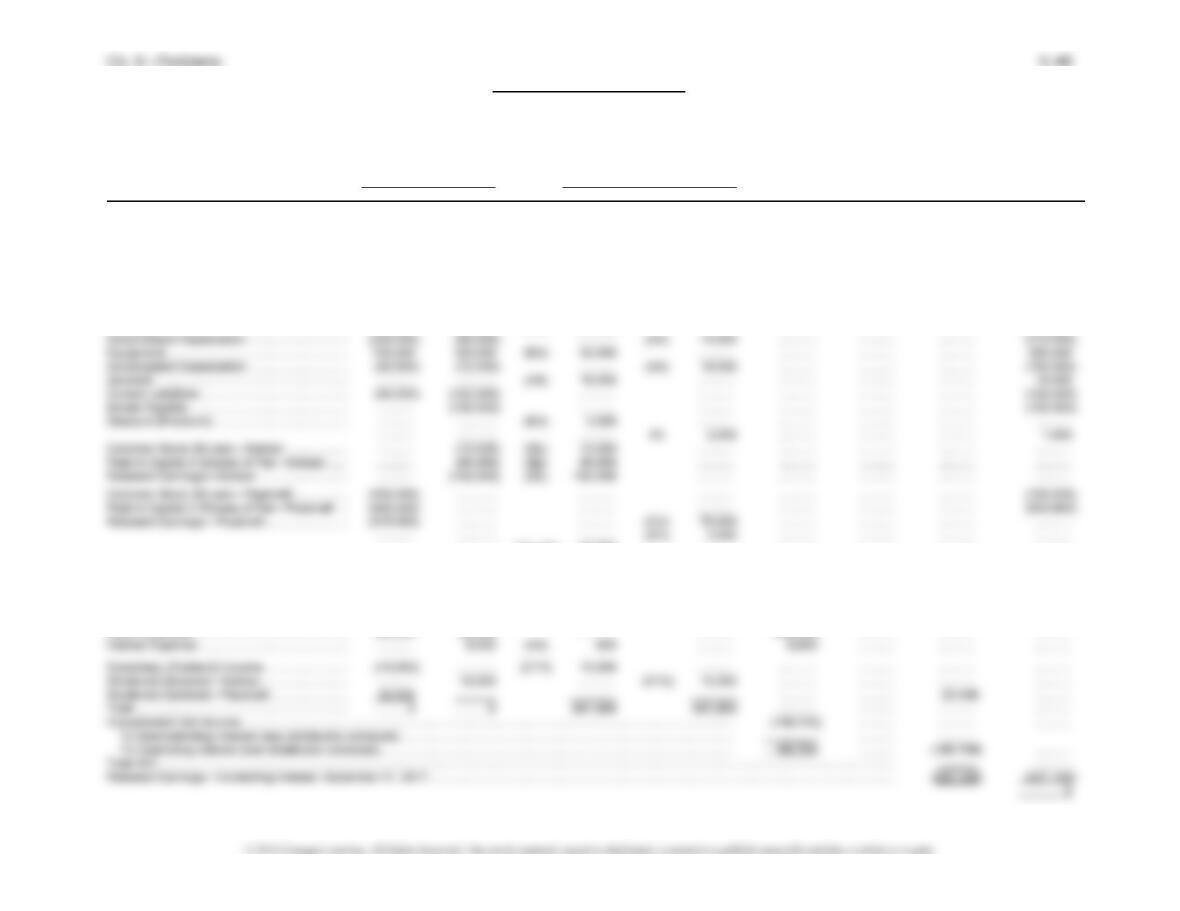

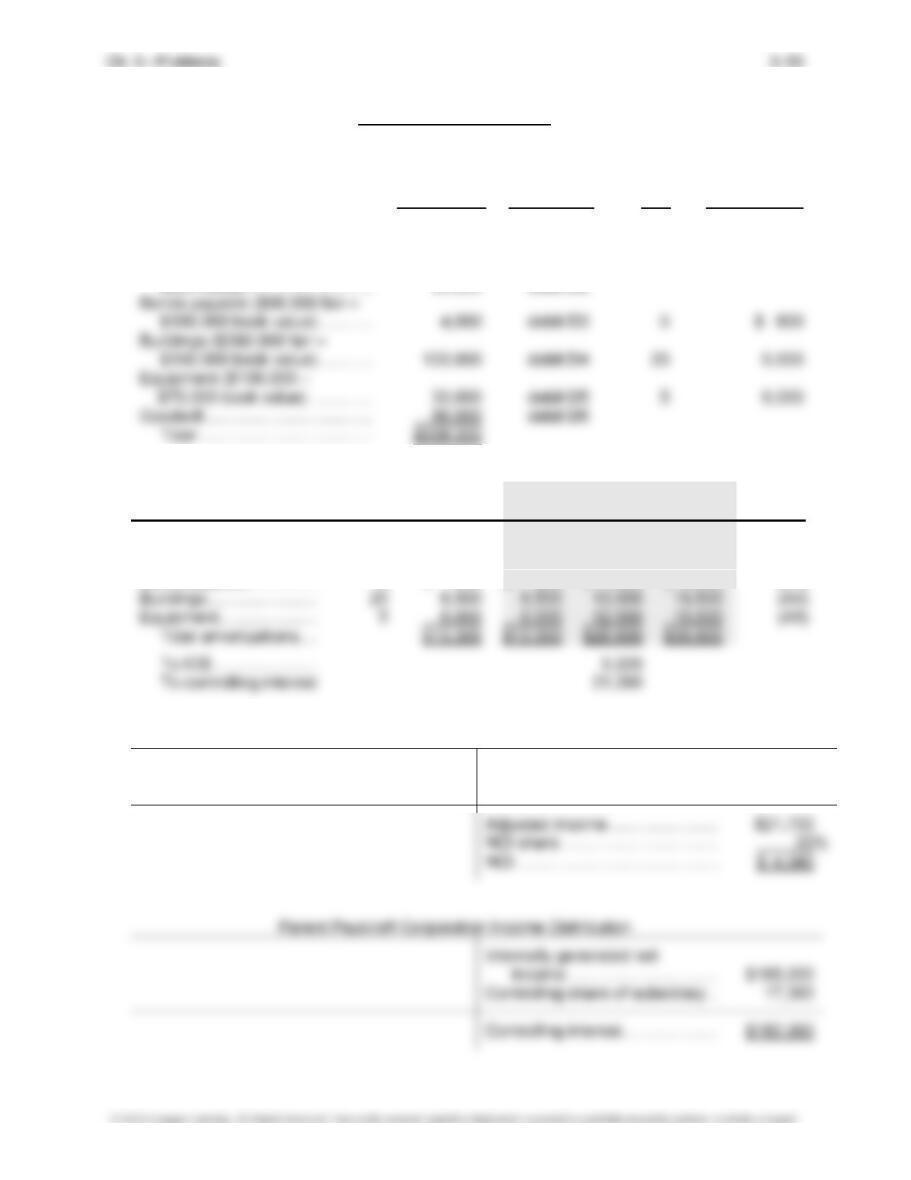

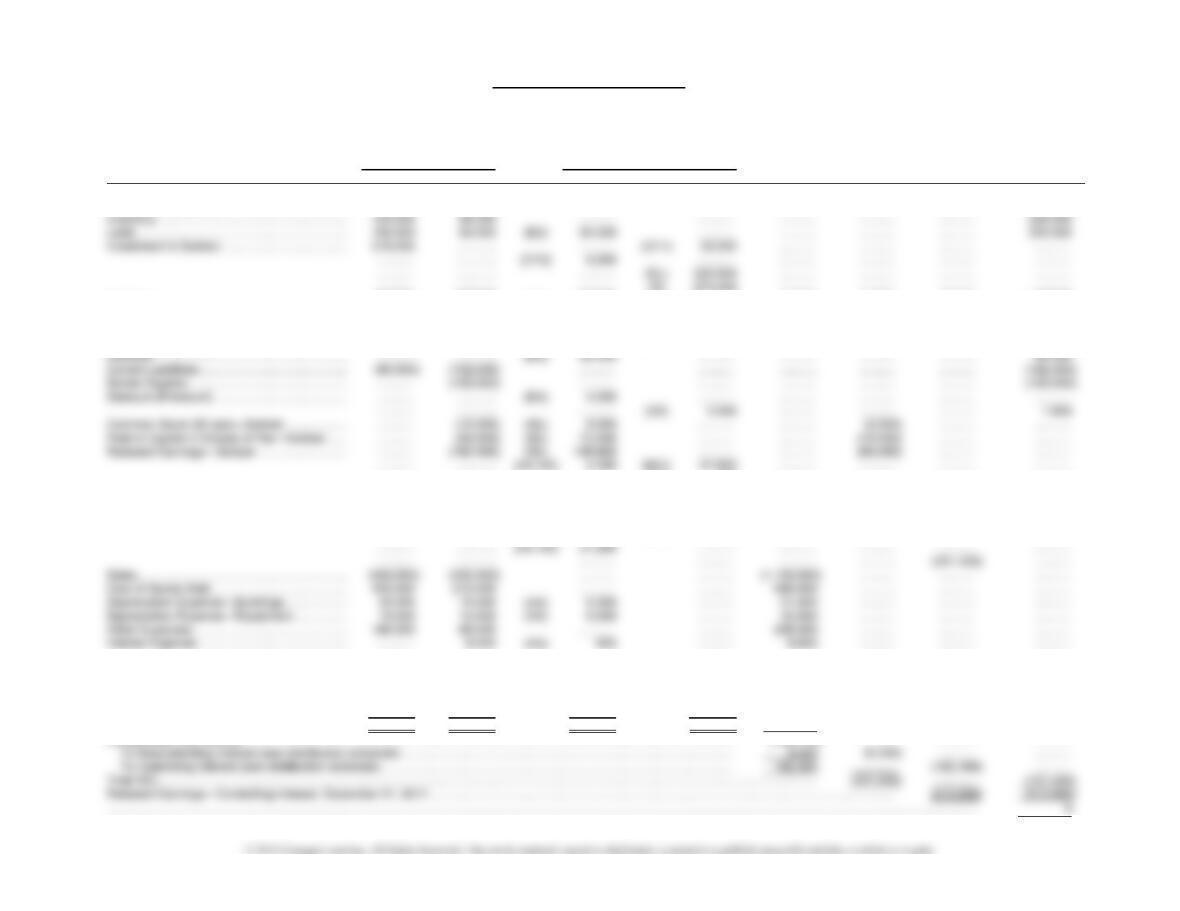

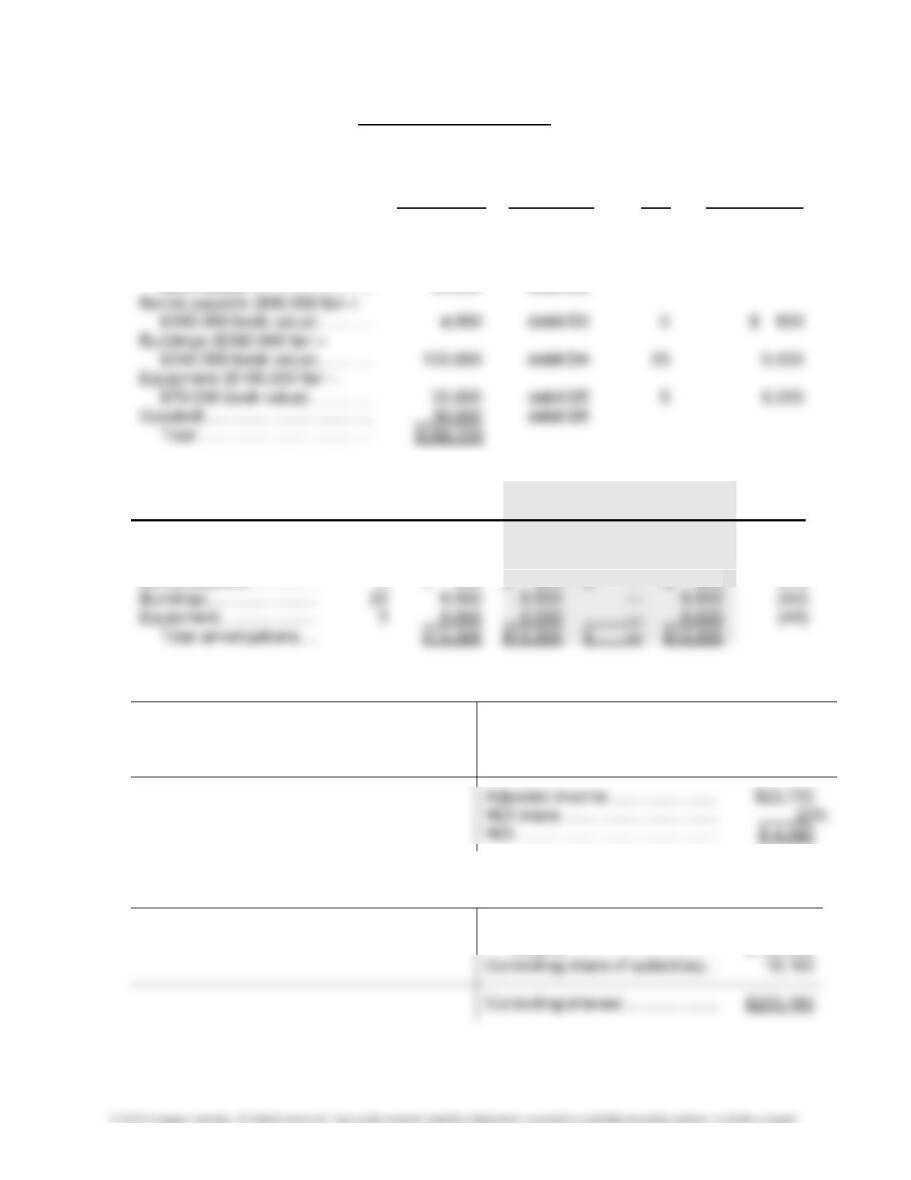

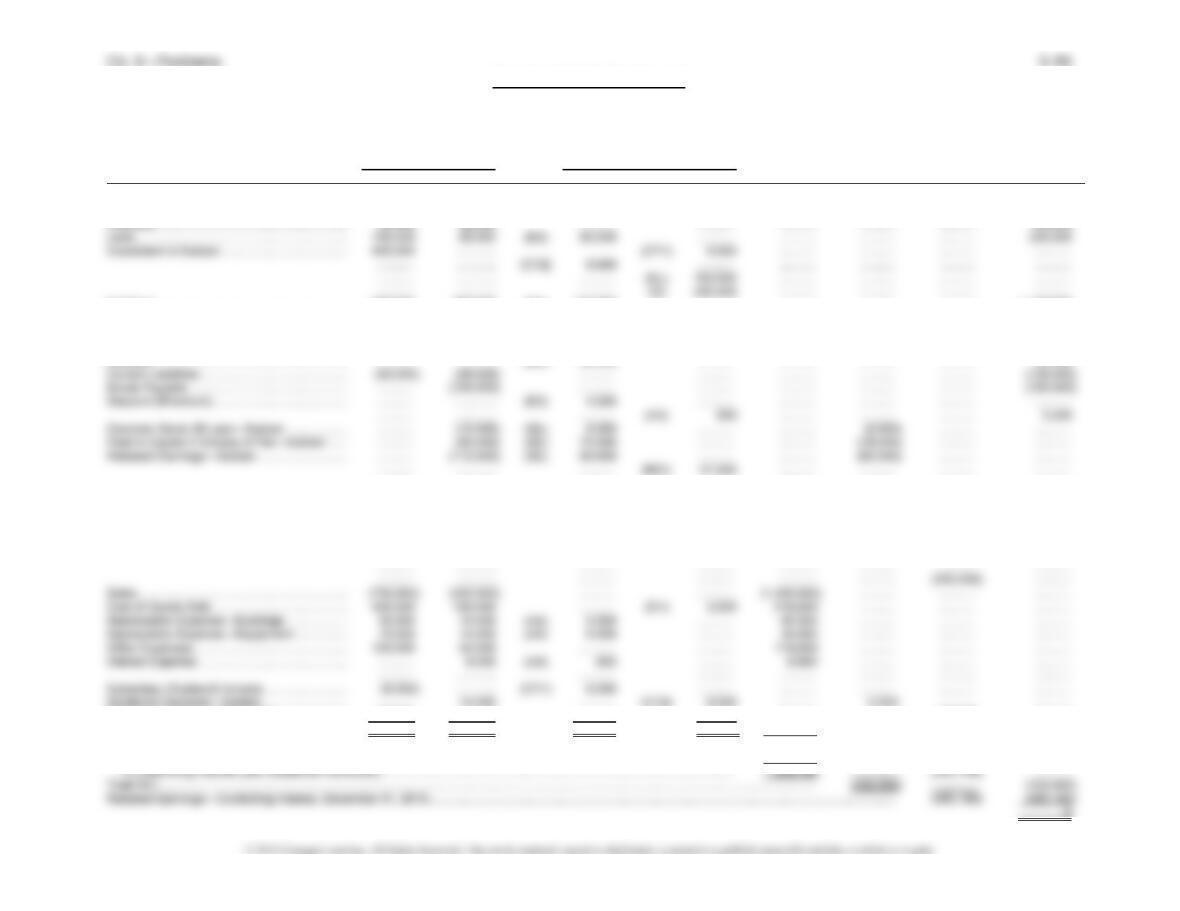

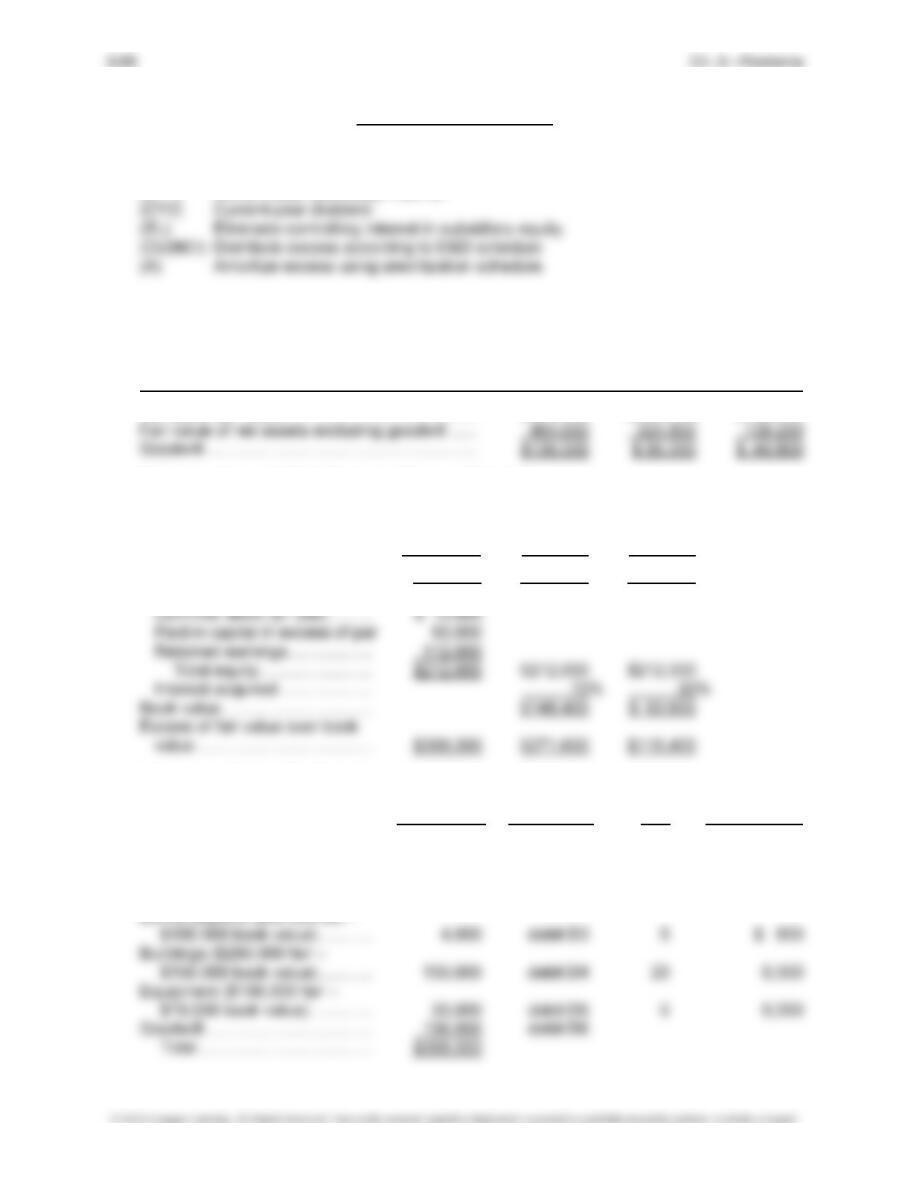

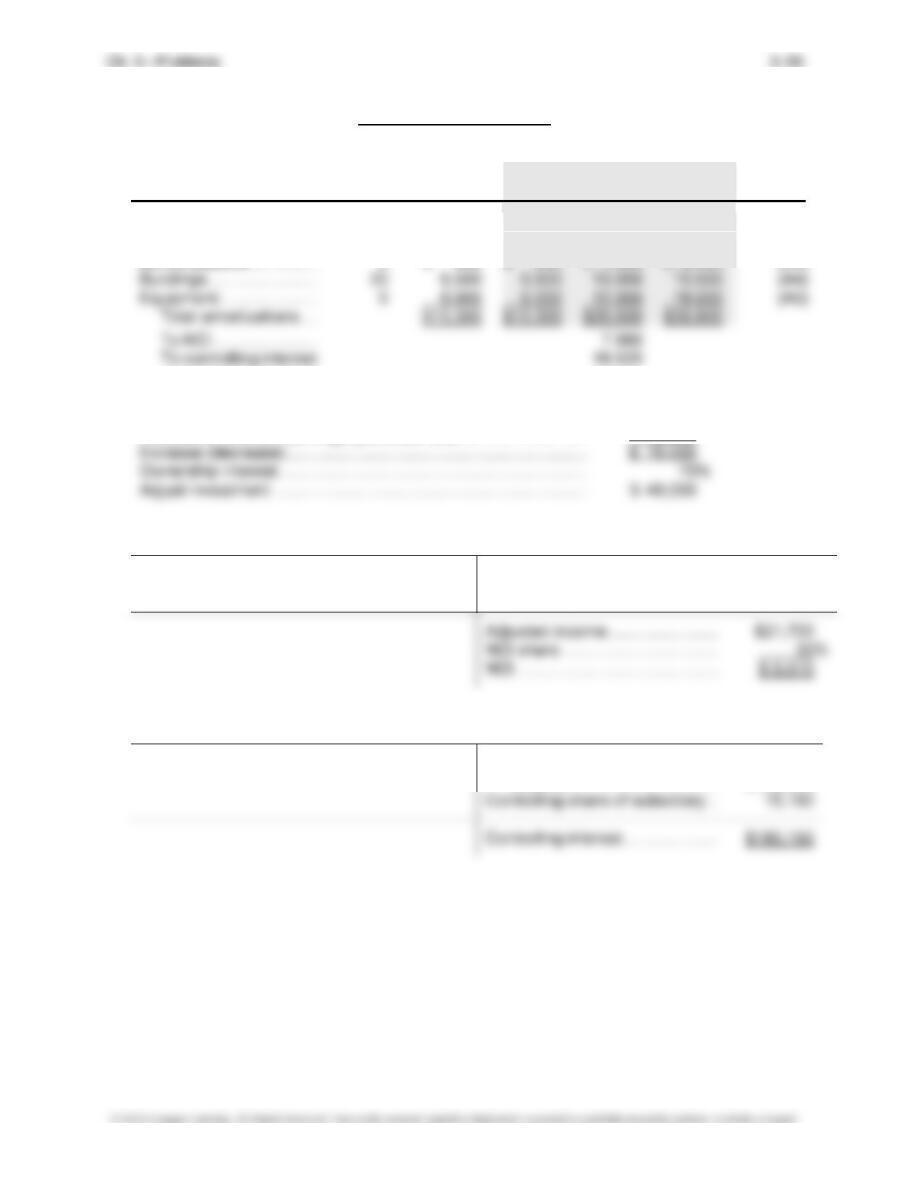

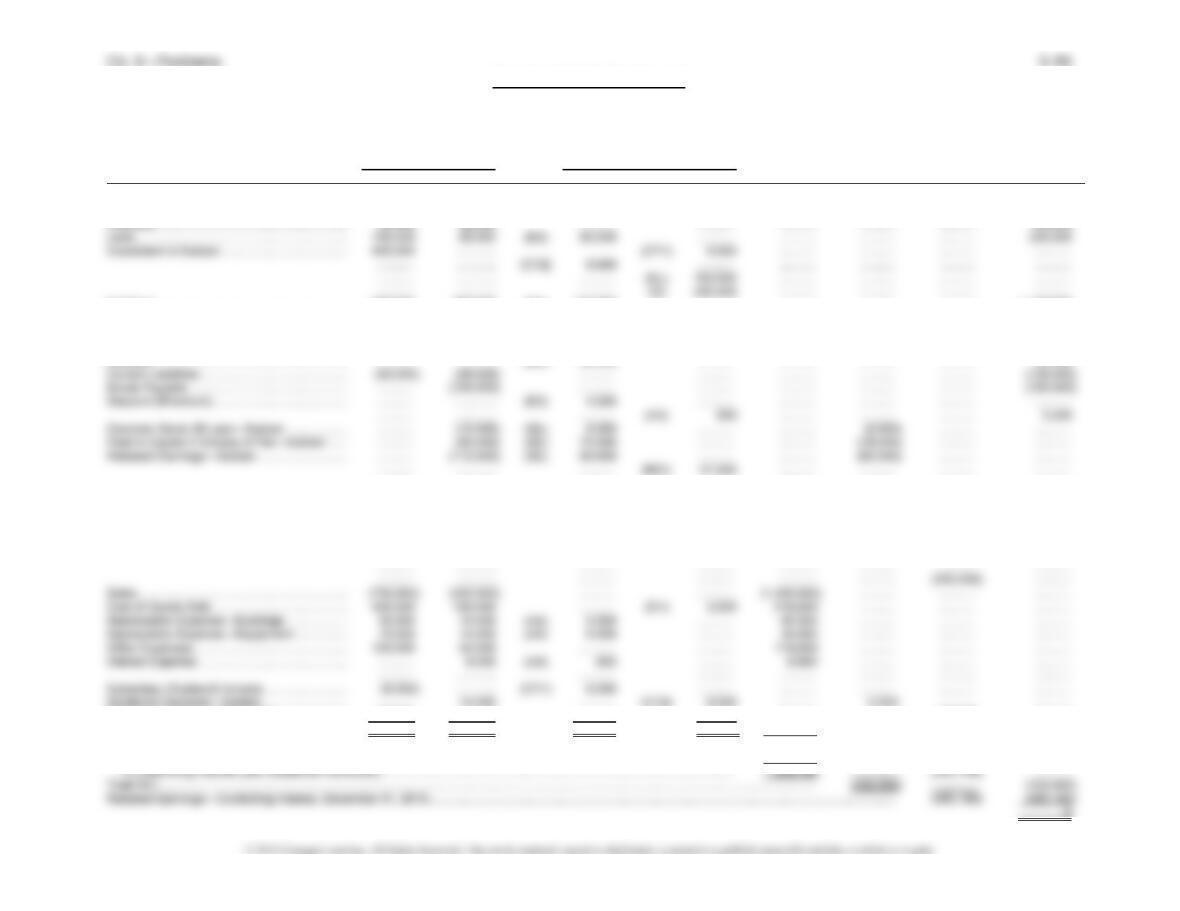

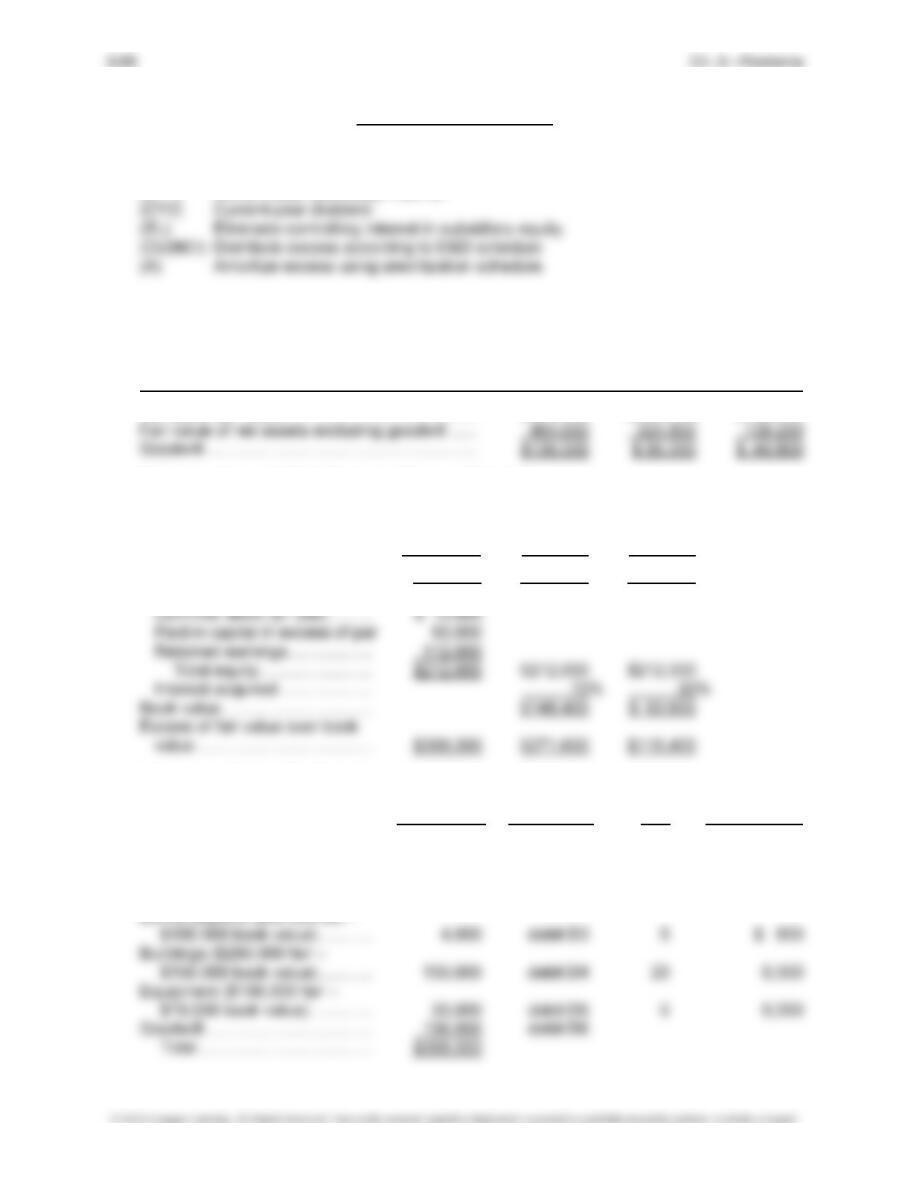

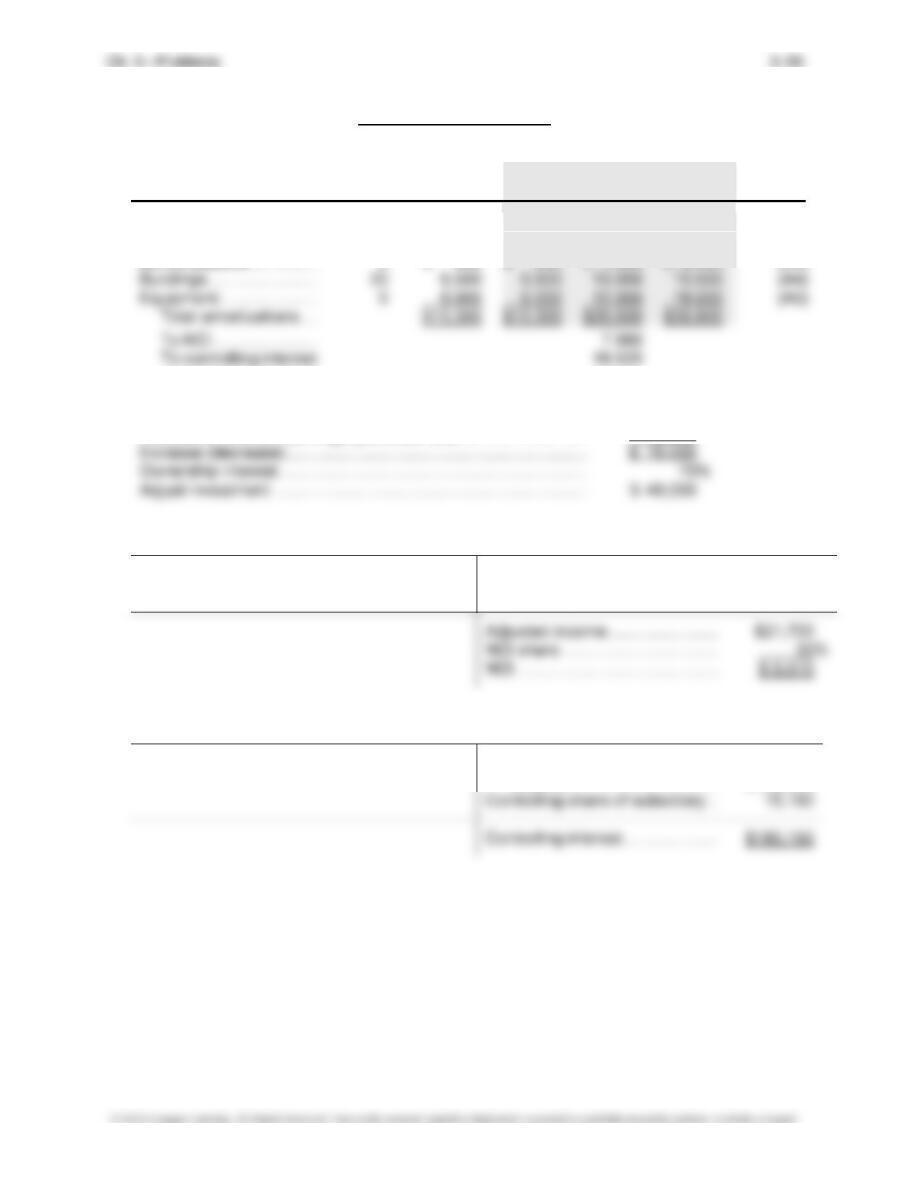

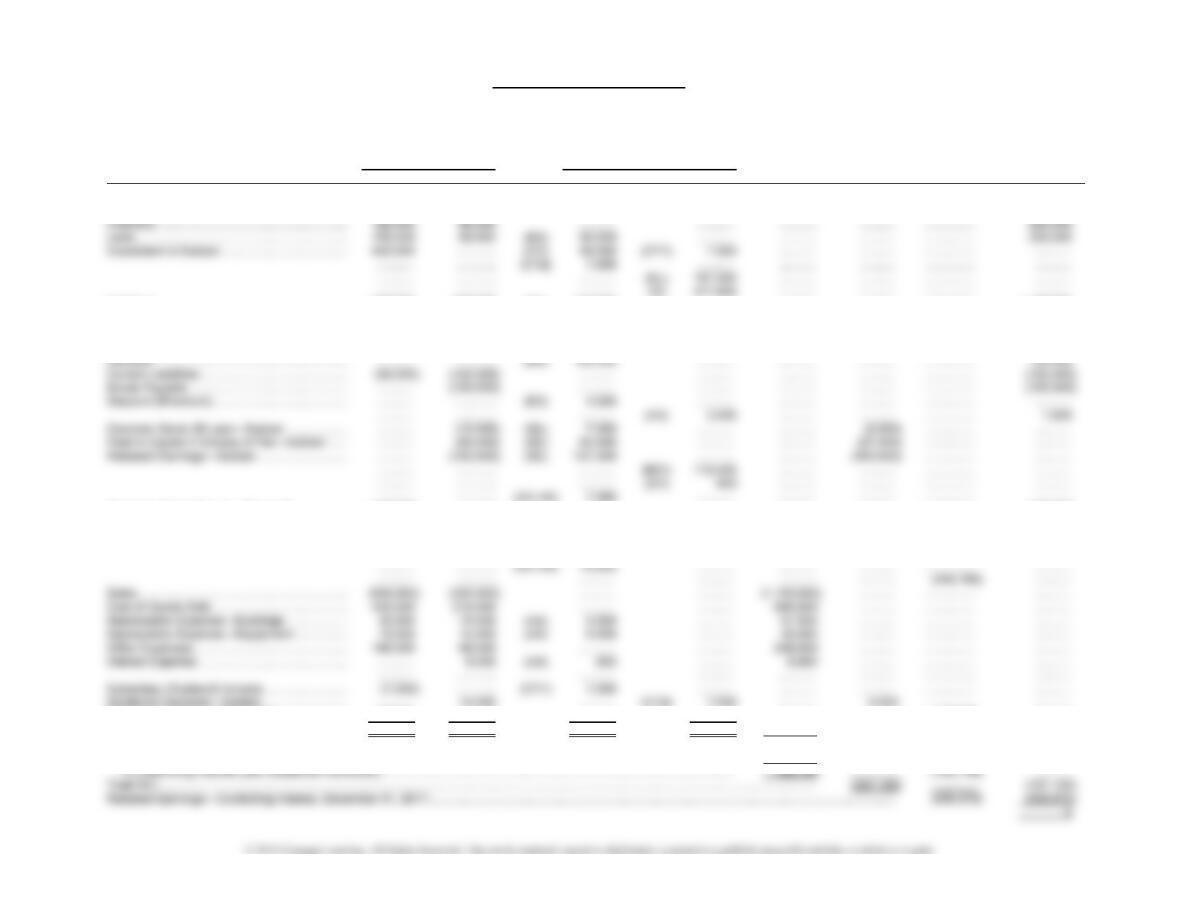

Problem 3-14, Continued

Fast Cool Company and Subsidiary Fast Air Company

Worksheet for Consolidated Financial Statements

For Year Ended December 31, 2015

Eliminations Consolidated Controlling Consolidated

Trial Balance

and Adjustments Income Retained Balance

Fast Cool Fast Air Dr. Cr. Statement NCI Earnings Sheet

Cash .................................................................... 147,000 37,000 ............ ............ ............ ............ ............ 184,000

............ ............ ............ (D) 320,000 ............ ............ ............ ............

Buildings .............................................................. 1,200,000 400,000 (D4) 150,000 ............ ............ ............ ............ 1,750,000

Accumulated Depreciation ................................... (176,000) (67,500) ............ (A4) 7,500 ............ ............ ............ (251,000)

Equipment ........................................................... 140,000 150,000 ............ (D5) 20,000 ............ ............ ............ 270,000

Accumulated Depreciation ................................... (68,000) (54,000) (A5) 4,000 ............ ............ ............ ............ (118,000)

Patent .................................................................. ............ 32,000 (D6) 10,000 (A6) 2,000 ............ ............ ............ 40,000

Purchase Contract ............................................... ............ ............ (D7) 10,000 (A7) 5,000 ............ ............ ............ 5,000

............ ............ ............ ............ ............ ............ ............ ............

............ ............ ............ ............ ............ ............ ............ ............

Common Stock ($1 par)—Fast Cool ................... (100,000) ............ ............ ............ ............ ............ ............ (100,000)

Paid-In Capital in Excess of Par—Fast Cool ....... (1,500,000) ............ ............ ............ ............ ............ ............ (1,500,000)

Retained Earnings—Fast Cool ............................ (400,000) ............ ............ ............ ............ ............ ............ ............

............ ............ ............ ............ ............ ............ ............ ............

............ ............ ............ ............ ............ ............ ............ ............

............ ............ ............ ............ ............ ............ (400,000) ............

Sales ................................................................... (700,000) (400,000) ............ ............ (1,100,000) ............ ............ ............

Cost of Goods Sold ............................................. 380,000 210,000 (D1) 5,000 ............ 595,000 ............ ............ ............

............ ............ ............ ............ ............ ............ ............ ............

............ ............ ............ ............ ............ ............ ............ ............

Subsidiary (Dividend) Income .............................. (47,500) ............ (CY1) 47,500 ............ ............ ............ ............ ............

Dividends Declared—Fast Air ............................. ............ 10,000 ............ (CY2) 10,000 ............ ............ ............ ............