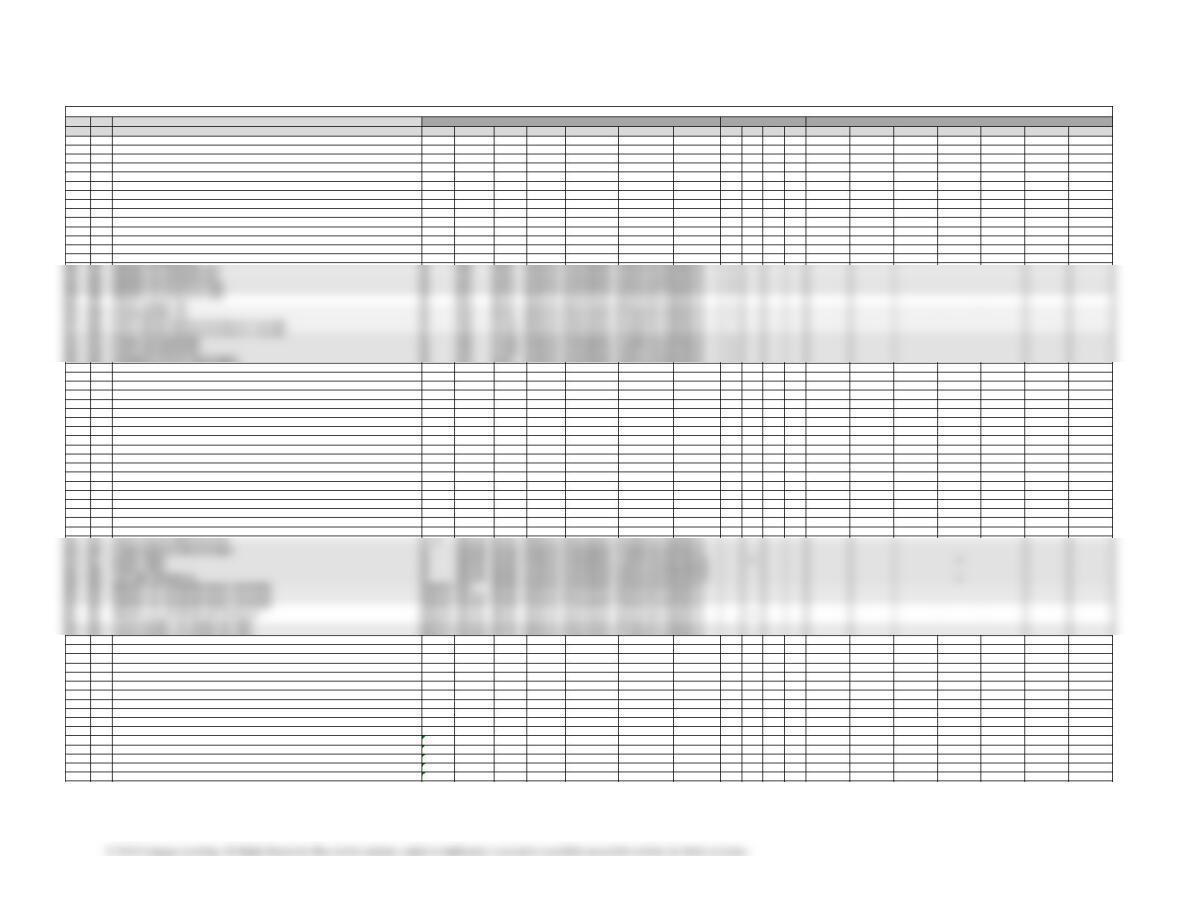

DQ 1 1 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 2 1 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 3 1 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 4 2 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 5 2 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 6 3 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 7 4 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 8 4 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 9 4 Easy 5 min. Analytics Measurement Process Costing Remembering

DQ 10 5 Easy 5 min. Analytics Measurement Process Costing Remembering

PE 1A Job order vs. process costing 1 Easy 5 min. Analytics Measurement Process Costing Remembering x

PE 1B Job order vs. process costing 1 Easy 5 min. Analytics Measurement Process Costing Remembering x

PE 2A Units to be assigned costs 2 Easy 5 min. Analytics Measurement Process Costing Applying x

PE 2B Units to be assigned costs 2 Easy 5 min. Analytics Measurement Process Costing Applying x

PE 8B Using process costs for decision making 4 Easy 5 min. Analytics Measurement Process Costing Applying x

EX 1 Entries for materials cost flows in a process cost system 1,3 Easy 5 min. Analytics Measurement Process Costing Remembering

EX 2 Flowchart of accounts related to service and processing departments 1 Easy 5 min. Analytics Measurement Process Costing Remembering

EX 3 Entries for flow of factory costs for process cost system 1,3 Easy 10 min. Analytics Measurement Process Costing Applying x

EX 4 Factory overhead rate, entry for applying factory overhead, and factory overhead account balance 1,3 Easy 10 min. Analytics Measurement Process Costing Applying x

EX 5 Equivalent units of production 2 Easy 5 min. Analytics Measurement Process Costing Applying x

EX 6 Equivalent units of production 2 Moderate 15 min. Analytics Measurement Process Costing Applying x

EX 7 Equivalent units of production 2 Moderate 15 min. Analytics Measurement Process Costing Applying x

EX 8 Cost per equivalent unit 2,4 Moderate 30 min. Analytics Measurement Process Costing Applying x

EX 9 Equivalent units of production 2 Moderate 10 min. Analytics Measurement Process Costing Applying

EX 10 Cost per equivalent unit 2 Moderate 15 min. Analytics Measurement Process Costing Applying x

EX 11 Equivalent units of production and related costs 2 Moderate 15 min. Analytics Measurement Process Costing Applying x x

EX 12 Costs of units completed and in process 2,4 Moderate 30 min. Analytics Measurement Process Costing Applying x

EX 13 Errors in equivalent unit coputation 2 Moderate 20 min. Analytics Measurement Process Costing Applying

EX 14 Cost per equivalent unit 2 Moderate 15 min. Analytics Measurement Process Costing Applying x

EX 15 Costs per equivalent unit and production costs 2,4 Moderate 30 min. Analytics Measurement Process Costing Applying

EX 16 Cost of production report 2,4 Moderate 20 min. Analytics Measurement Process Costing Applying x

EX 17 Cost of production report 2,4 Moderate 20 min. Analytics Measurement Process Costing Applying

EX 18 Cost of production and journal entries 1,2,3,4 Moderate 30 min. Analytics Measurement Process Costing Applying

EX 30 Cost per equivalent unit: average cost method Appendix Moderate 20 min. Analytics Measurement Process Costing Applying x

PR 1A Entries for process cost system 1,3 Moderate 1.5 hours Analytics Measurement Process Costing Applying x x

PR 2A Cost of production report 2,4 Moderate 1.5 hours Analytics Measurement Process Costing Applying x

PR 3A Equivalent units and related costs: cost of production report 2,3,4 Challenging 1.5 hours Analytics Measurement Process Costing Applying x x

PR 4A Work in process account data for two months: cost of production reports 1,2,3 Moderate 2 hours Analytics Measurement Process Costing Applying x x

PR 5A Equivalent units and related costs: cost of production report: average cost method Appendix Moderate 1 hours Analytics Measurement Process Costing Applying x

PR 1B Entries for process cost system 1,3 Moderate 1.5 hours Analytics Measurement Process Costing Applying x x

PR 2B Cost of production report 2,4 Moderate 1.5 hours Analytics Measurement Process Costing Applying x

PR 3B Equivalent units and related costs: cost of production report 2,3,4 Challenging 1.5 hours Analytics Measurement Process Costing Applying x x

PR 4B Work in process account data for two months: cost of production reports 1,2,3 Moderate 2 hours Analytics Measurement Process Costing Applying x x

PR 5B Equivalent units and related costs: cost of production report: average cost method Appendix Moderate 1 hours Analytics Measurement Process Costing Applying x

CP 1 Ethics and professional conduct in business 1 Easy 10 min. Ethics Measurement Process Costing Analyzing x

CP 2 Accounting for materials cost 2 Moderate 15 min. Analytics Measurement Process Costing Analyzing x

CP 3 Analyzing unit costs 4 Moderate 15 min. Analytics Measurement Process Costing Analyzing x

CP 4 Decision making 4 Challenging 30 min. Analytics Measurement Process Costing Analyzing

CP 5 Process costing companies 1 Moderate 45 min. Analytics Measurement Process Costing Applying