CHAPTER 18 Managerial Accounting Concepts and Principles

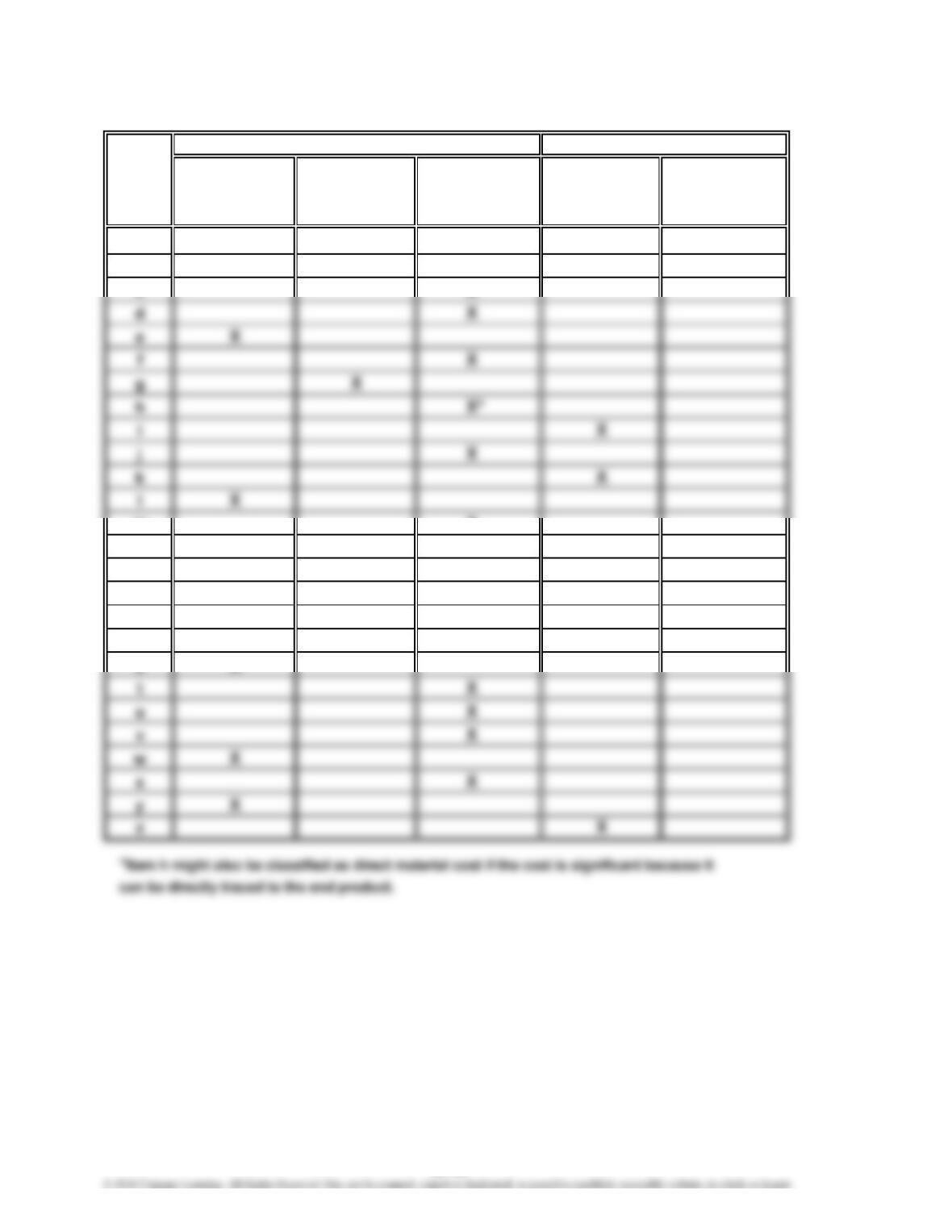

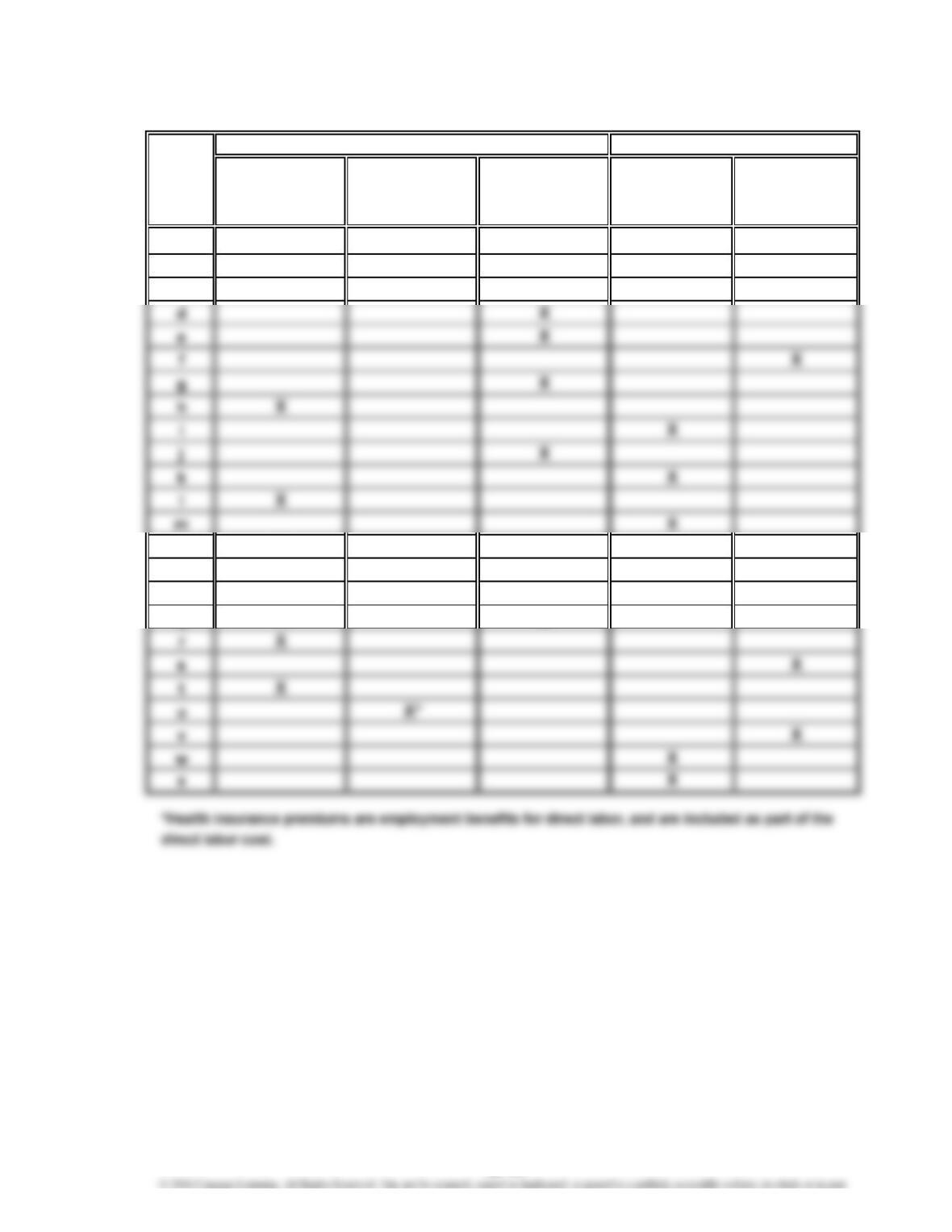

Prob. 18–4B

1. On Company

a. $30,800 ($282,800 + $65,800 – $317,800)

b. $854,000 ($317,800 + $387,800 + $148,400)

Off Company

a. $581,560 ($685,720* + $91,140 – $195,300)

b. $685,720 ($1,519,000 – $256,060 – $577,220)

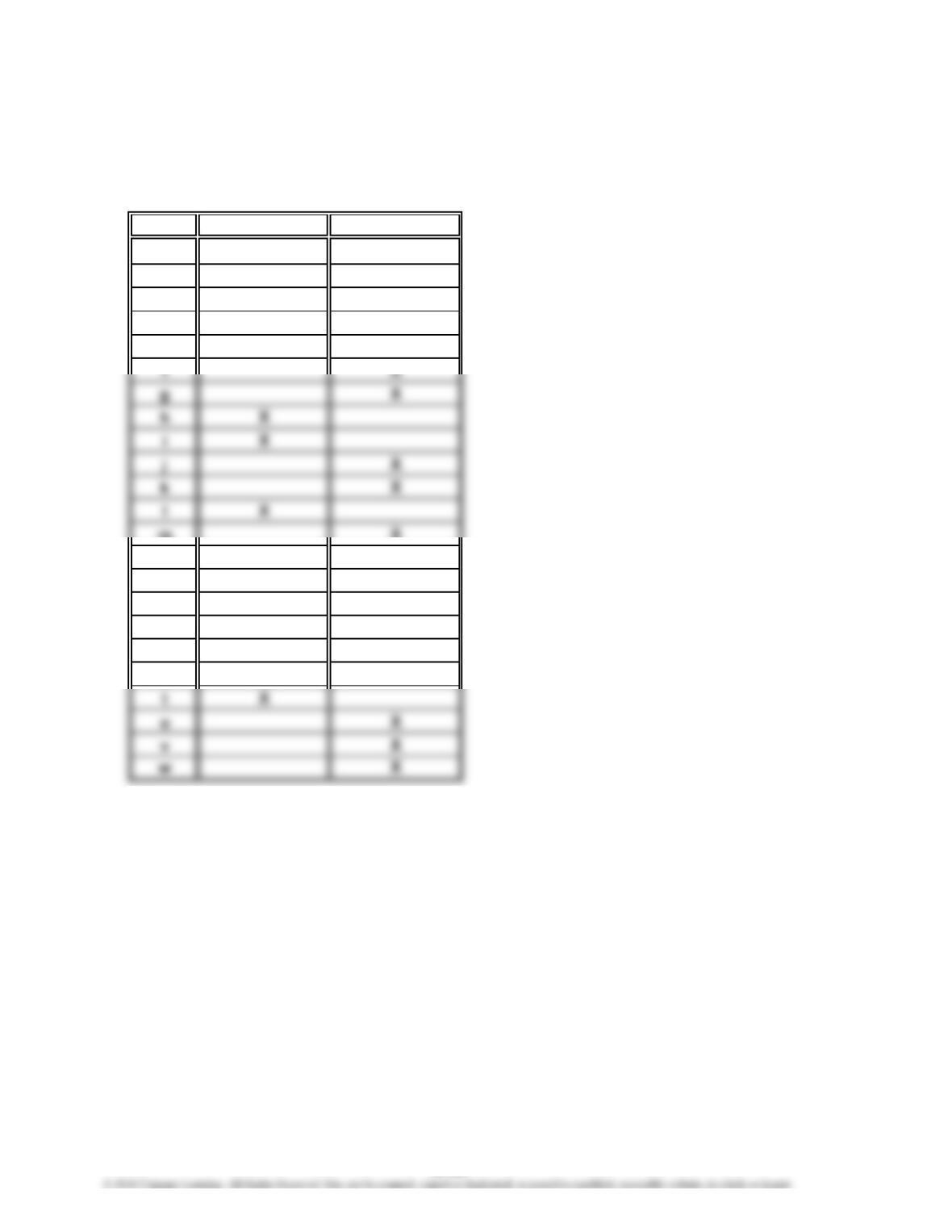

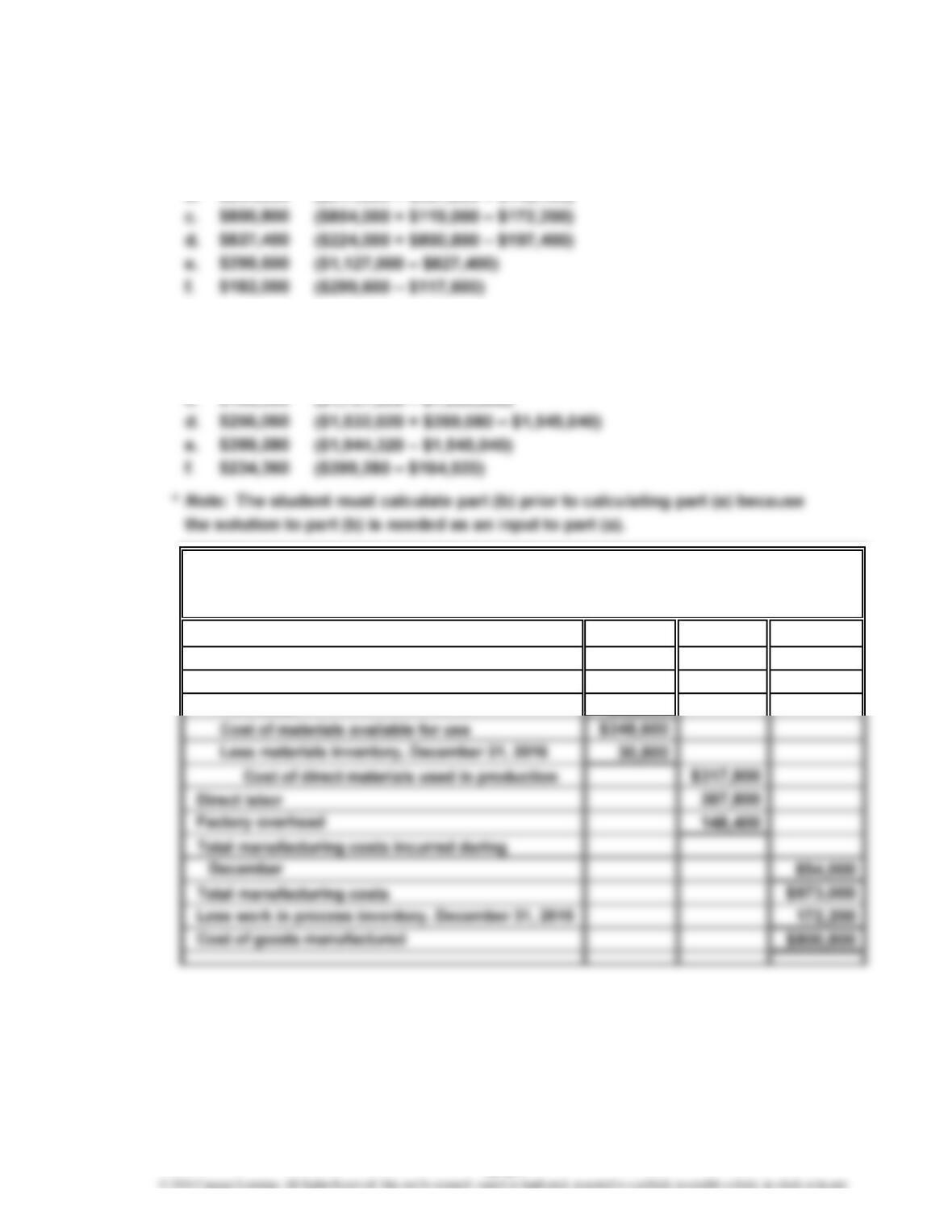

2.

Work in process inventory, December 1, 2016 $119,000

Direct materials:

Materials inventory, December 1, 2016 $ 65,800

Purchases 282,800

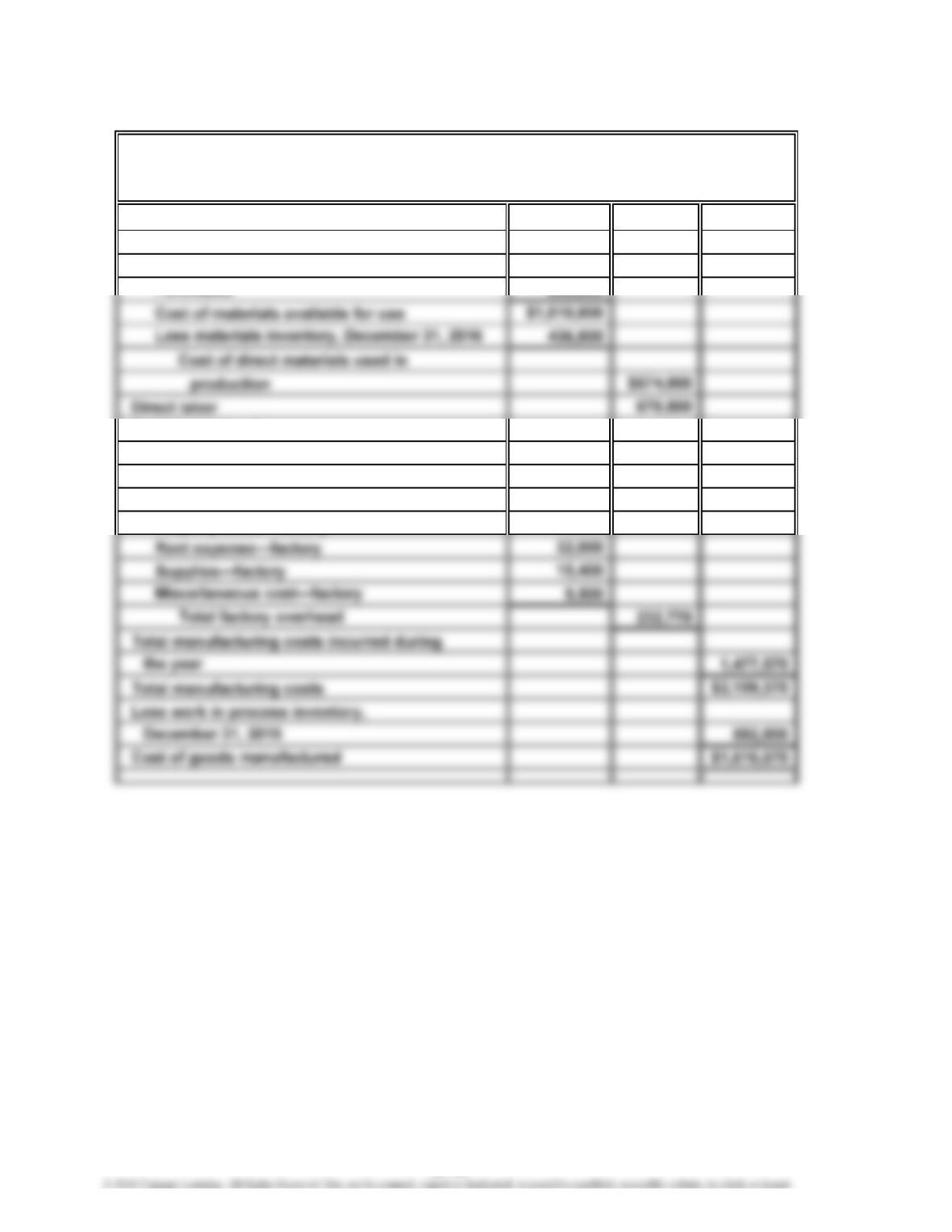

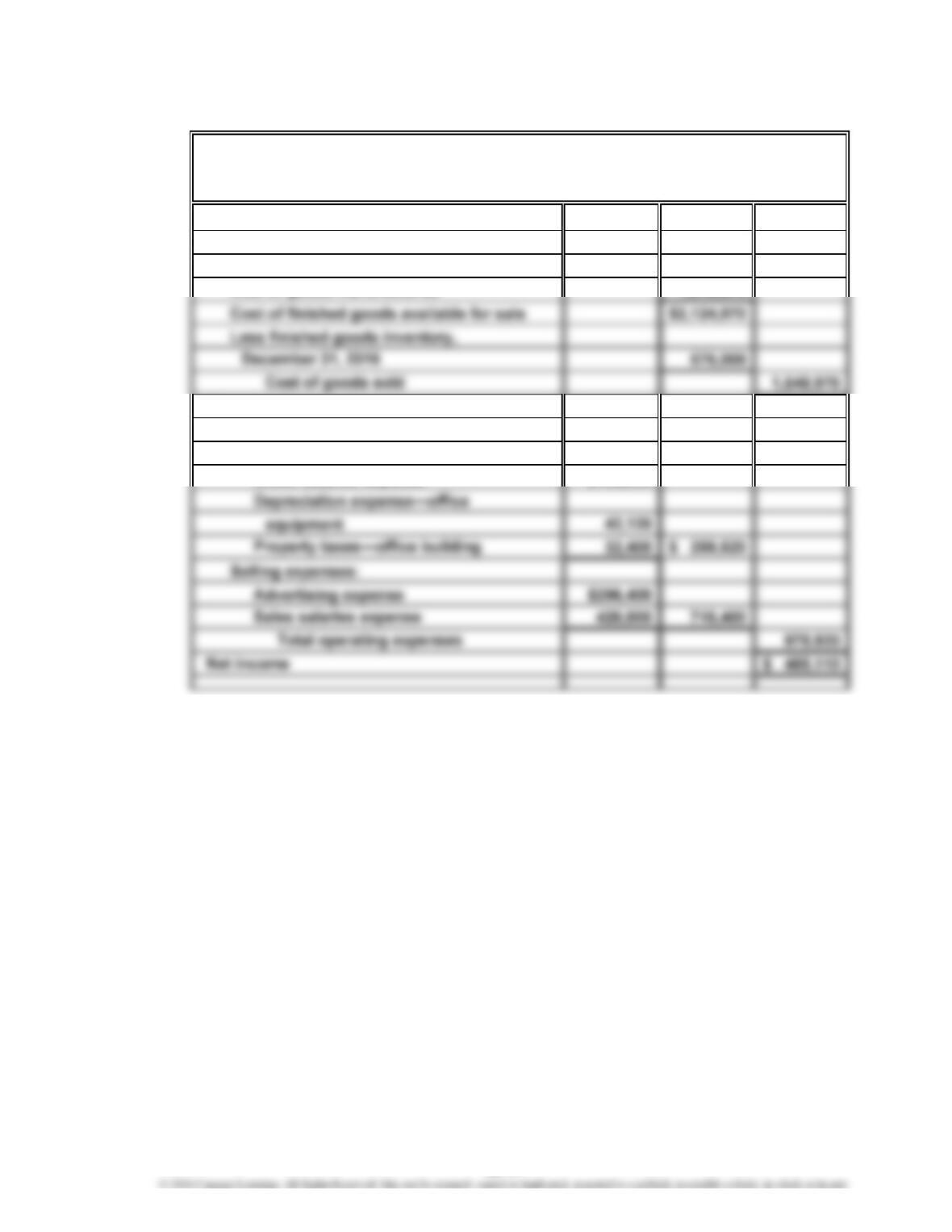

ON COMPANY

Statement of Cost of Goods Manufactured

For the Month Ended December 31, 2016

18-21