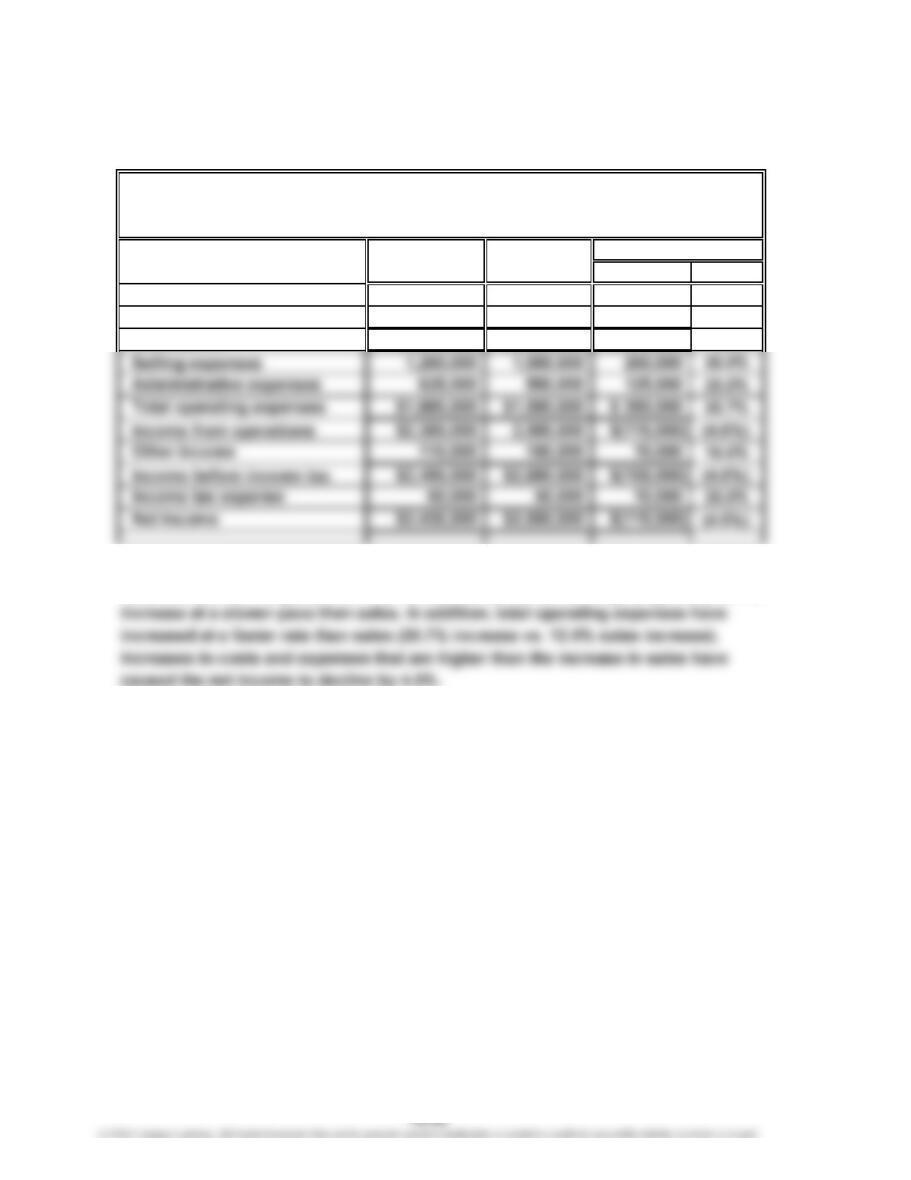

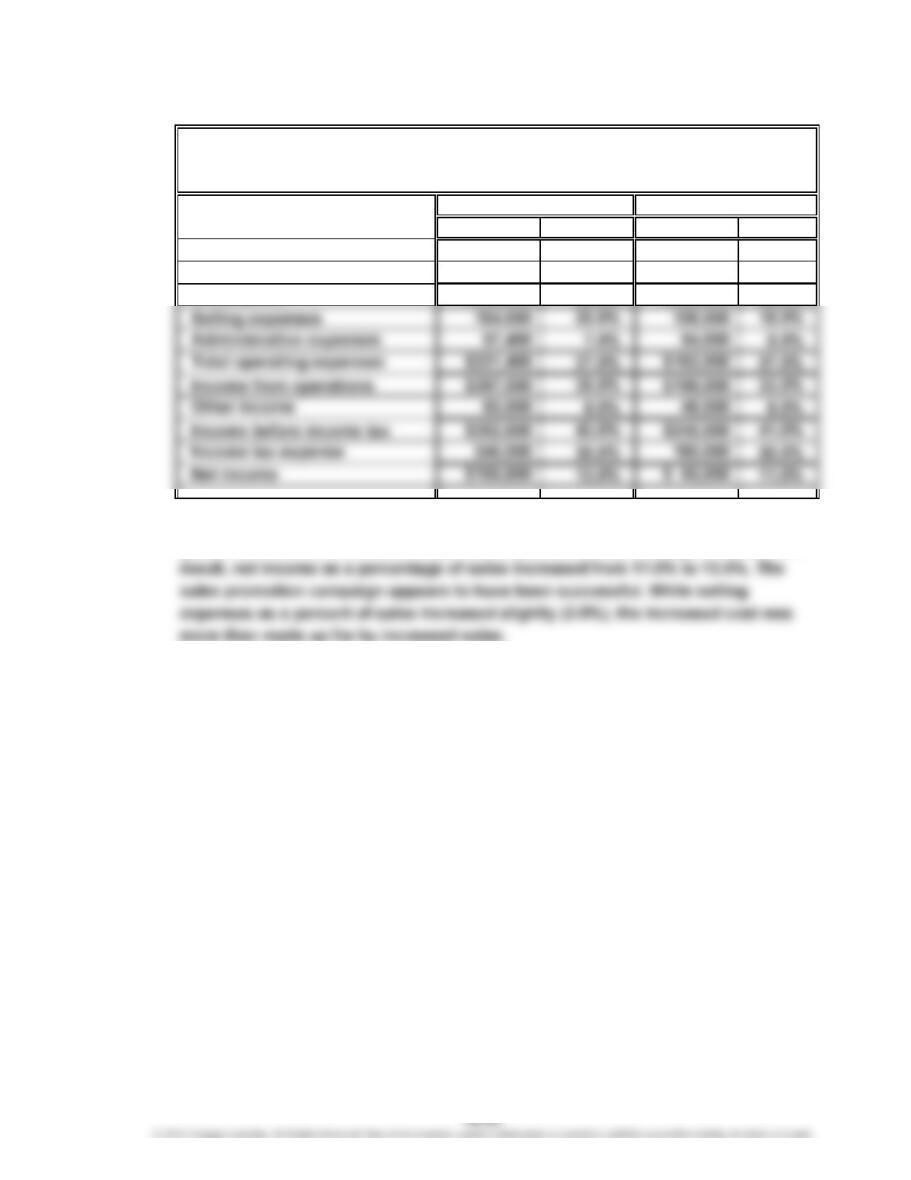

CHAPTER 15 Financial Statement Analysis

Prob. 15–4A

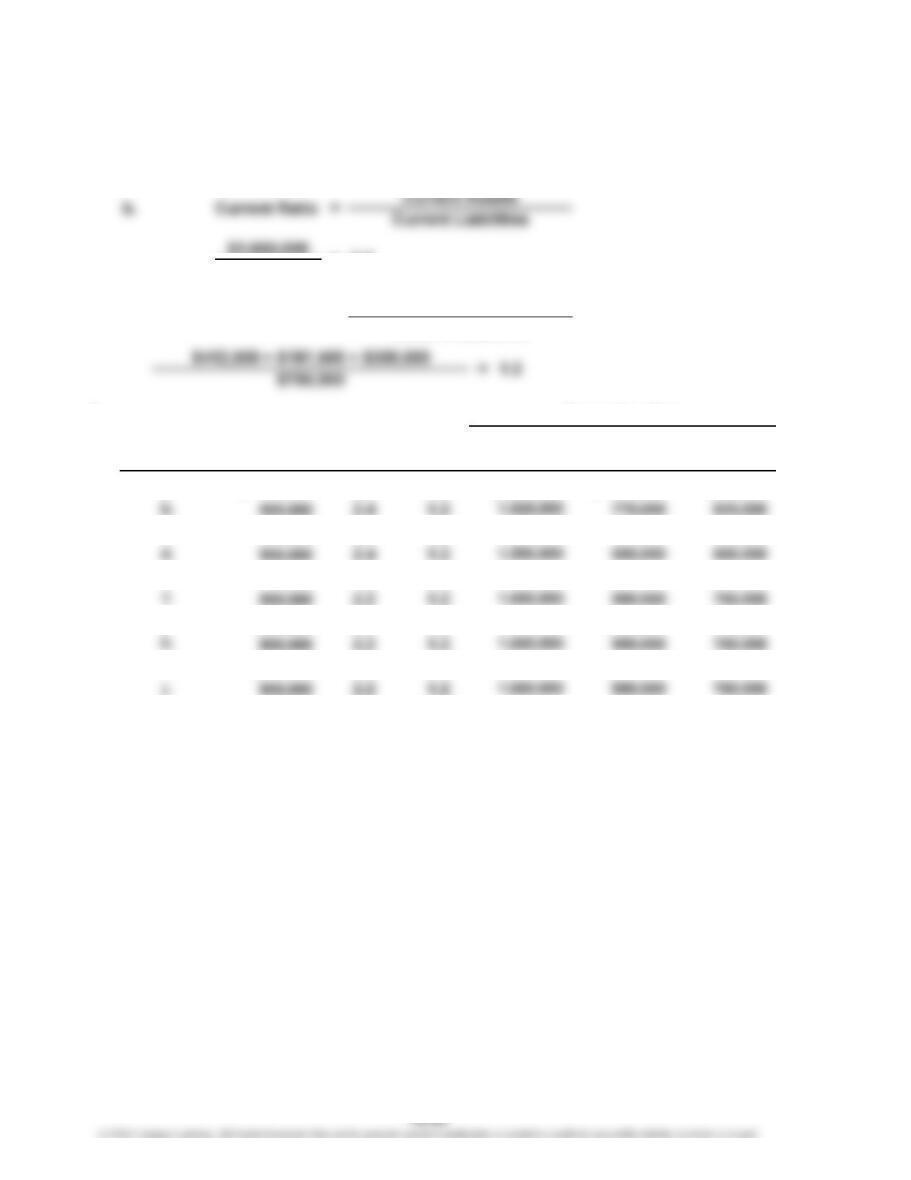

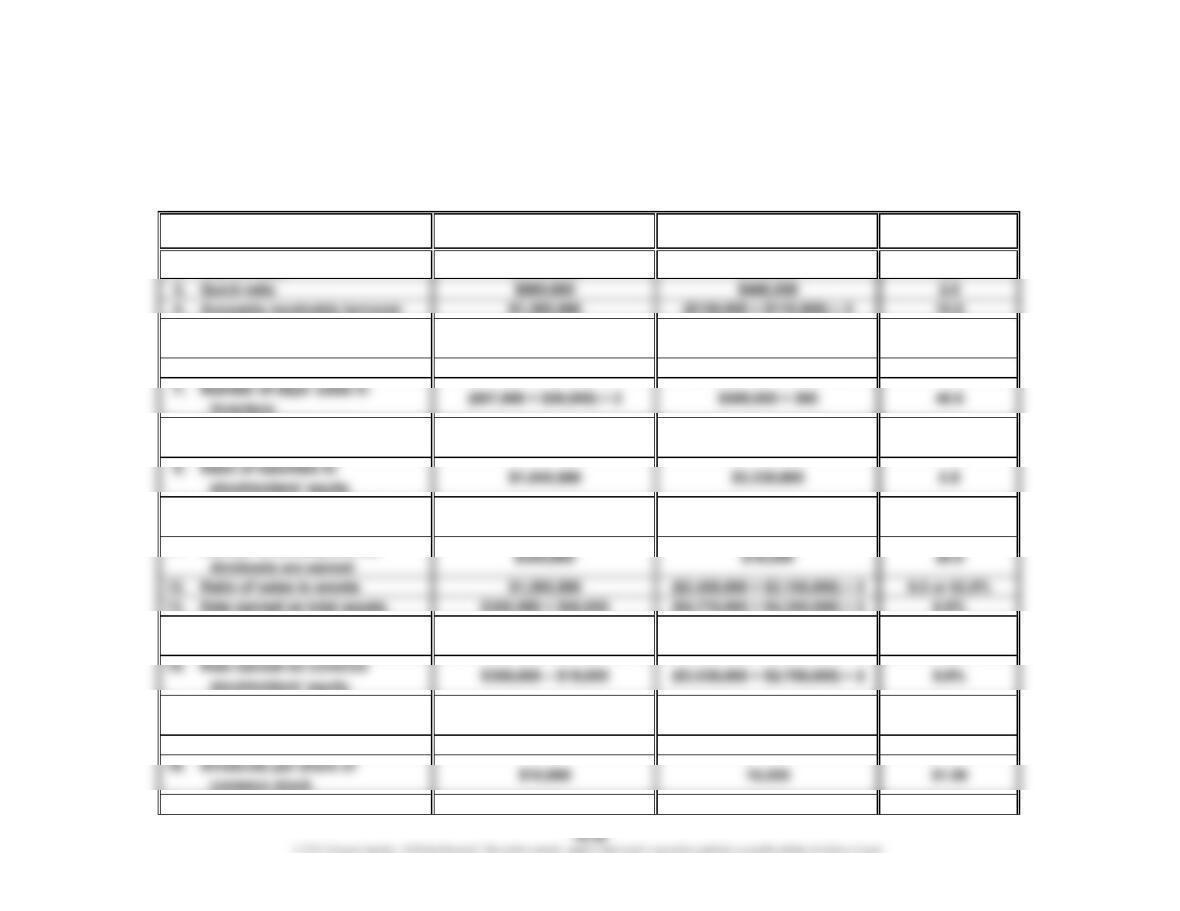

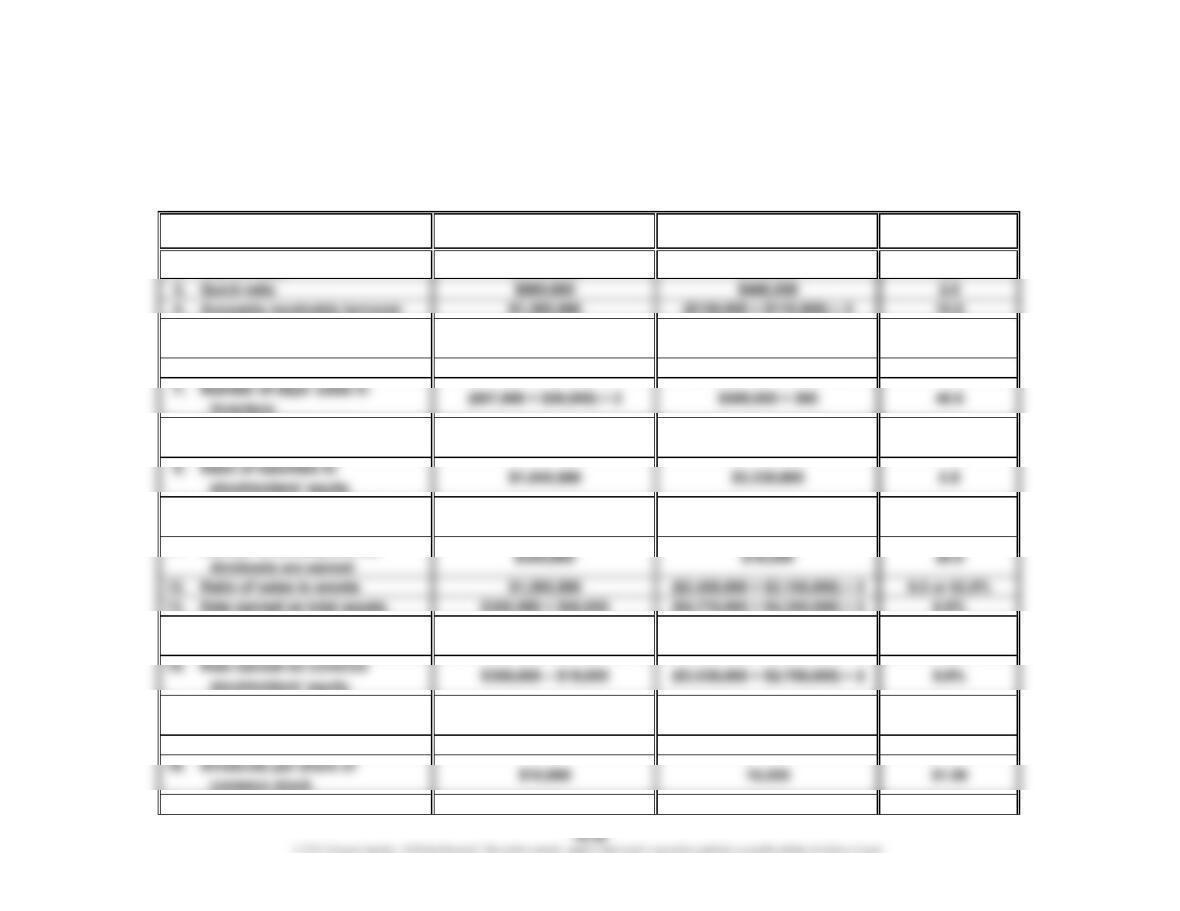

1. Working Capital: $1,100,000 – $440,000 = $660,000

Calculated

Numerator Denominator Value

2. Current ratio $1,100,000 $440,000 2.5

5. Number of days' sales in

receivables

6. Inventory turnover $500,000 ($67,000 + $58,000) ÷ 2 8.0

8. Ratio of fixed assets to

long-term liabilities

10. Number of times interest

charges are earned

11. Number of times preferred

14. Rate earned on

stockholders’ equity

16. Earnings per share on

common stock

17. Price-earnings ratio 71.25 28.50 2.5

19. Dividend yield $1.00 $71.25 1.4%

Ratio

$1,320,000 $1,100,000

36.5

1.2

($130,000 + $110,000) ÷ 2 $1,200,000 ÷ 365

6.8

$300,000

$380,000 + $66,000 $66,000

$28.50$300,000 – $15,000 10,000

9.7%

($3,230,000 + $2,955,000) ÷ 2