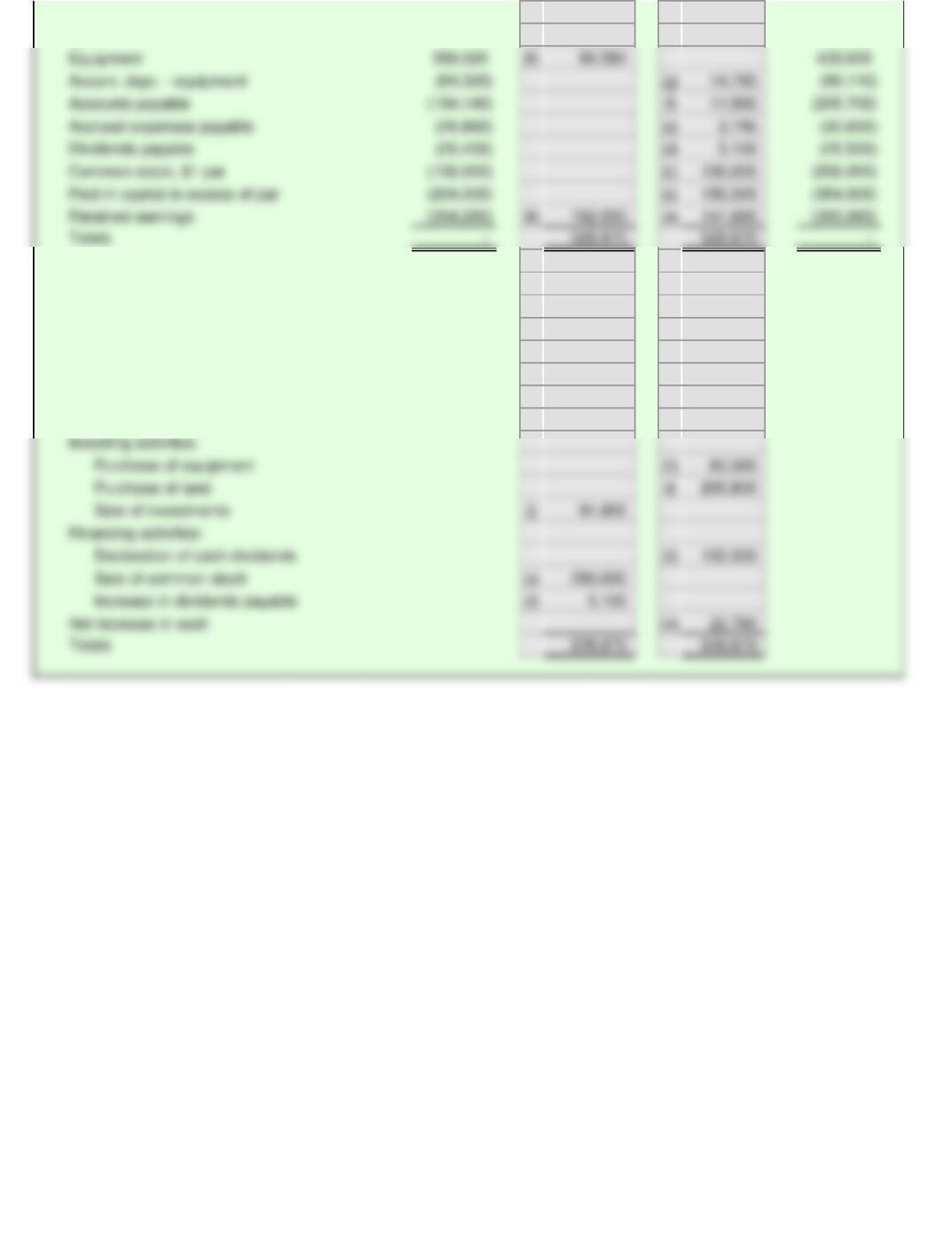

Prepaid expenses 25,200 (m) 6,440 31,640

Land 302,400 302,400

Buildings 1,134,000 (l) 579,600 1,713,600

Accum. depr. - buildings (414,540) (k) 51,660 (466,200)

Bonds payable (390,000) (d) 390,000 -

Common stock, $5 par (50,400) (c) 150,000 (200,400)

Paid-in capital in excess of par (126,000) (c) 240,000 (366,000)

Retained earnings (2,118,660) (b) 131,040 (a) 524,580 (2,512,200)

Totals - 1,360,200 1,360,200 -

Operating activities:

Net income (a) 524,580

Depreciation - buildings (k) 51,660

Depreciation - machinery and equipment (j) 22,680

Amortization of patents (i) 5,040

Increase in accounts receivable (o) 73,080

Decrease in inventories (n) 134,680

Increase in prepaid expenses (m) 6,440