CHAPTER 14

UNDERSTANDING THE ISSUES

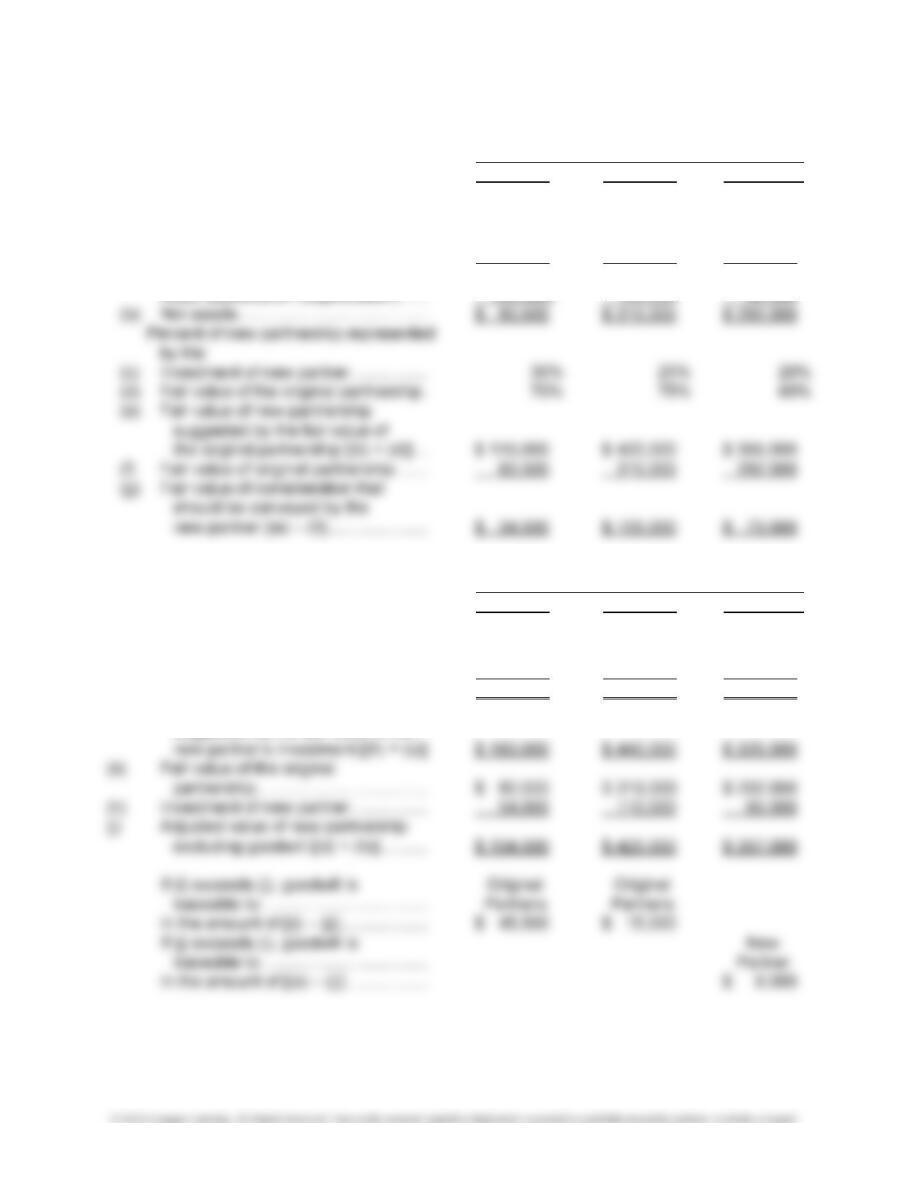

1. A major concern is that the value used as a

existing partnership’s net assets. Existing

capital balances most often do not reflect

30% interest by paying 30% of the existing

partnership’s capital will not result in the in-

However, the incoming partner’s capital

balance of $30,000 will only represent a

2. The first step would be to determine the fair

value of the net assets of the original part-

been recognized. Once the fair value of the

net assets (e.g., $400,000) has been

suggested value of the new partnership

entity ($400,000 ÷ 80% = $500,000). The

partnership and that of the original partner-

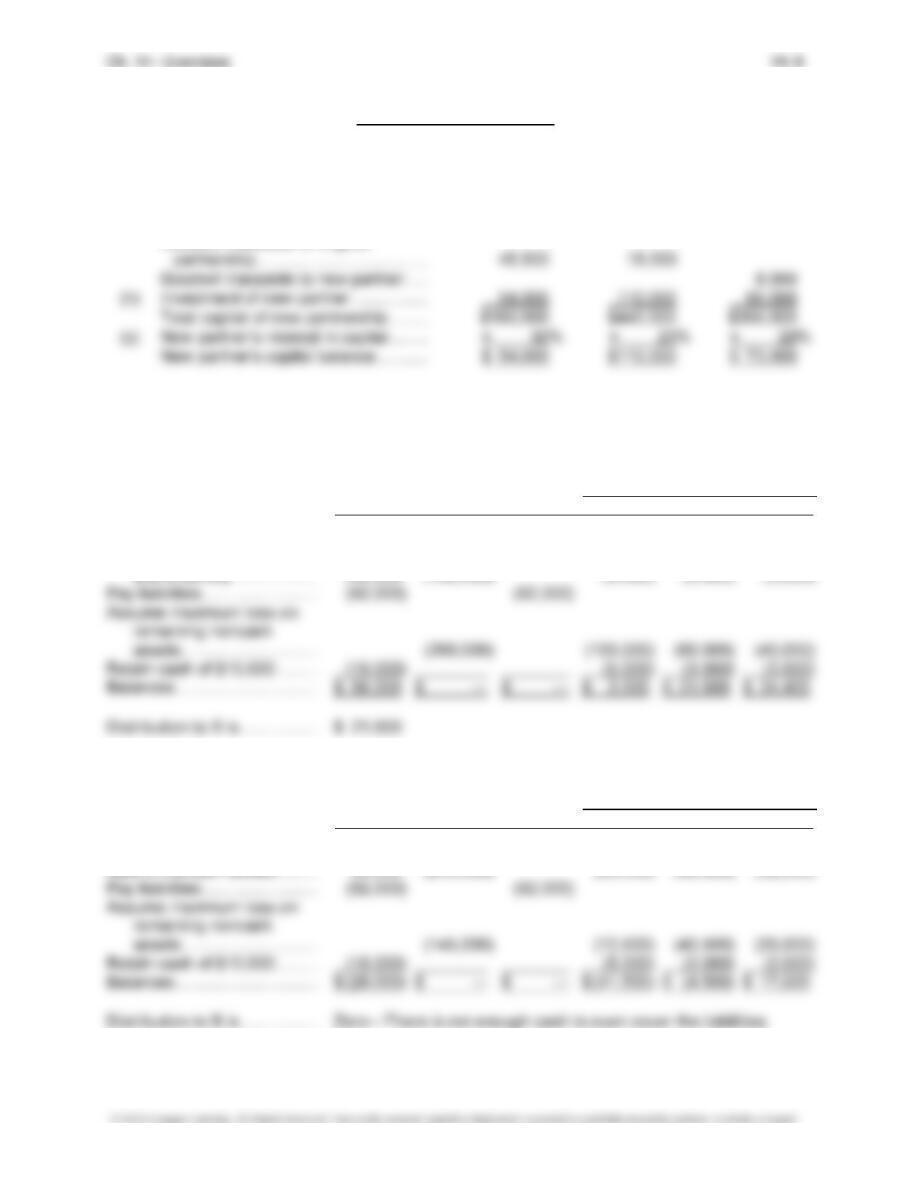

3. Several guidelines govern the process of

liquidating a partnership. First, all assets

ception to this priority involves the doctrine

of right of offset. Third, every attempt

say, all distributions should be based

on the conservative assumptions that re-

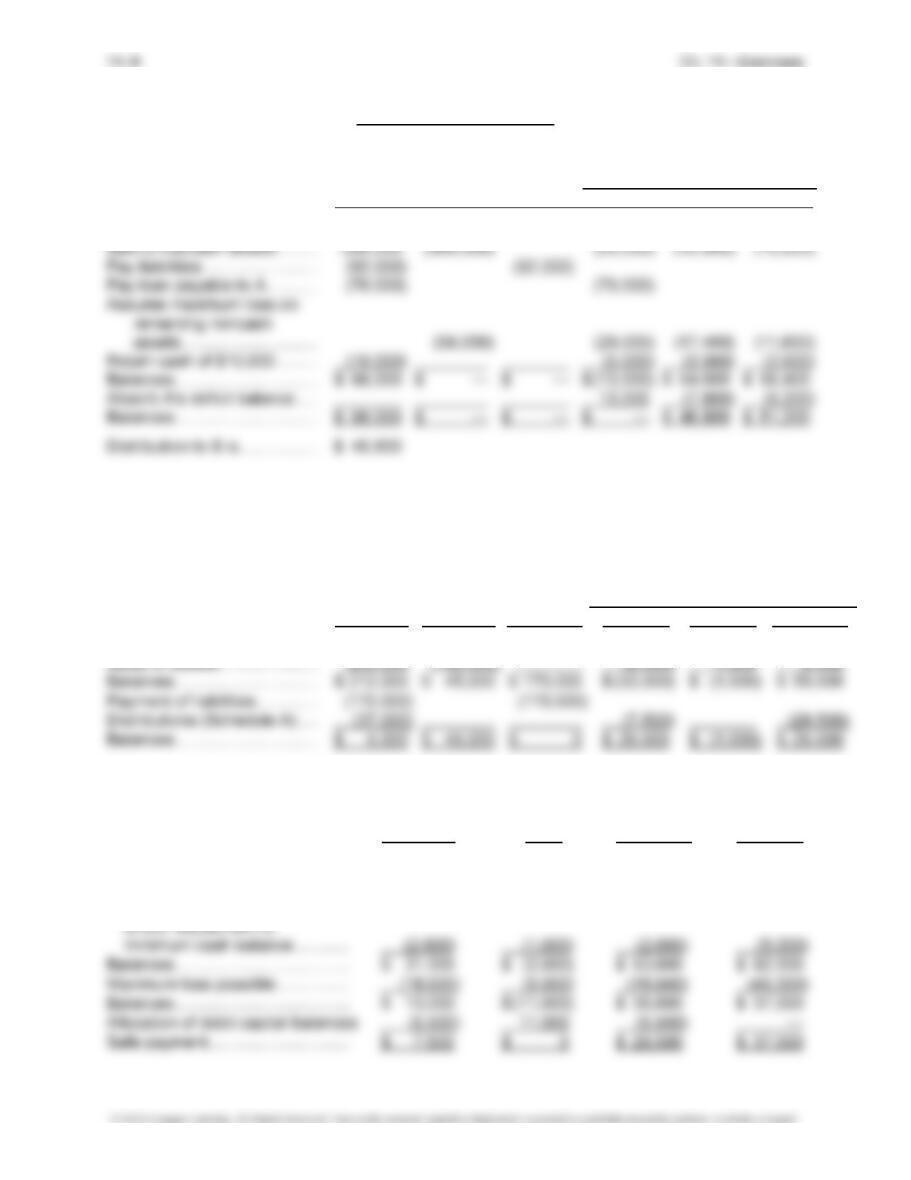

4. If a fellow partner has a deficit capital

balance, it is possible that other partners

will have to absorb that deficit partner’s

during the liquidation process, it is hoped

that the deficit will be eliminated. If the

creditors and that those creditors will attach

to the personal assets of individual part-