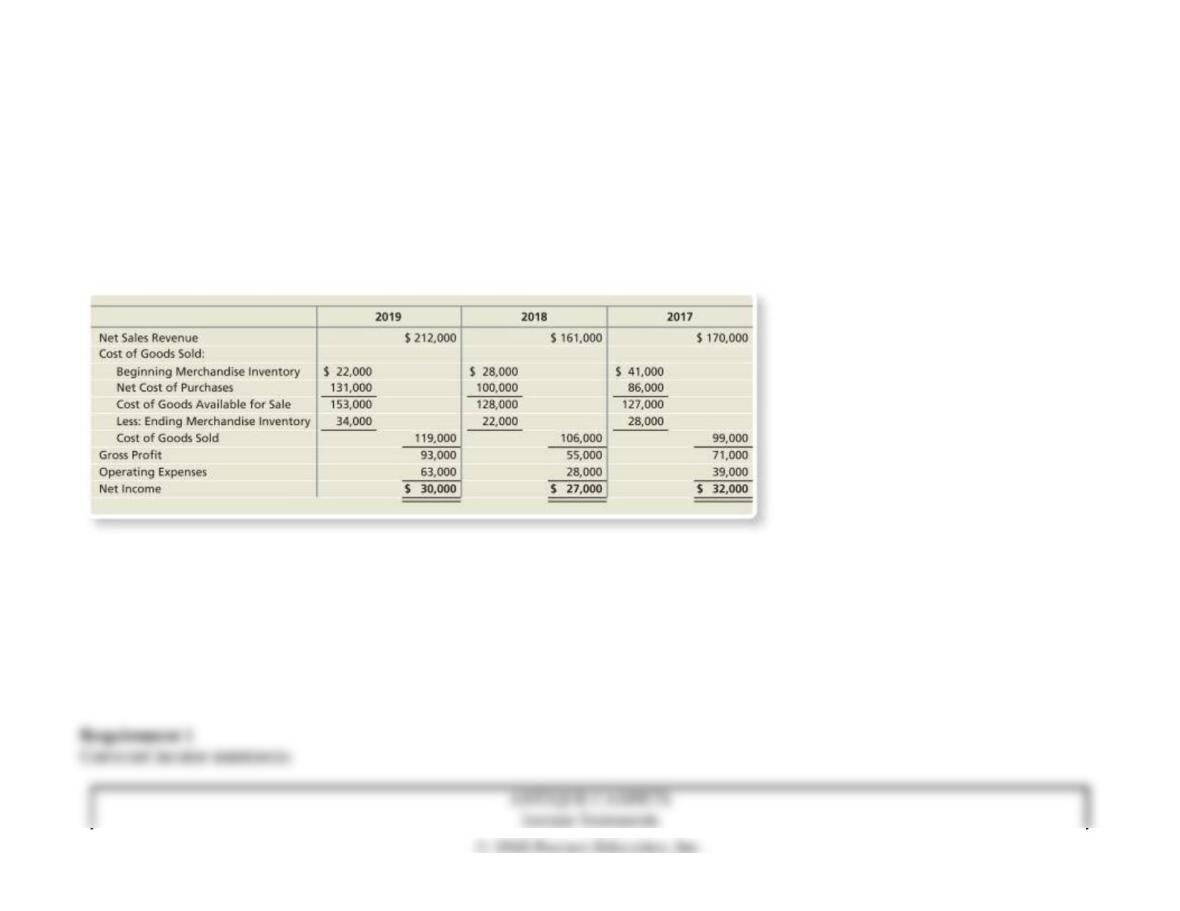

P6-34B Accounting for inventory using the perpetual inventory system—FIFO, LIFO, and weighted-average, and comparing FIFO,

LIFO, and weighted-average

Learning Objectives 2, 3

5. FIFO GP $4,640

Accounting for inventory using the perpetual inventory system—FIFO, LIFO, and weighted-average, and comparing FIFO, LIFO,

and weighted-average

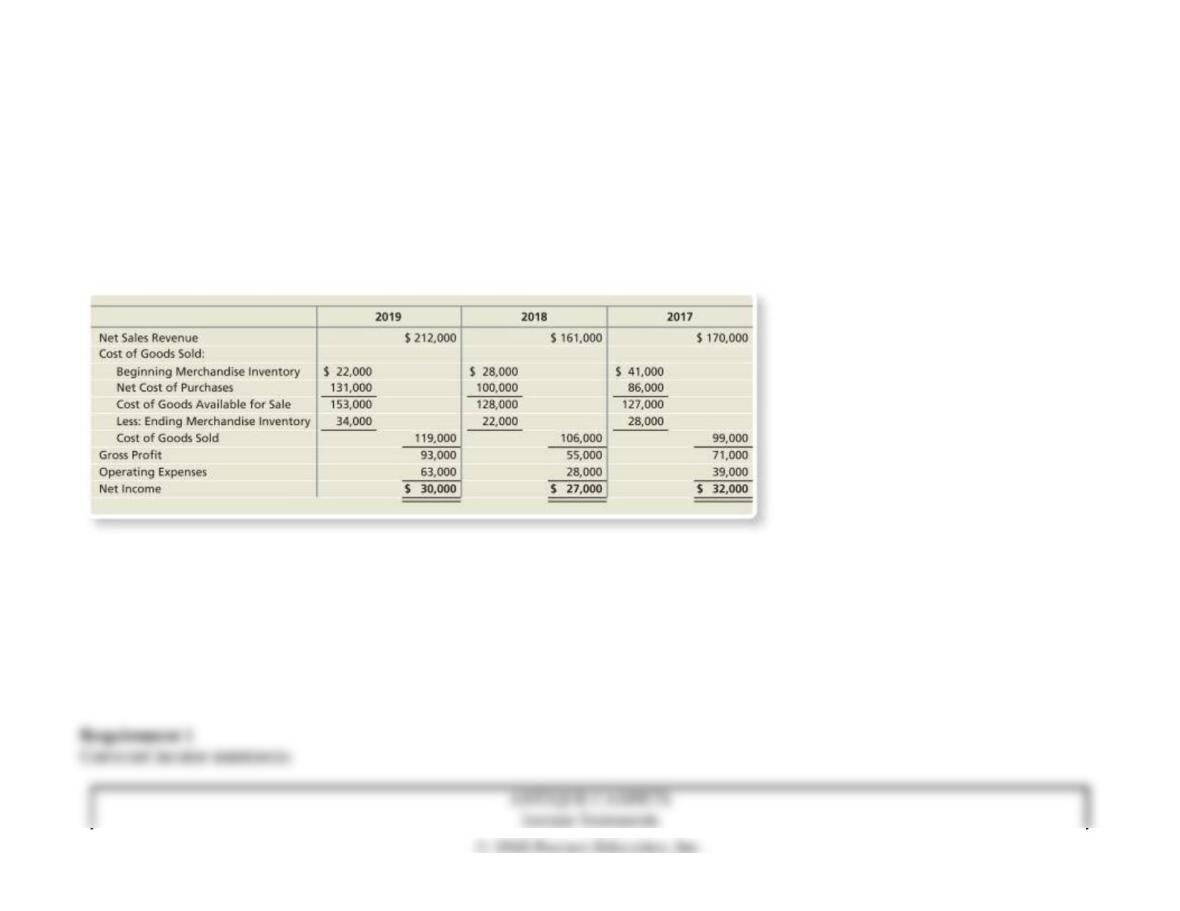

Steel It began January with 55 units of iron inventory that cost $35 each. During January, the company completed the following inventory

transactions:

Units Unit Cost Unit Sales

Price

Jan. 3 Sale 45 $ 83

8 Purchase 75 $ 52

21 Sale 70 85

30 Purchase 10 55

Requirements

1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method.

2. Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method.

3. Prepare a perpetual inventory record for the merchandise inventory using the weighted-average inventory costing method.

4. Determine the company’s cost of goods sold for January using FIFO, LIFO, and weighted-average inventory costing methods.

5. Compute gross profit for January using FIFO, LIFO, and weighted-average inventory costing methods.

6. If the business wanted to maximize gross profit, which method would it select?

SOLUTION

Requirement 1