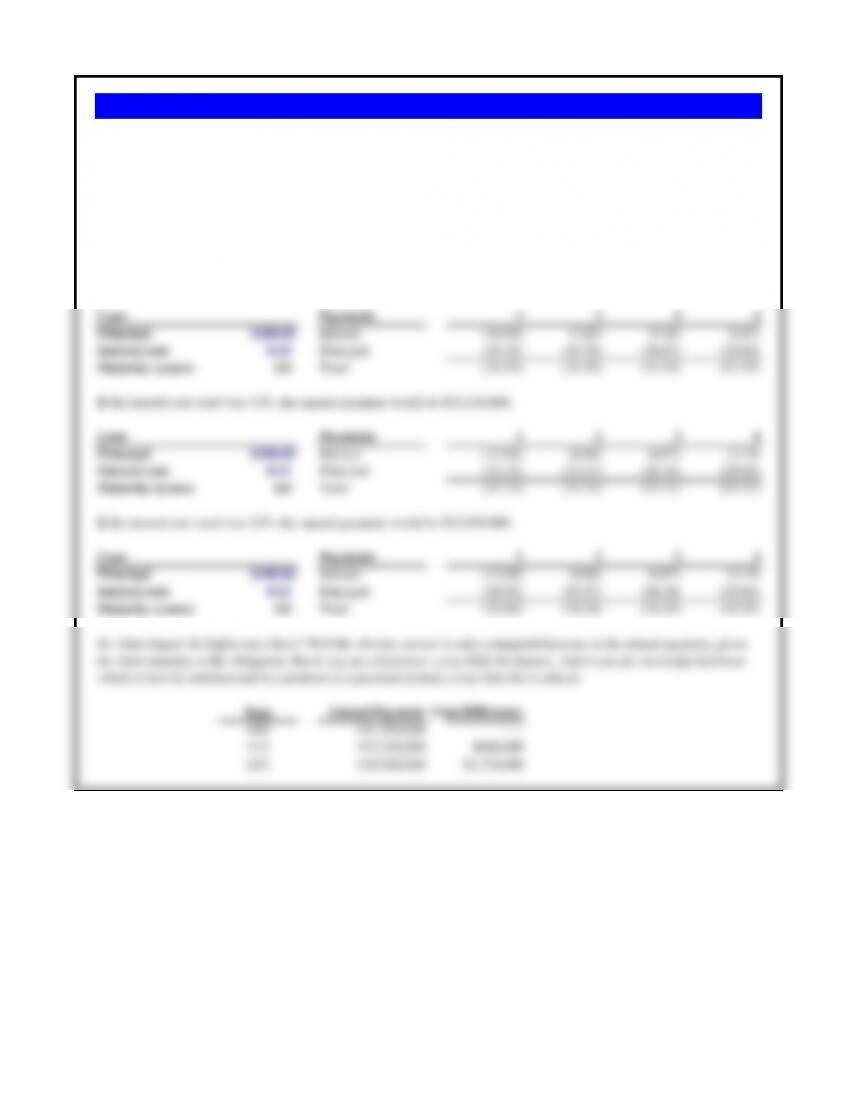

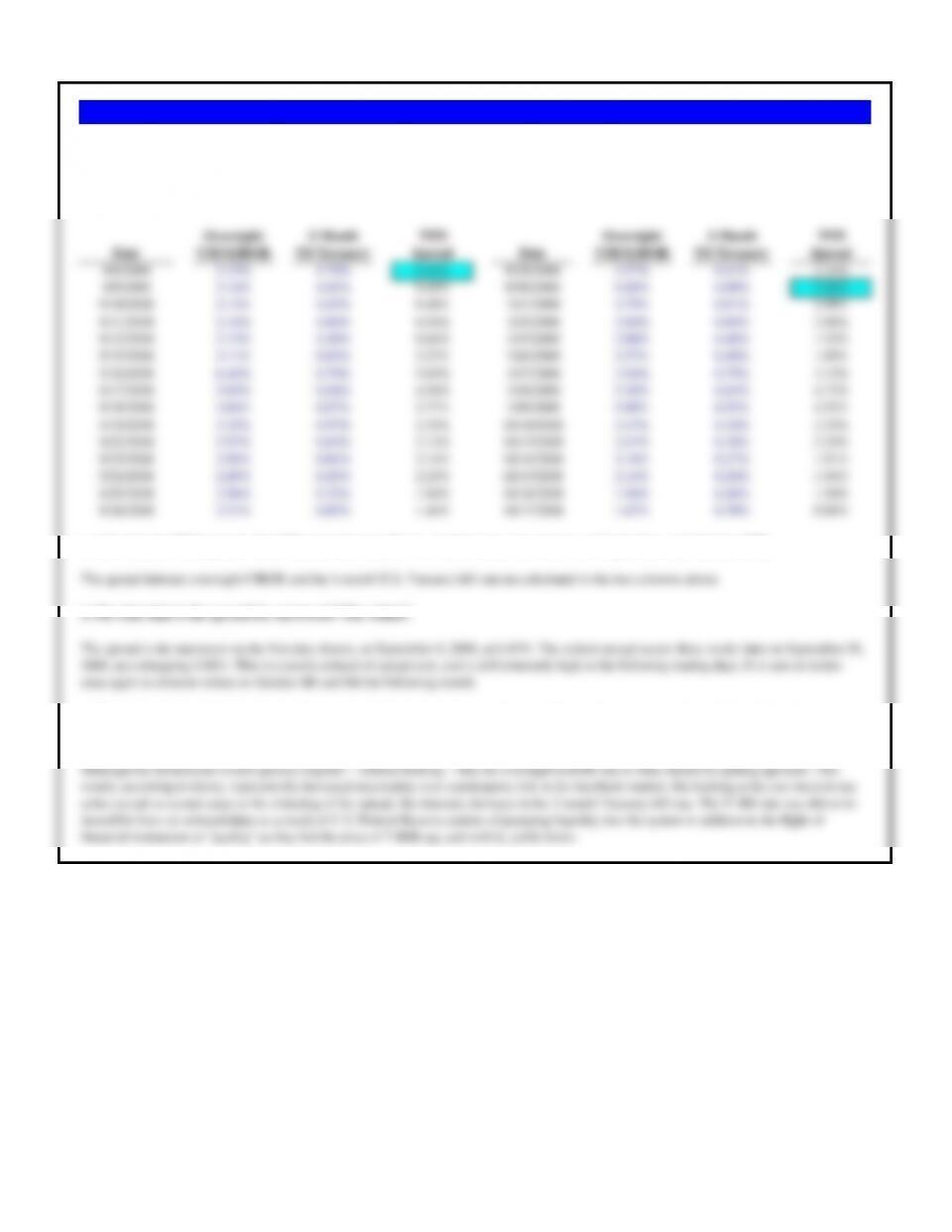

Assumptions Values in LIBOR

Principal borrowing need € 20,000,000

Maturity needed, in years 4.00

Current euro-LIBOR 4.000%

Banque de Paris' spread & expectation 2.000% 0.500%

Banque de Paris' initiation fee 1.800%

Banque de Sorbonne's spread & expectation 2.500% 0.250%

Banque de Sorbonne's initiation fee 0.000%

Raid Gauloises must evaluate both loan proposals under both potential interest rate scenarios.

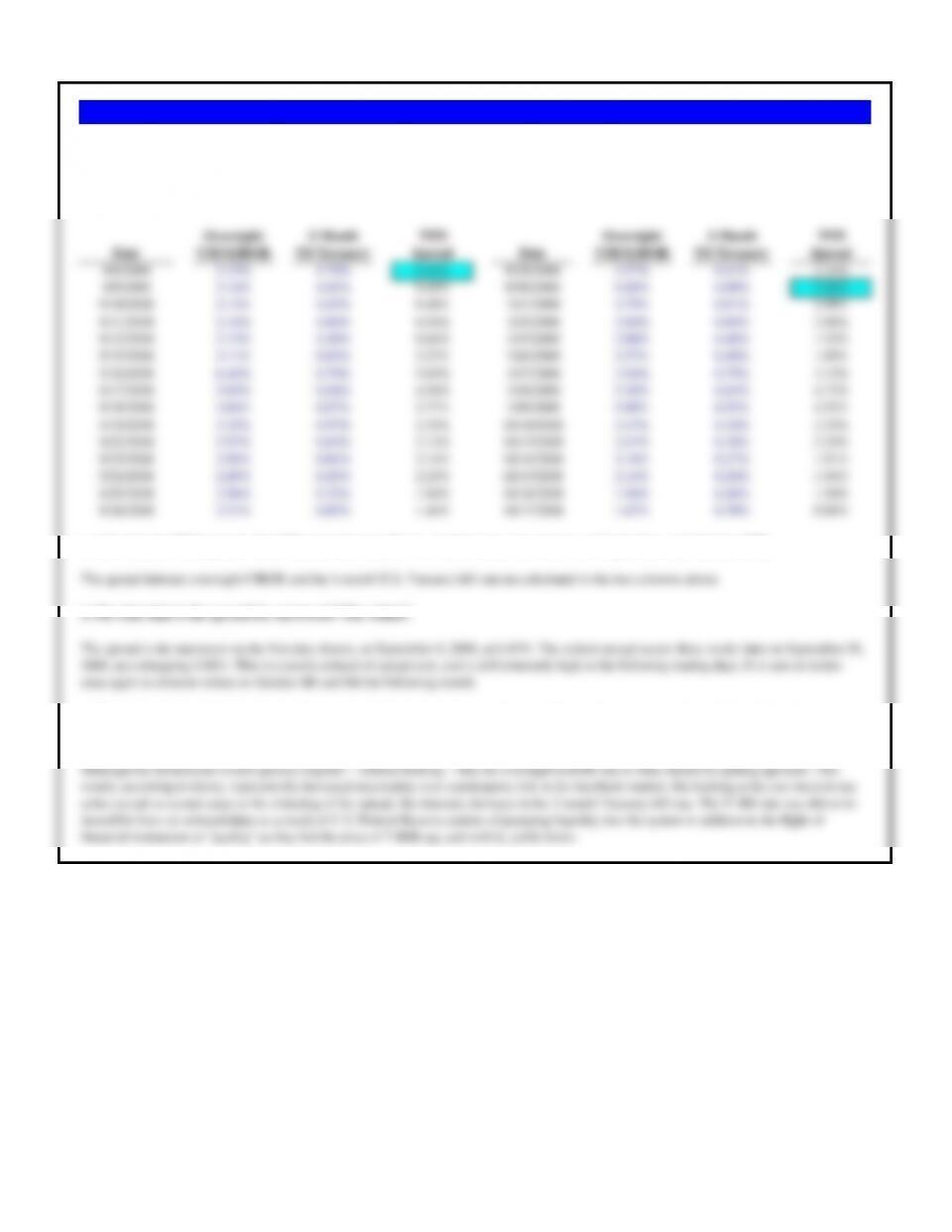

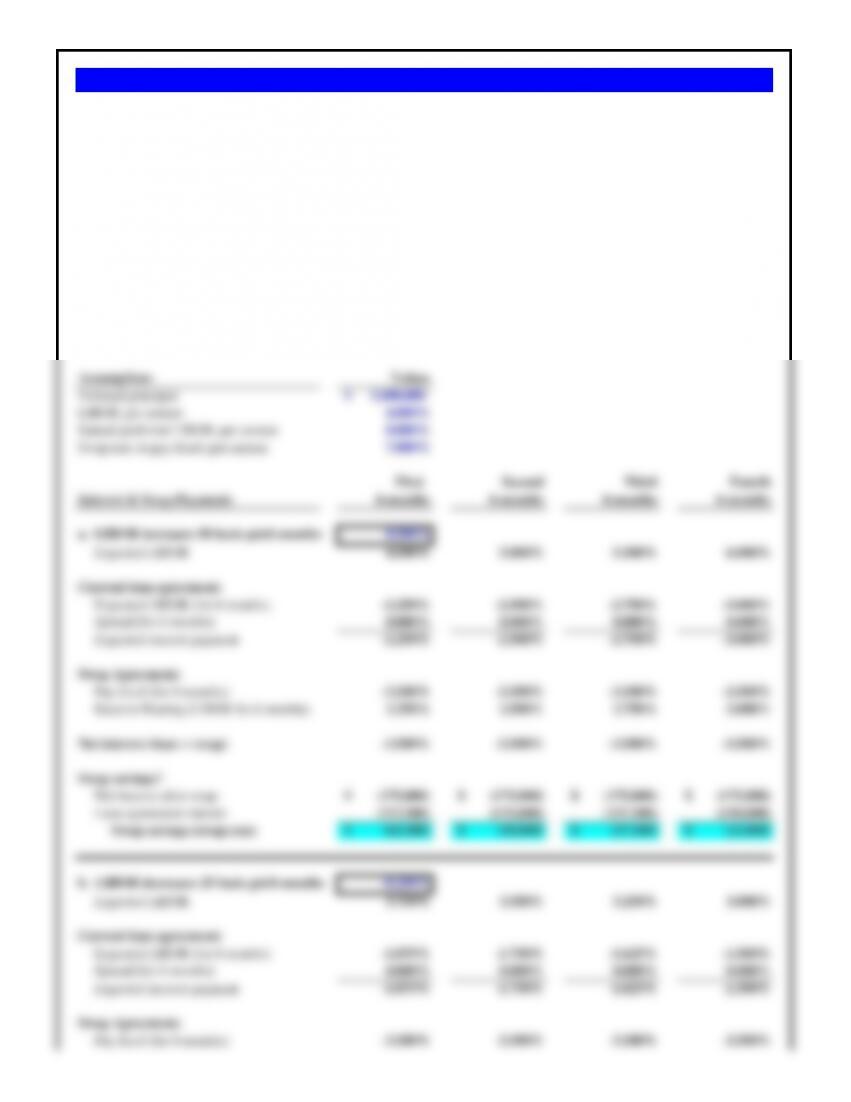

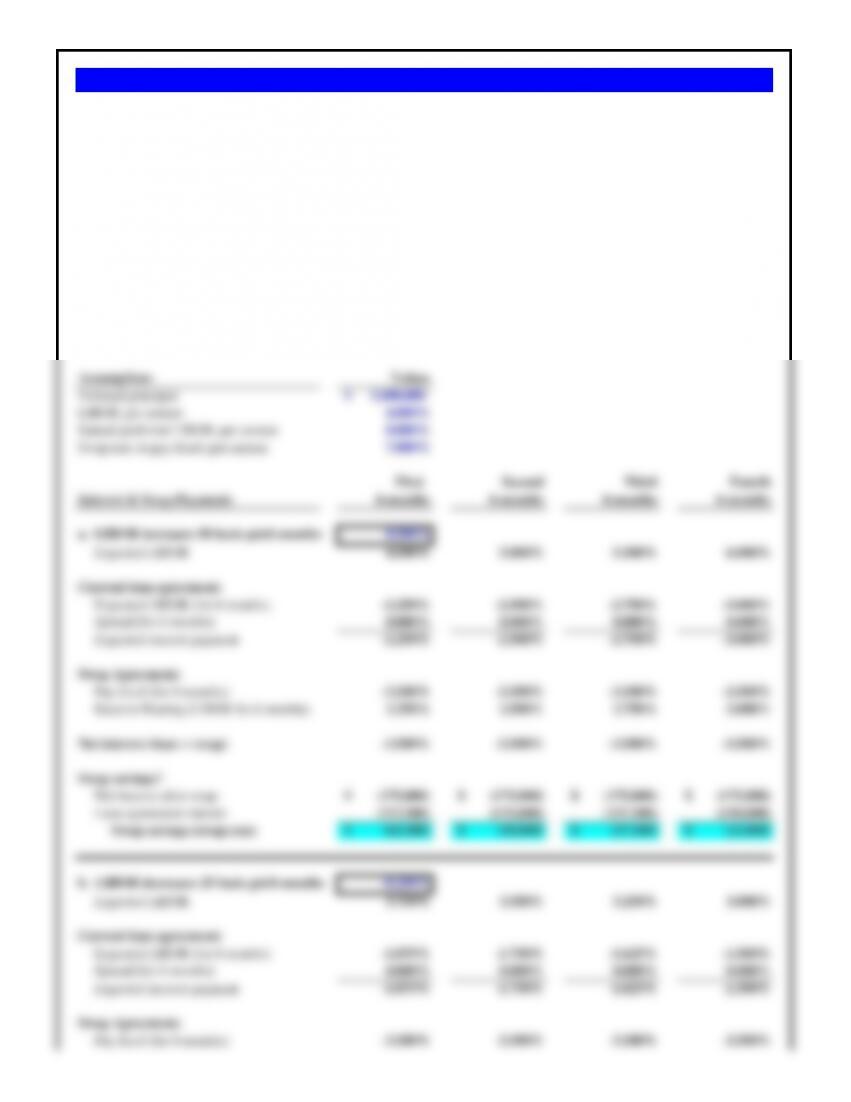

Banque de Paris Loan Proposal Year 0 Year 1 Year 2 Year 3 Year 4

Expected interest rates & payments:

Expected euro-LIBOR 4.000% 4.500% 5.000% 5.500% 6.000%

Bank spread 2.000% 2.000% 2.000% 2.000% 2.000%

Interest rate 6.000% 6.500% 7.000% 7.500% 8.000%

Funds raised, net of fees € 19,640,000

Expected interest costs -€ 1,300,000 -€ 1,400,000 -€ 1,500,000 -€ 1,600,000

Repayment of principal -€ 20,000,000

Total cash flows € 19,640,000 -€ 1,300,000 -€ 1,400,000 -€ 1,500,000 -€ 21,600,000

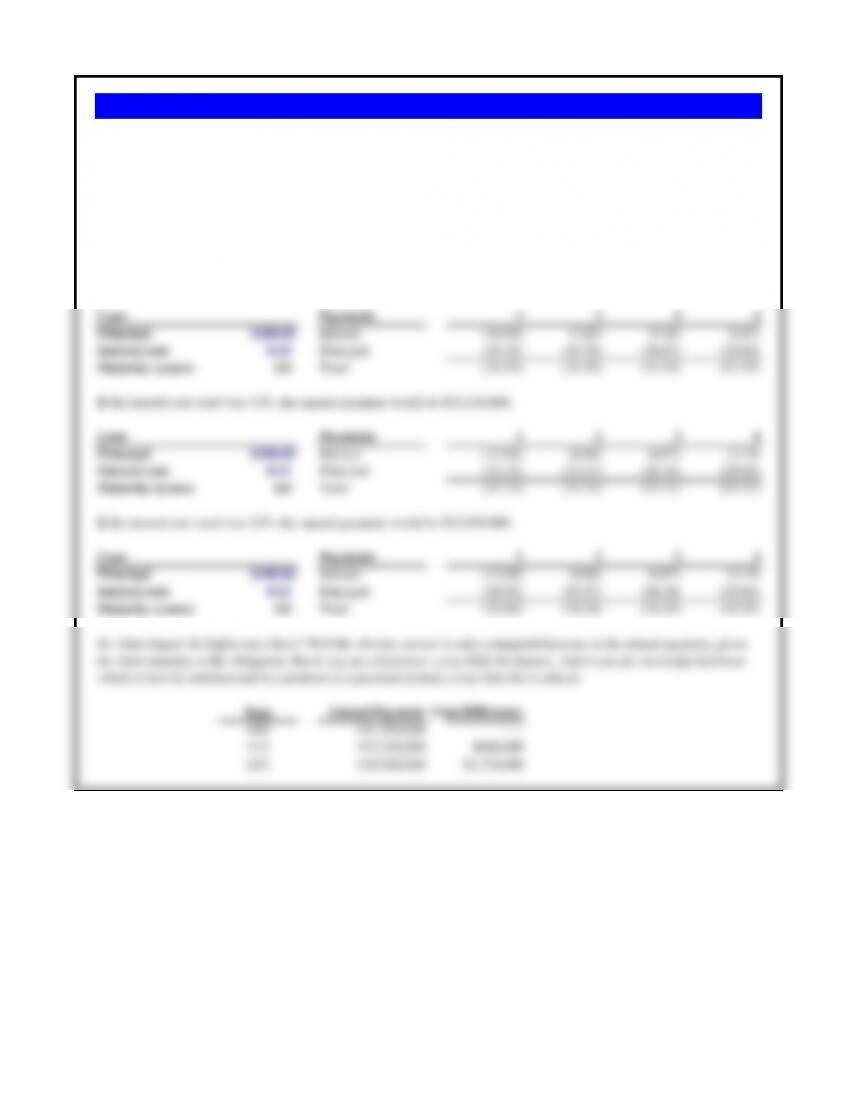

euro-LIBOR rises 0.500% per year 7.7438%

euro-LIBOR rises 0.250% per year 7.1365% Found by plugging in .250% in expectations above.

Banque de Sorbonne Loan Proposal Year 0 Year 1 Year 2 Year 3 Year 4

Expected interest rates & payments:

Expected euro-LIBOR 4.000% 4.250% 4.500% 4.750% 5.000%

Bank spread 2.500% 2.500% 2.500% 2.500% 2.500%

Interest rate 6.500% 6.750% 7.000% 7.250% 7.500%

Funds raised, net of fees € 20,000,000

Expected interest costs -€ 1,350,000 -€ 1,400,000 -€ 1,450,000 -€ 1,500,000

Repayment of principal -€ 20,000,000

Total cash flows € 20,000,000 -€ 1,350,000 -€ 1,400,000 -€ 1,450,000 -€ 21,500,000

euro-LIBOR rises 0.500% per year 7.0370% Found by plugging in .500% in expectations above.

euro-LIBOR rises 0.250% per year 7.1036%

The Banque de Sorbonne loan proposal is actually lower all-in-cost under either interest rate scenario.

Euro-LIBOR is currently 4.00%. Raid’s economist forecasts that LIBOR will rise by 0.5 percentage points each year. Banque de Sorbonne,

however, officially forecasts euro-LIBOR to begin trending upward at the rate of 0.25 percentage points per year. Raid Gauloises’s cost of capital is

11%. Which loan proposal do you recommend for Raid Gauloises?

Raid Gauloises is a rapidly growing French sporting goods and adventure racing outfitter. The company has decided to borrow €20,000,000 via a

euro-euro floating rate loan for four years. Raid must decide between two competing loan offerings from two of its banks.

Problem 8.11 Raid Gauloises

Banque de Paris has offered the four-year debt at euro-LIBOR + 2.00% with an up-front initiation fee of 1.8%. Banque de Sorbonne, however, has

offered euro-LIBOR + 2.5%, a higher spread, but with no loan initiation fees up-front, for the same term and principal. Both banks reset the interest

rate at the end of each year.