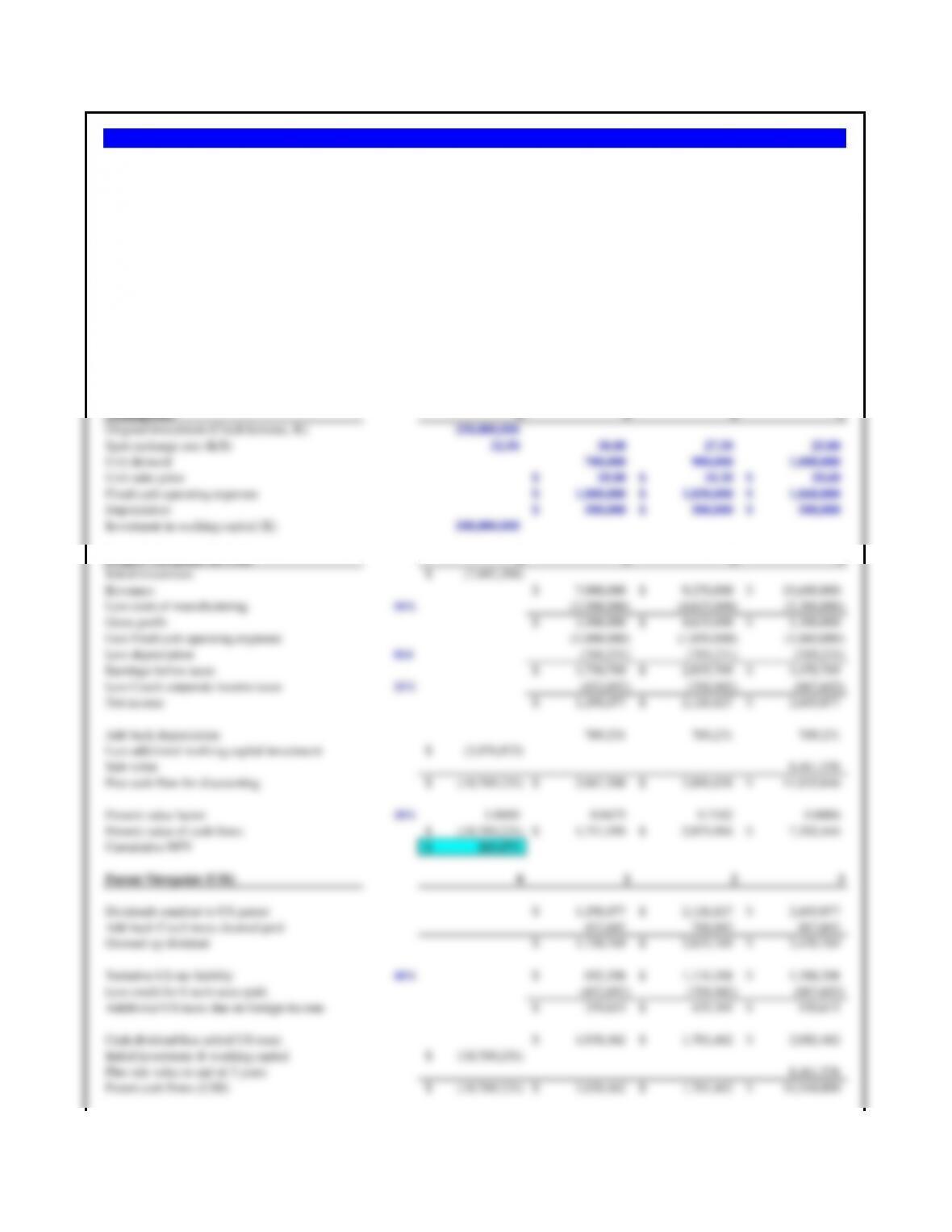

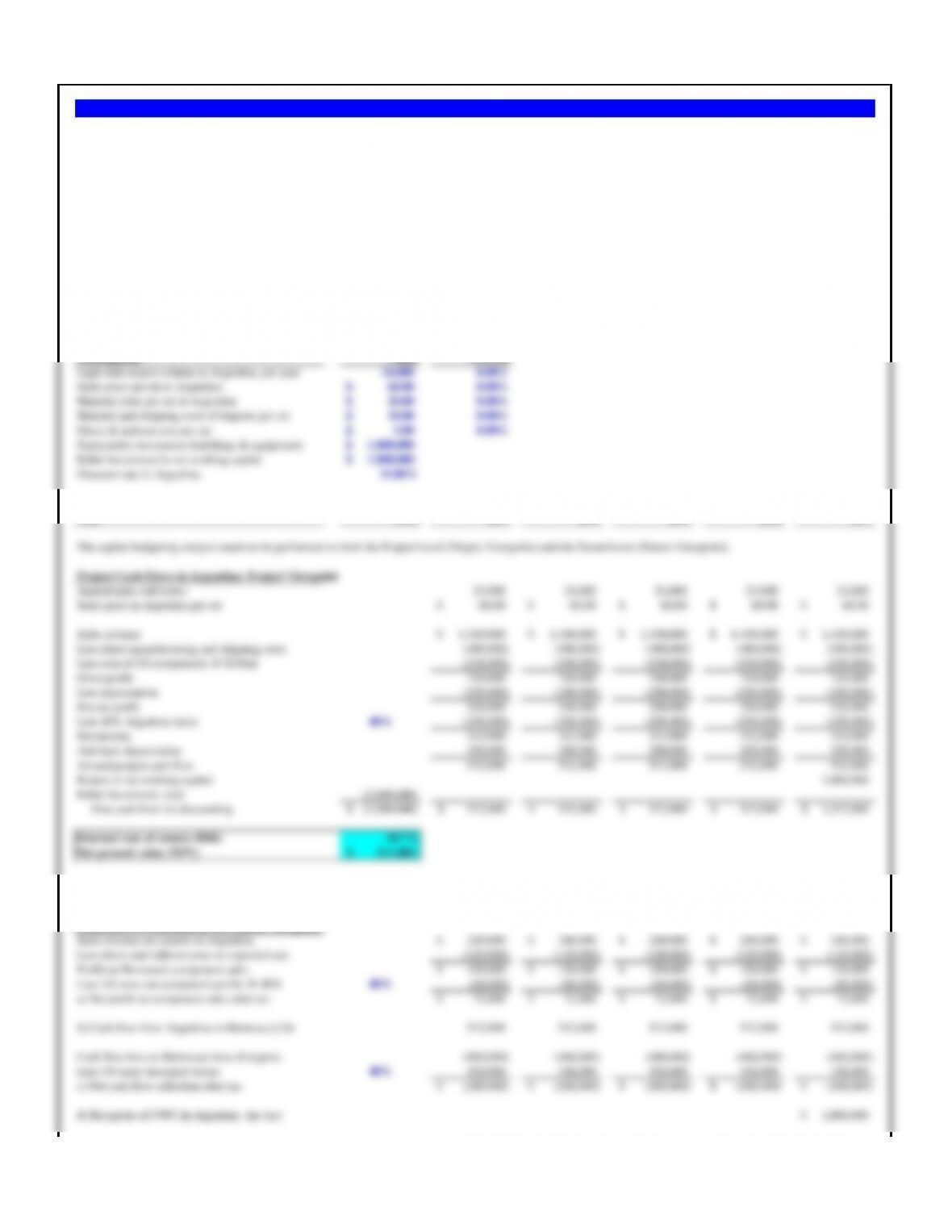

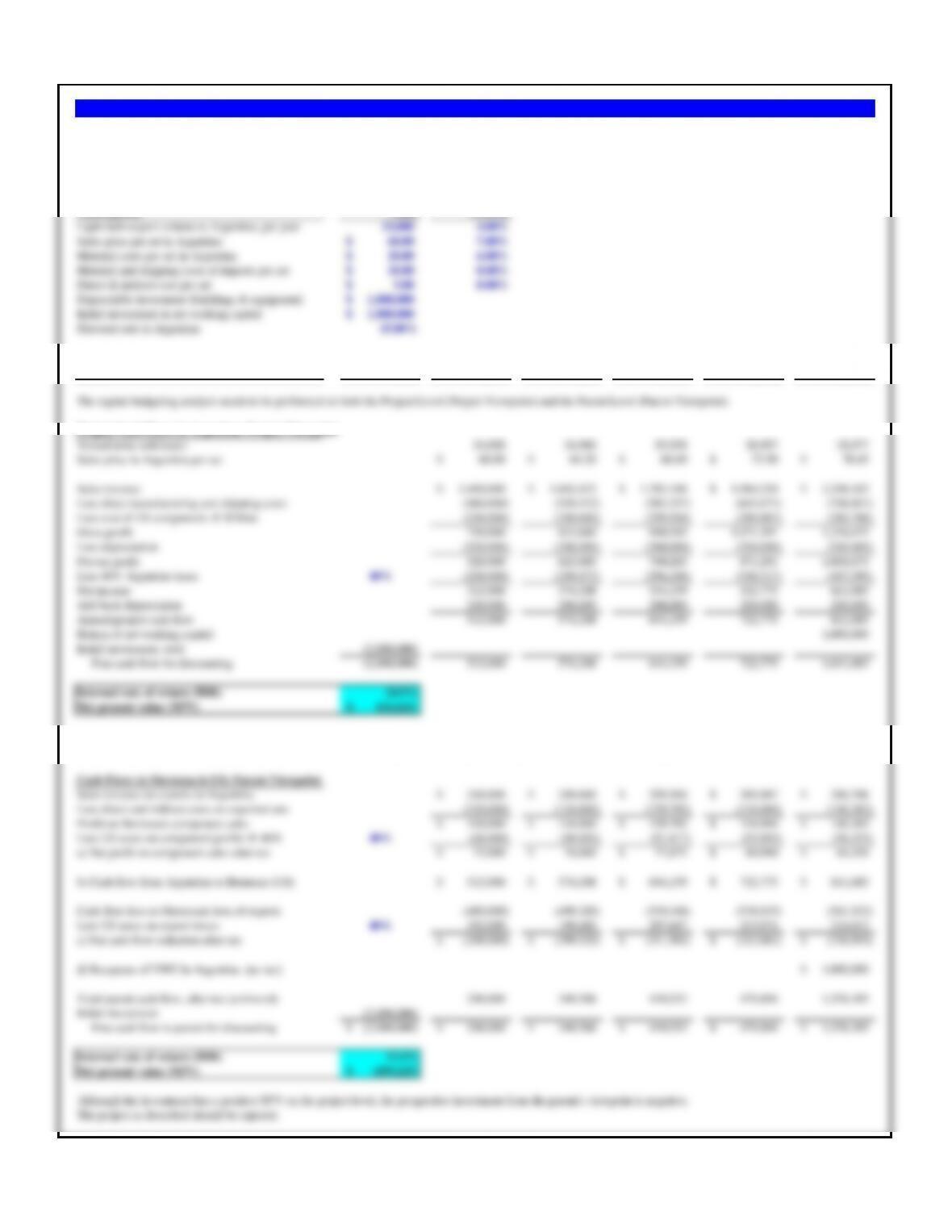

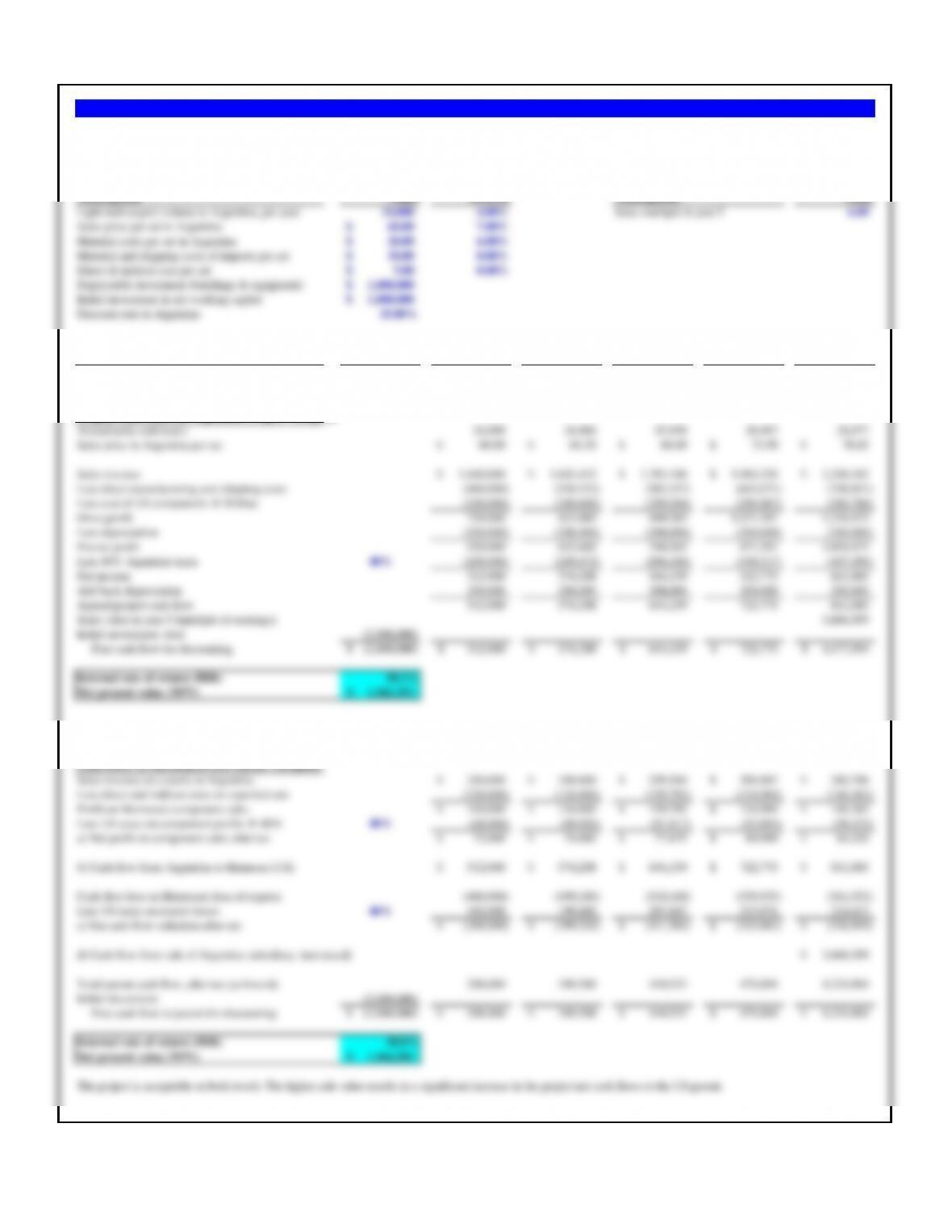

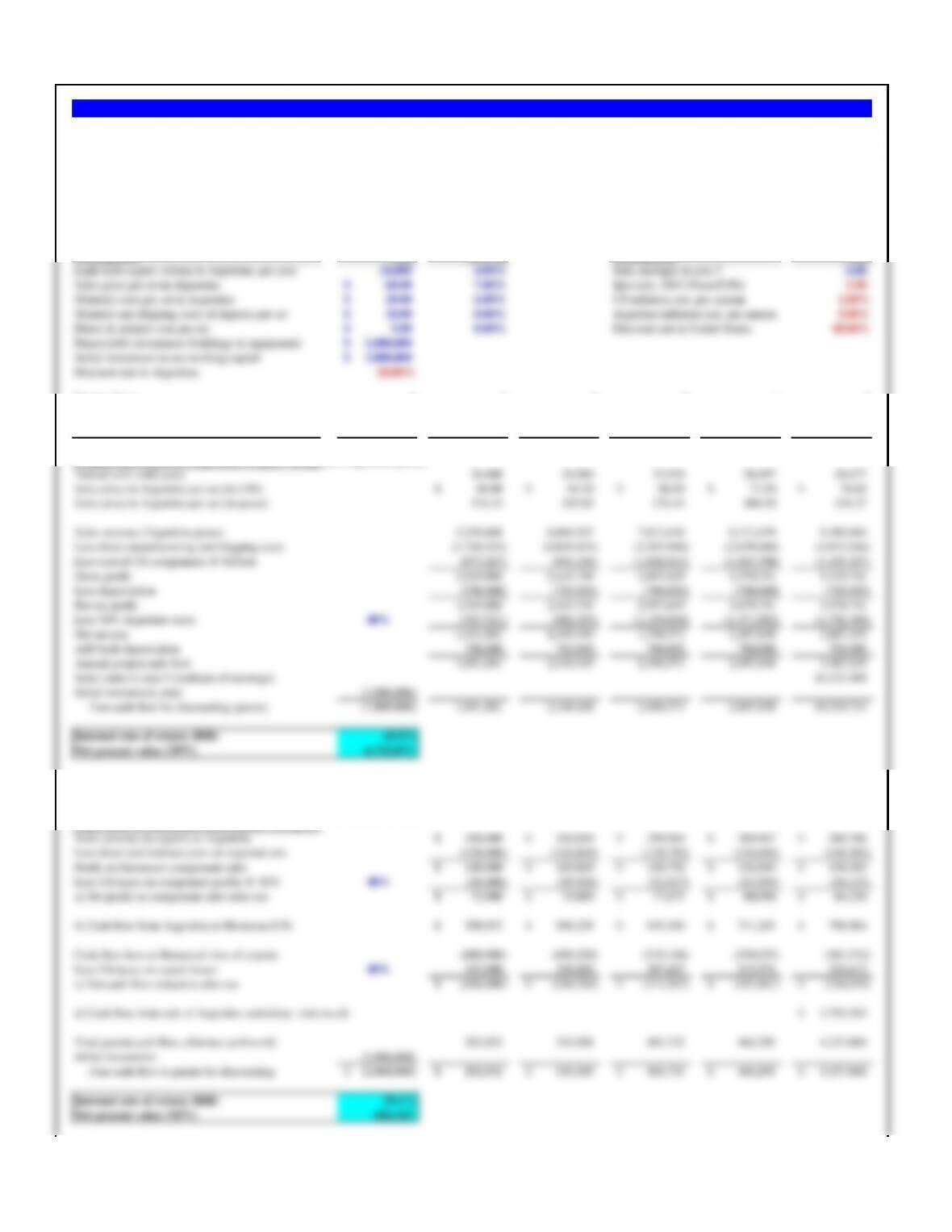

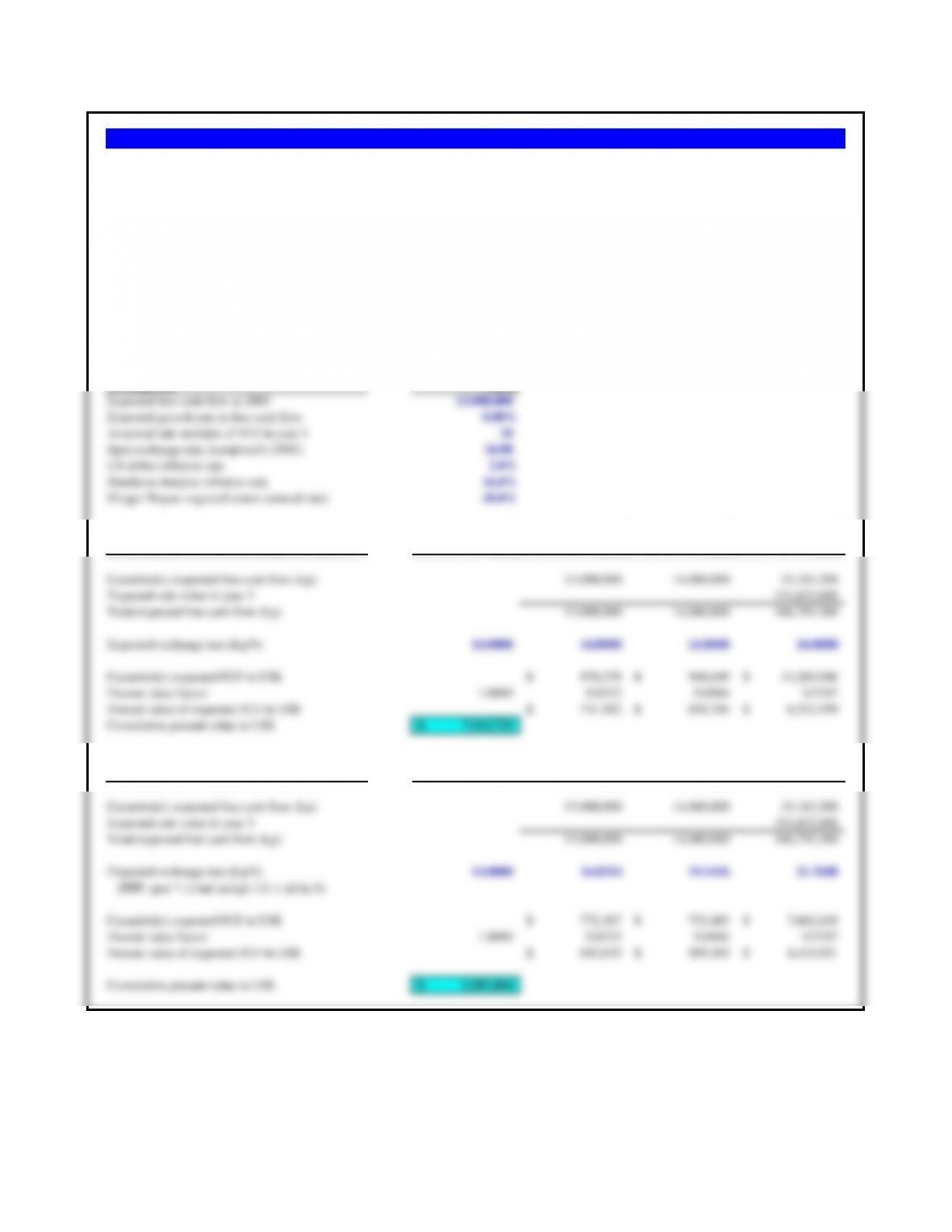

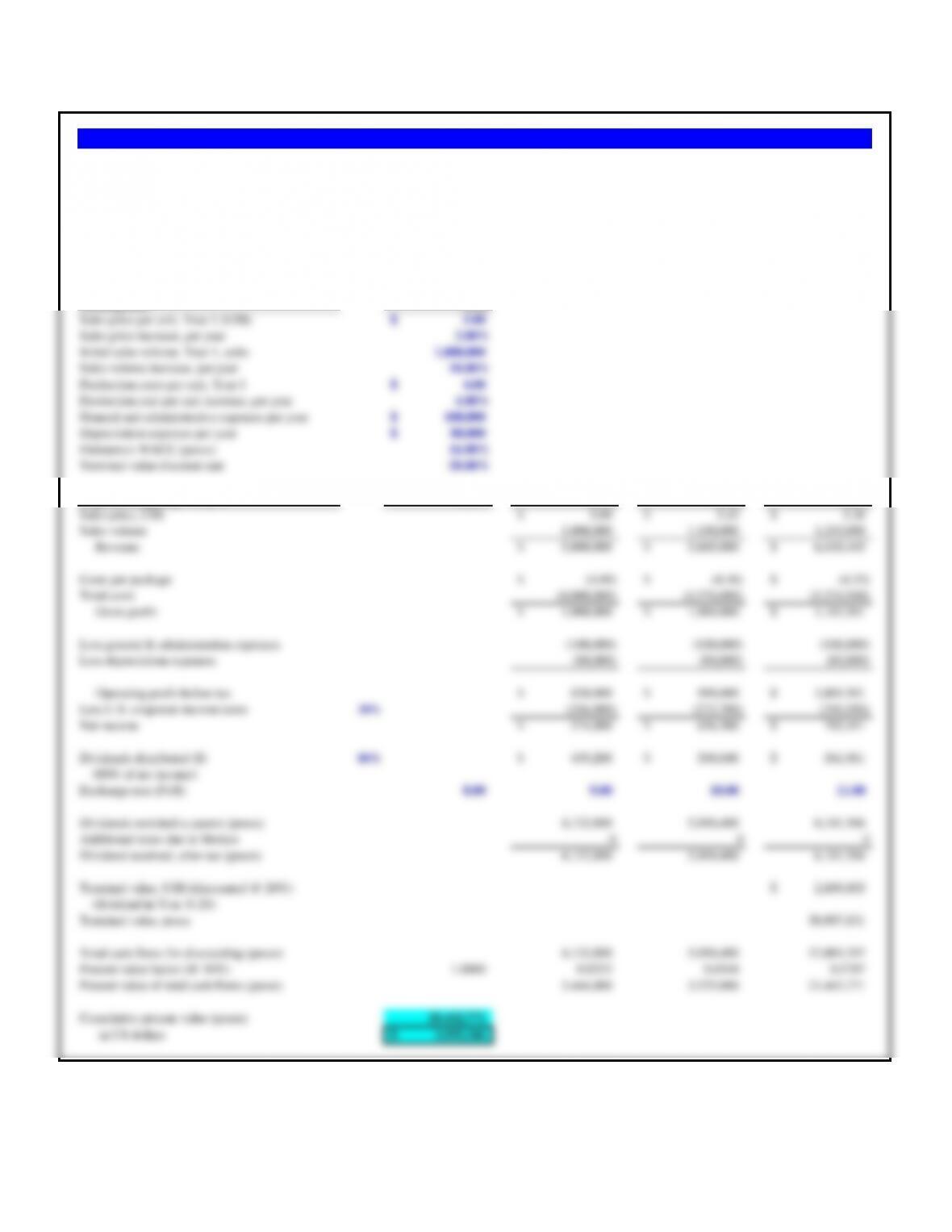

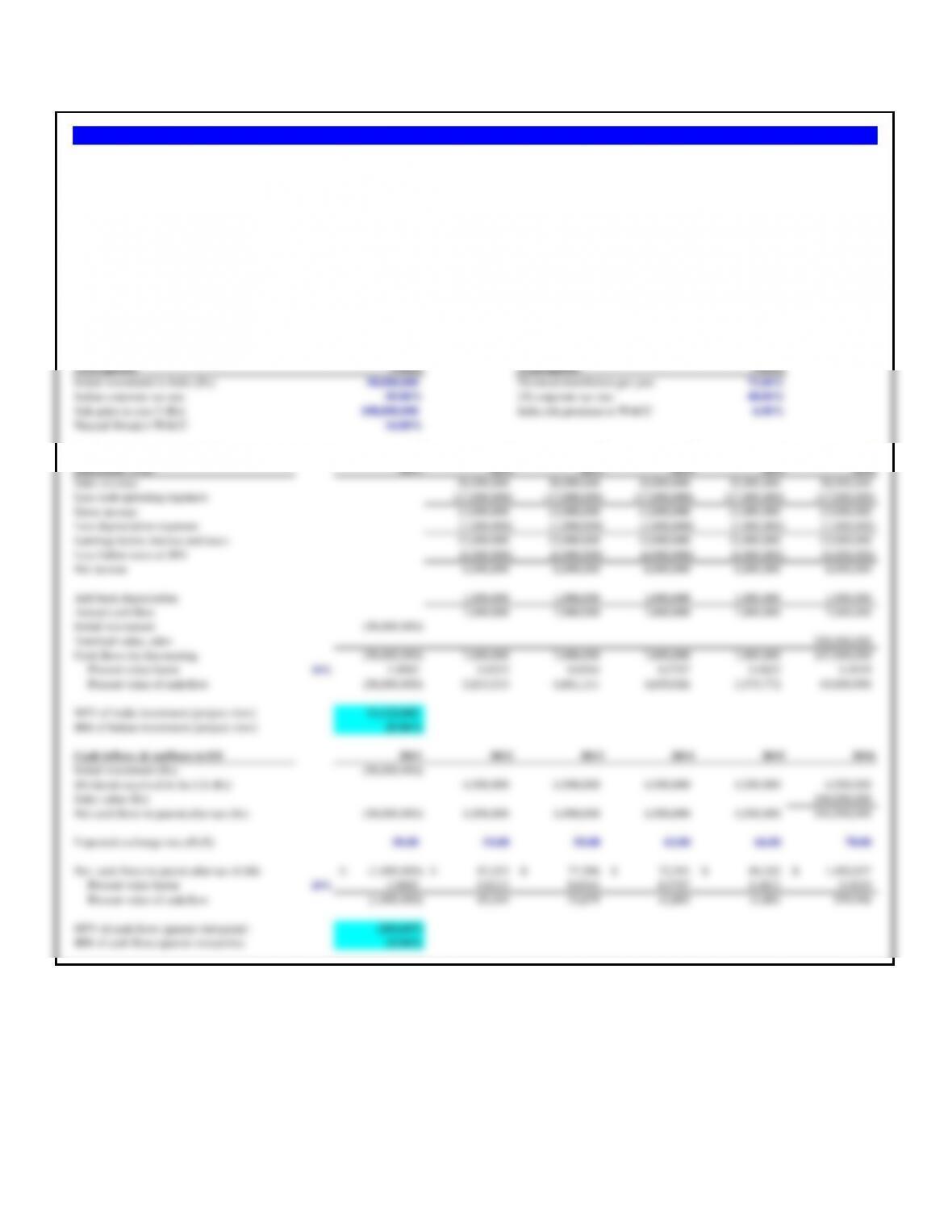

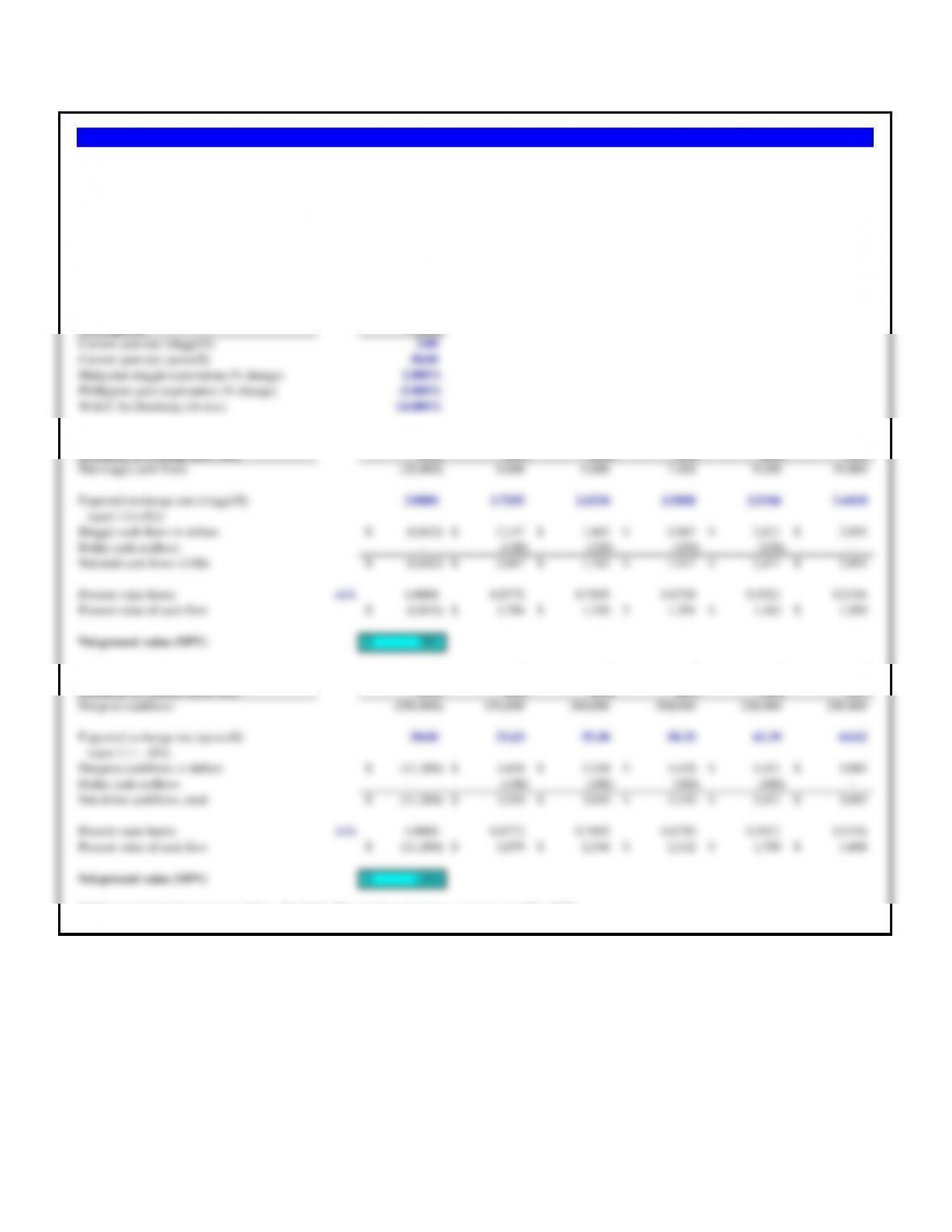

Assumptions Values Assumptions Values

Initial investment in India (Rs) 50,000,000 Dividend distribution per year 75.00%

Indian corporate tax rate 50.00% US corporate tax rate 40.00%

Sale price in year 5 (Rs) 100,000,000 India risk premium to WACC 6.00%

Natural Mosaic's WACC 14.00%

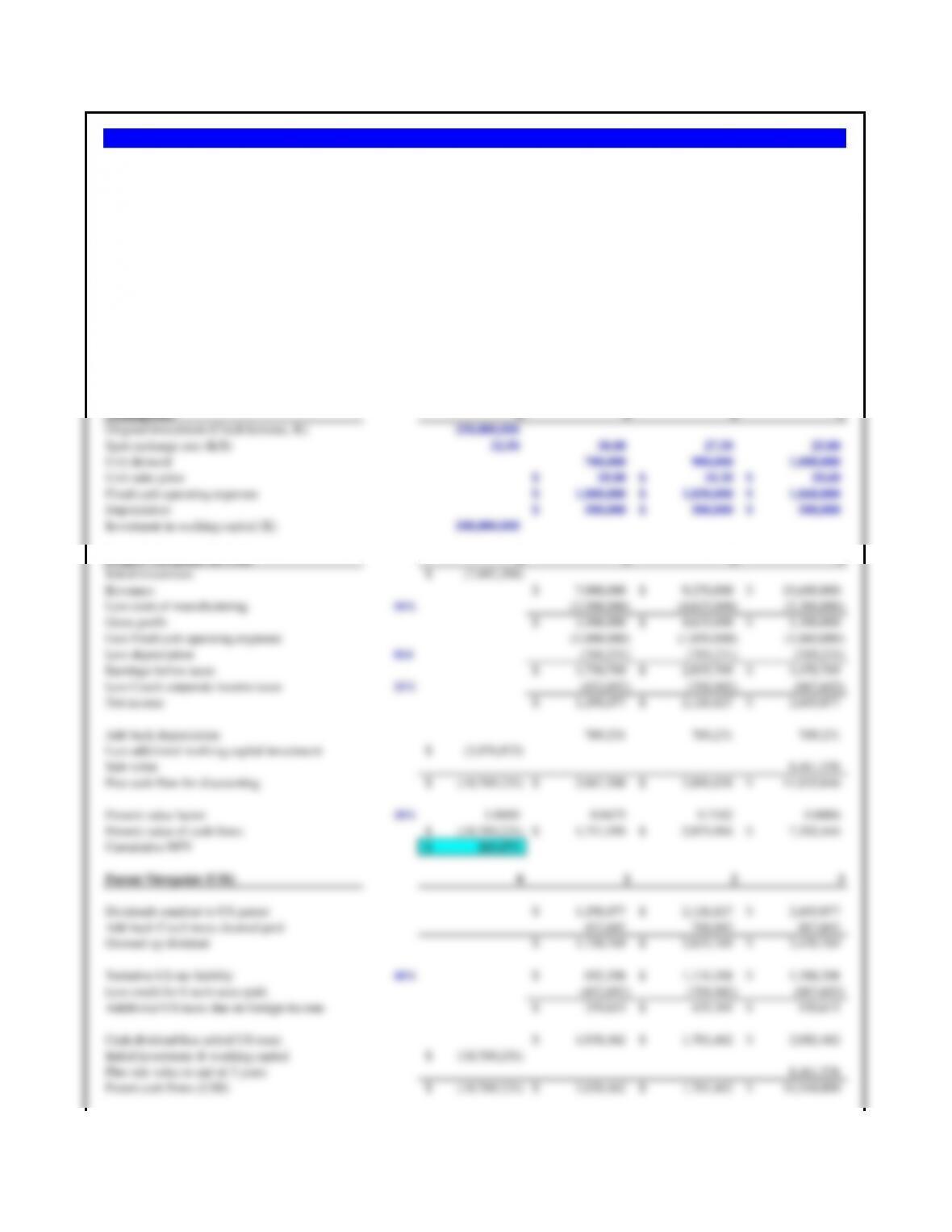

Pro forma income and cash flow 0 1 2 3 4 5

(December 31st) 2011 2012 2013 2014 2015 2016

Sales revenue 30,000,000 30,000,000 30,000,000 30,000,000 30,000,000

Less cash operating expenses (17,000,000) (17,000,000) (17,000,000) (17,000,000) (17,000,000)

Gross income 13,000,000 13,000,000 13,000,000 13,000,000 13,000,000

Less depreciation expenses (1,000,000) (1,000,000) (1,000,000) (1,000,000) (1,000,000)

Earnings before interest and taxes 12,000,000 12,000,000 12,000,000 12,000,000 12,000,000

Less Indian taxes at 50% (6,000,000) (6,000,000) (6,000,000) (6,000,000) (6,000,000)

Net income 6,000,000 6,000,000 6,000,000 6,000,000 6,000,000

Add back depreciation 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000

Annual cash flow 7,000,000 7,000,000 7,000,000 7,000,000 7,000,000

Initial investment (50,000,000)

NPV of India investment (project view) 11,122,042

IRR of Indian investment (project view) 25.96%