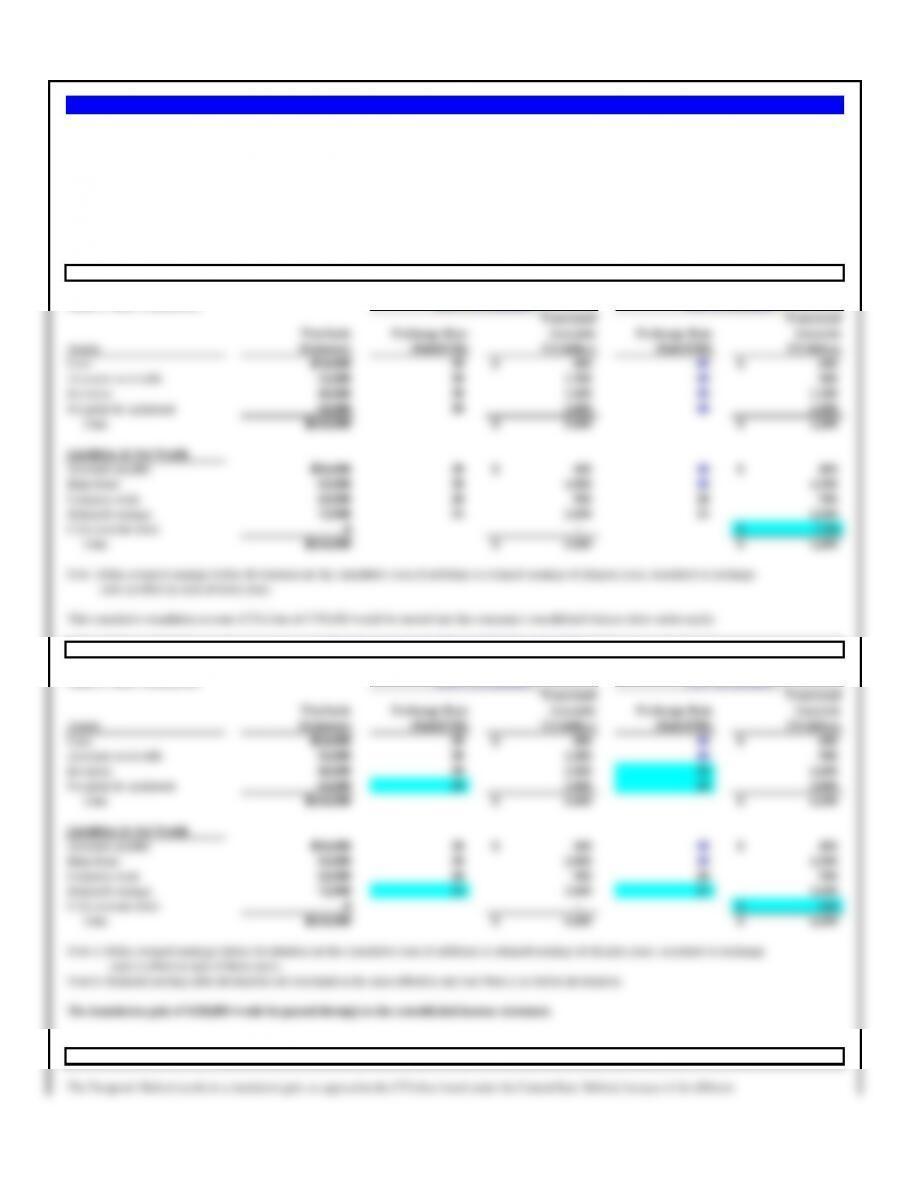

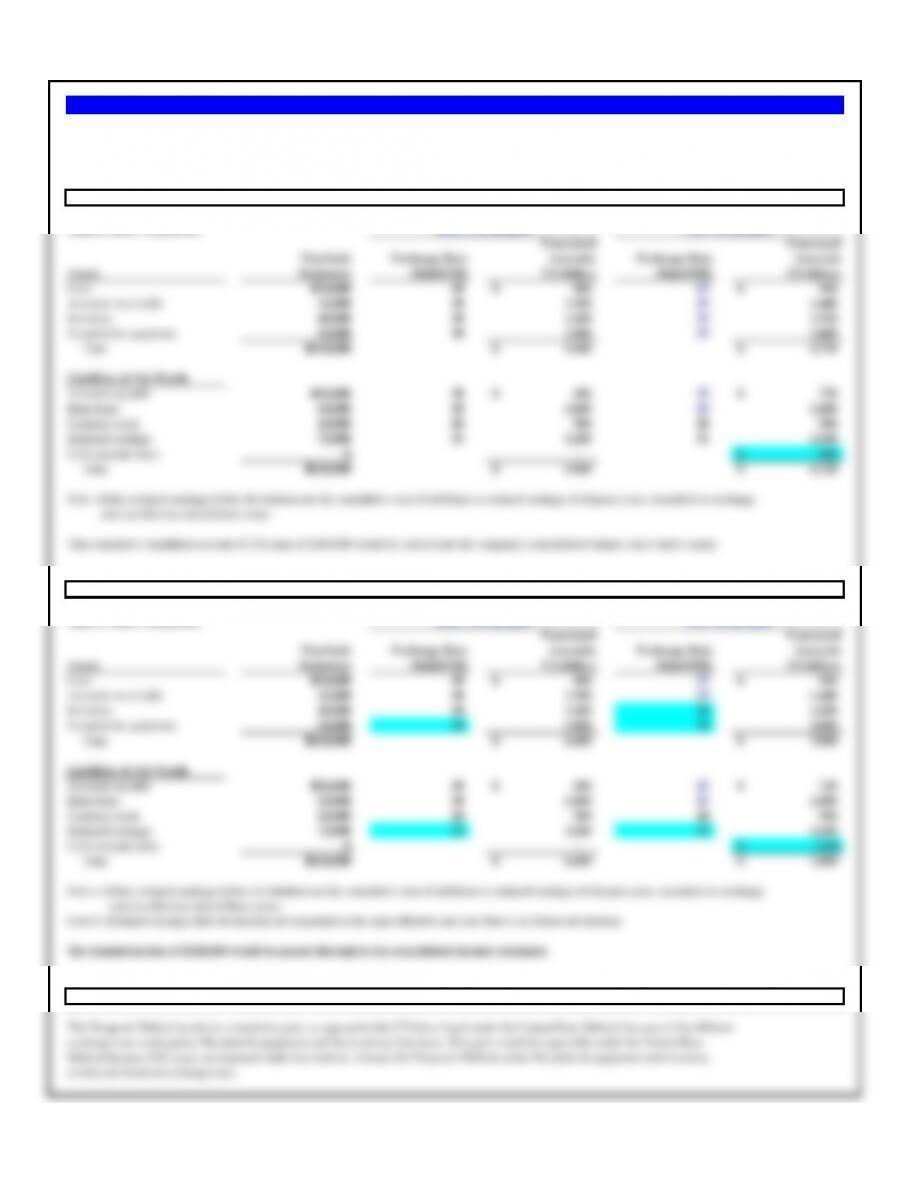

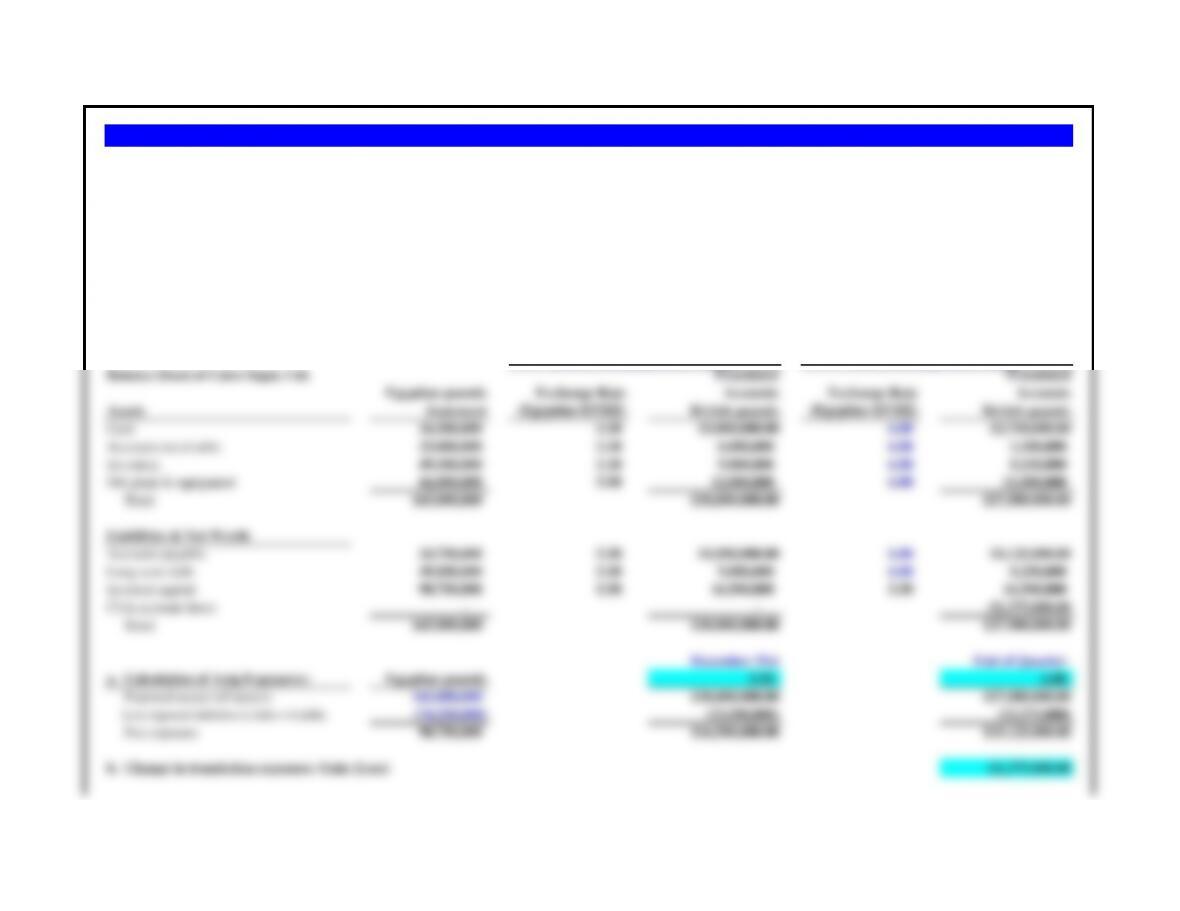

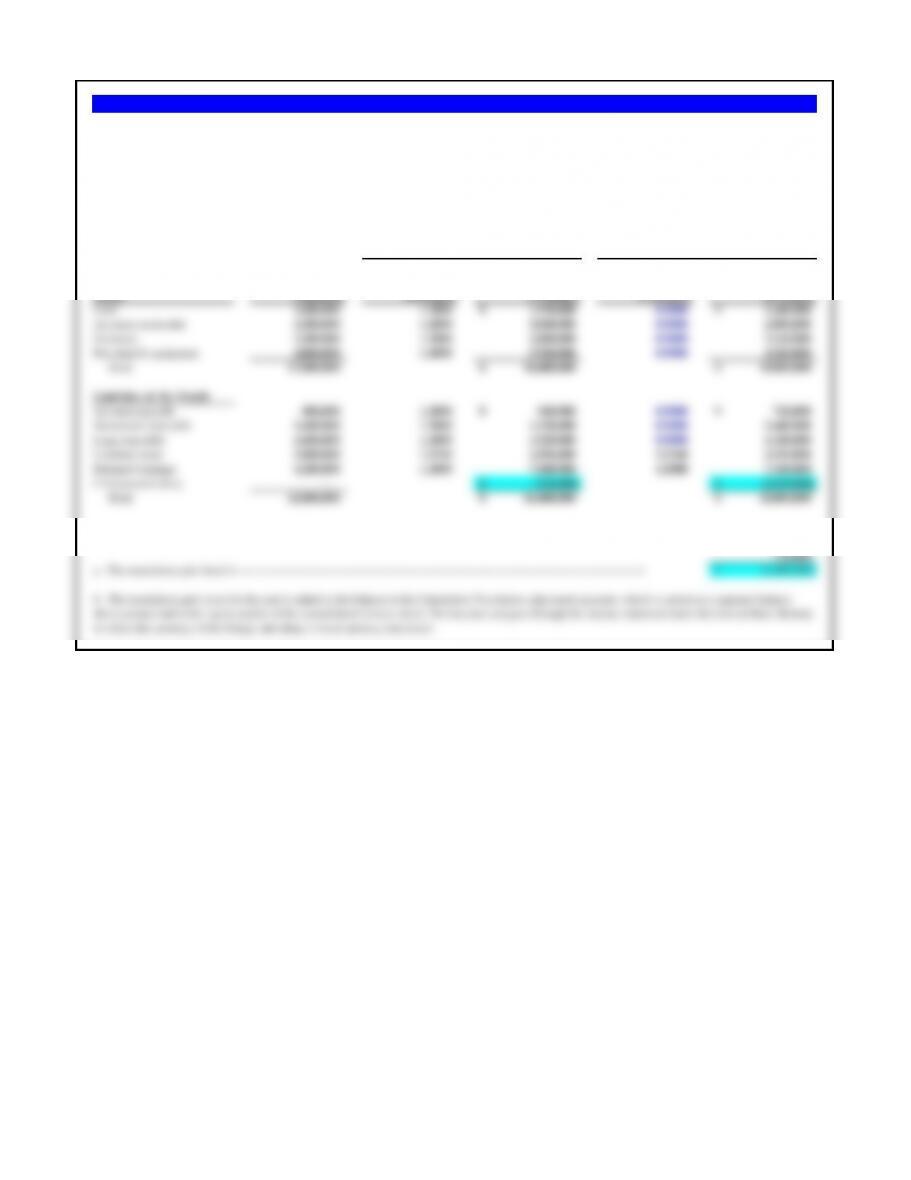

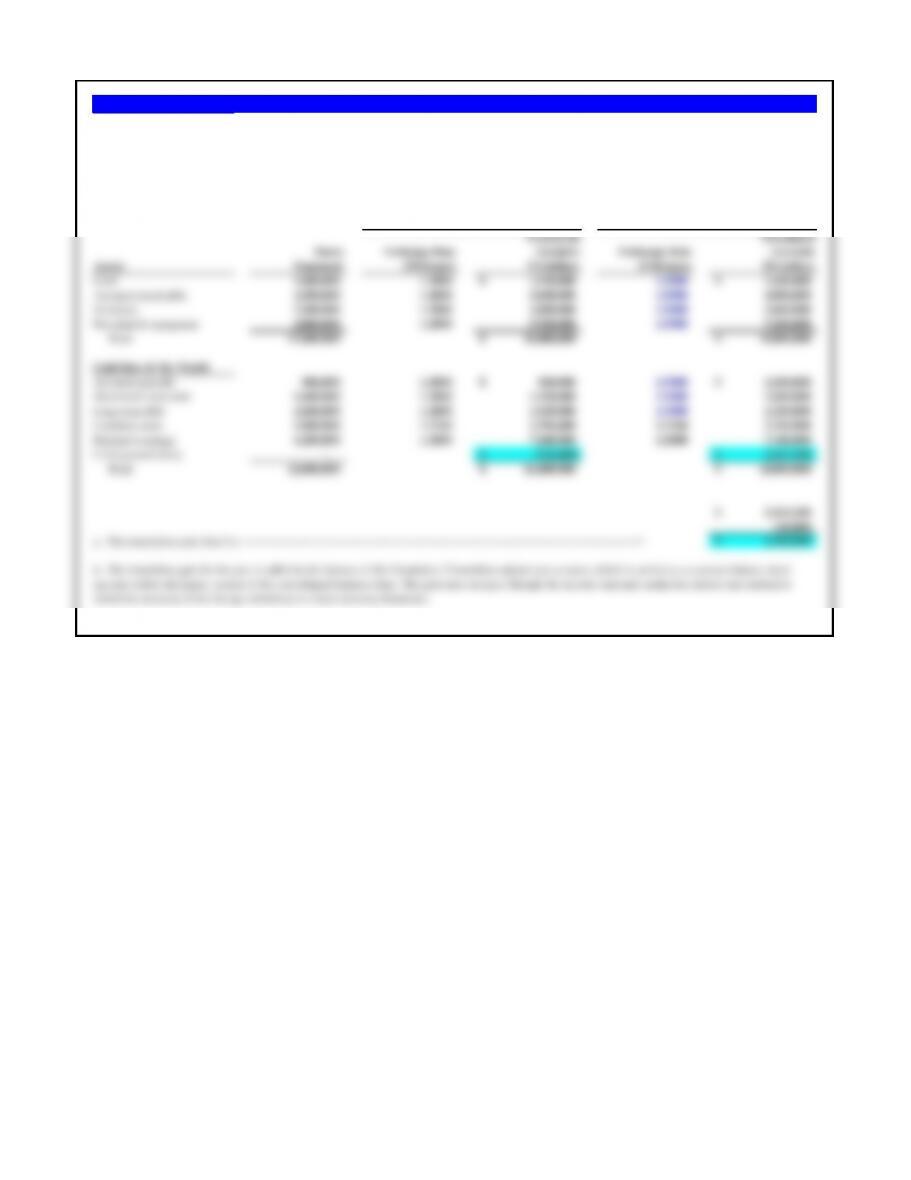

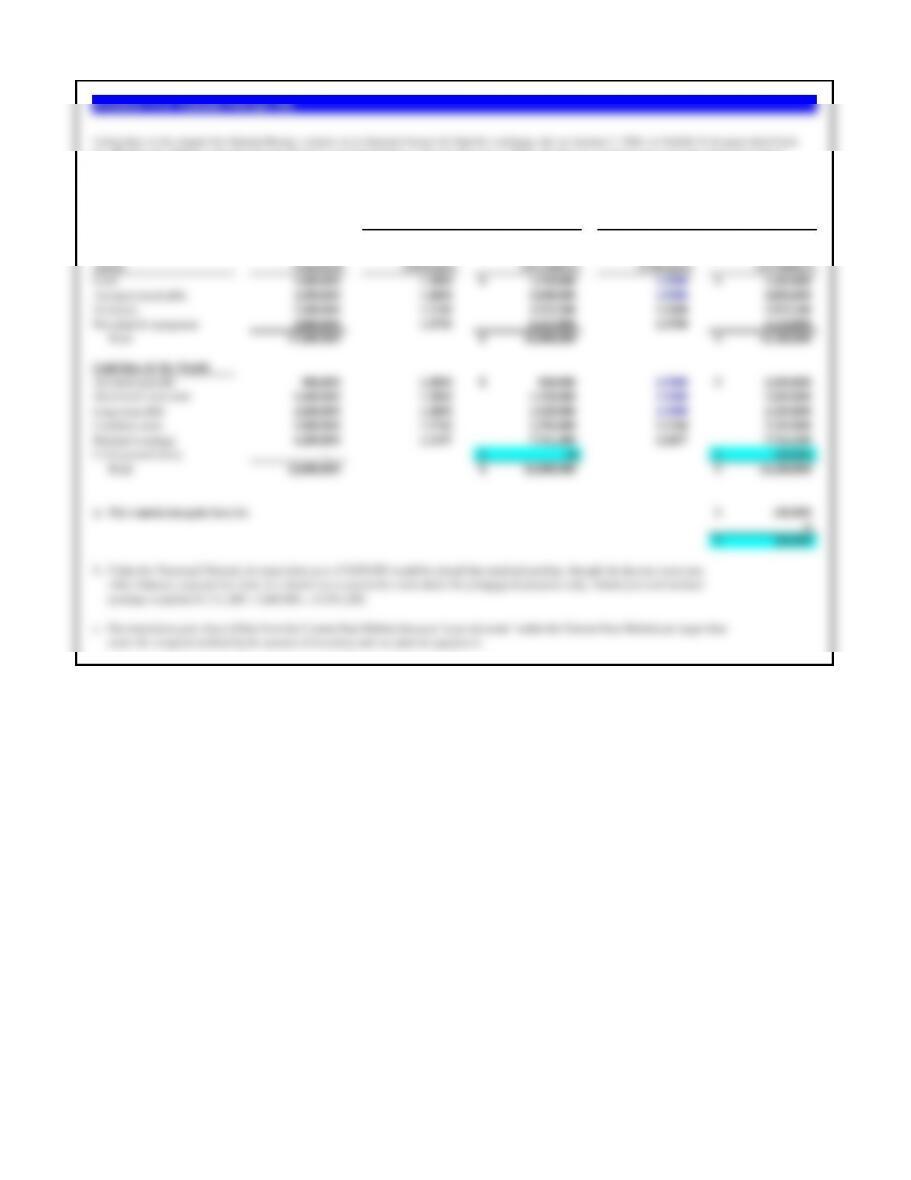

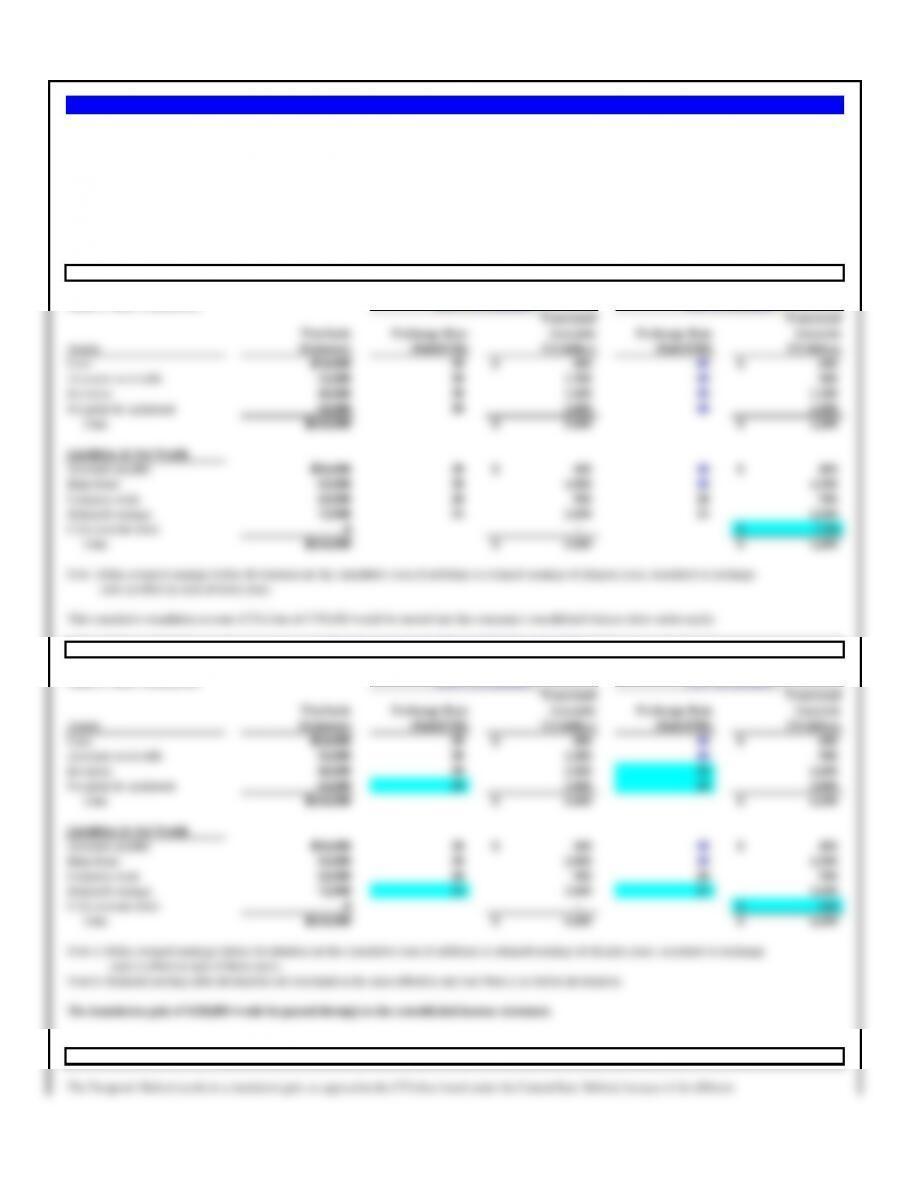

Translated Translated

Euros Exchange Rate Accounts Exchange Rate Accounts

Assets Statement (US$/euro) (US dollars) (US$/euro) (US dollars)

Cash 1,600,000 1.2000 1,920,000$ 0.9000 1,440,000$

Accounts receivable 3,200,000 1.2000 3,840,000 0.9000 2,880,000

Inventory 2,400,000 1.2180 2,923,200 1.2180 2,923,200

Net plant & equipment 4,800,000 1.2760 6,124,800 1.2760 6,124,800

Total 12,000,000 14,808,000$ 13,368,000$

Liabilities & Net Worth

Accounts payable 800,000 1.2000 960,000$ 0.9000 720,000$

Short-term bank debt 1,600,000 1.2000 1,920,000 0.9000 1,440,000

Long-term debt 1,600,000 1.2000 1,920,000 0.9000 1,440,000

Common stock 1,800,000 1.2760 2,296,800 1.2760 2,296,800

Retained earnings 6,200,000 1.2437 7,711,200 1.2437 7,711,200

Translation gain (loss) - (0)$ (240,000)$

Total 12,000,000 14,808,000$ 13,368,000$

(240,000)$ 0

a. The translation gain (loss) -- as a result of using the Temporal Method is -----------------------------------------------------------> (240,000)$

b. Under the Temporal Method, the translation loss of $240,000 would be closed into retained earnings through the income statement,

rather than as a separate line item. It is shown as a separate line item above for pedagogical purposes only. Actual year-end retained

earnings would be $7,711,200 - $240,000 = $7,471,200.