I. Importance of Accounting—we live in the information age, where

information, and its reliability, impacts the financial well-being of us

all.

A. Accounting Activities

Accounting is an information and measurement system that

identifies, records and communicates relevant, reliable, and

comparable information about an organizations business activities.

B. Users of Accounting Information

1. External Information Users—those not directly involved with

running the company. Examples: shareholders (investors),

lenders, directors, external auditors, non-executive employees,

labor unions, regulators, voters, legislators, government

officials, customers, suppliers, lawyers, brokers, etc.

a. Financial Accounting—area of accounting aimed at

serving external users by providing them with general-

purpose financial statements.

b. General-Purpose Financial Statements—statements that

have broad range of purposes which external users rely on.

2. Internal Information Users—those directly involved in

managing and operating an organization.

a. Managerial Accounting—area of accounting that serves

the decision-making needs of internal users.

b. Internal Reports—not subject to same rules as external

reports. They are designed with special needs of external

users in mind.

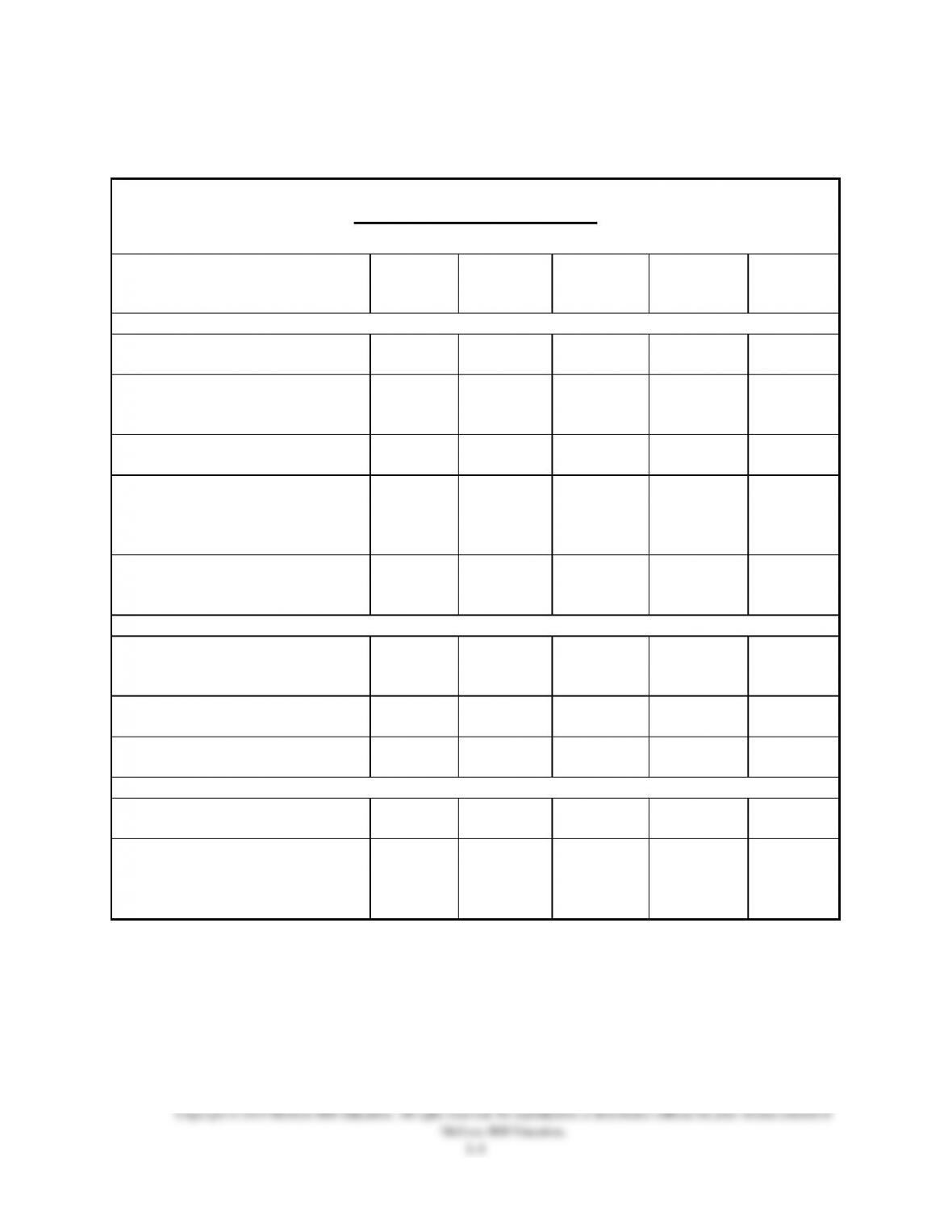

C. Opportunities in Accounting

Four broad areas of opportunities are financial, managerial,

taxation, and accounting related.

1. Private accounting offers the most opportunities.

2. Public accounting offers the next largest number of

opportunities

3. Government (and not-for-profit) agencies, including business

regulation and investigation of law violations also offer

opportunities.

II. Fundamentals of Accounting—accounting is guided by principles,

standards, concepts, and assumptions.

A. Ethics—a key concept. Ethics are beliefs that distinguish right

from wrong.

B. Fraud Triangle—model that asserts three factors must exist for

person to commit fraud: opportunity, pressure, and rationalization.