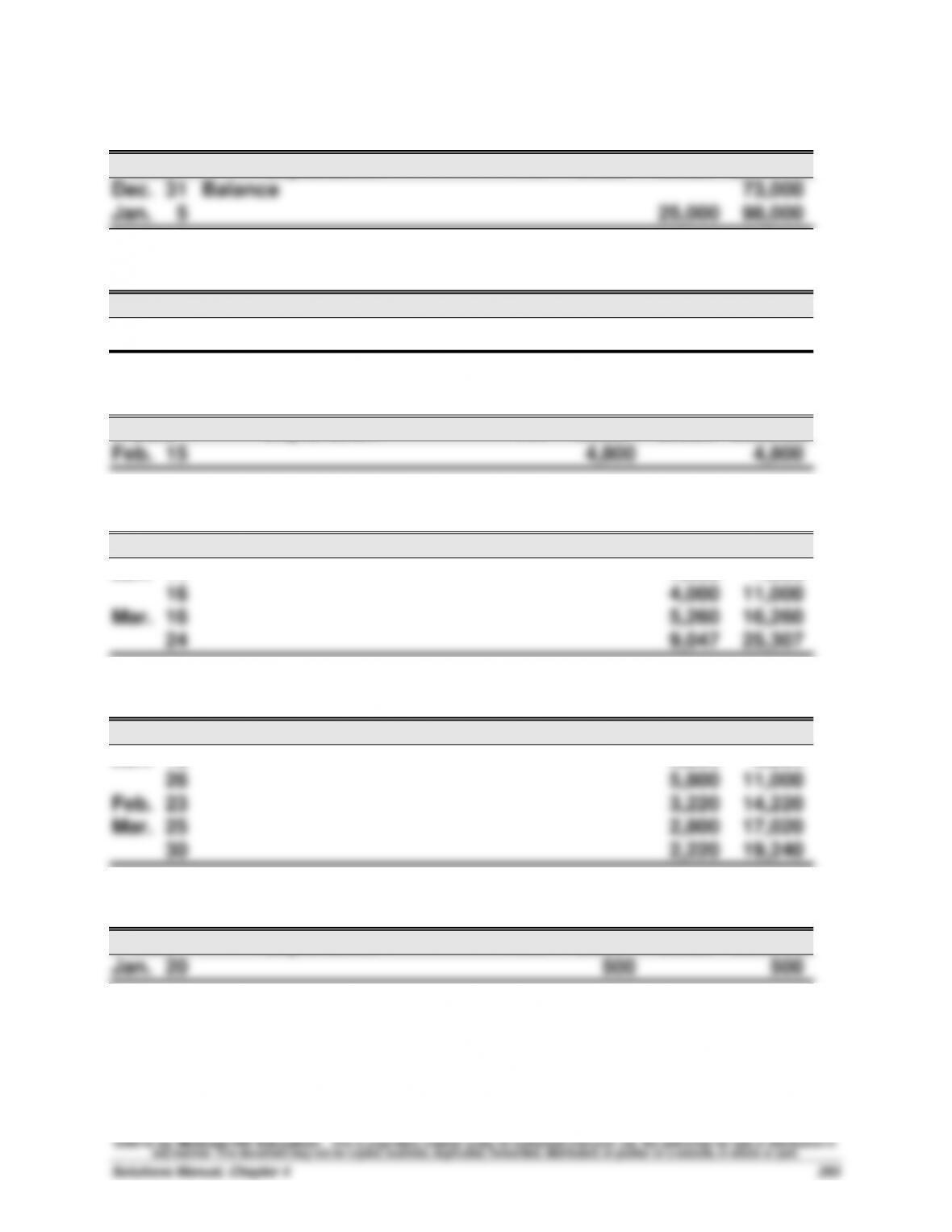

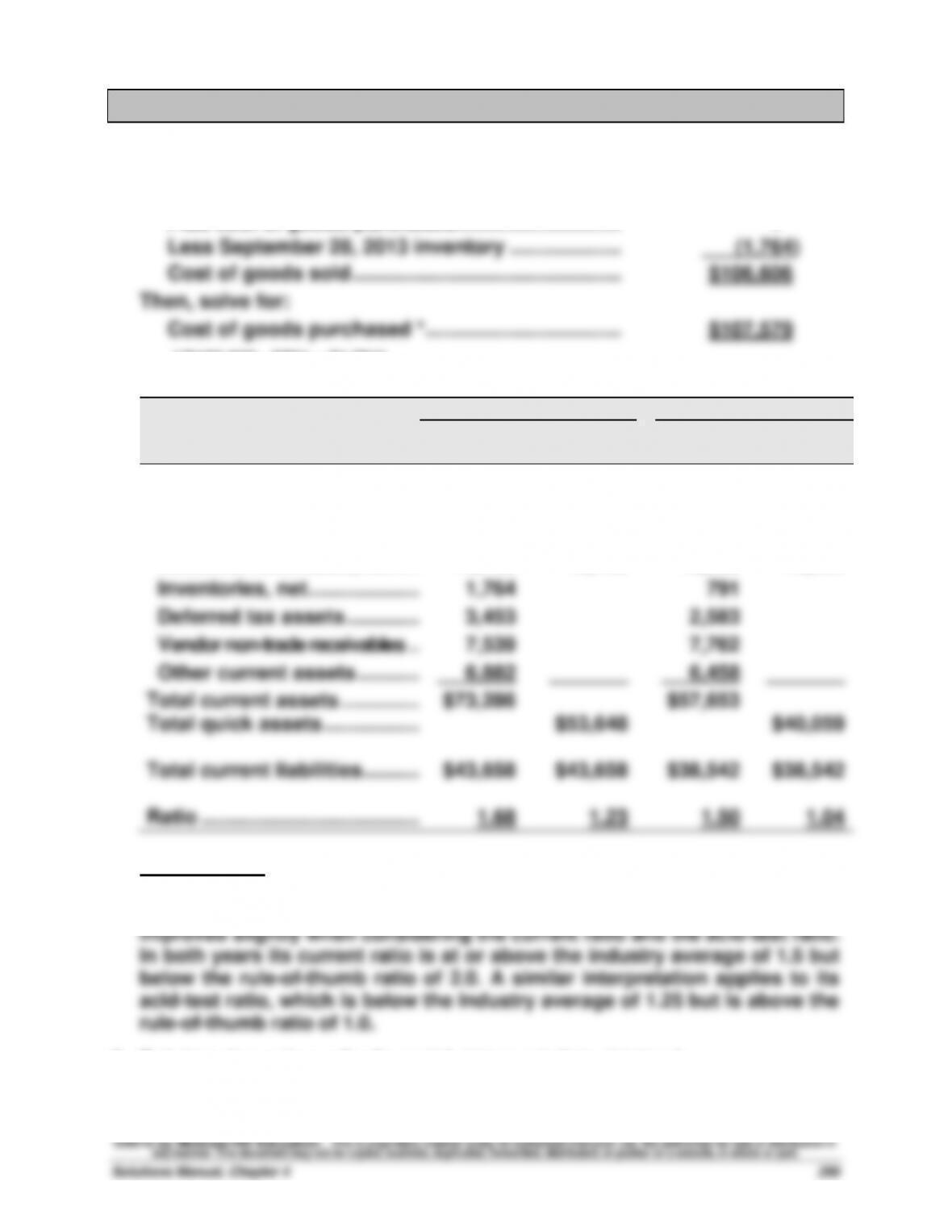

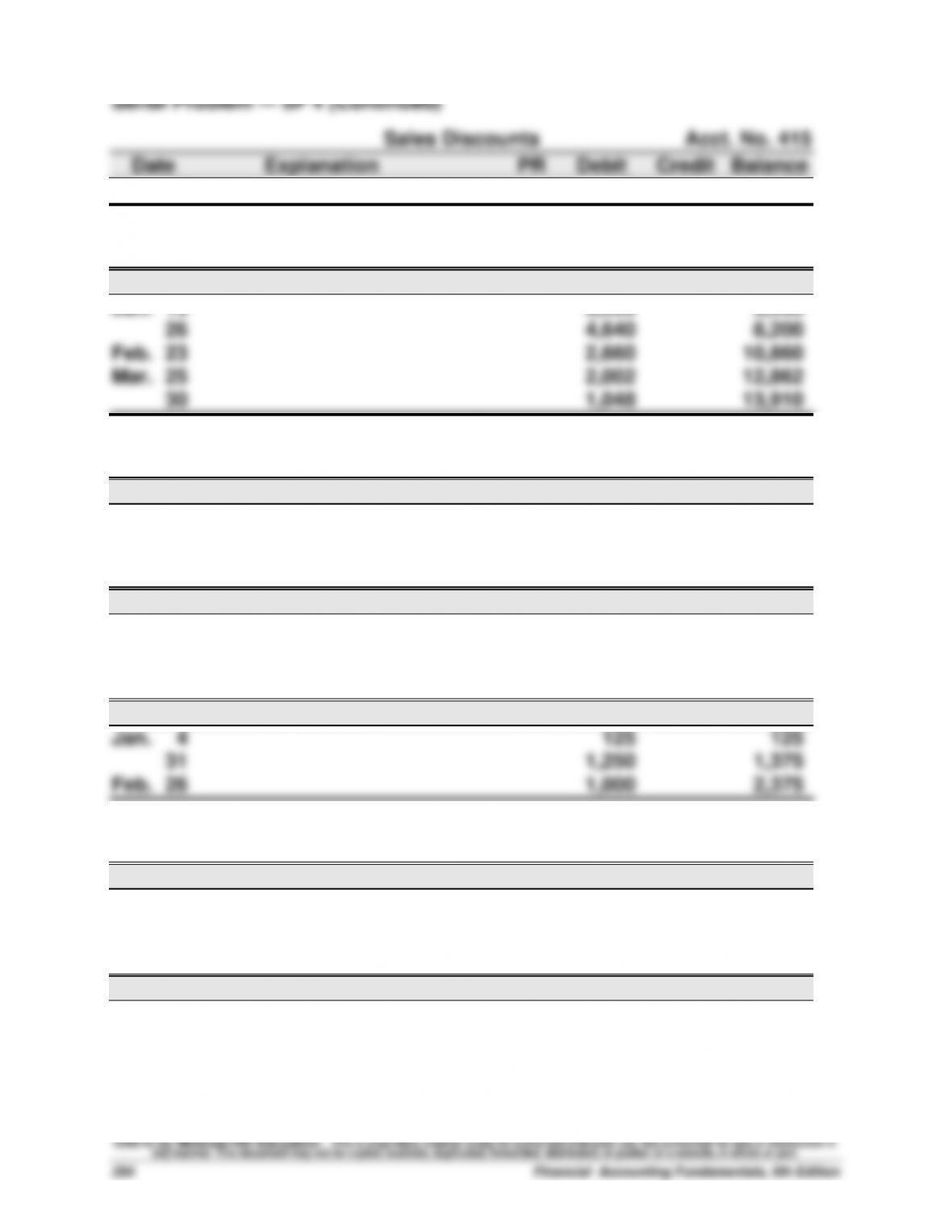

Serial Problem — SP 4 (Continued) Part 3

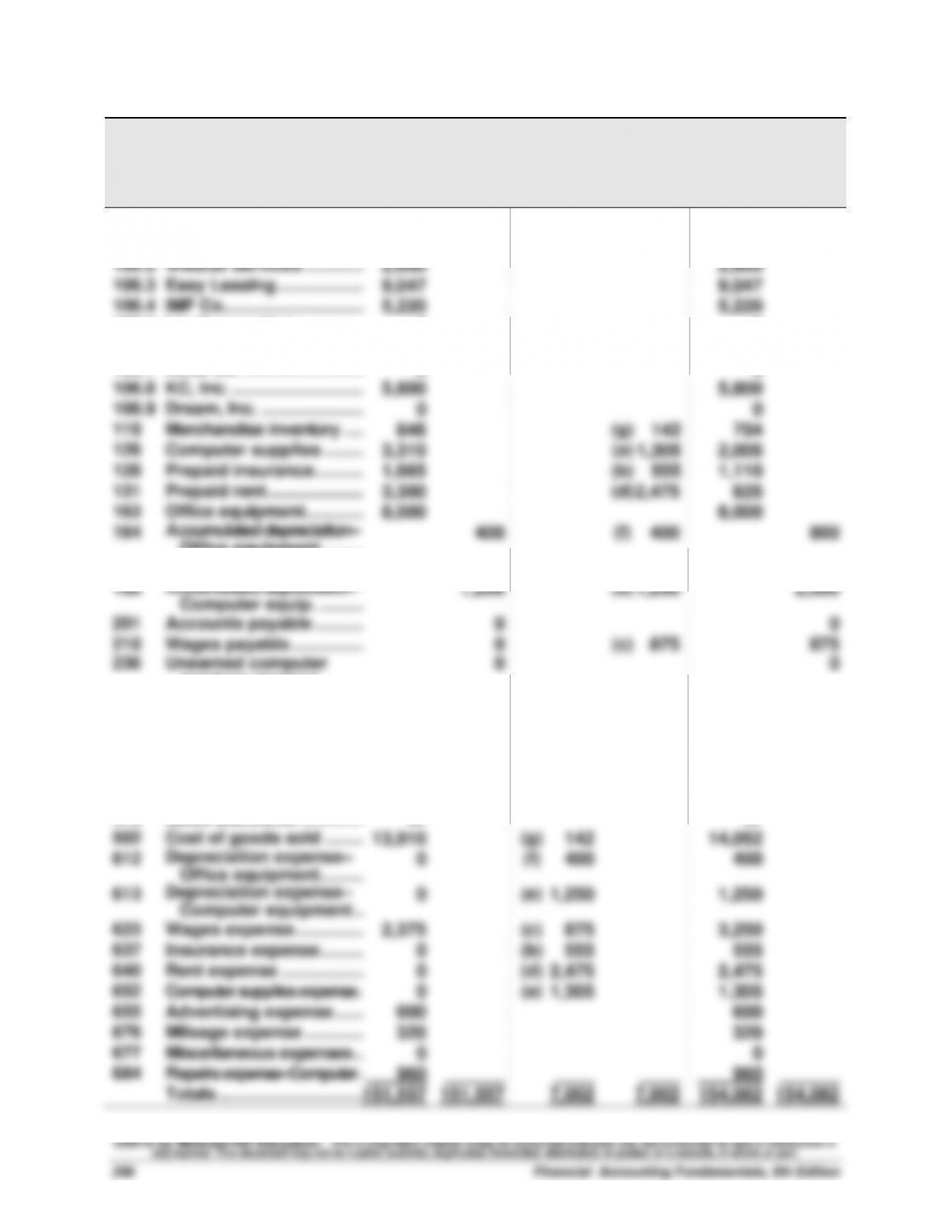

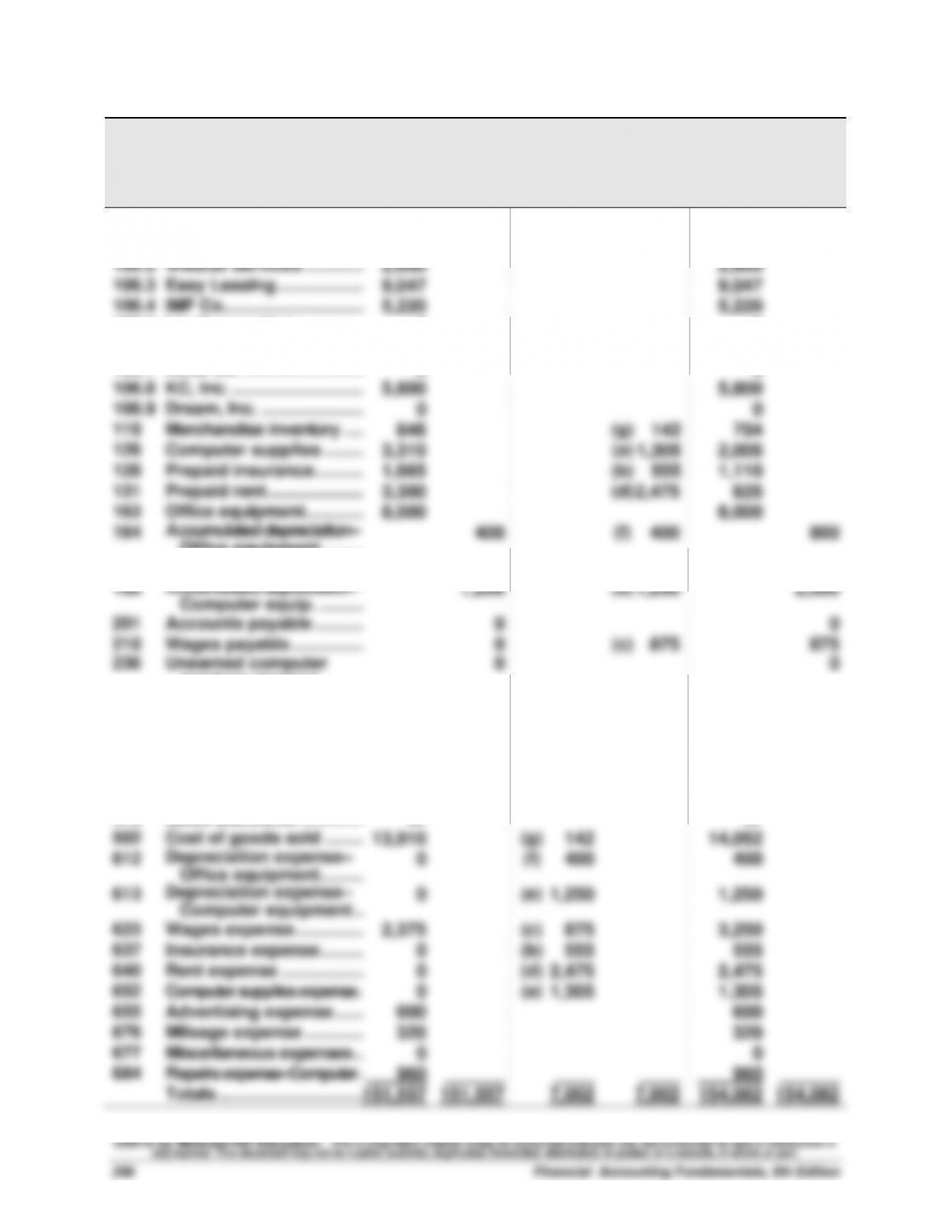

BUSINESS SOLUTIONS

Partial Work Sheet

March 31, 2016

Cash ................................

Alex’s Engineering Co. ...........

Wildcat Services ....................

Easy Leasing ..........................

IMF Co. ................................

Liu Corporation ......................

Gomez Co. ..............................

Delta Co. ................................

KC, Inc. ................................

Dream, Inc. .............................

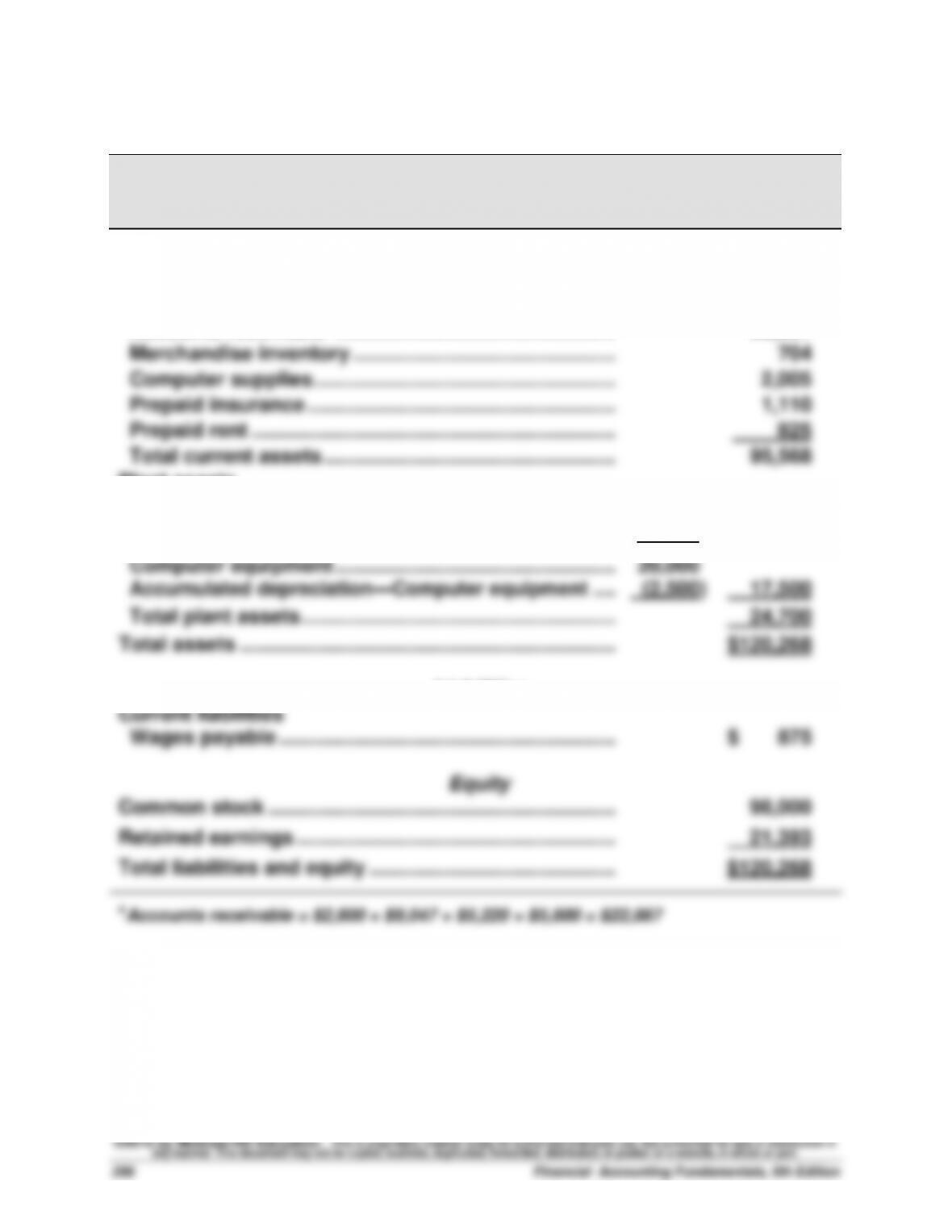

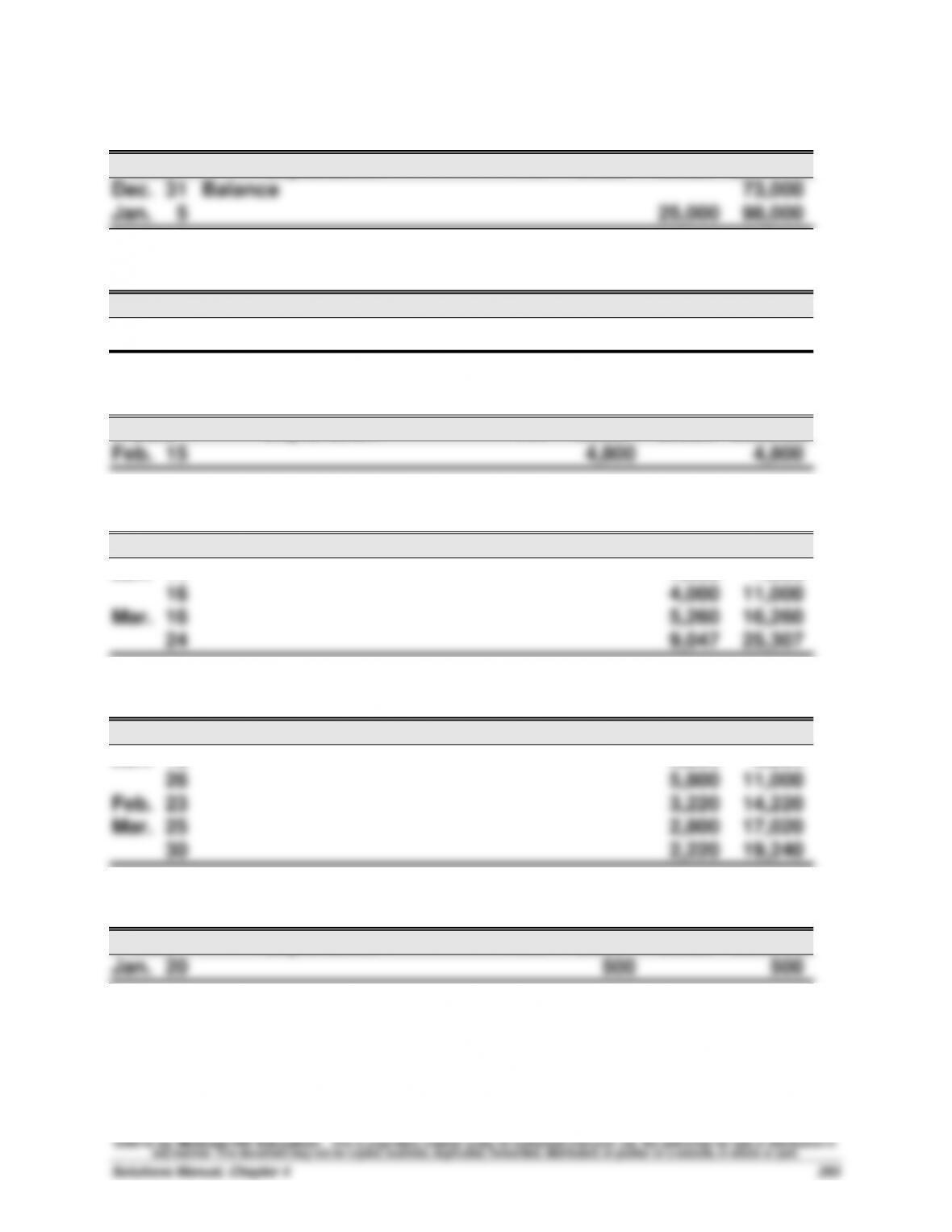

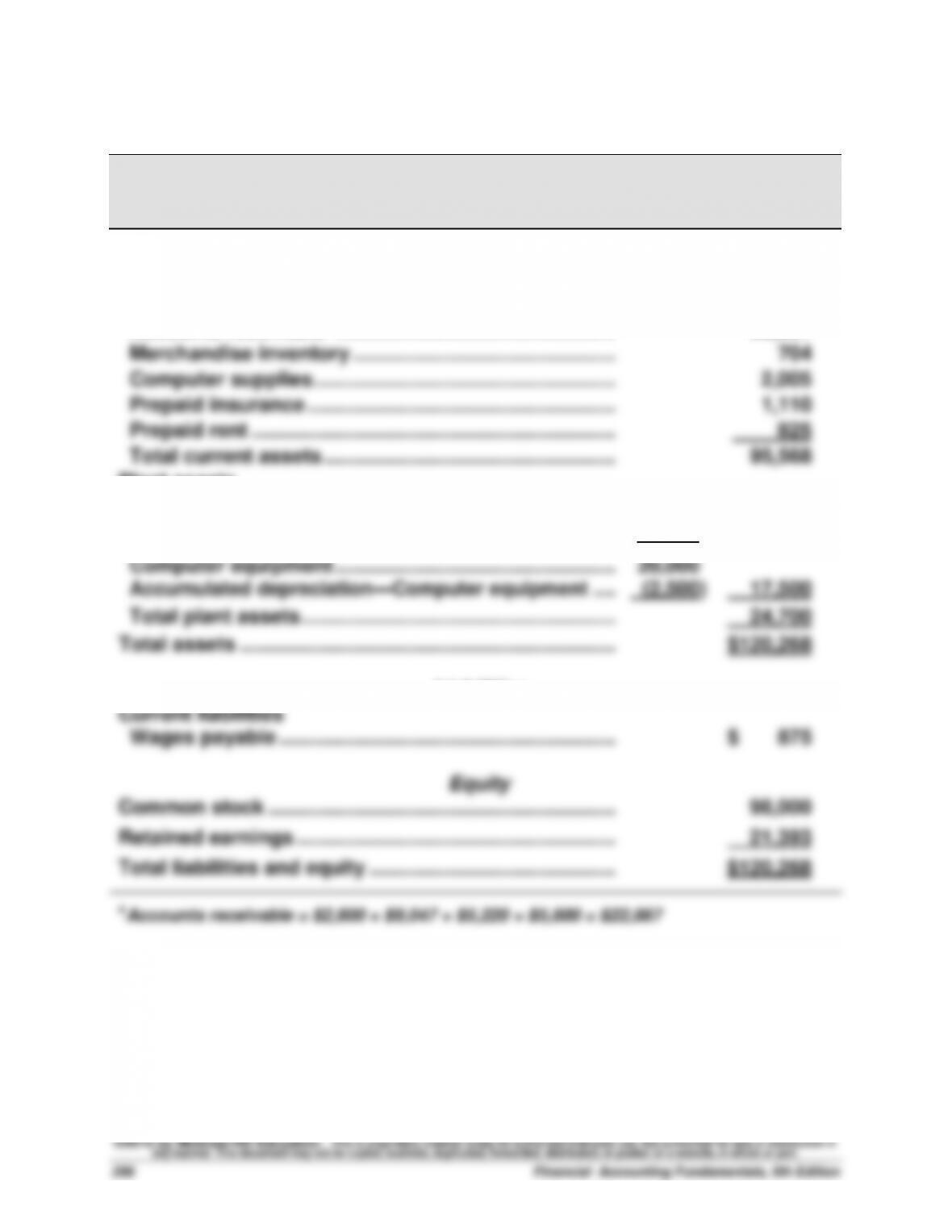

Merchandise inventory ............

Computer supplies ................

Prepaid insurance ..................

Prepaid rent ............................

Office equipment....................

Accumulated depreciation–

Office equipment .................

Computer equipment .............

Accumulated depreciation–

Computer equip. .................

Accounts payable ..................

Wages payable .......................

Unearned computer

services revenue .................

Common stock .......................

Retained earnings ..................

Dividends ...............................

Computer services revenue ..........

Sales ................................

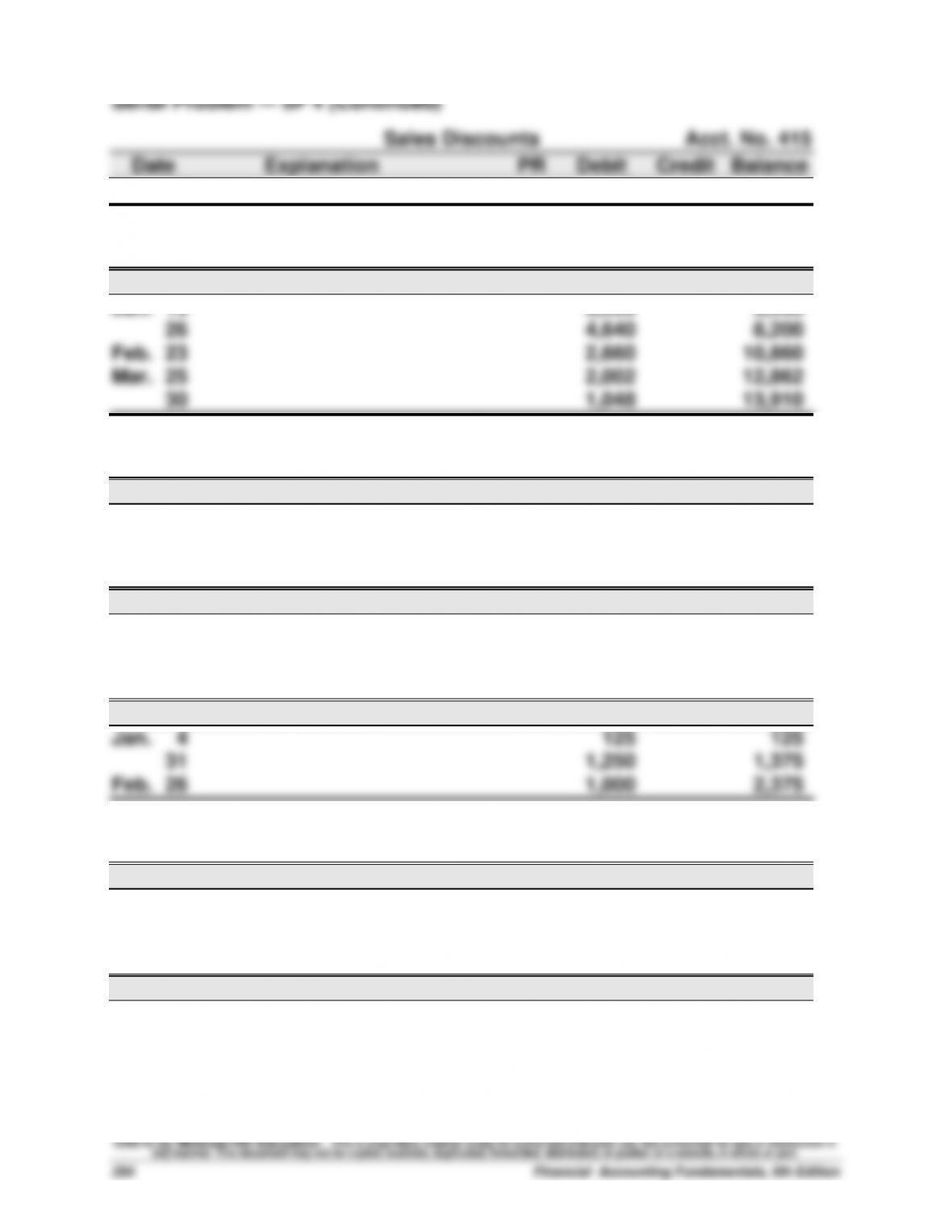

Sales returns and allow. ............

Sales discounts .....................

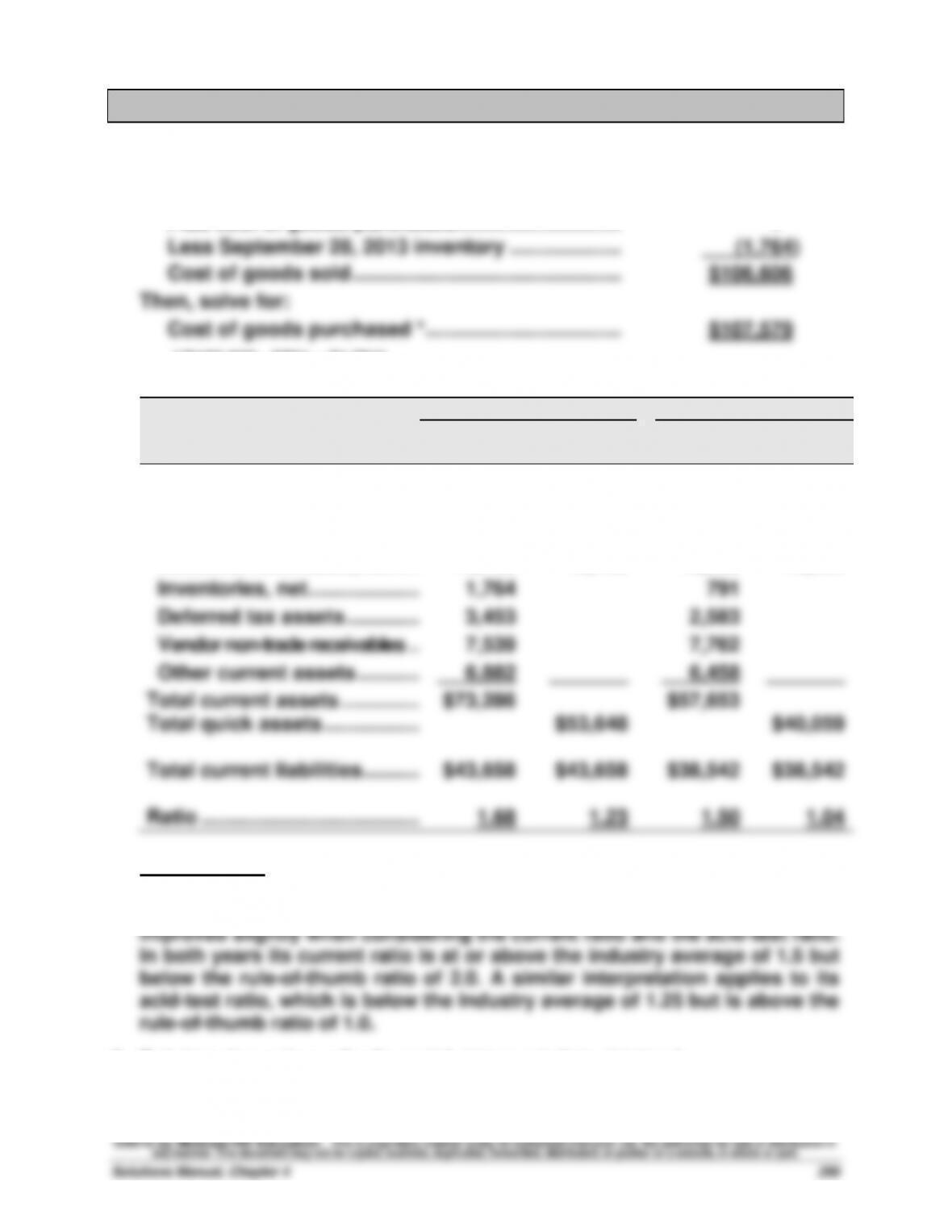

Cost of goods sold ................

Depreciation expense–

Office equipment .................

Depreciation expense–

Computer equipment ..........

Wages expense ......................

Insurance expense .................

Rent expense .........................

Computer supplies expense ............

Advertising expense ..............

Mileage expense ....................

Miscellaneous expenses ..........

Repairs expense–Computer .........

Totals ................................