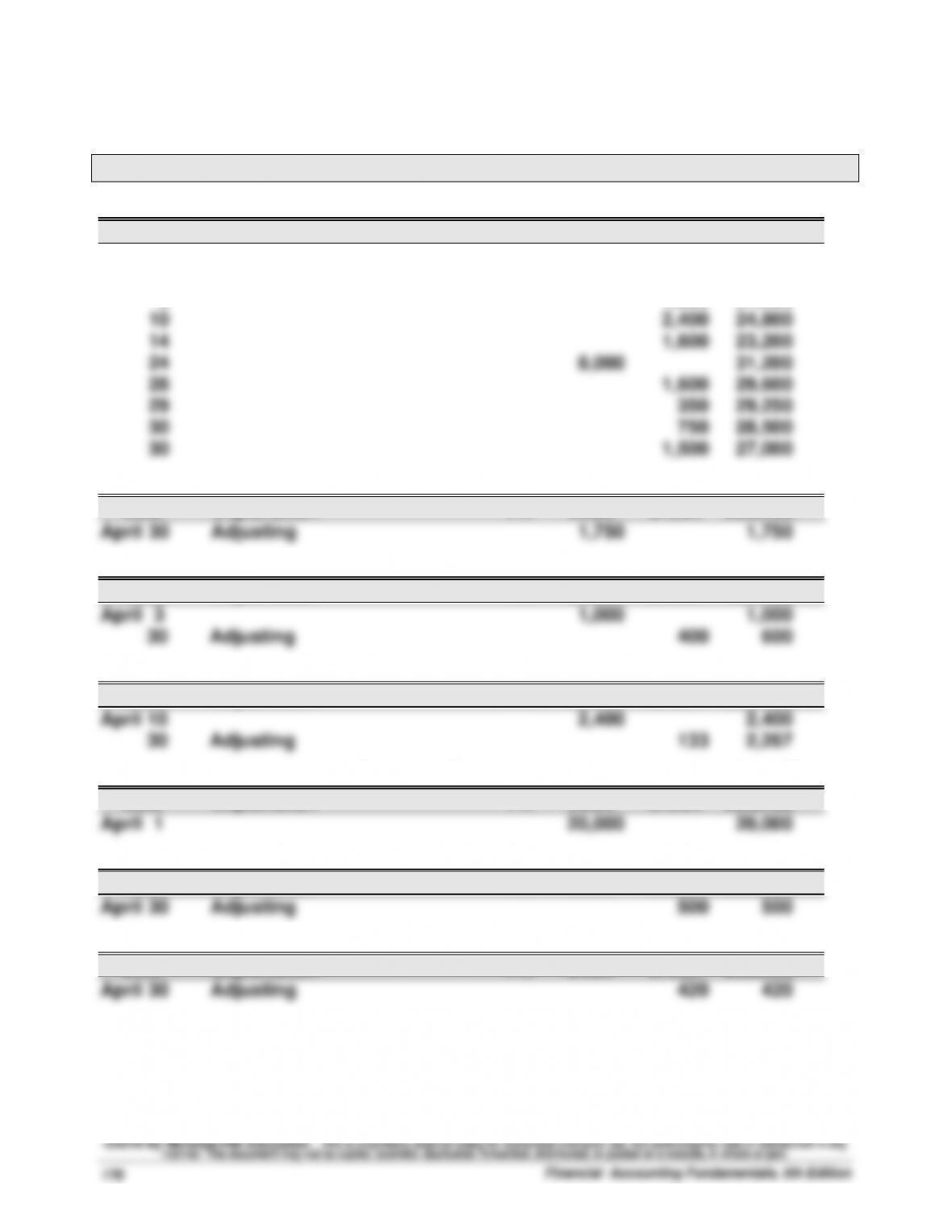

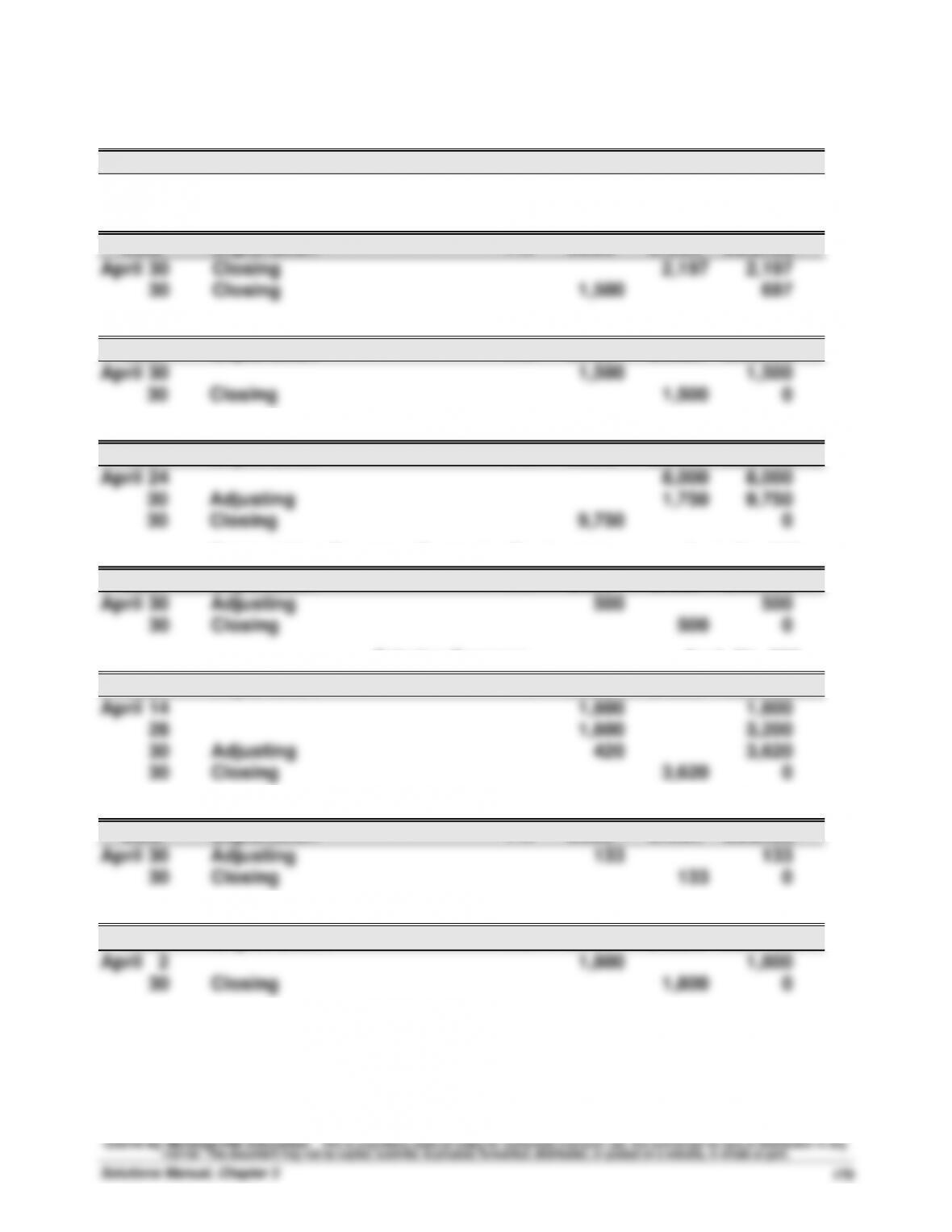

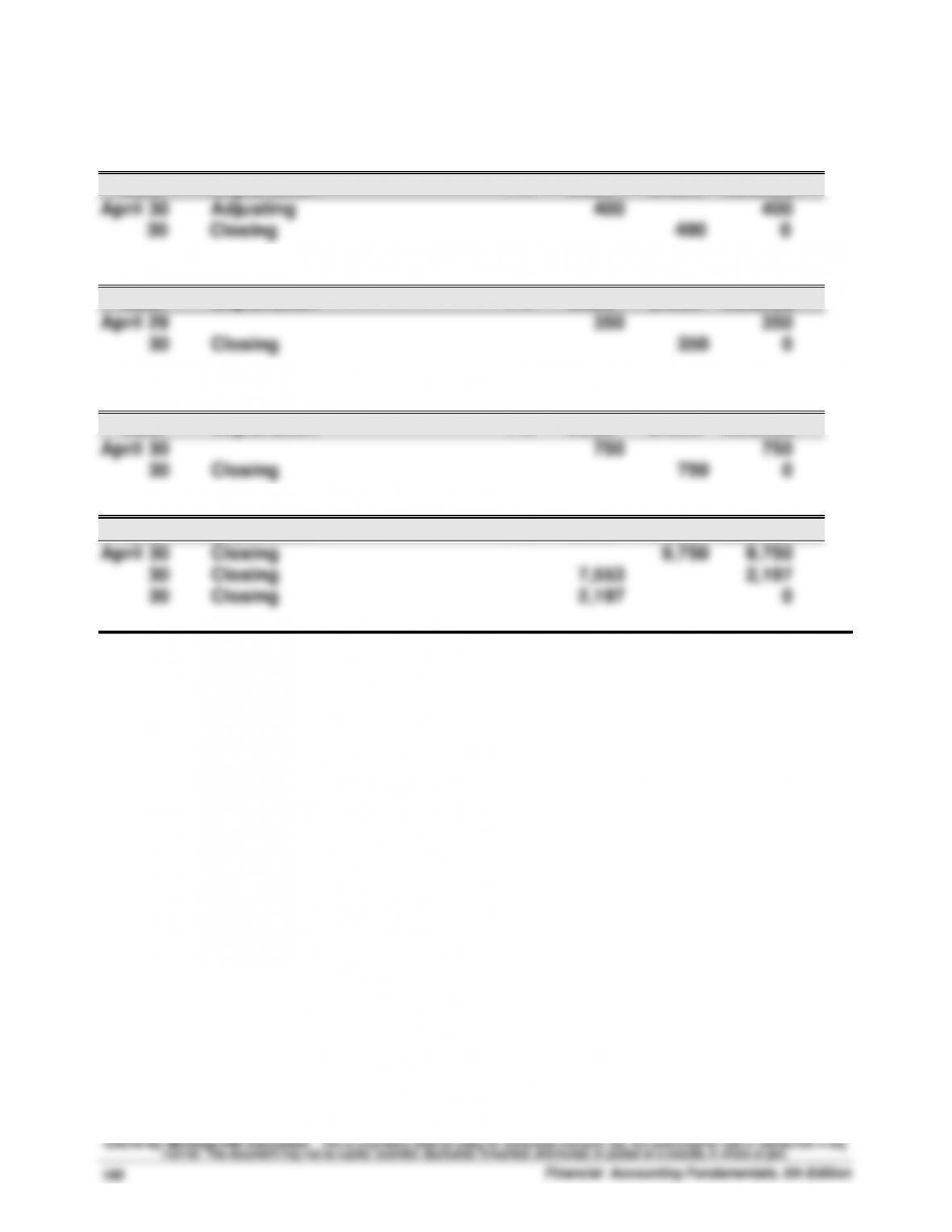

Problem 3-8A (Continued)

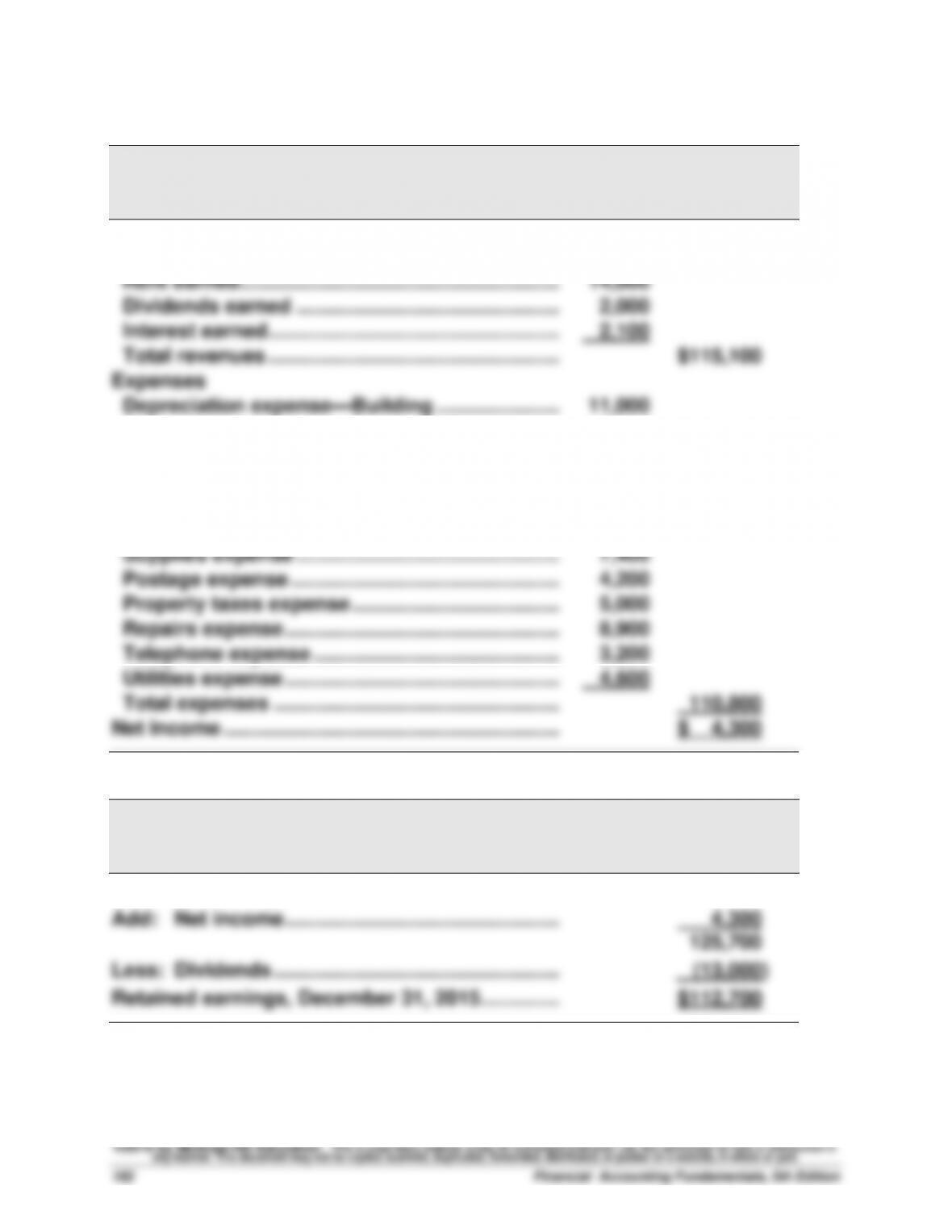

TYBALT CONSTRUCTION

Balance Sheet

December 31, 2015

Assets

Current assets

Plant assets

Equipment ........................................................... 40,000

Accumulated depreciation—Equipment .......... (20,000) 20,000

Building ............................................................... 150,000

Accumulated depreciation—Building .............. (50,000) 100,000

Accounts payable ............................................... $ 16,500

Interest payable .................................................. 2,500

Rent payable ....................................................... 3,500

Wages payable ................................................... 2,500

Property taxes payable ...................................... 900

Unearned professional fees .............................. 7,500

Current portion of long-term note payable…... 7,000