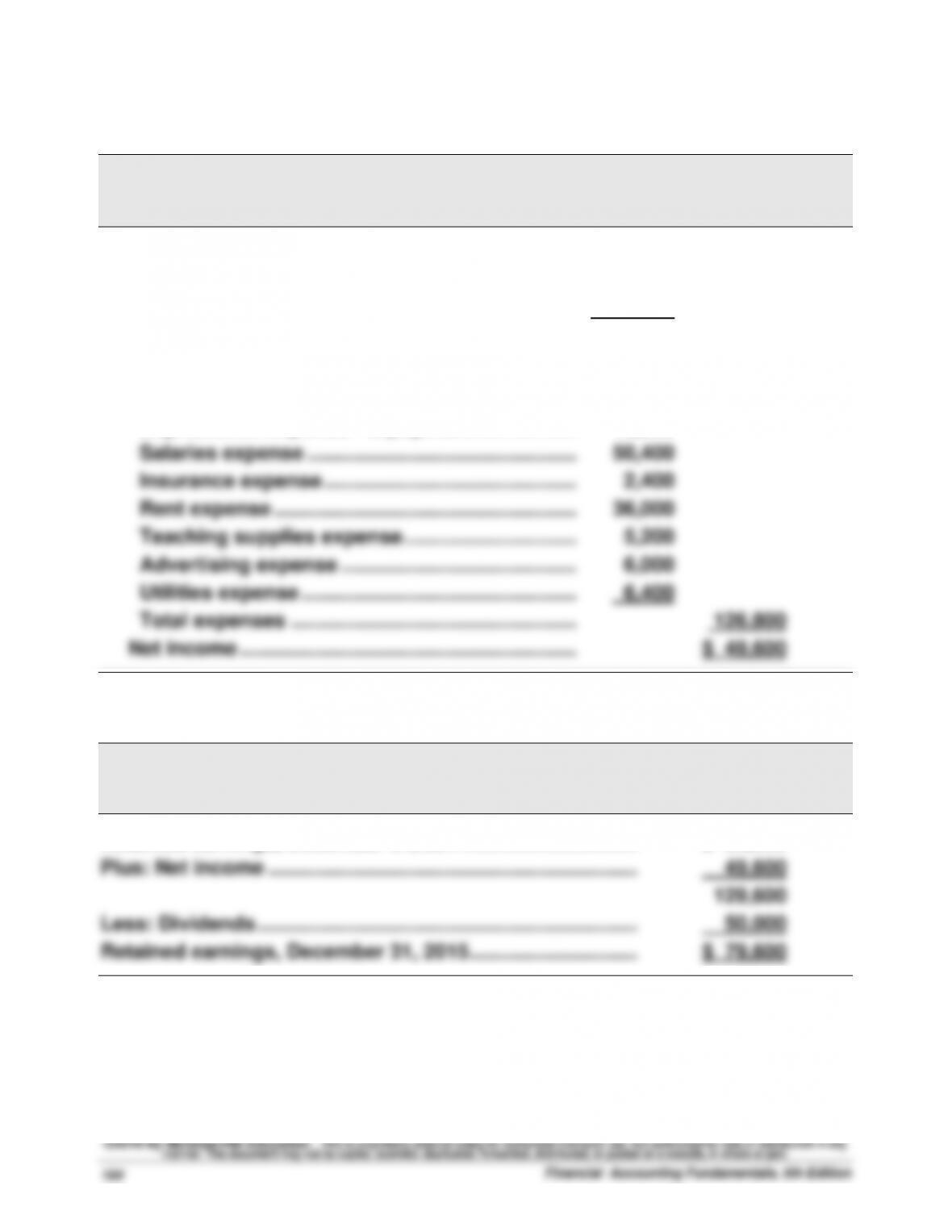

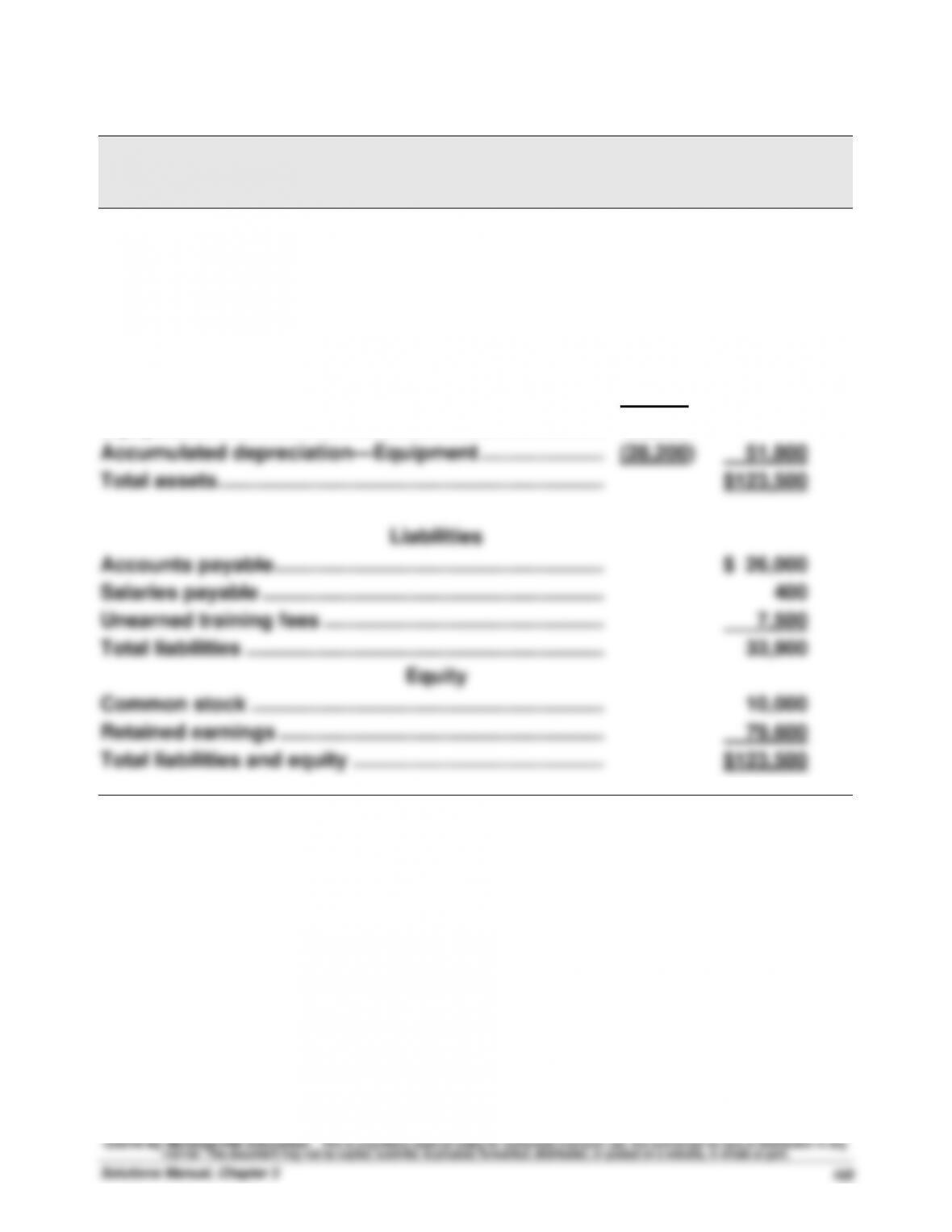

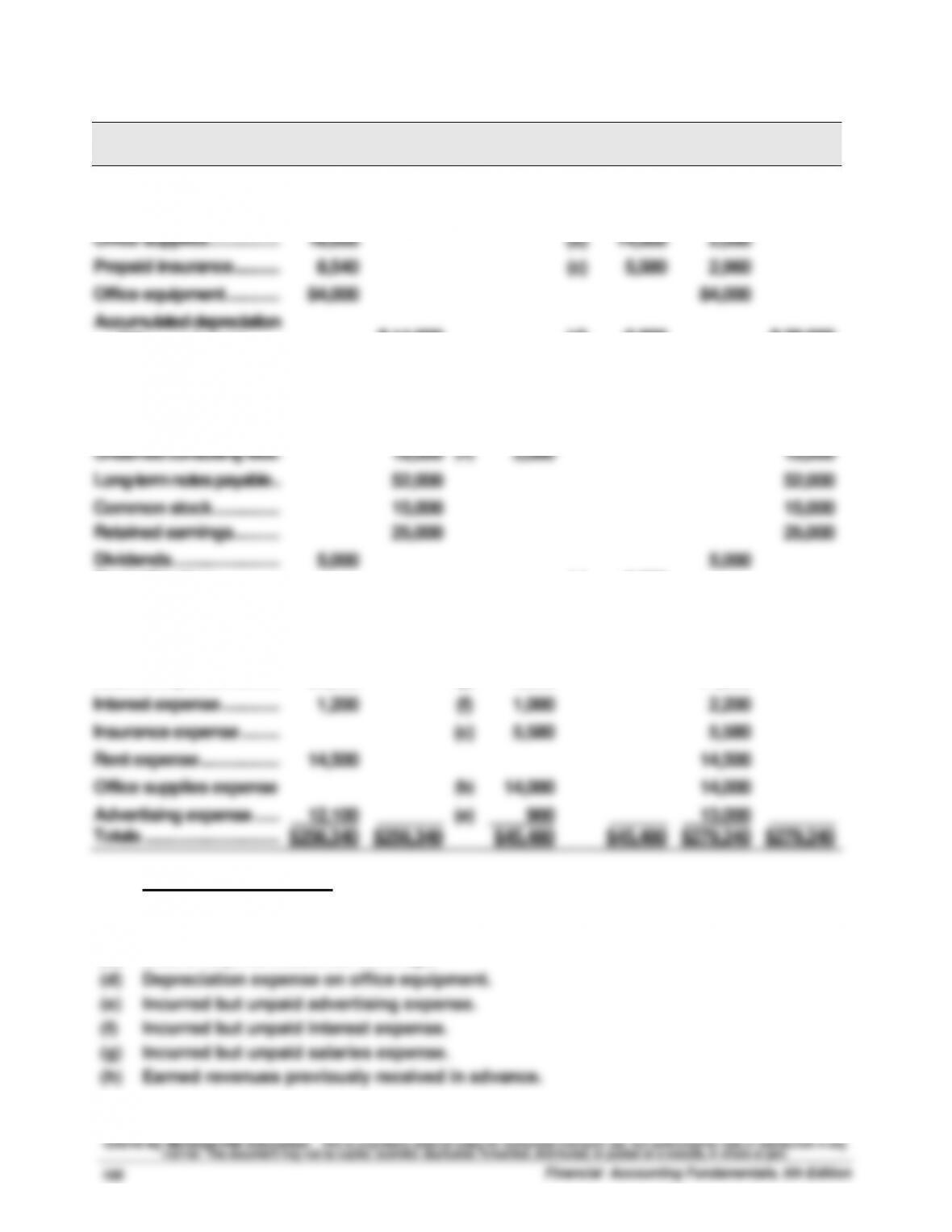

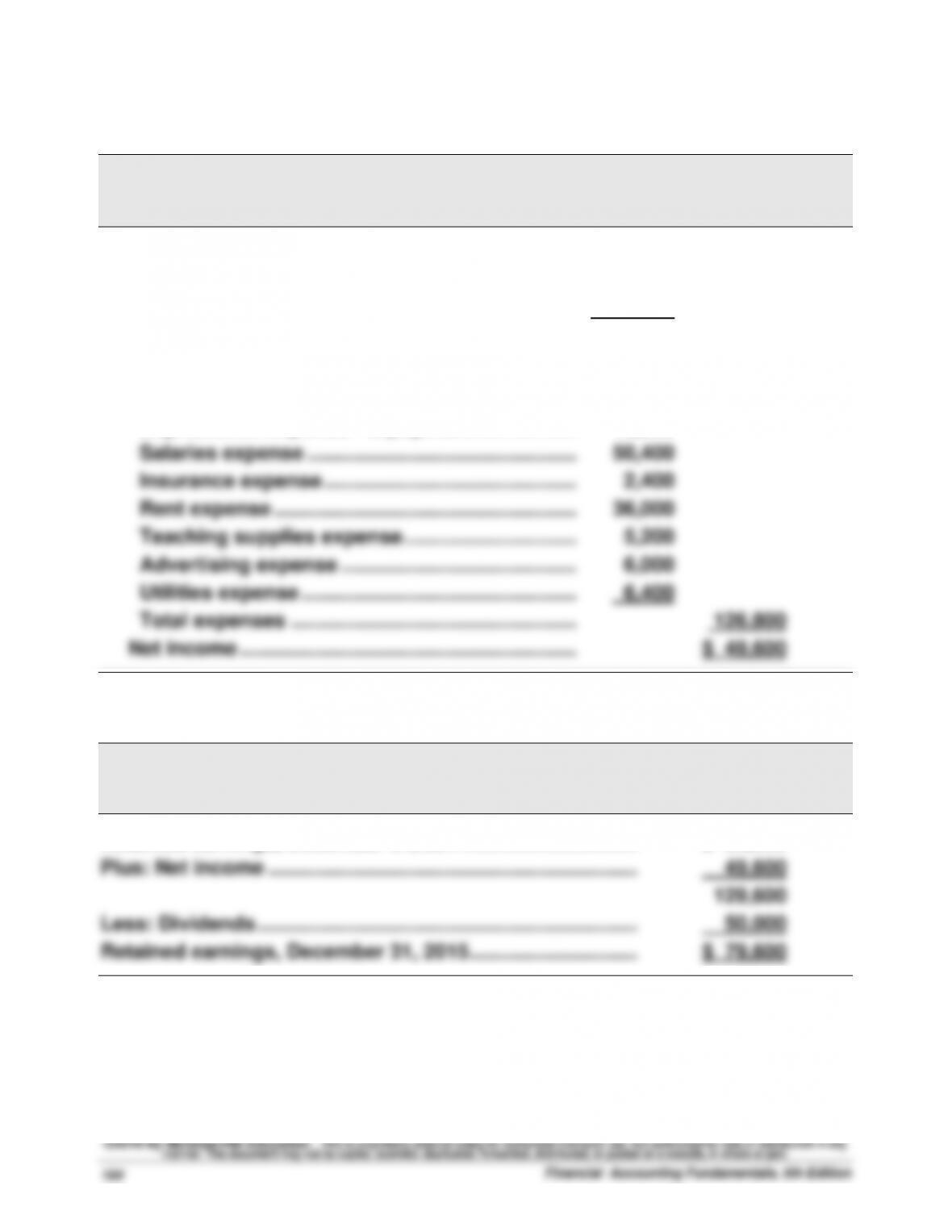

Problem 3-6A (90 minutes)

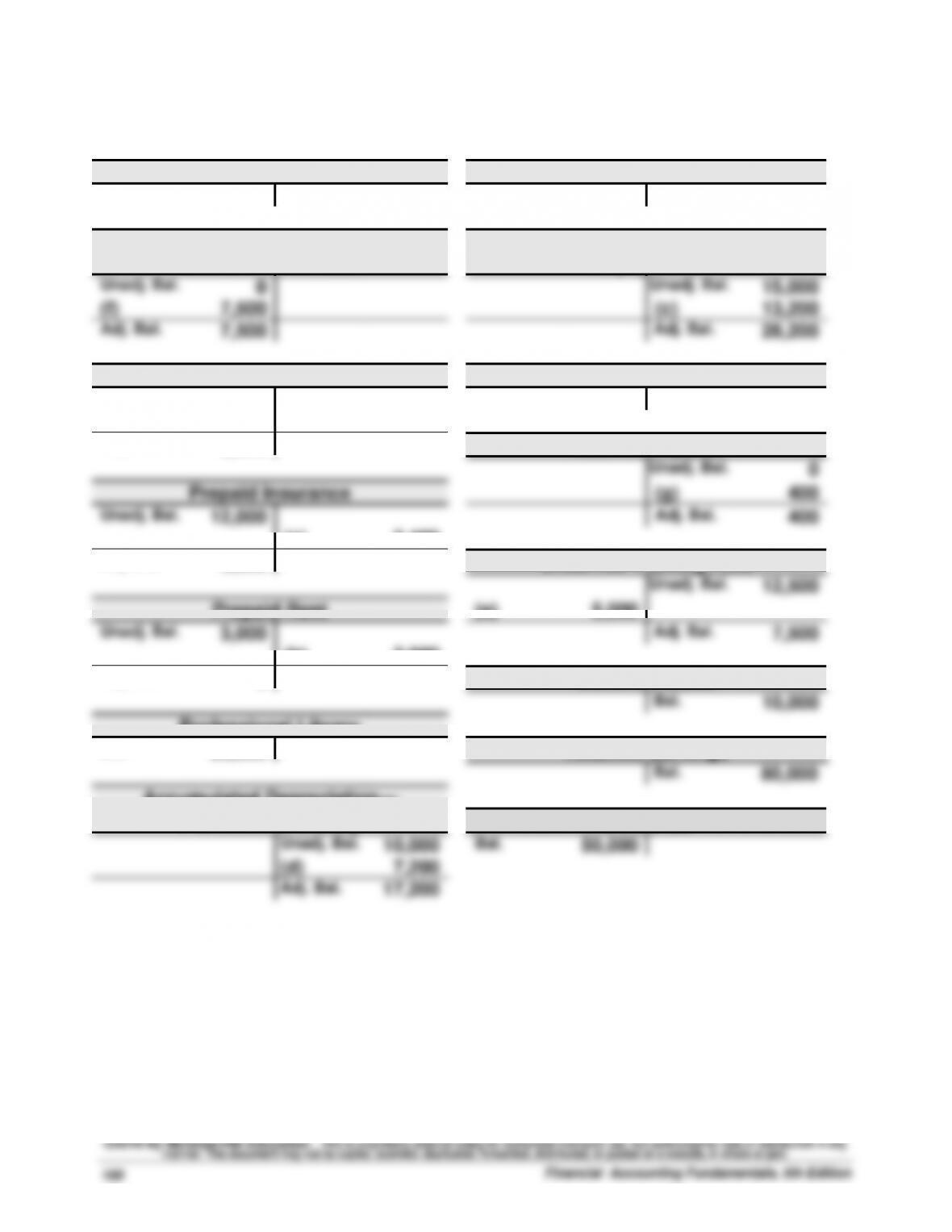

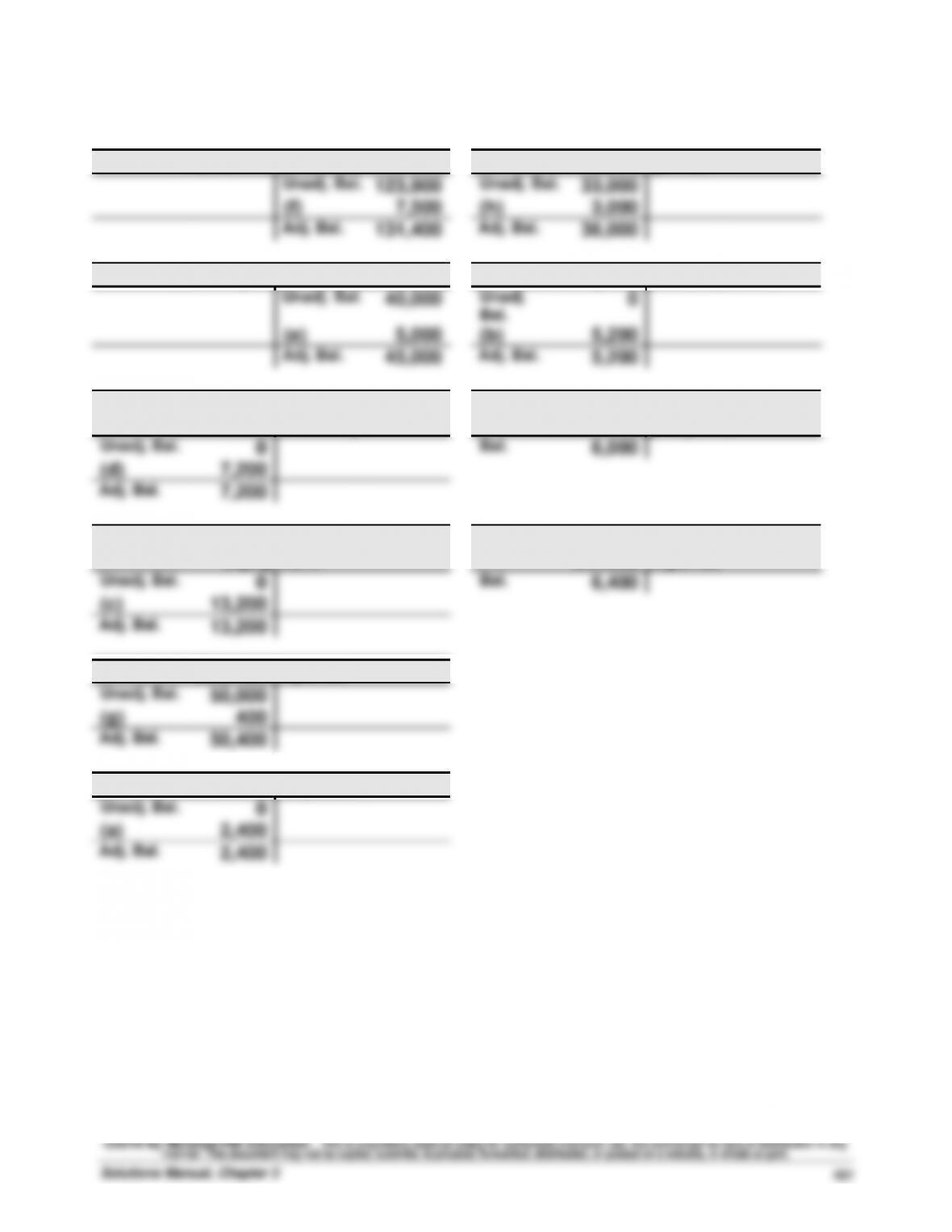

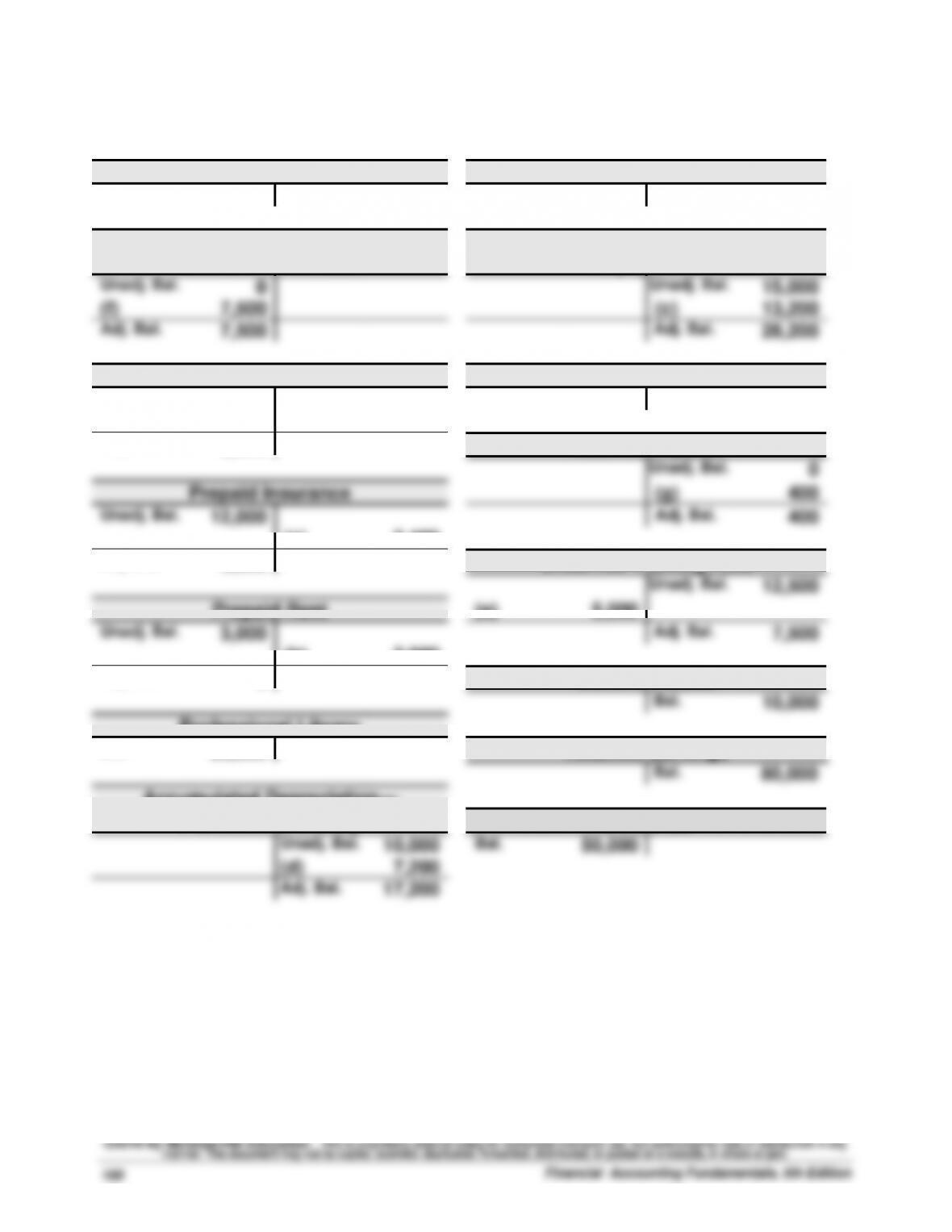

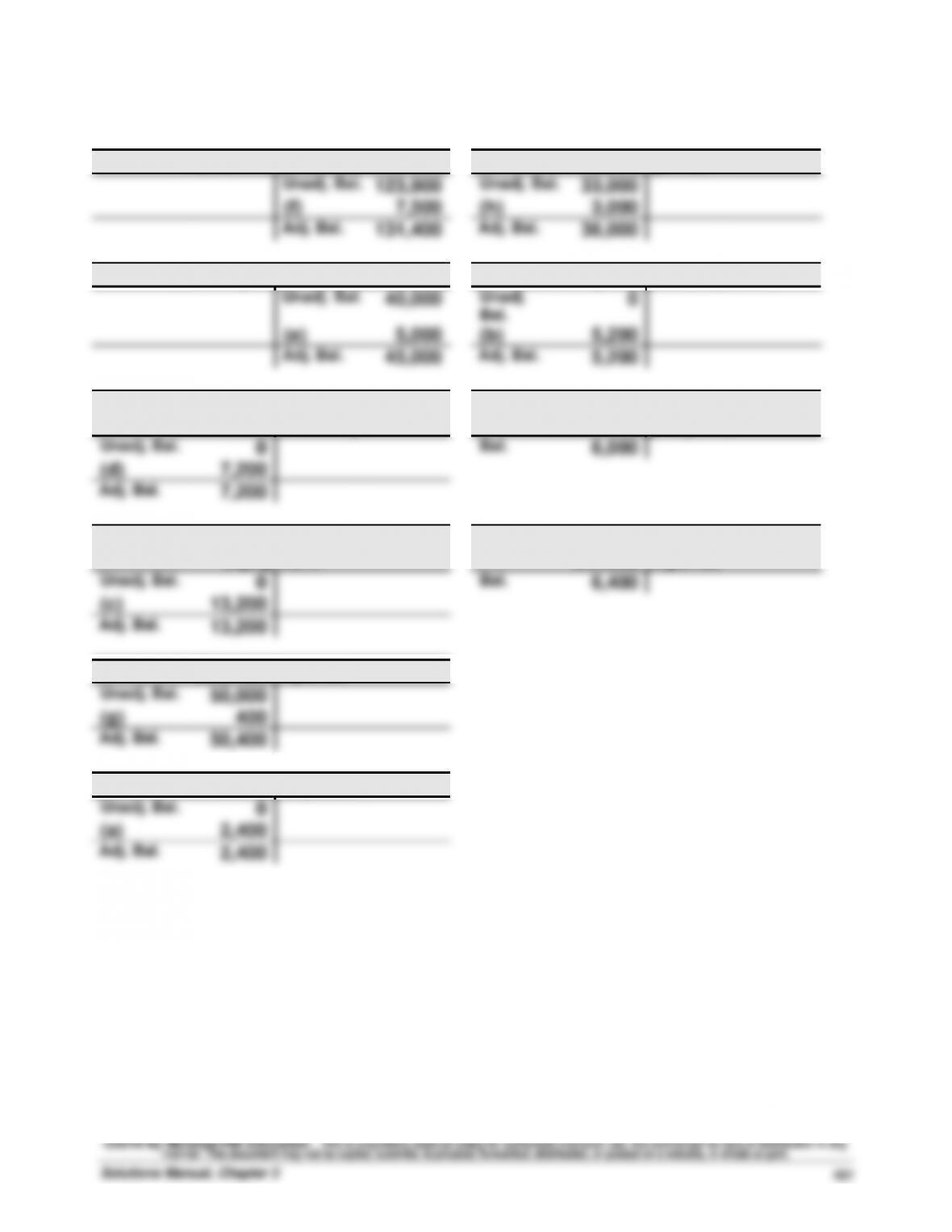

INSTRUCTOR: Ledger accounts are shown after Part 7 as they would appear after all entries are posted.

Part 2 — Transactions for April

April 1 Cash ............................................................... 101 30,000

Computer Equipment ................................... 167 20,000

3 Office Supplies .............................................. 124 1,000

Cash ....................................................... 101 1,000

Acquired office supplies.

10 Prepaid Insurance ......................................... 128 2,400

Cash ....................................................... 101 2,400

Commissions Earned ........................... 405 8,000

Collected commissions from airlines.

28 Salaries Expense .......................................... 622 1,600

Cash ....................................................... 101 1,600

Paid two weeks’ salaries.

Paid the telephone bill.

Paid cash for dividends.