Teamwork in Action (Concluded)

Part 3

Without completing the table, team members should be able to project the

final number in the first column and for each of the columns (A), (D), and

(E). Specifically:

(Col. 1) Last interest period date is 12/31/2019 because this is a five-year

bond, issued 1/1/2015, with semiannual interest payments made

on 6/30 and 12/31 of each year.

(Col. A) Interest paid of $4,500 (every interest period has the same amount

recorded).

Part 4

Total Bond interest expense = Interest Paid - Premium

= ($4,500 x 10 periods) - $4,100

= $45,000 - $4,100 = $40,900

Part 5 List likely includes:

a. Table column headings

for the period and for

columns (A), (B), and (E).

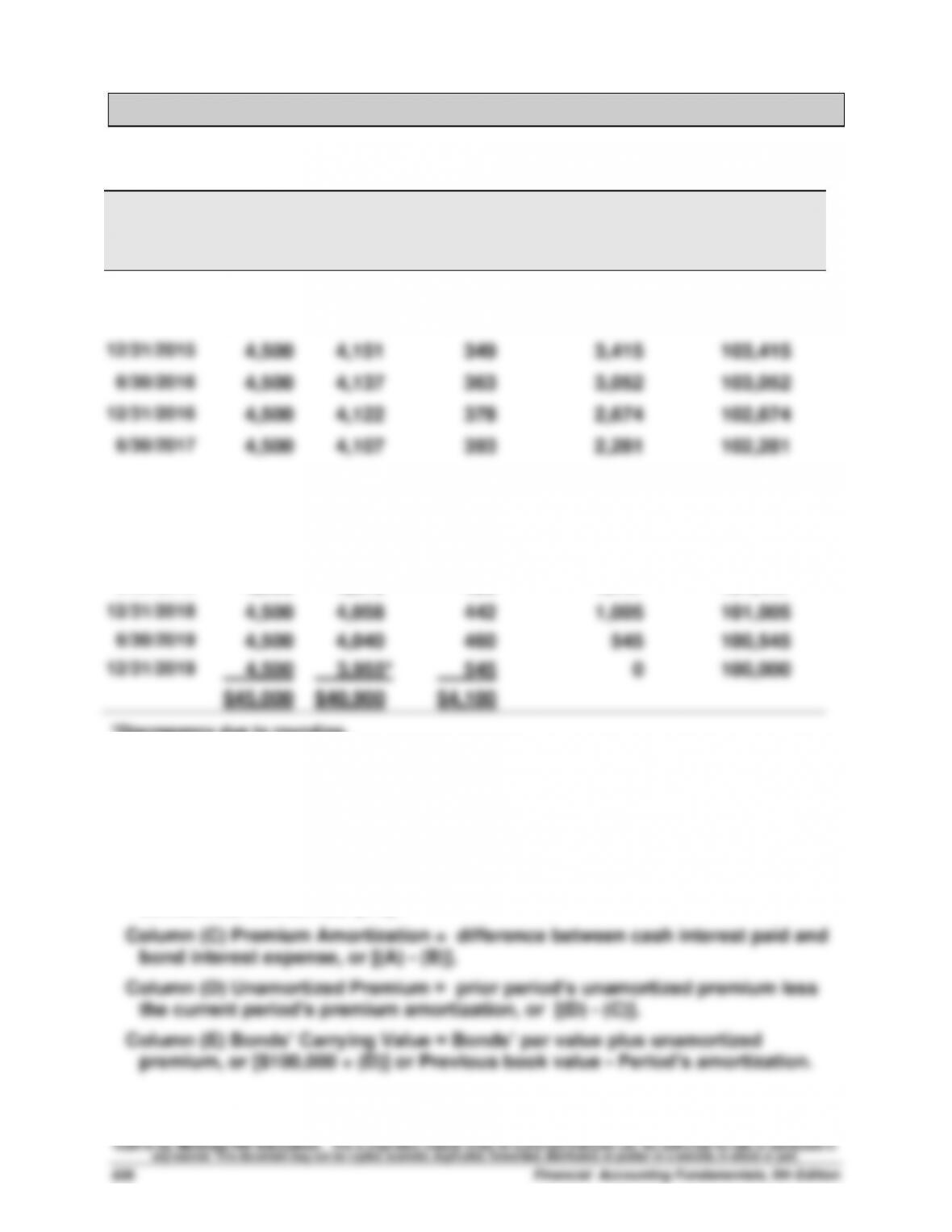

a. Column (C) will be Discount Amortization and

Column (D) will be Unamortized Discount.

b. Dates in the period

column and interest paid in

column (A).

c. Computations in

Columns (A), (B), and (D)

will follow the same format.

b. Bond interest expense is higher (lower) than the

interest paid and will increase (decrease) as we

amortize a discount (premium).

c. Carrying value (E) will increase as we amortize a

discount.

d. Ending unamortized

premium and discount (D)

will both be zero.

d. Carrying value (E) will decrease as we amortize a

premium.

e. Carrying value at

12/31/2019 will be $100,000

in both cases.

f. Unamortized discount

and premium (D) decreases

each period

e. Computation of Column (C) will be (B) - (A),

and not (A) - (B).

f. Computation of Column (E) will be previous Column

(E) plus discount amortization whereas with a

premium we subtract to find the new carrying value.