Financial & Managerial Accounting, 5th Edition

Quick Study 10-4 (10 minutes)

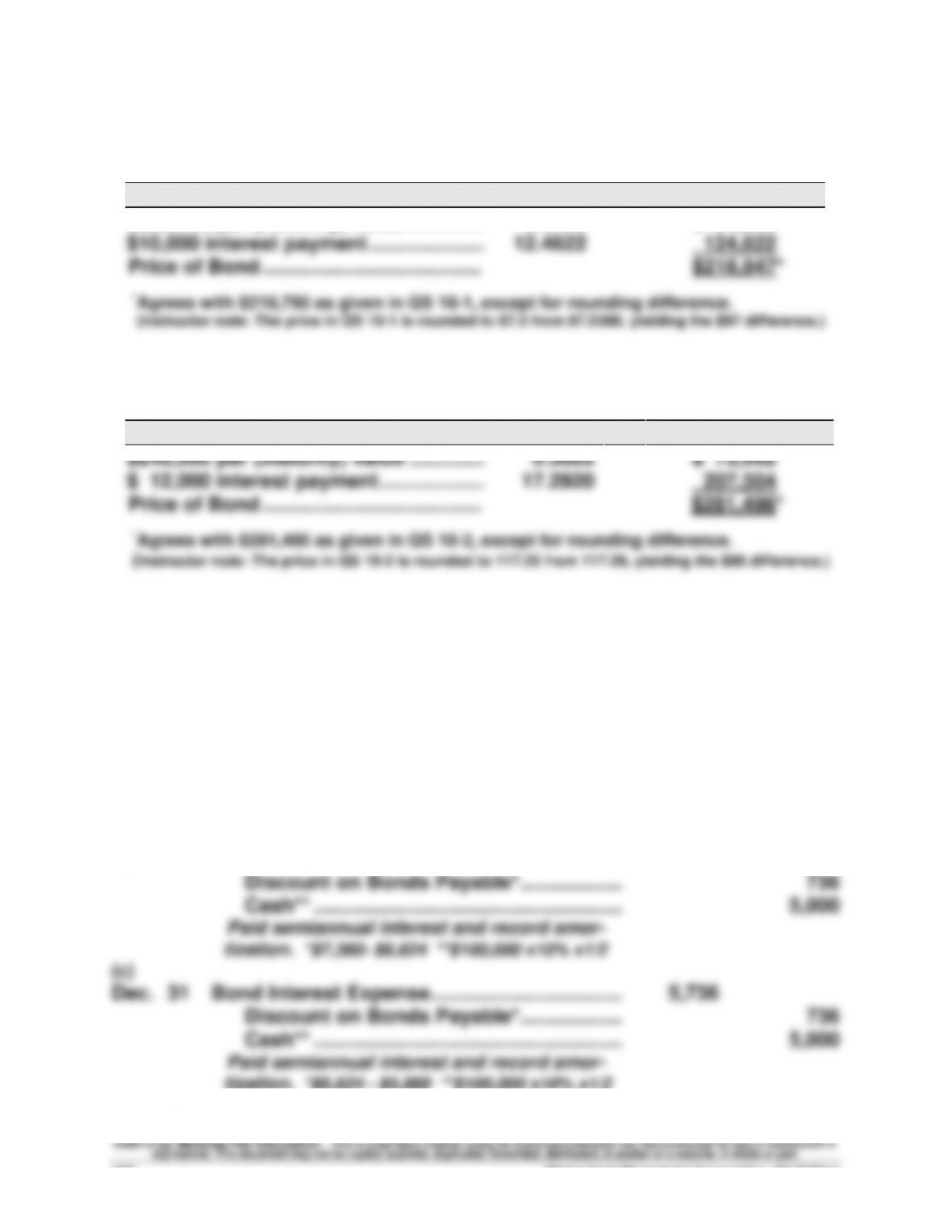

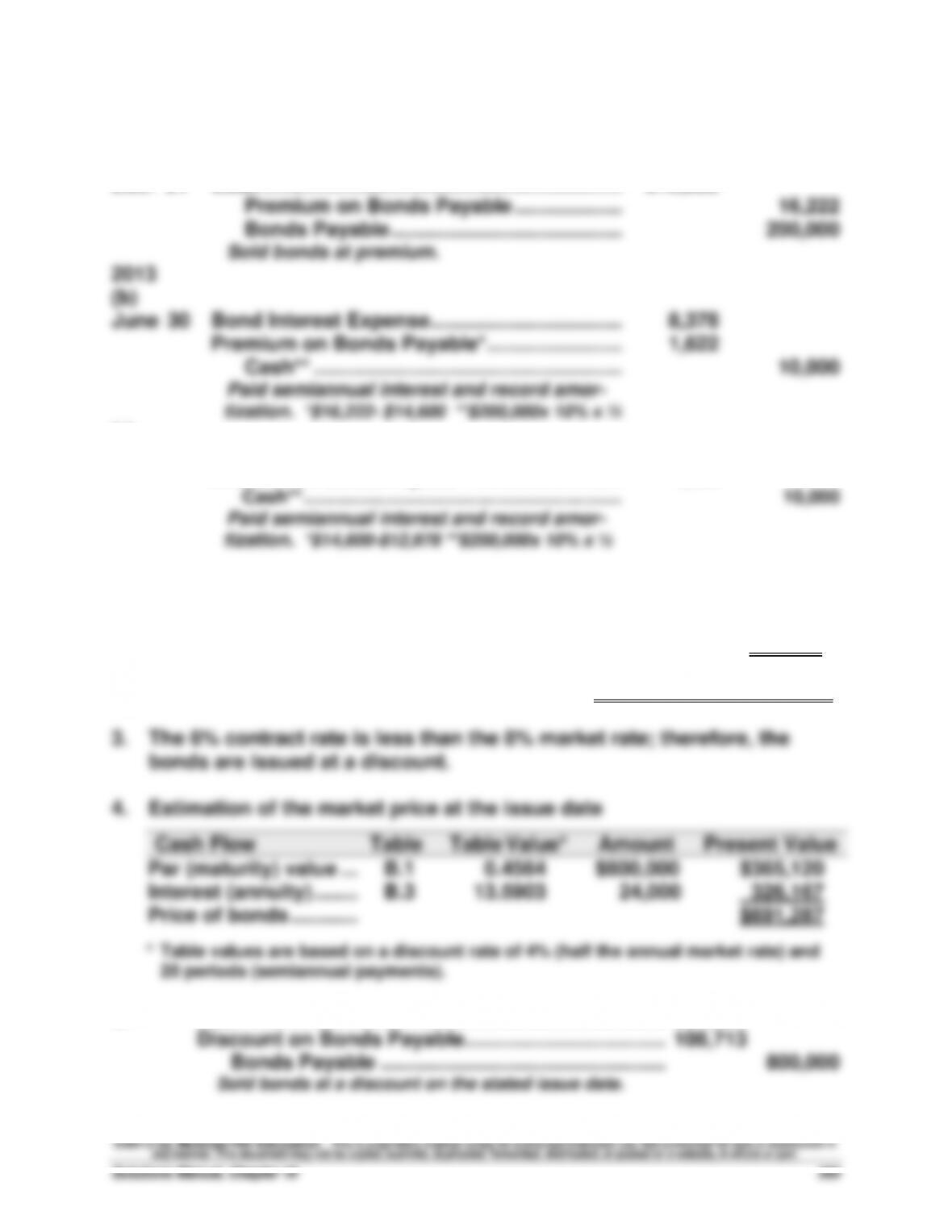

a. Using facts in QS 10-1, the bond’s cash proceeds for the bond selling at

a discount are computed as follows

$250,000 par (maturity) value ................

$10,000 interest payment .......................

Price of Bond .......................................

*Agrees with $218,750 as given in QS 10-1, except for rounding difference.

(Instructor note: The price in QS 10-1 is rounded to 87.5 from 87.5388, yielding the $97 difference.)

b. Using facts in QS 10-2, the bond’s cash proceeds for the bond selling at

a premium are computed as

$240,000 par (maturity) value ................

$ 12,000 interest payment .....................

Price of Bond .......................................

*Agrees with $281,400 as given in QS 10-2, except for rounding difference.

(Instructor note: The price in QS 10-2 is rounded to 117.25 from 117.29, yielding the $96 difference.)

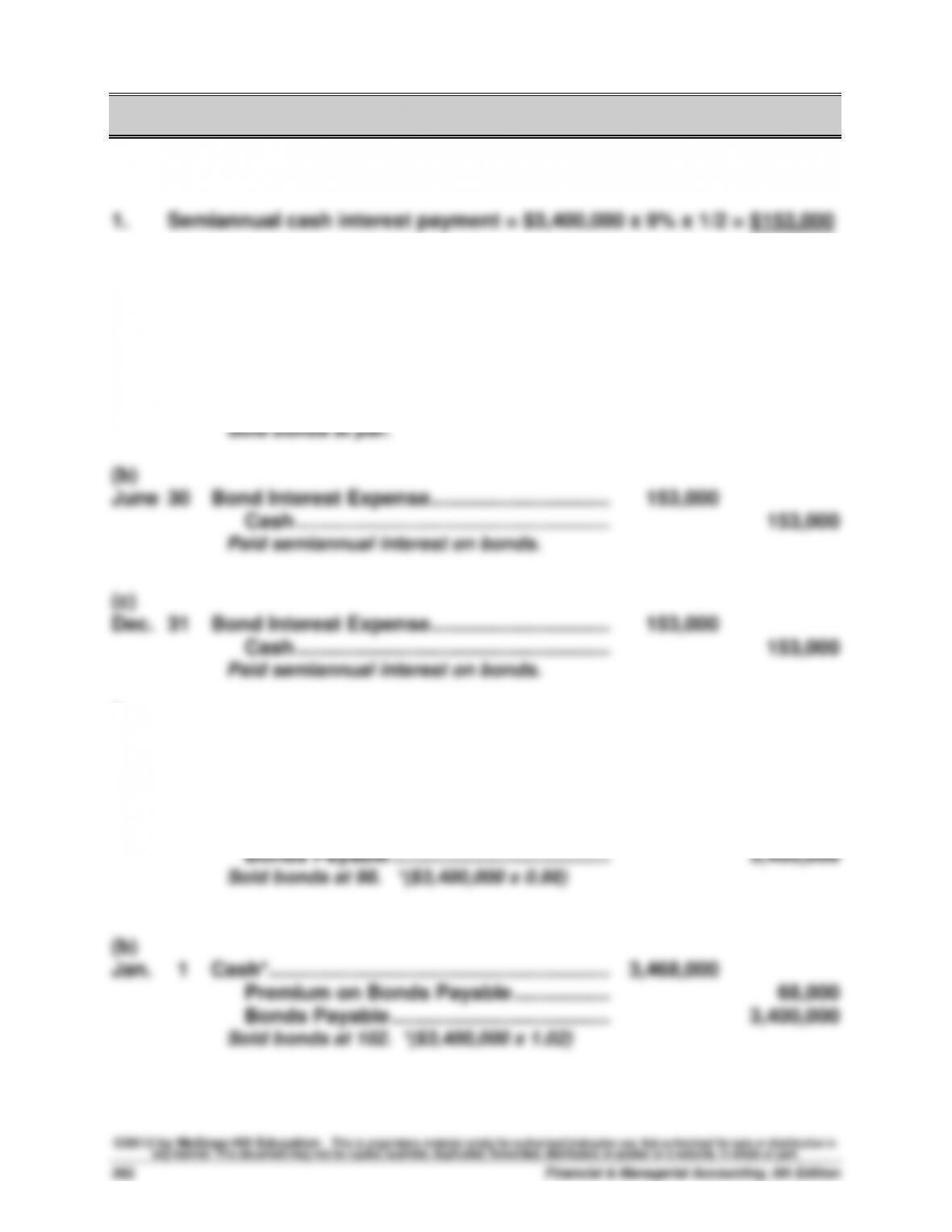

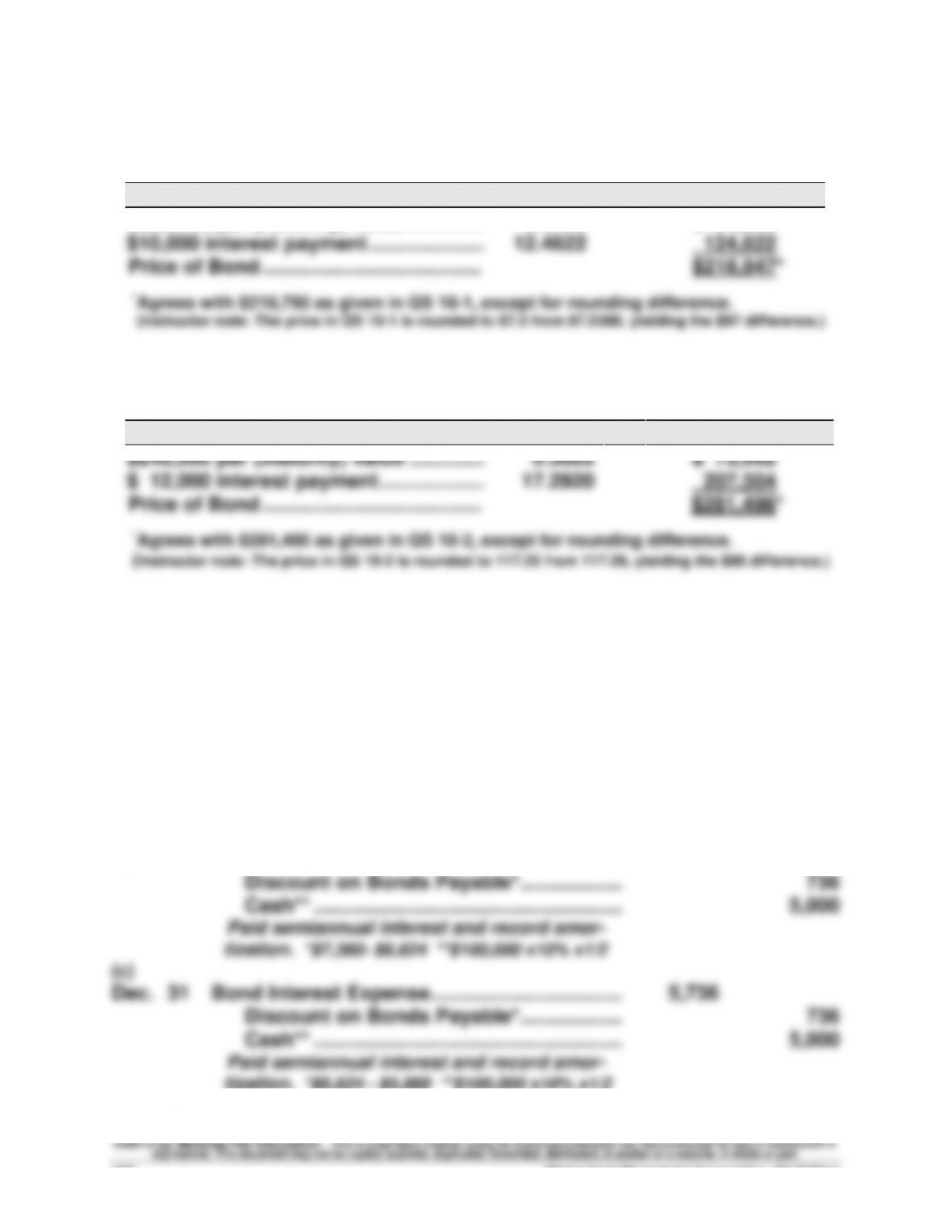

Quick Study 10-5 (15 minutes)

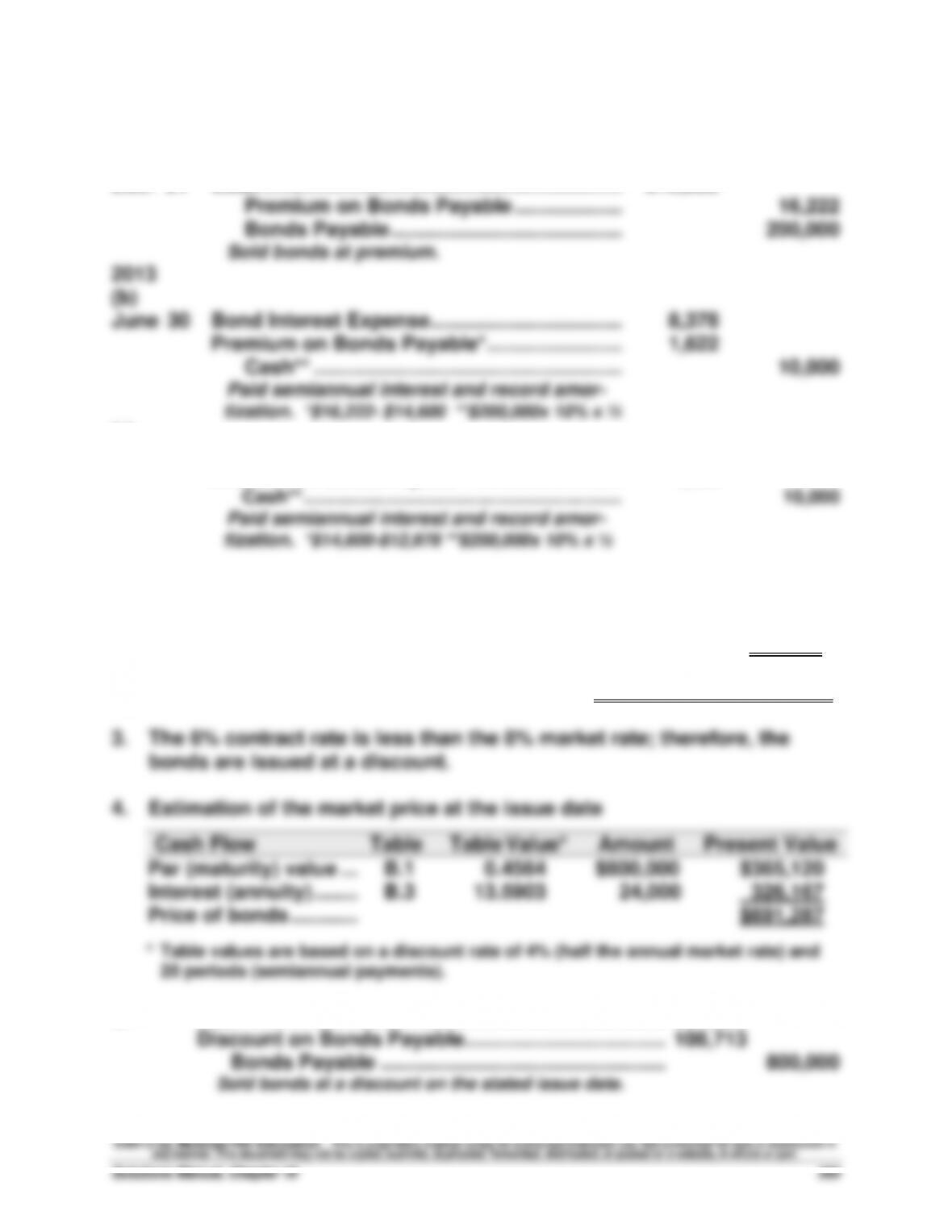

2012

Cash ................................................................................

Discount on Bonds Payable ................................

Bonds Payable .........................................................

Bond Interest Expense ..................................................

Discount on Bonds Payable* ................................

Cash** ................................................................

Paid semiannual interest and record amor-

tization. *$7,360- $6,624 **$100,000 x10% x1/2

Bond Interest Expense ..................................................

Discount on Bonds Payable* ................................

Cash** ................................................................

Paid semiannual interest and record amor-

tization. *$6,624 - $5,888 **$100,000 x10% x1/2