Chapter 24 - Performance Measurement and Responsibility Accounting

Chapter Outline

6. Utilities expenseportion of floor space occupied by departments

(if used uniformly); otherwise more complicated

7. Service Department expenses – (provide support to an

organization’s operating departments) See Exhibit 24.4 for

common allocation bases

F. Departmental Income Statements

1. Departmental income statements are prepared after all expenses

have been assigned to the departments.

a. Direct expenses are accumulated by department.

b. Indirect expenses – all the direct and indirect expenses

incurred in service departments are compiled and then

allocated to the operating departments.

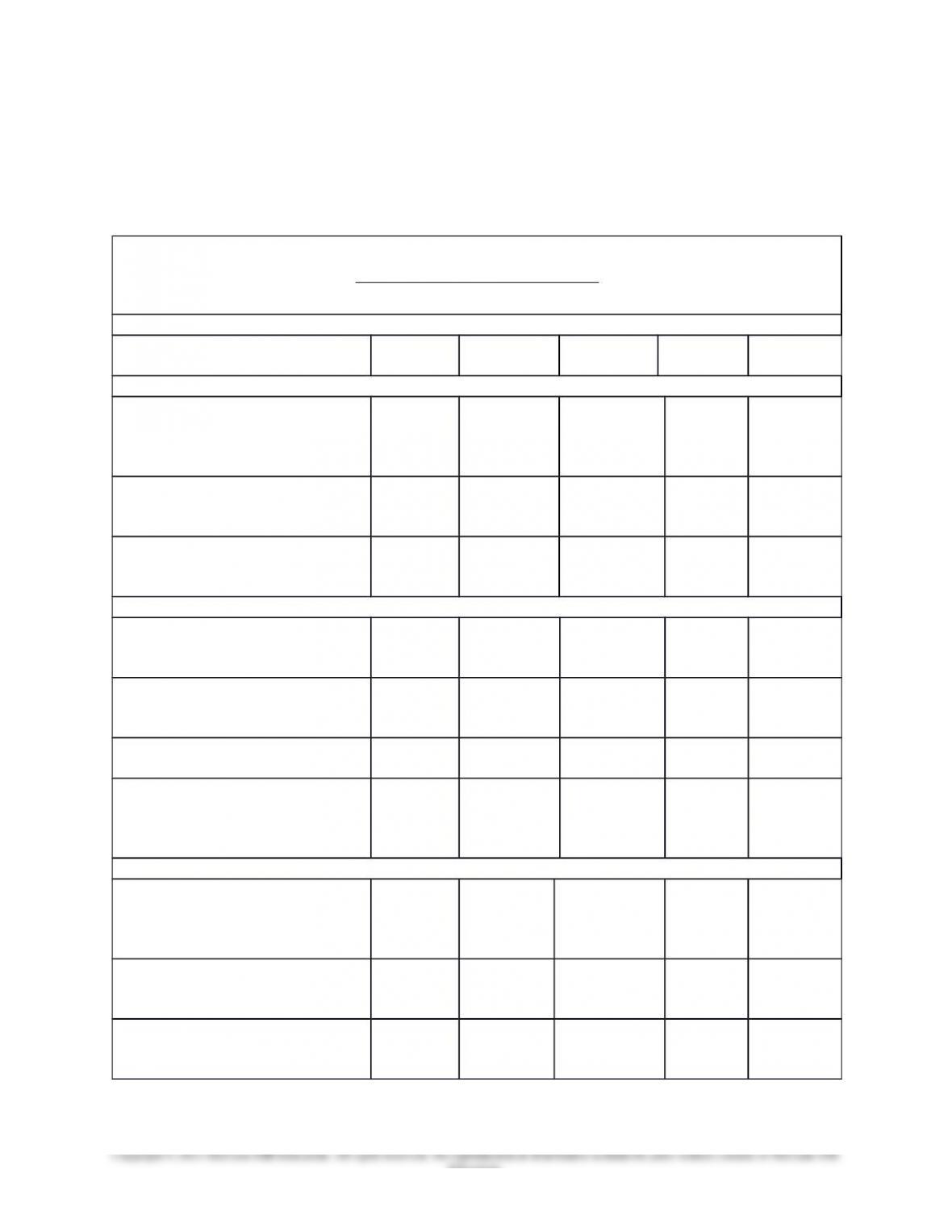

2. Four Steps for allocating costs and preparing departmental

income statements.

a. Step one – accumulate revenues and direct expenses for each

service and selling department.

i. Cost centers do not generate revenues

ii. Direct expenses include wages, salaries, and other

expenses that a department incurs but does not share with

any other department.

b. Step two – allocate indirect expenses across all service and

operating departments

i. Can include items such as depreciation, rent, advertising

and other indirect expenses.

ii. The indirect expenses are recorded in company accounts

and an allocation based is identified to allocate the costs

to the departments on a departmental expense allocation

spreadsheet

c. Step three – allocate service department expenses to

operating departments using a departmental expense

allocation spreadsheet. (Review Exhibits 24.6 through 24.14).

d. Step four – the departmental expense allocation spreadsheet

can be used to prepare departmental performance reports for

the company’s service and operating departments.

i. Actual service department expenses are compared with

budgeted amounts to help assess cost center performance.

ii. Amounts in the operating department columns are used to

prepare departmental income statements. (Exhibit 24.15)

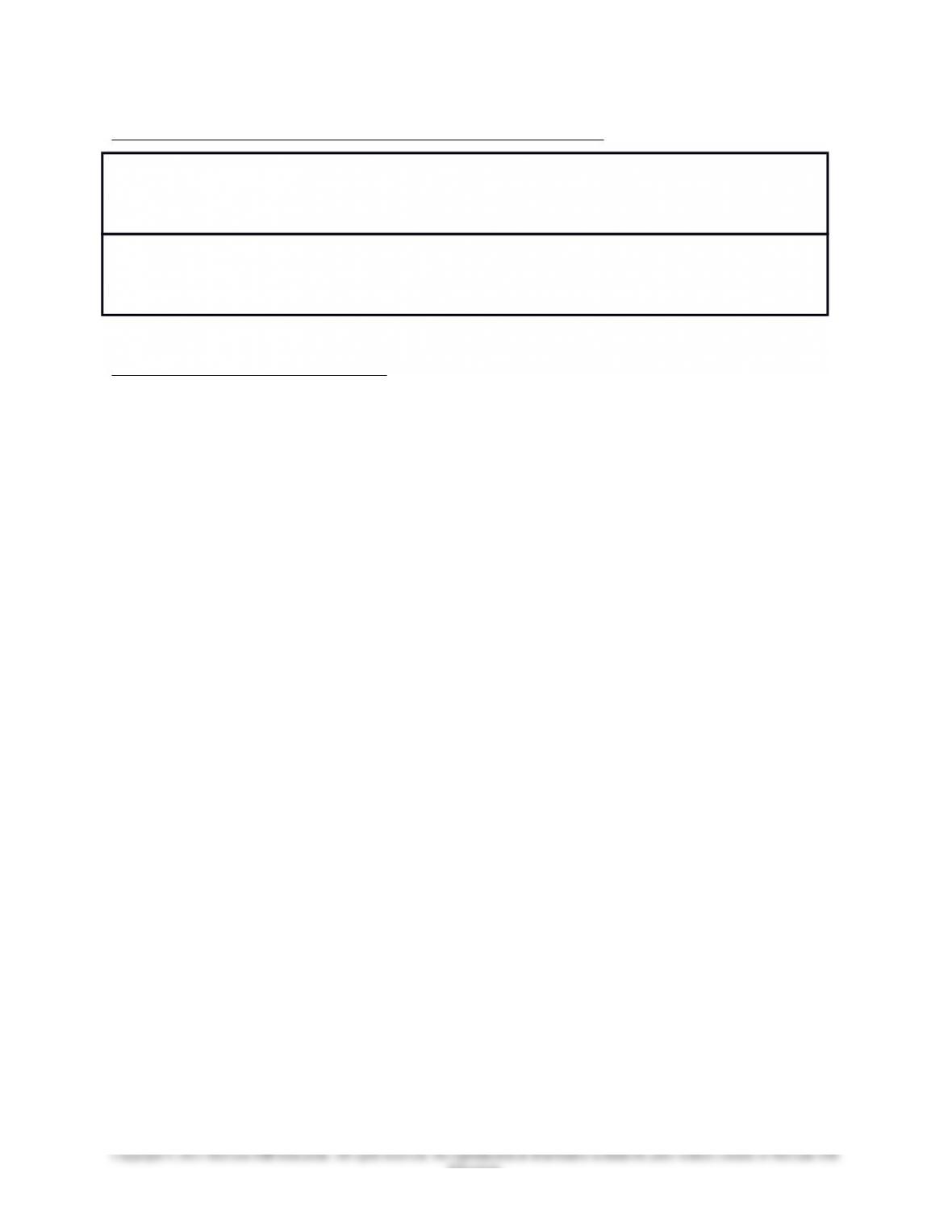

G. Departmental Contribution to Overhead (see Exhibit 24.16)

1. Departmental income statements not always best for evaluating

each profit center’s performance especially when indirect

expenses are a large portion of total expenses.

2. Evaluate using departmental contributions to overheada report

of the amount of sales less direct expenses (indirect expenses are

often considered “overhead”).

Notes

24-6