1) Michelin Jewelers completed the following transactions. Michelin Jewelers uses the perpetual inventory system. On April 2, Michelin sold $9,000 of merchandise to a customer on account with terms of 3/15, n/30. Michelin’s cost of the merchandise sold was $5,500. Which of the following journal entries correctly records the Cost of goods sold?

A)

|

Cost of goods sold |

5,500 |

|

|

Accounts receivable |

|

5,500 |

B)

|

Sales revenue |

5,500 |

|

|

Cost of goods sold |

|

5,500 |

C)

|

Cost of goods sold |

5,500 |

|

|

Inventory |

|

5,500 |

D)

|

Inventory |

5,500 |

|

|

Cost of goods sold |

|

5,500 |

Answer:View Answer

2) Which of the following applies to goods that are produced by a manufacturing company and ready to sell?

A) Materials inventory

B) Work in process inventory

C) Merchandise inventory

D) Finished goods inventory

Answer:View Answer

3) What is freight in?

A) Transportation costs to ship goods into the warehouse

B) Transportation costs that are not recorded

C) Costs that are expensed

D) Transportation costs to ship goods out of the warehouse

Answer:View Answer

4) Ace Plastics produces many different kinds of products all in one manufacturing facility. They have identified four activities for their costing system:

Materials management allocated by number of purchase orders

Chemical processing allocated on metric tons

Molding allocated on direct labor hours

Packaging allocated by number of units produced

The activity rates are as follows:

|

Materials management |

$12.00 |

Per purchase order |

|

Chemical processing |

$7.50 |

Per metric ton |

|

Molding |

$24.00 |

Per direct labor hour |

|

Packaging |

$0.10 |

Per unit |

Ace received an order for 3,000 plastic toys. The engineering design shows that the order will require $540 of direct material cost in total, $90 of direct labor cost, will require 4 purchase orders, will use 2 metric tons of chemical base, will need 8 direct labor hours, and will produce 3.000 units of product. What will the full production cost of the order be?

A) $630

B) $645

C) $1,095

D) $1,185

Answer:View Answer

5) When a company is considering the option of processing their product further to achieve higher sales revenues, they must consider all of the following factors EXCEPT:

A) how much additional costs are necessary to process further?

B) how much incremental revenue can be earned if processed further?

C) how much cost is required to produce the basic product, before processing further?

D) will the additional processing produce any environmental toxins?

Answer:View Answer

6) Gordon Corporation reported the following equity section on its current balance sheet. The common stock is currently selling for $11.50 per share.

|

Common stock, $5 par, 100,000 shares authorized, 40,000 shares issued |

$200,000 |

|

Paid in capital in excess of parcommon |

120,000 |

|

Retained earnings |

290,000 |

|

Total stockholders’ equity |

$610,000 |

Which of the following would be TRUE if the company issued a 2-for-1 stock split?

A) Retained earnings would be decreased by $460,000

B) Common stock would be increased by $200,000

C) Paid-in capital in excess of par would be increased by $260,000

D) None of the account balances would change

Answer:View Answer

7) In the following situation, which internal control procedure needs strengthening?

The controller’s duties include approving bank reconciliations, approving general journal entries, hiring administrative staff, and approving various types of administrative expenses. She needs new computer equipment for the accounting office, but there are no guidelines specifying whether she can approve purchases of office equipment.

A) Assignment of responsibilities

B) Competent, reliable, and ethical personnel

C) Separation of duties

D) Documents

Answer:View Answer

8) A company uses the periodic inventory method. Which of the following entries would be made to record a return of $200 of inventory purchased on account?

A) The accounting entry would be a $200 debit to Purchase returns and allowances and a $200 credit to Accounts payable

B) The accounting entry would be a $200 debit to Accounts payable and a $200 credit to Purchase returns and allowances

C) The accounting entry would be a $200 debit to Purchases and a $200 credit to Accounts payable

D) The accounting entry would be a $200 debit to Accounts payable and a $200 credit to Purchases

Answer:View Answer

9) Cantrell Company is considering investing $396,000 in high-tech communications equipment which would have an estimated life of 4 years and zero residual value. The technology manager says that it will return cash flows as shown below:

|

Year 1 |

$100,000 |

|

Year 2 |

$200,000 |

|

Year 3 |

$100,000 |

|

Year 4 |

$50,000 |

The VP Finance points out that the project must pass the company’s 7% hurdle rate, and asks one of the analysts to calculate the internal rate of return before they discuss the project further. Using the tables below, please calculate the IRR for this project.

|

Present Value of $1 |

|

|

|

|

|

|

|

|

5% |

6% |

7% |

8% |

9% |

10% |

|

1 |

0.952 |

0.943 |

0.935 |

0.926 |

0.917 |

0.909 |

|

2 |

0.907 |

0.890 |

0.873 |

0.857 |

0.842 |

0.826 |

|

3 |

0.864 |

0.840 |

0.816 |

0.794 |

0.772 |

0.751 |

|

4 |

0.823 |

0.792 |

0.763 |

0.735 |

0.708 |

0.683 |

|

5 |

0.784 |

0.747 |

0.713 |

0.681 |

0.650 |

0.621 |

Please choose the percentage below that comes closest to the actual IRR.

A) 5%

B) 6%

C) 7%

D) 8%

Answer:View Answer

10) A business pays $500 cash for supplies. Which account is debited?

A) Cash

B) Accounts payable

C) Supplies

D) Service revenue

Answer:View Answer

11) Hot Tamale Company had $120,000 of revenues and $125,000 of expenses. No dividends were paid. The second of the year-end closing entries should include which of the following line items?

A) Credit Retained earnings $125,000

B) Debit Retained earnings $125,000

C) Debit Income summary $125,000

D) Credit Income summary $125,000

Answer:View Answer

12) Avery Supplies uses a periodic inventory system. Avery purchased $10,000 of inventory on account. The terms were 3/10, n/30. The purchase was made on February 1. Which of the following journal entries properly records this transaction?

A)

|

Purchases |

10,000 |

|

|

Accounts payable |

|

10,000 |

B)

|

Accounts payable |

10,000 |

|

|

Purchases |

|

10,000 |

C)

|

Inventory |

10,000 |

|

|

Accounts payable |

|

10,000 |

D)

|

Inventory |

10,000 |

|

|

Cash |

|

10,000 |

Answer:View Answer

13) Please refer to the following information and compute the debt ratio:

|

|

Debit |

Credit |

|

Cash |

$4,500 |

|

|

Accounts receivable |

1,200 |

|

|

Prepaid rent |

700 |

|

|

Land |

20,000 |

|

|

Equipment |

4,000 |

|

|

Accumulated depreciation |

|

$800 |

|

Accounts payable |

|

2,900 |

|

Salary payable |

|

600 |

|

Notes payablelong term |

|

9,000 |

A) 1.83

B) 2.37

C) 0.40

D) 0.42

Answer:View Answer

14) Underallocation of manufacturing overhead would require which of the following year-end adjustments?

A) A credit to Finished goods inventory

B) A credit to Manufacturing overhead

C) A debit to Work-in process inventory

D) A credit to Cost of goods sold

Answer:View Answer

15) Olivera Company provides the following data for the year 2013:

Net sales revenue$398,000

Cost of goods sold$255,000

Operating expenses$95,000

Income tax expense$9,000

On a vertical analysis, what percentage would be shown for net income?

A) 12.1%

B) 8.8%

C) 9.8%

D) 27.3%

Answer:View Answer

16) Which of the following accounting methods is usually used to compute amortization expense?

A) Declining-balance

B) Units-of-production

C) Straight-line

D) First-In, First-Out

Answer:View Answer

17) Jarvis Foods produces a gourmet condiment which sells for $10.00 per unit. Variable costs are $7.50 per unit, and fixed costs are $18,000 per month. Jarvis is currently selling 8,000 units per month. How much is Jarvis’s margin of safety expressed in sales revenue?

A) $8,000

B) $7,400

C) $6,000

D) $2,600

Answer:View Answer

18) Hot Tamale Company had $120,000 of revenues and $113,000 of expenses. No dividends were paid. These factors will result in which of the following?

A) Retained earnings will go down

B) Retained earnings will go up

C) Paid-in capital will go down

D) Paid-in capital will go up

Answer:View Answer

19) Arabica Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2012, they estimated total manufacturing overhead costs at $1,050,000, and they estimated total direct labor costs at $840,000. In June, 2012, Arabica completed job number 511. Job stats are as follows:

Direct materials cost $27,500

Direct labor cost$13,000

Direct labor hours400 hours

Units of product produced:200 crates

How much manufacturing overhead was allocated to the job?

A) $16,250

B) $10,400

C) $5,000

D) $34,375

Answer:View Answer

20) Net income for the year is $25,000. Withdrawals of $36,000 per were taken at the end of the year. Which of the following occurs?

A) The Capital account decreases by $22,000

B) The Capital account decreases by $11,000

C) The Capital account increases by $11,000

D) The Capital account increases by $22,000

Answer:View Answer

21) The production line at Gateway Computers is most likely treated as a(n):

A) cost center

B) revenue center

C) profit center

D) investment center

Answer:View Answer

22) The following information is needed to reconcile the cash balance for Woods Paper Products.

A deposit of $5,794.62 is in transit.

Outstanding checks total $1,533.25.

The book balance is $5,695.62.

The bookkeeper recorded a $1,524.00 check as $15,240 in payment of the current month’s rent.

The bank balance at February 28, 2008 was $16,500.25.

A deposit of $300 was credited by the bank for $3,000.

A customer’s check for $1,280 was returned for nonsufficient funds.

The bank service charge is $70.

Which of the following journal entries is needed to adjust for the NSF check?

A)

|

Accounts receivable |

1,280 |

|

|

Cash |

|

1,280 |

B)

|

Cash |

1,280 |

|

|

Sales revenue |

|

1,280 |

C)

|

NSF check |

1,280 |

|

|

Cash |

|

1,280 |

D)

|

Accounts payable |

1,280 |

|

|

Cash |

|

1,280 |

Answer:View Answer

23) The revenue principle guides accountants in which of the following ways?

A) Ensures that information is reported at regular intervals

B) Determines when to record expenses

C) Determines when to record revenue

D) Dictates that expenses be deducted from revenues

Answer:View Answer

24) Please refer to the following information for Peartree Company:

Common stock, $1.00 par, 100,000 issued, 95,000 outstanding

Paid-in capital in excess of par: $2,150,000

Retained earnings: $910,000

Treasury stock: 5,000 shares purchased at $20 per share

If Peartree resold 1,000 shares of treasury stock for $24 per share, which of the following statements would be TRUE?

A) Total equity of the company would remain unchanged

B) Total equity of the company would go up by $24,000

C) Total equity of the company would go down by $24,000

D) Total equity of the company would go up by $4,000

Answer:View Answer

25) Arturo Sales purchased some equipment for $12,000 by issuing a 6-month note payable. How would this transaction be shown on the statement of cash flows?

A) In the noncash financing and investing activities section

B) In the investing activities section

C) In the operating activities section

D) In the financing activities section

Answer:View Answer

26) A job order costing system is useful in which of the following circumstances?

A) Mass production of a commodity

B) Manufacturing multiple products in separate batches

C) Continuous flow production of a single product

D) Manufacturing a product in a multi-step flow of production

Answer:View Answer

27) Samson Company had the following balances and transactions during 2013.

|

Beginning inventory |

10 units at $70 |

|

March 10 |

Sold 8 units |

|

June 10 |

Purchased 20 units at $80 |

|

October 30 |

Sold 15 units |

What would the company’s Inventory amount be on the December 31, 2013 balance sheet if the perpetual average-costing method is used? (Answers are rounded to the nearest dollar.)

A) $537

B) $554

C) $490

D) $560

Answer:View Answer

28) Which of the following statements about managerial accounting is CORRECT?

A) Managerial accounting reports are audited annually by Certified Public Accountants

B) Managerial accounting reports help investors make decisions

C) Managerial accounting reports provide detailed information on parts of a company

D) Managerial accounting reports must follow Generally Accepted Accounting principles (GAAP)

Answer:View Answer

29) Carte Blanco Company is evaluating an investment of $1,000,000 which will yield cash flows of $257,000 per year for 5 years with no residual value. What is the internal rate of return? (Please choose the rate that is closest to the actual solution.)

|

Present Value of an Annuity of $1 |

|

|

|

|

|

|

|

|

5% |

6% |

7% |

8% |

9% |

10% |

|

1 |

0.952 |

0.943 |

0.935 |

0.926 |

0.917 |

0.909 |

|

2 |

1.859 |

1.833 |

1.808 |

1.783 |

1.759 |

1.736 |

|

3 |

2.723 |

2.673 |

2.624 |

2.577 |

2.531 |

2.487 |

|

4 |

3.546 |

3.465 |

3.387 |

3.312 |

3.240 |

3.170 |

|

5 |

4.329 |

4.212 |

4.100 |

3.993 |

3.890 |

3.791 |

A) 7%

B) 8%

C) 9%

D) 10%

Answer:View Answer

30) Which of the following is NOT one of the four perspectives of a balanced scorecard?

A) Financial perspective

B) Customer perspective

C) Technological perspective

D) Learning and growth perspective

Answer:View Answer

31) Compute the amount of payment for an invoice of $5,600, 4/10, n/30 paid on the 7th day.

A) $5,600

B) $5,040

C) $5,376

D) $5,570

Answer:View Answer

32) Arturo Manufacturing Company provided the following information for the year 2012:

Purchasesdirect materials $180,000

Direct materials used in production$192,000

Direct labor$235,000

Indirect materials$23,500

Indirect labor $9,500

Depreciation on factory plant & equipment$12,000

Plant utilities & insurance$135,000

Cost of goods manufactured$591,000

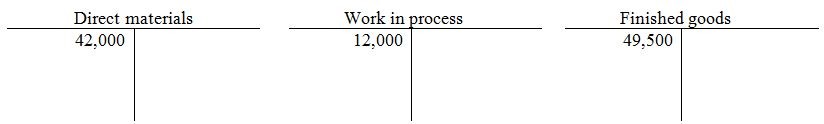

Please refer to the T-accounts below which show the beginning balances for the year.

Use the T-accounts to record the transactions for the year. What is the ending balance in the work in process account?

A) $28,000

B) $12,000

C) $22,000

D) $30,000

Answer:View Answer

33) Orlando Avionics makes three types of radios for small aircraft-model A, model B, and model C. The manufacturing operations are mechanized and there is no direct labor. Manufacturing overhead costs are significant, and Orlando has adopted an activity-based costing system. Direct materials costs per unit for each model are as follows:

Model A$28

Model B$32

Model C$40

Orlando has three activities-assembly, materials management, and testing. The cost driver for assembly is machine hours. The cost driver for materials management is number of parts, and the cost driver for testing is the number of units of product. Total costs and production volumes for the year 2012 were estimated as follows:

|

|

Total cost |

Total units |

|

|

Assembly |

$780,000 |

120,000 |

Machine hours |

|

Materials management |

$120,000 |

80,000 |

Parts |

|

Testing |

$22,500 |

5,000 |

Units |

What is the allocation rate for the Assembly activity? (Please round to the nearest cent.)

A) $7.69 per machine hour

B) $0.60 per machine hour

C) $0.15 per machine hour

D) $6.50 per machine hour

Answer:View Answer

34) Which of the following journal entries would be recorded if a business purchased $200 of supplies on account?

A)

|

Accounts payable |

200 |

|

|

Supplies |

|

200 |

B)

|

Supplies |

200 |

|

|

Accounts payable |

|

200 |

C)

|

Supplies |

200 |

|

|

Cash |

|

200 |

D)

|

Cash |

200 |

|

|

Supplies |

|

200 |

Answer:View Answer