Chapter 8/Application: The Costs of Taxation ❖ 13

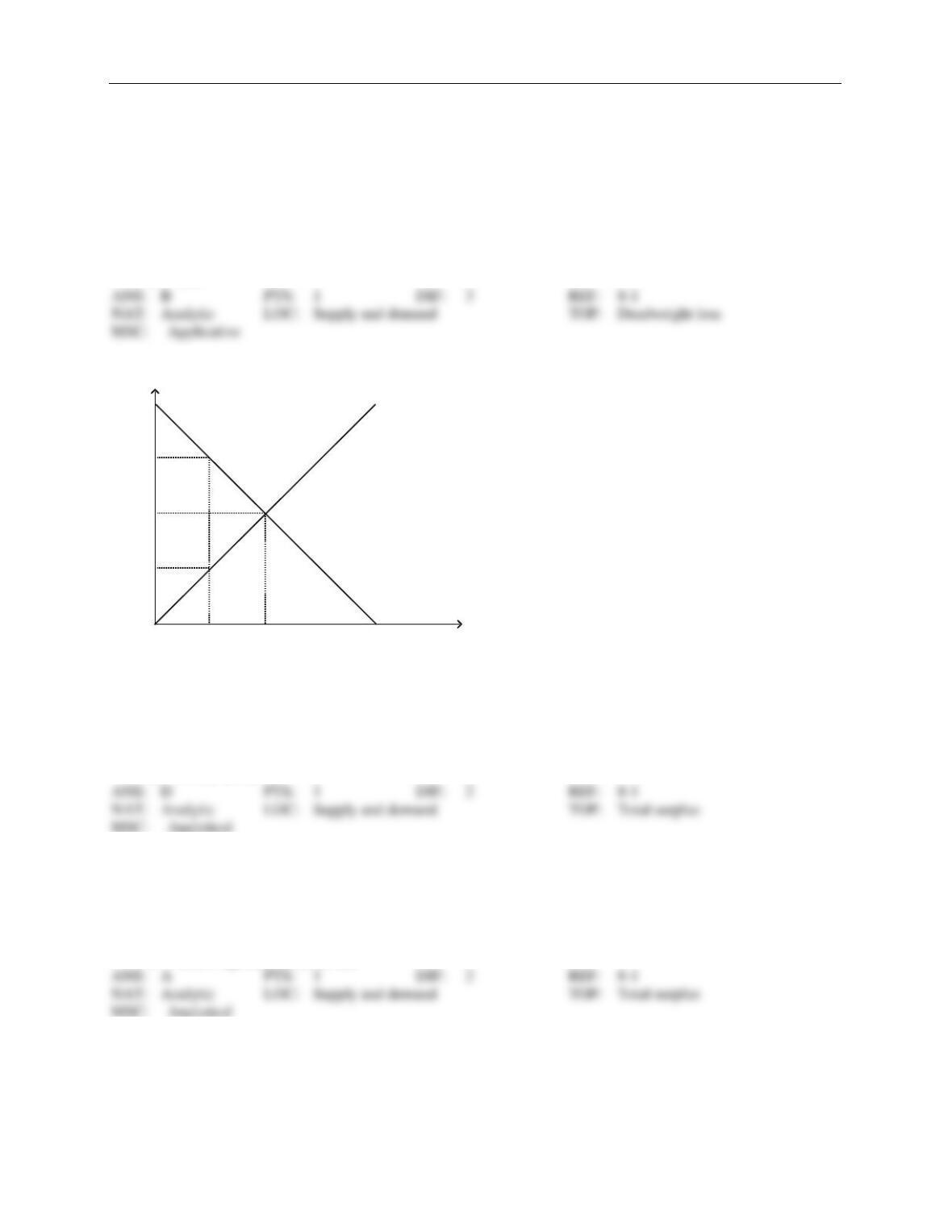

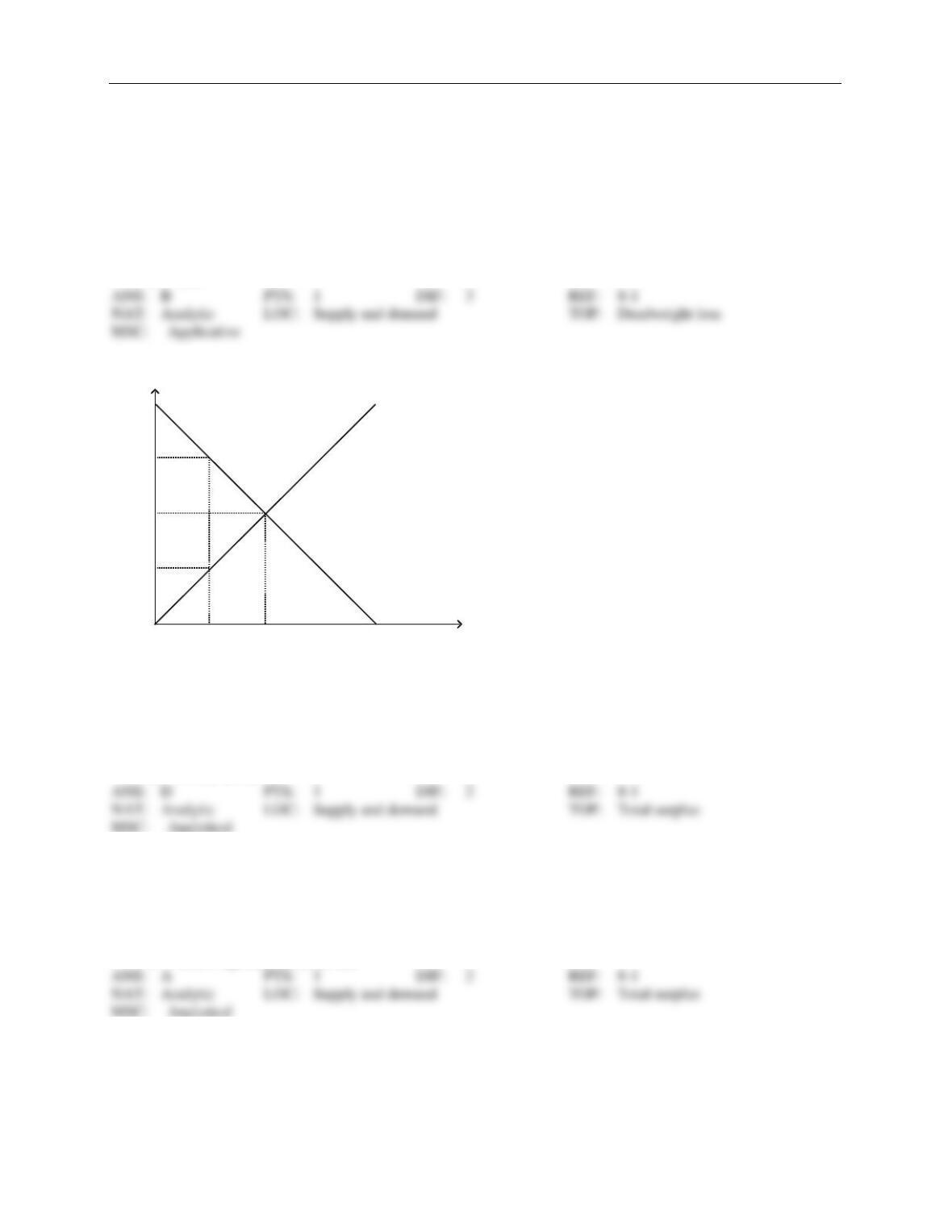

57. The supply curve for cameras is the typical upward-sloping straight line, and the demand curve for cameras is

the typical downward-sloping straight line. When cameras are taxed, the area on the relevant supply-and-

demand graph that represents

government’s tax revenue is a rectangle.

the deadweight loss of the tax is a triangle.

the loss of consumer surplus caused by the tax is neither a rectangle nor a triangle.

All of the above are correct.

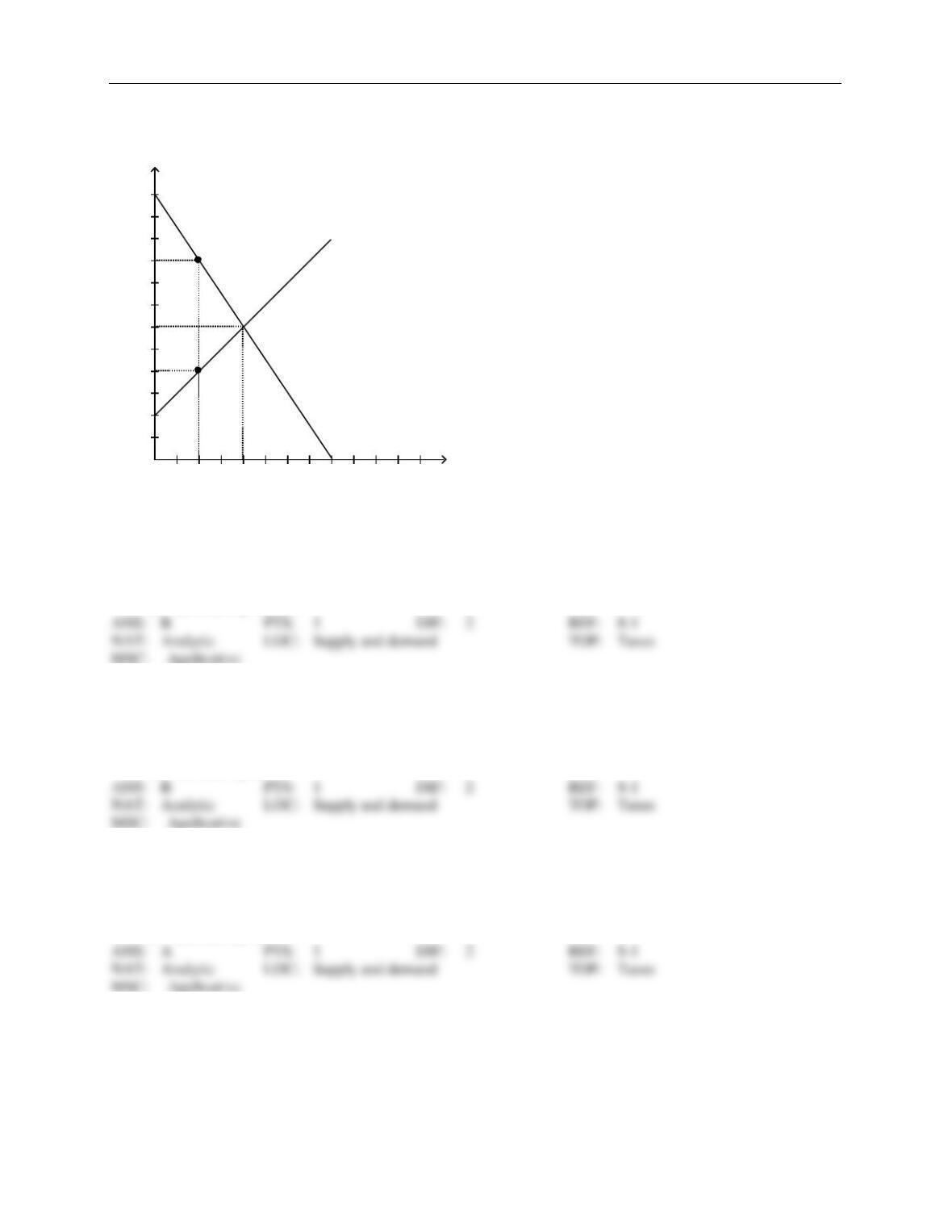

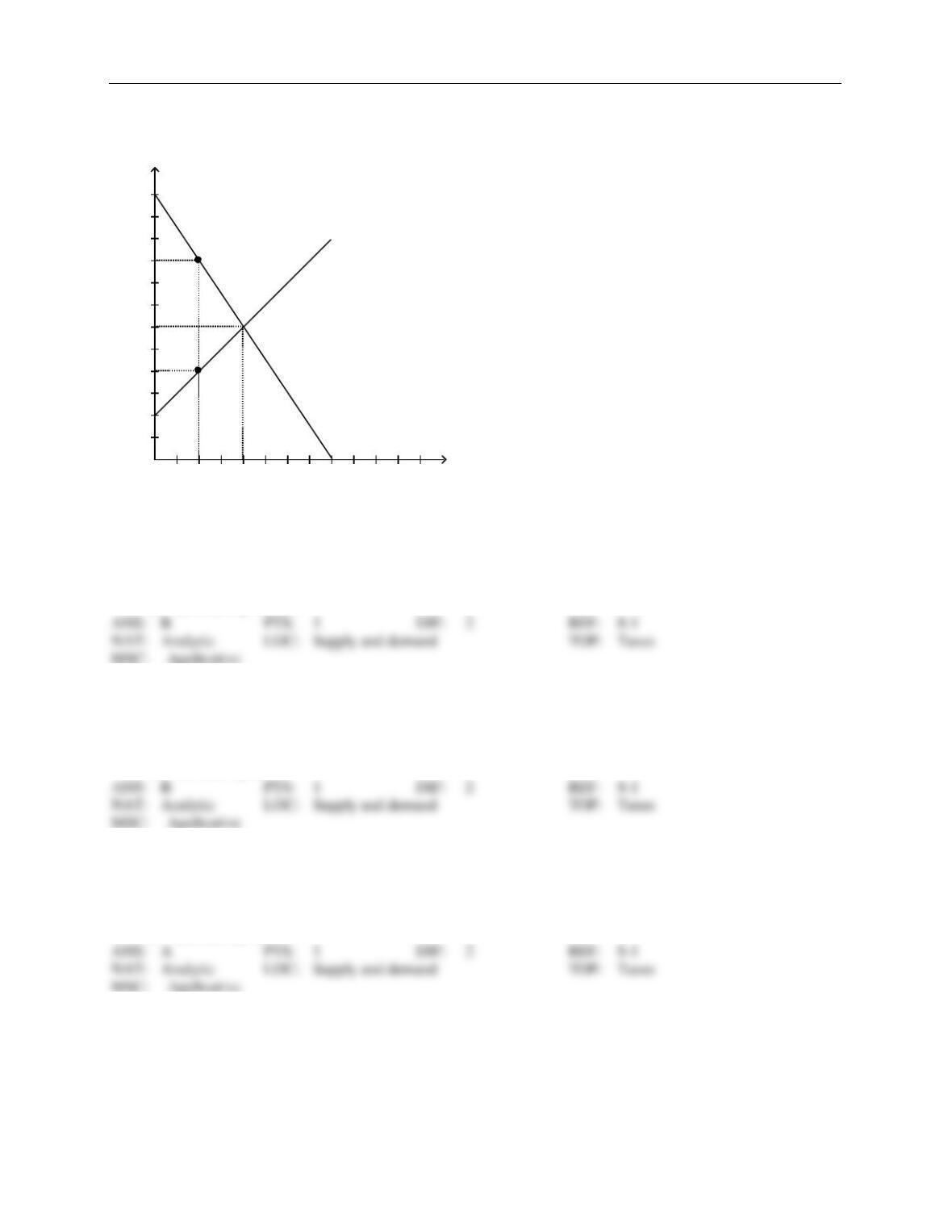

58. For good X, the supply curve is the typical upward-sloping straight line, and the demand curve is the typical

downward-sloping straight line. A tax of $15 per unit is imposed on good X. The tax reduces the equilibrium

quantity in the market by 300 units. The deadweight loss from the tax is

59. In the market for widgets, the supply curve is the typical upward-sloping straight line, and the demand curve is

the typical downward-sloping straight line. The equilibrium quantity in the market for widgets is 200 per

month when there is no tax. Then a tax of $5 per widget is imposed. As a result, the government is able to

raise $750 per month in tax revenue. We can conclude that the equilibrium quantity of widgets has fallen by

60. In the market for widgets, the supply curve is the typical upward-sloping straight line, and the demand curve is

the typical downward-sloping straight line. The equilibrium quantity in the market for widgets is 250 per

month when there is no tax. Then a tax of $6 per widget is imposed. As a result, the government is able to

raise $750 per month in tax revenue. We can conclude that the after-tax quantity of widgets is