Chapter 11: The Basics of Capital Budgeting

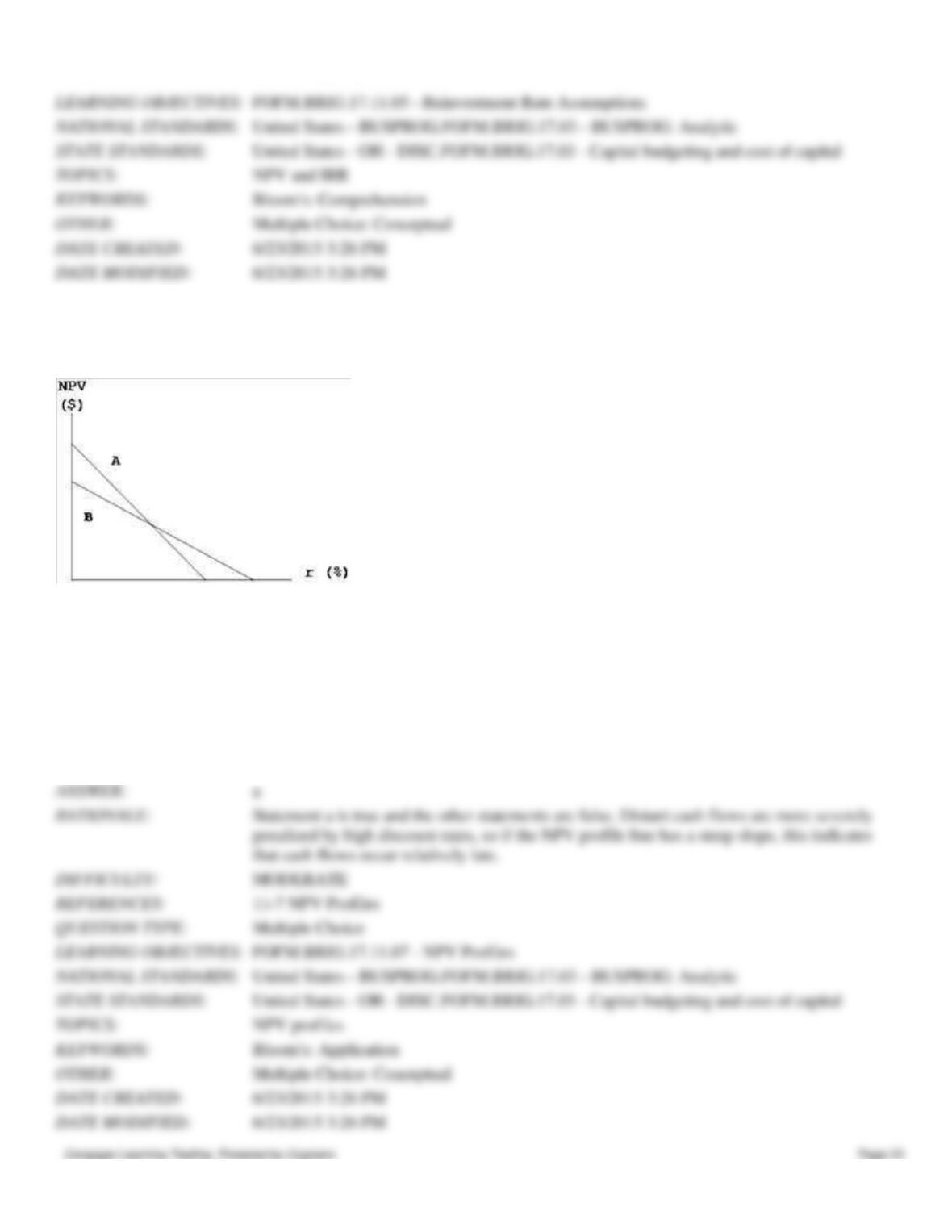

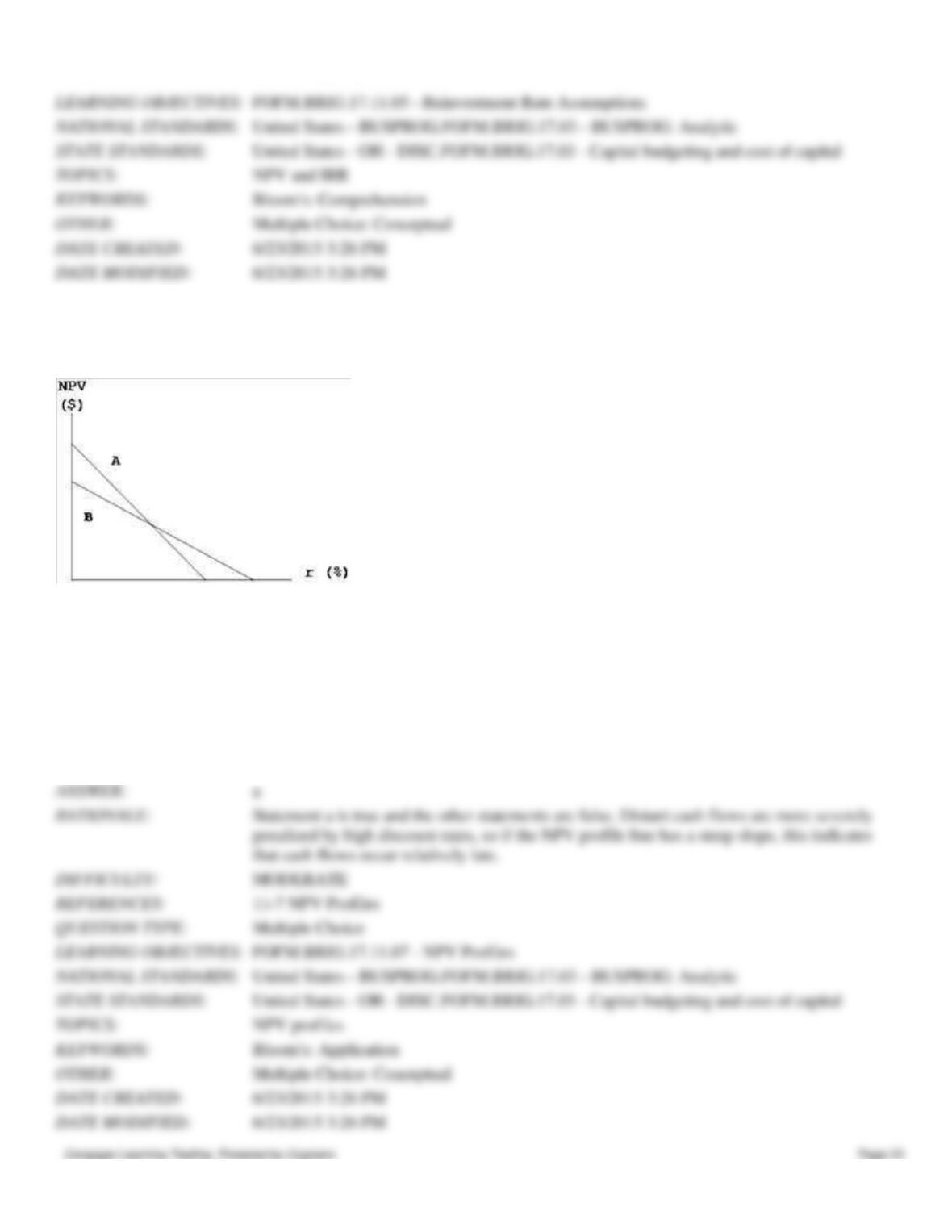

50. Assume that the economy is enjoying a strong boom, and as a result interest rates and money costs generally are

relatively high. The WACC for two mutually exclusive projects that are being considered is 12%. Project S has an IRR of

20% while Project L's IRR is 15%. The projects have the same NPV at the 12% current WACC. However, you believe

that the economy will soon fall into a mild recession, and money costs and thus your WACC will soon decline. You also

think that the projects will not be funded until the WACC has decreased, and their cash flows will not be affected by the

change in economic conditions. Under these conditions, which of the following statements is CORRECT?

You should reject both projects because they will both have negative NPVs under the new conditions.

You should delay a decision until you have more information on the projects, even if this means that a

competitor might come in and capture this market.

You should recommend Project L, because at the new WACC it will have the higher NPV.

You should recommend Project S, because at the new WACC it will have the higher NPV.

You should recommend Project L because it will have both a higher IRR and a higher NPV under the new

conditions.

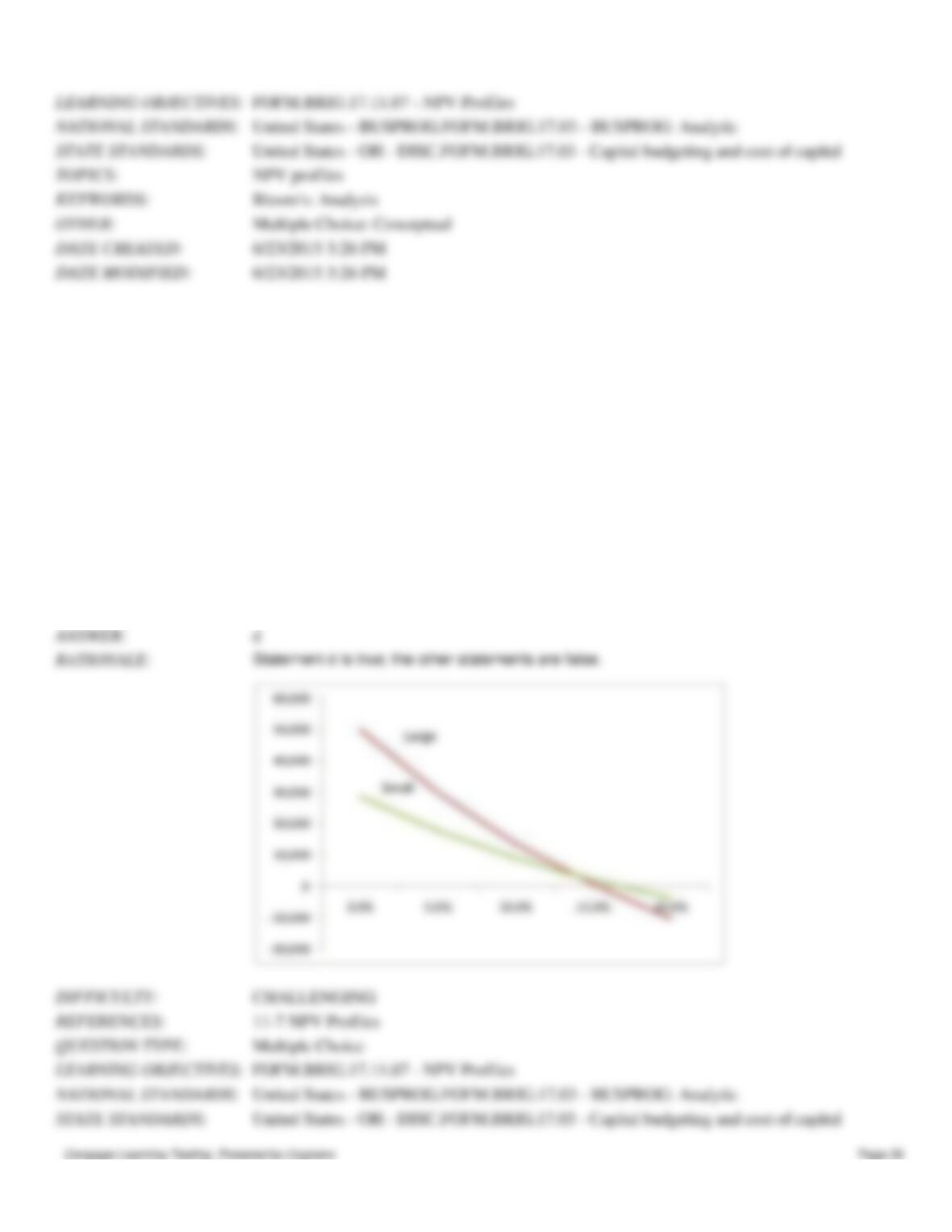

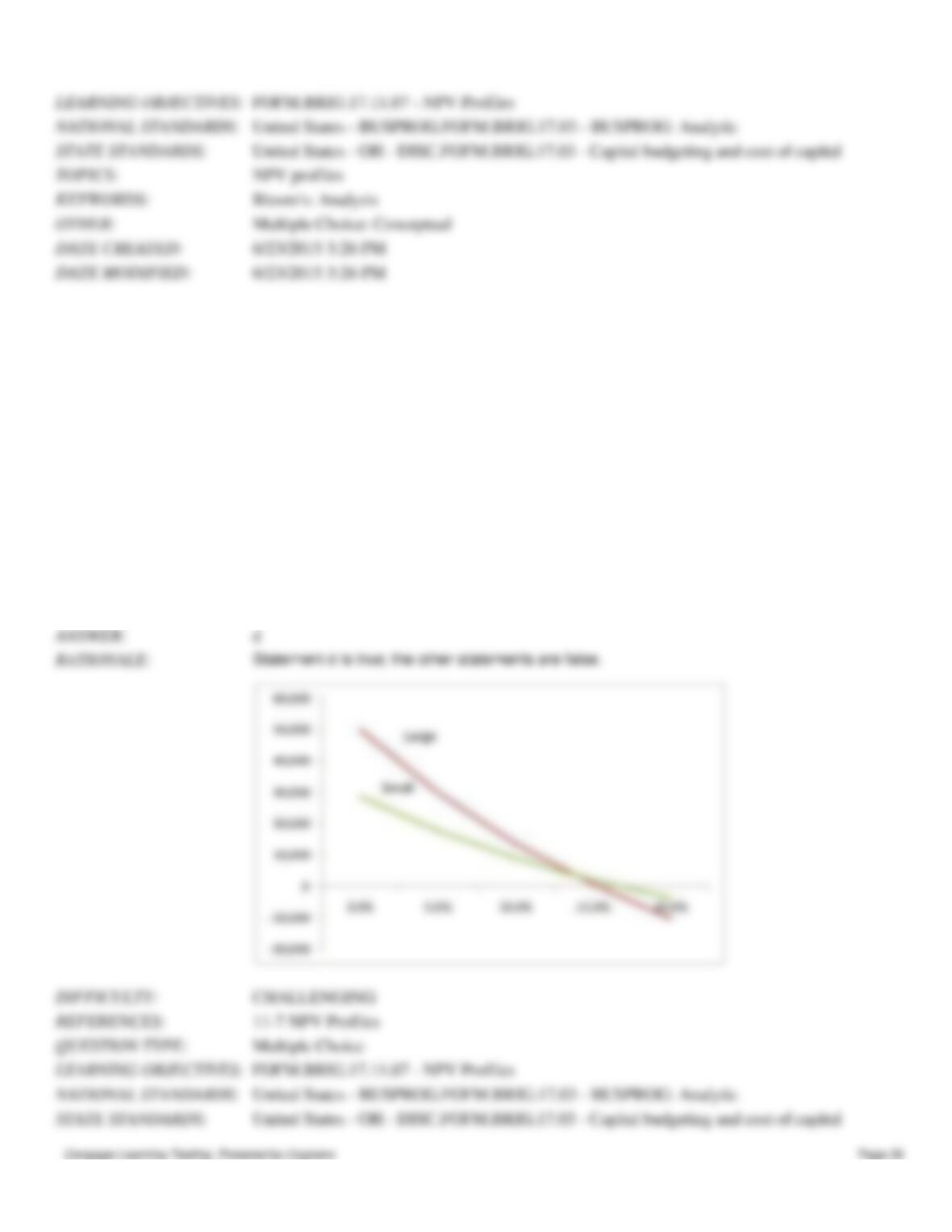

51. Which of the following statements is CORRECT?

The NPV method was once the favorite of academics and business executives, but today most authorities

regard the MIRR as being the best indicator of a project’s profitability.

If the cost of capital declines, this lowers a project’s NPV.

The NPV method is regarded by most academics as being the best indicator of a project’s profitability, hence

most academics recommend that firms use only this one method and disregard other methods.

A project’s NPV depends on the total amount of cash flows the project produces, but because the cash flows

are discounted at the WACC, it does not matter if the cash flows occur early or late in the project’s life.

The NPV and IRR methods may give different recommendations regarding which of two mutually exclusive

projects should be accepted, but they always give the same recommendation regarding the acceptability of a

normal, independent project.