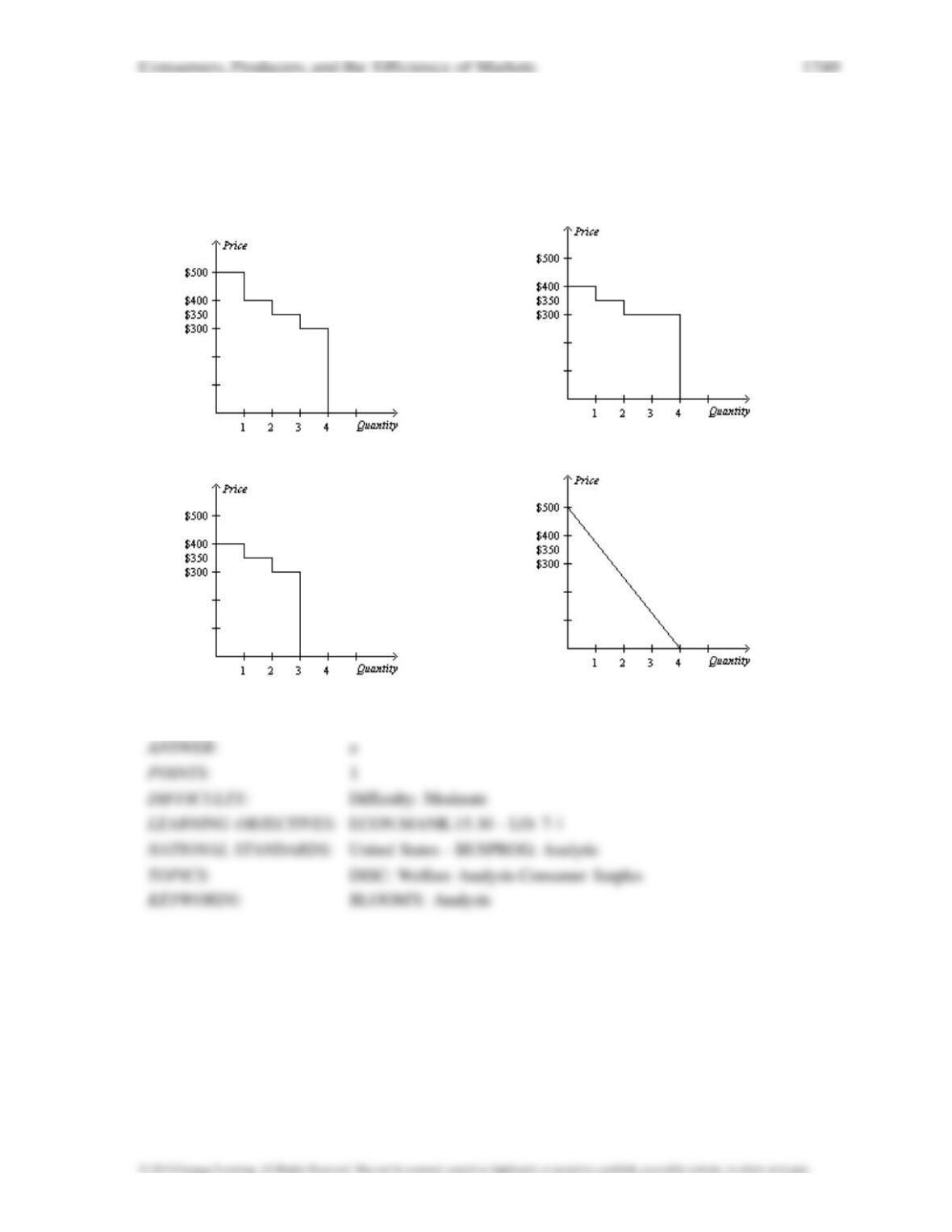

55.

Refer to Table 7-7. You have two essentially identical extra tickets to the Midwest Regional

Sweet 16 game in

the men’s NCAA basketball tournament. The table shows the willingness to

pay of the four potential buyers in the

market for a ticket to the game. You hold an auction to sell

the two tickets. Who makes the winning bids, and what

do they offer to pay for the tickets?

a.

Michael and Earvin; more than $350 but less than or equal to $400

b.

Michael and Earvin; more than $400 but less than or equal to $500

c.

Earvin and Larry; more than $300 but less than or equal to $350

d.

Larry and Charles; less than $300

56.

Refer to Table 7-7. You have two essentially identical extra tickets to the Midwest Regional

Sweet 16 game in

the men’s NCAA basketball tournament. The table shows the willingness to

pay of the four potential buyers in the

market for a ticket to the game. You hold an auction to sell

the two tickets. Michael and Earvin each offer to pay

$360 for a ticket, and you sell them the two tickets. What is the total consumer surplus in the

market?

a. $720

b. $180

c. $140

d. $40