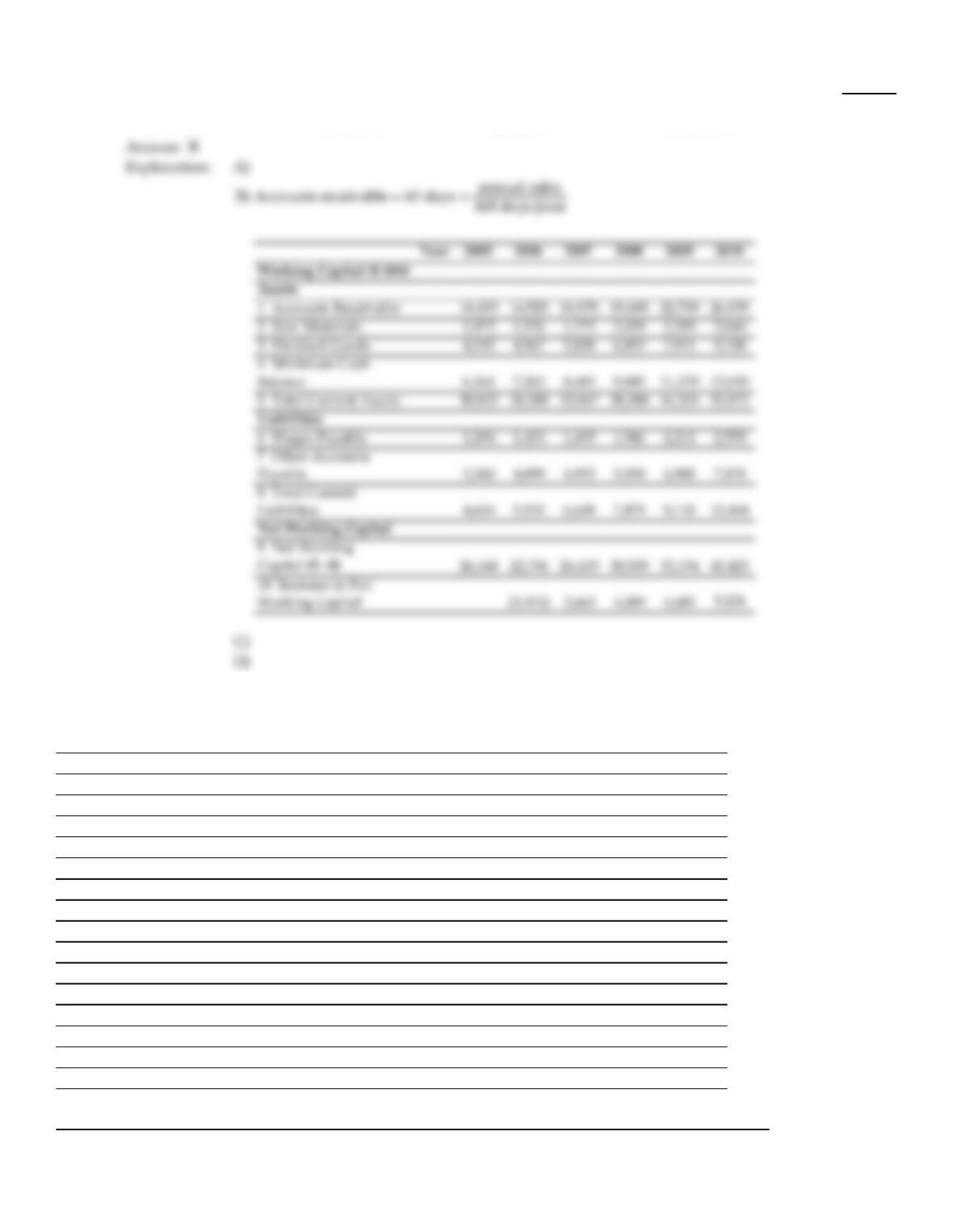

Use the tables for the question(s) below.

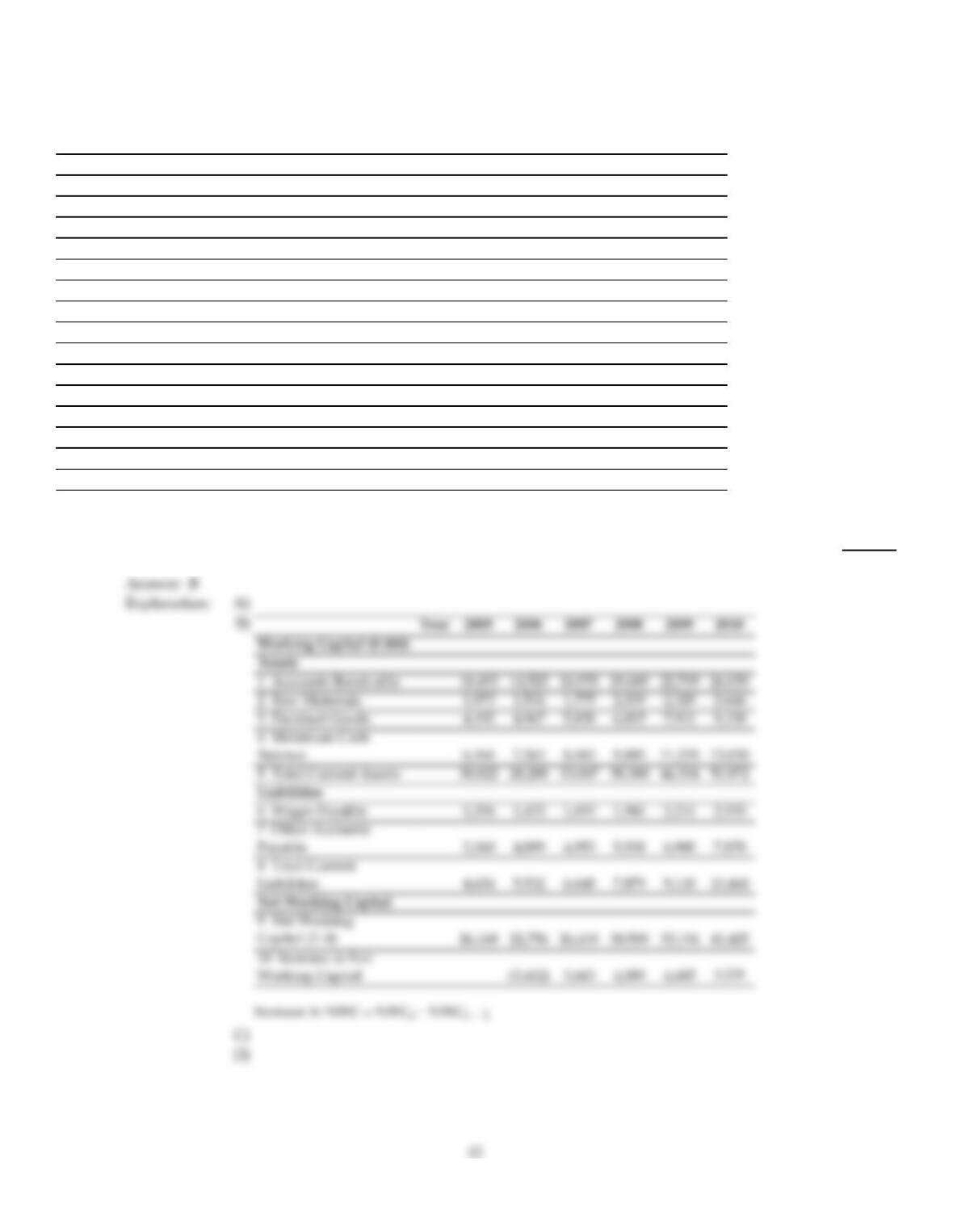

Pro Forma Income Statement for Ideko, 2005-2010

Year 2005 2006 2007 2008 2009 2010

Income Statement ($ 000)

1 Sales 75,000 88,358 103,234 119,777 138,149 158,526

2 Cost of Goods Sold

3 Raw Materials (16,000) (18,665) (21,593) (24,808) (28,333) (32,193)

4 Direct Labor Costs (18,000) (21,622) (25,757) (30,471) (35,834) (41,925)

5 Gross Profit 41,000 48,071 55,883 64,498 73,982 84,407

6 Sales and Marketing (11,250) (14,579) (18,582) (23,356) (27,630) (31,705)

7 Administrative (13,500) (13,254) (15,485) (16,769) (17,959) (20,608)

8 EBITDA 16,250 20,238 21,816 24,373 28,393 32,094

9 Depreciation (5,500) (5,450) (5,405) (6,865) (7,678) (7,710)

10 EBIT 10,750 14,788 16,411 17,508 20,715 24,383

11 Interest Expense (net) (75) (6,800) (6,800) (6,800) (7,820) (8,160)

12 Pretax Income 10,675 7,988 9,611 10,708 12,895 16,223

13 Income Tax (3,736) (2,796) (3,364) (3,748) (4,513) (5,678)

14 Net Income 6,939 5,193 6,247 6,960 8,382 10,545

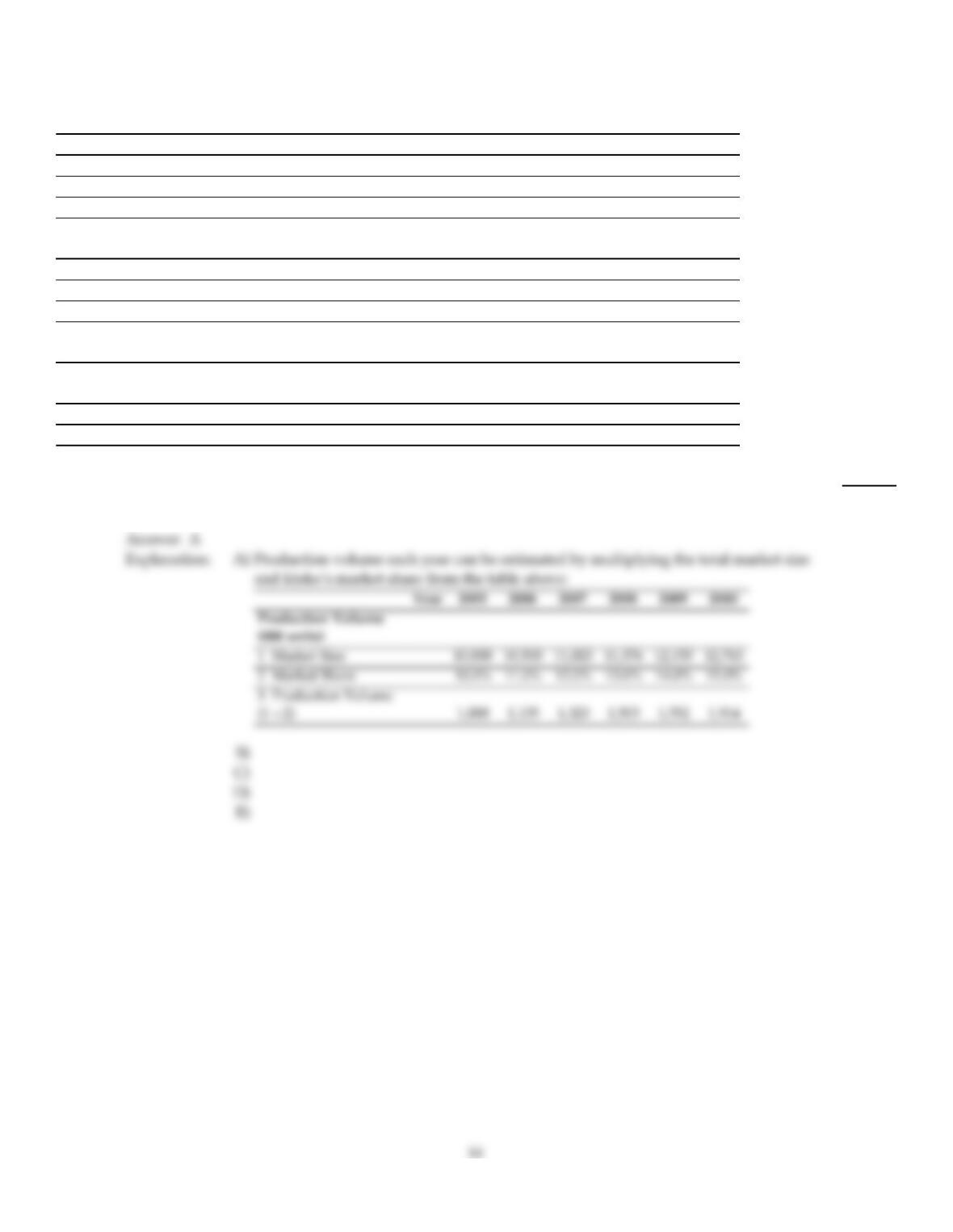

Pro Forma Balance Sheet for Ideko, 2005-2010

Year 2005 2006 2007 2008 2009 2010

Balance Sheet ($ 000)

Assets

1 Cash and Cash Equivalents 6,164 7,262 8,485 9,845 11,355 13,030

2 Accounts Receivable 18,493 14,525 16,970 19,689 22,709 26,059

3 Inventories 6,165 6,501 7,613 8,854 10,240 11,784

4 Total Current Assets 30,822 28,288 33,067 38,388 44,304 50,872

5 Property, Plant, and Equipment 49,500 49,050 48,645 61,781 69,102 69,392

6 Goodwill 72,332 72,332 72,332 72,332 72,332 72,332

7 Total Assets 152,654 149,670 154,044 172,501 185,738 192,597

Liabilities

8 Accounts Payable 4,654 5,532 6,648 7,879 9,110 10,448

9 Debt 100,000 100,000 100,000 115,000 120,000 120,000

10 Total Liabilities 104,654 105,532 106,648 122,879 129,110 130,448

Stockholder’s Equity

11 Starting Stockholder’s Equity 48,000 44,138 47,396 49,621 56,628

12 Net Income 5,193 6,247 6,960 8,382 10,545

13 Dividends (2,000) (9,055) (2,989) (4,735) (1,375) (5,024)

14 Capital Contributions 50,000 - - - - - - - - - - - - ---

15 Stockholder’s Equity 48,000 44,138 47,396 49,621 56,628 62,149

16 Total Liabilities and Equity 152,654 149,670 154,044 172,501 185,738 192,597