Test Bank for Financial Accounting: Tools for Business Decision Making, Eighth Edition

FOR INSTRUCTOR USE ONLY

*Ex. 197

Condensed financial data of Gorni Company appear below:

GORNI COMPANY

Comparative Balance Sheet

December 31

2017 2016

Assets

Cash $ 70,000 $ 35,000

Accounts receivable 82,000 53,000

Inventories 120,000 132,000

Prepaid expenses 19,000 25,000

Investments 80,000 65,000

Plant assets 310,000 250,000

Accumulated depreciation (65,000) (60,000)

Total $616,000 $500,000

Liabilities and Stockholders' Equity

Accounts payable $ 85,000 $ 75,000

Accrued expenses payable 22,000 24,000

Bonds payable 130,000 150,000

Common stock 245,000 170,000

Retained earnings 134,000 81,000

Total $616,000 $500,000

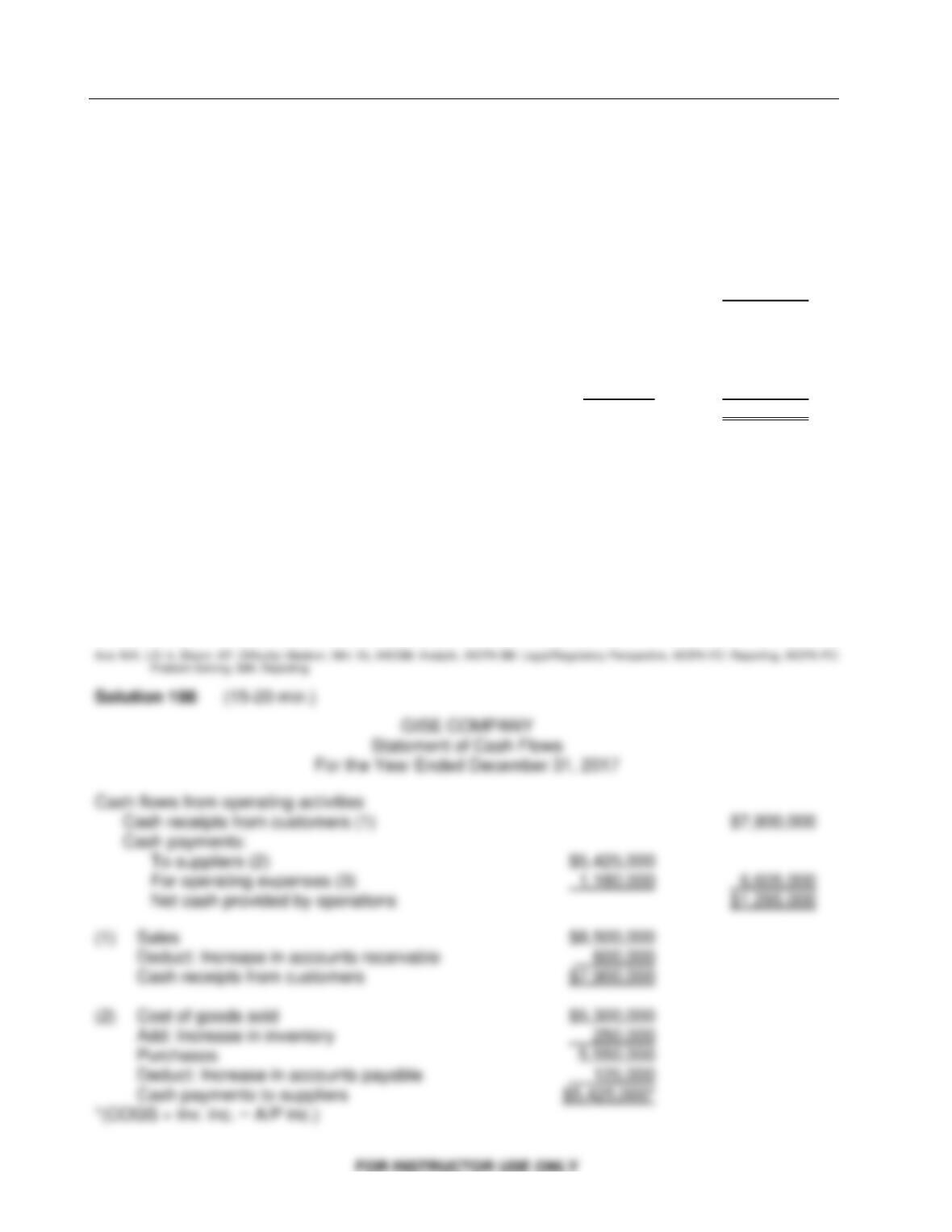

GORNI COMPANY

Income Statement

For the Year Ended December 31, 2017

Sales $480,000

Less:

Cost of goods sold $290,000

Operating expenses (excluding depreciation) 60,000

Depreciation expense 17,000

Income taxes 15,000

Interest expense 13,000

Loss on disposal of plant assets 8,000 403,000

Net income $ 77,000

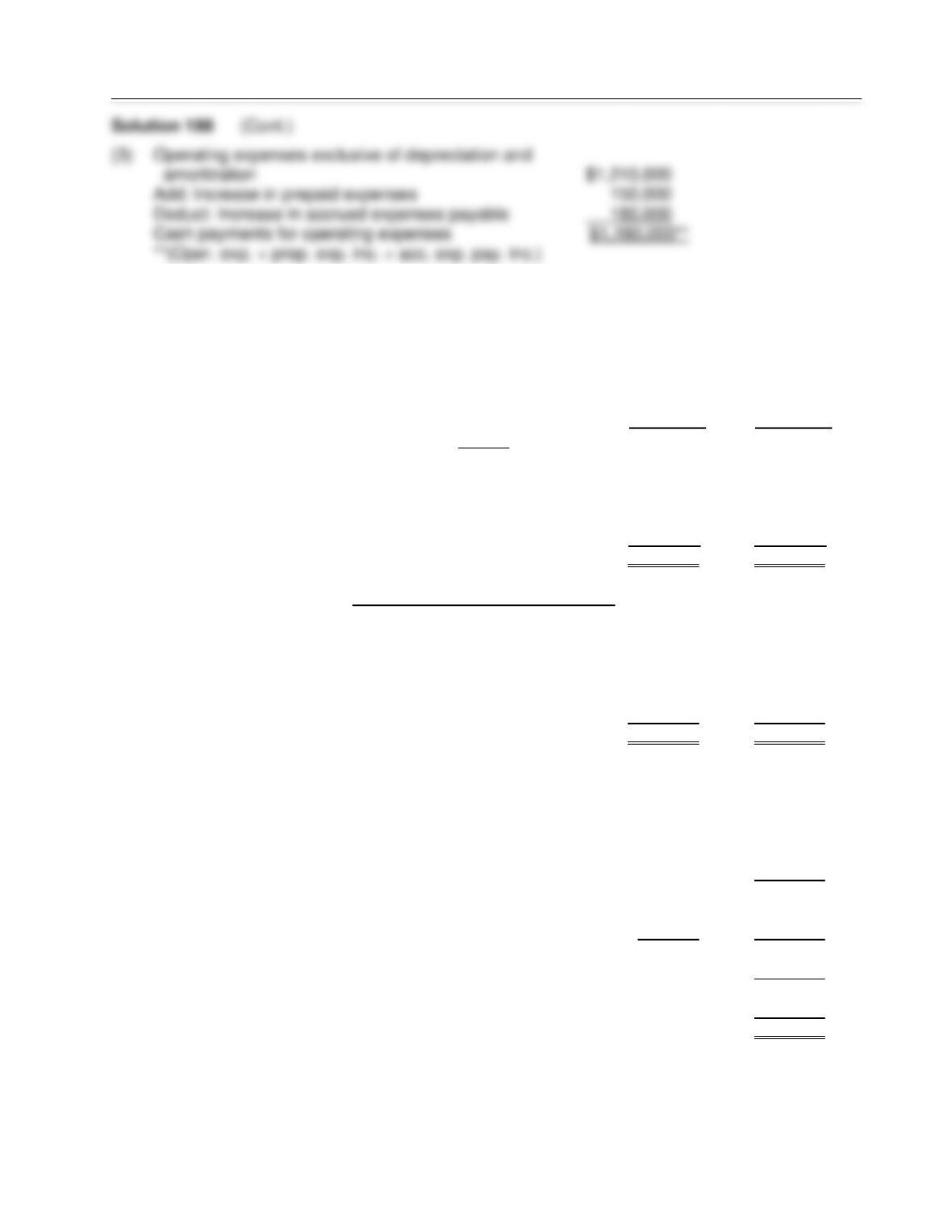

Additional information:

1. New plant assets costing $85,000 were purchased for cash in 2017.

2. Old plant assets costing $25,000 were sold for $5,000 cash when book value was $13,000.

3. Bonds with a face value of $20,000 were converted into $20,000 of common stock.

4. A cash dividend of $24,000 was declared and paid during the year.

5. Accounts payable pertain to merchandise purchases.

Instructions

Prepare a statement of cash flows for the year using the direct method.