Test Bank for Financial Accounting: Tools for Business Decision Making, Eighth Edition

FOR INSTRUCTOR USE ONLY

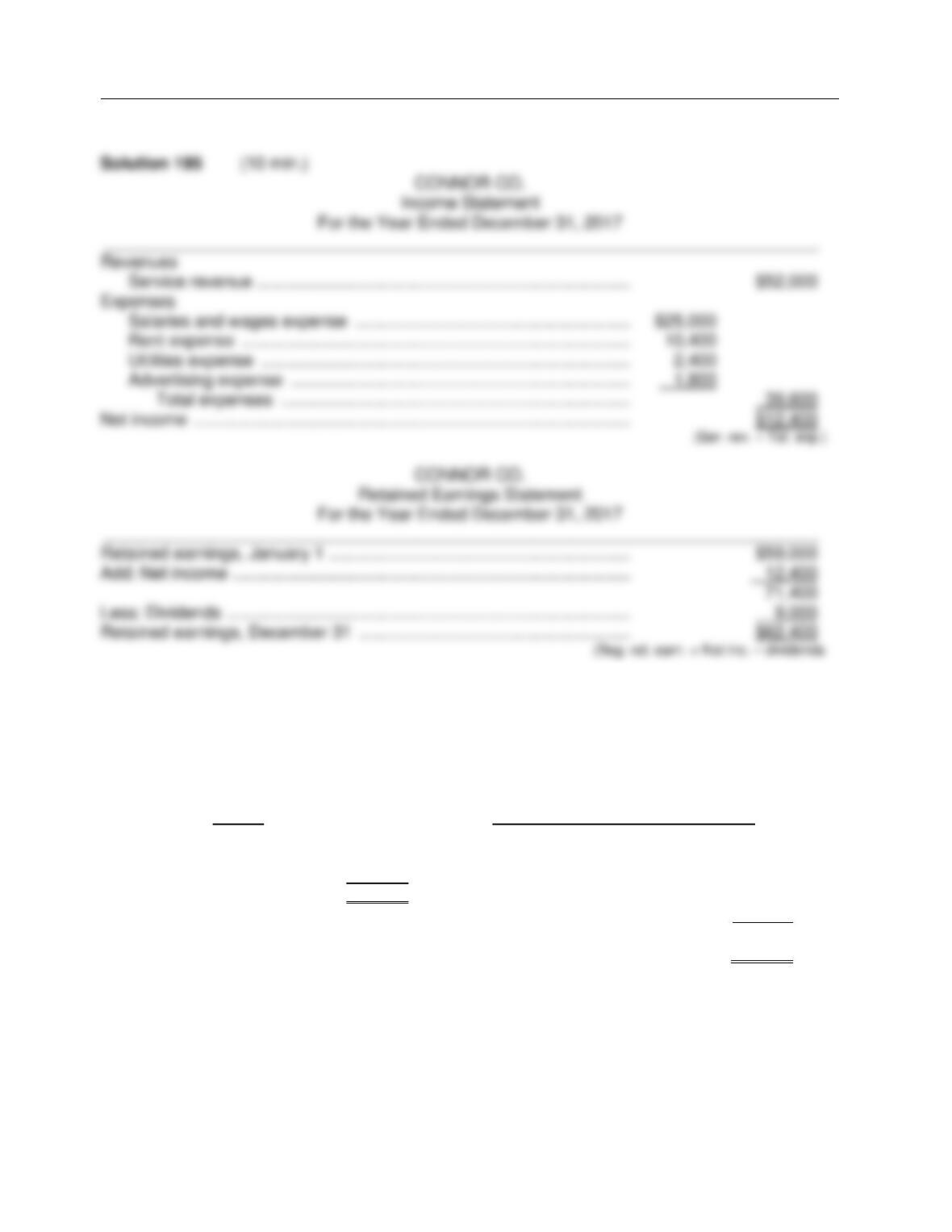

Ex. 193

Use the following accounts and information to prepare, in good form, an income statement and a

retained earnings statement, for the month of August and a balance sheet at August 31, 2017 for

Pierce Industries.

Accounts payable $ 1,100 Dividends $ 3,000

Accounts receivable 5,400 Insurance expense 1,200

Buildings 63,000 Supplies 1,400

Cash 18,600 Notes payable 3,300

Service revenue 25,700 Rent expense 3,400

Common stock 52,000 Salaries and wages expense 12,000

Retained earnings (beginning) 25,900

PIERCE INDUSTRIES

Income Statement

For the Month Ended August 31, 2017

___________________________________________________________________________

Revenues

$

Expenses

$

Total expenses

Net income $ t

PIERCE INDUSTRIES

Retained Earnings Statement

For the Month Ended August 31, 2017

___________________________________________________________________________

Retained Earnings, August 1 $

Add:

Less:

Retained Earnings, August 31 $ t