155. You receive a paycheck from your employer, and your pay stub indicates that $300 was deducted to pay the FICA

(Social Security/Medicare) tax. Which of the following statements is correct?

The $300 that you paid is not necessarily the true burden of the tax that falls on you, the employee.

Your employer is required by law to pay $300 to match the $300 deducted from your check.

This type of tax is an example of a payroll tax.

All of the above are correct.

156. You receive a paycheck from your employer, and your pay stub indicates that $400 was deducted to pay the FICA

(Social Security/Medicare) tax. Which of the following statements is correct?

This type of tax is an example of a payback tax.

Your employer is required by law to pay $400 to match the $400 deducted from your check.

The $400 that you paid is the true burden of the tax that falls on you, the employee.

All of the above are correct.

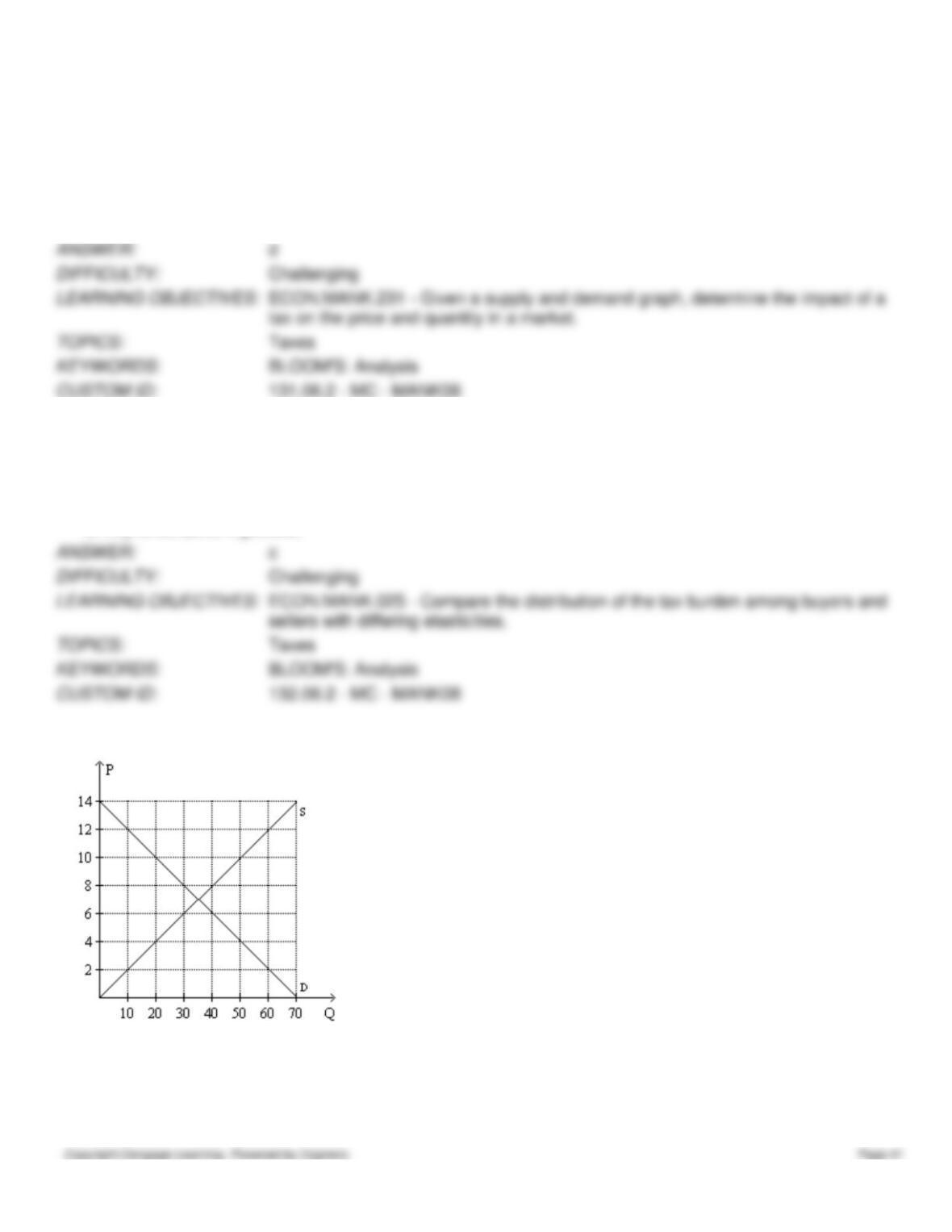

157. The mayor of Workerville proposes a local payroll tax to fund a new water park for the city. The mayor proposes to

collect half the tax from workers and half the tax from firms. The mayor will be able to successfully divide the burden of

the tax equally if the

demand for labor is more elastic than the supply of labor.

supply of labor is more elastic than the demand for labor.

demand for labor and supply of labor are equally elastic.

It is not possible for the tax burden to fall equally on firms and workers.

158. The mayor of Workerville proposes a local payroll tax to fund a new water park for the city. The mayor proposes to

collect half the tax from workers and half the tax from firms. Workers will bear

an equal share of the tax in comparison to firms.

a greater share of the tax in comparison to firms.