31-631

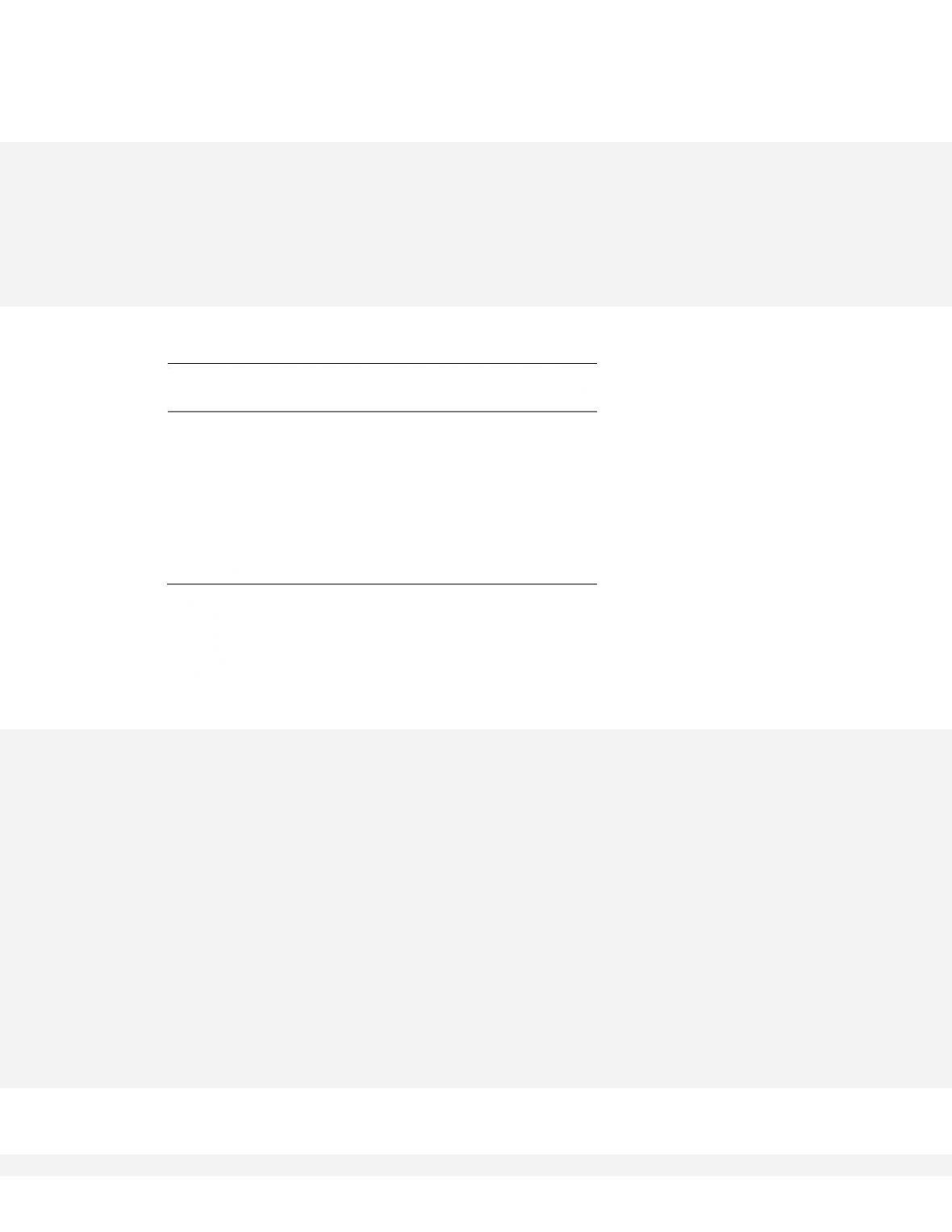

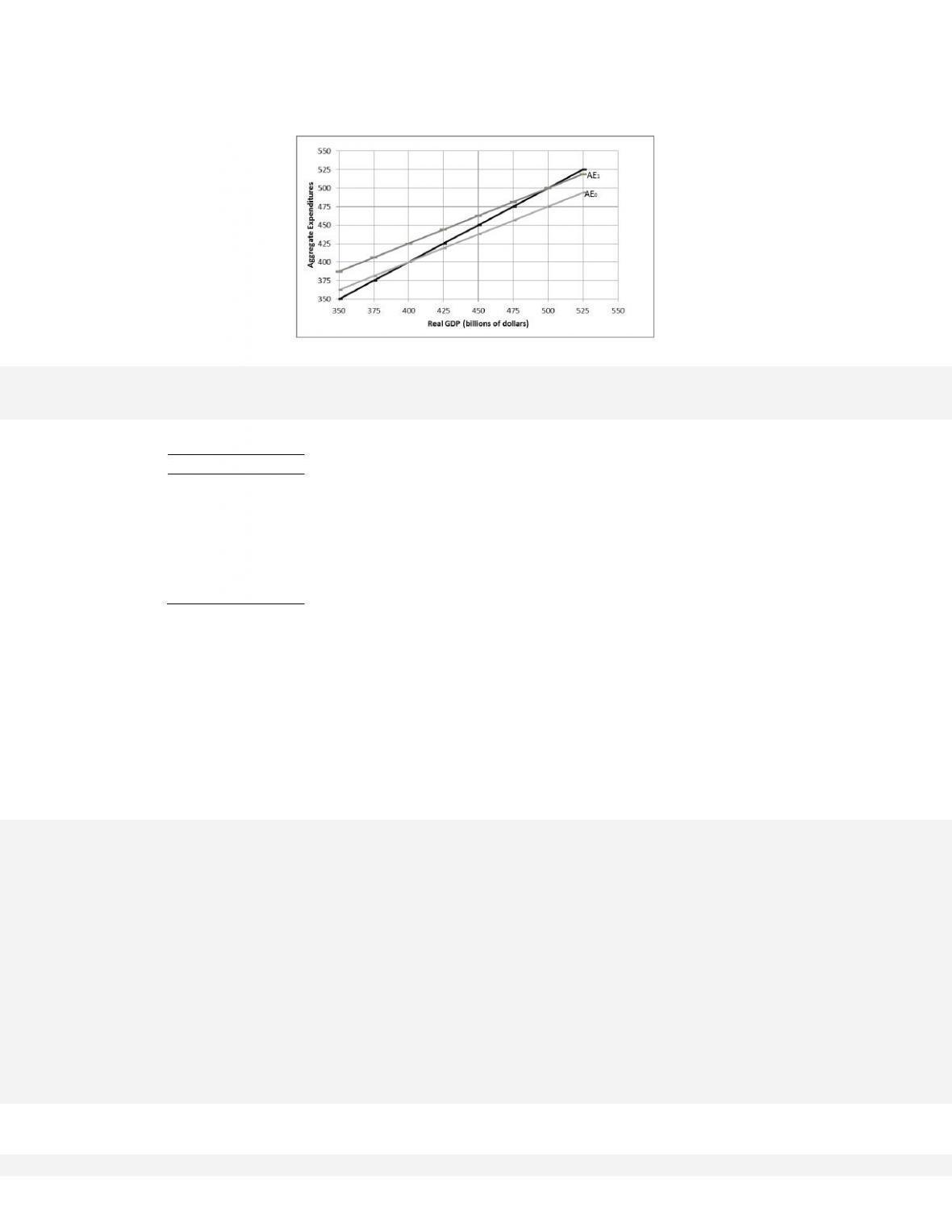

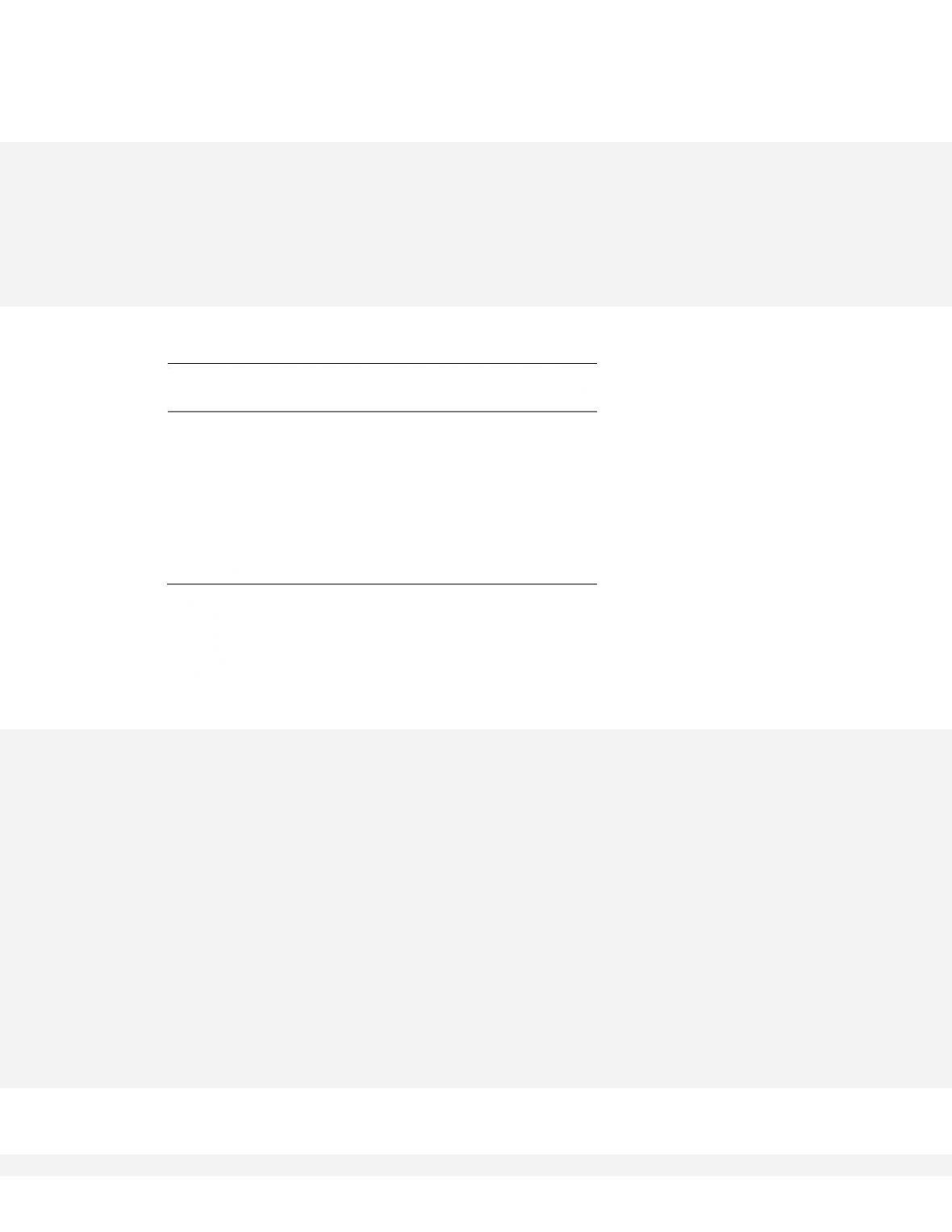

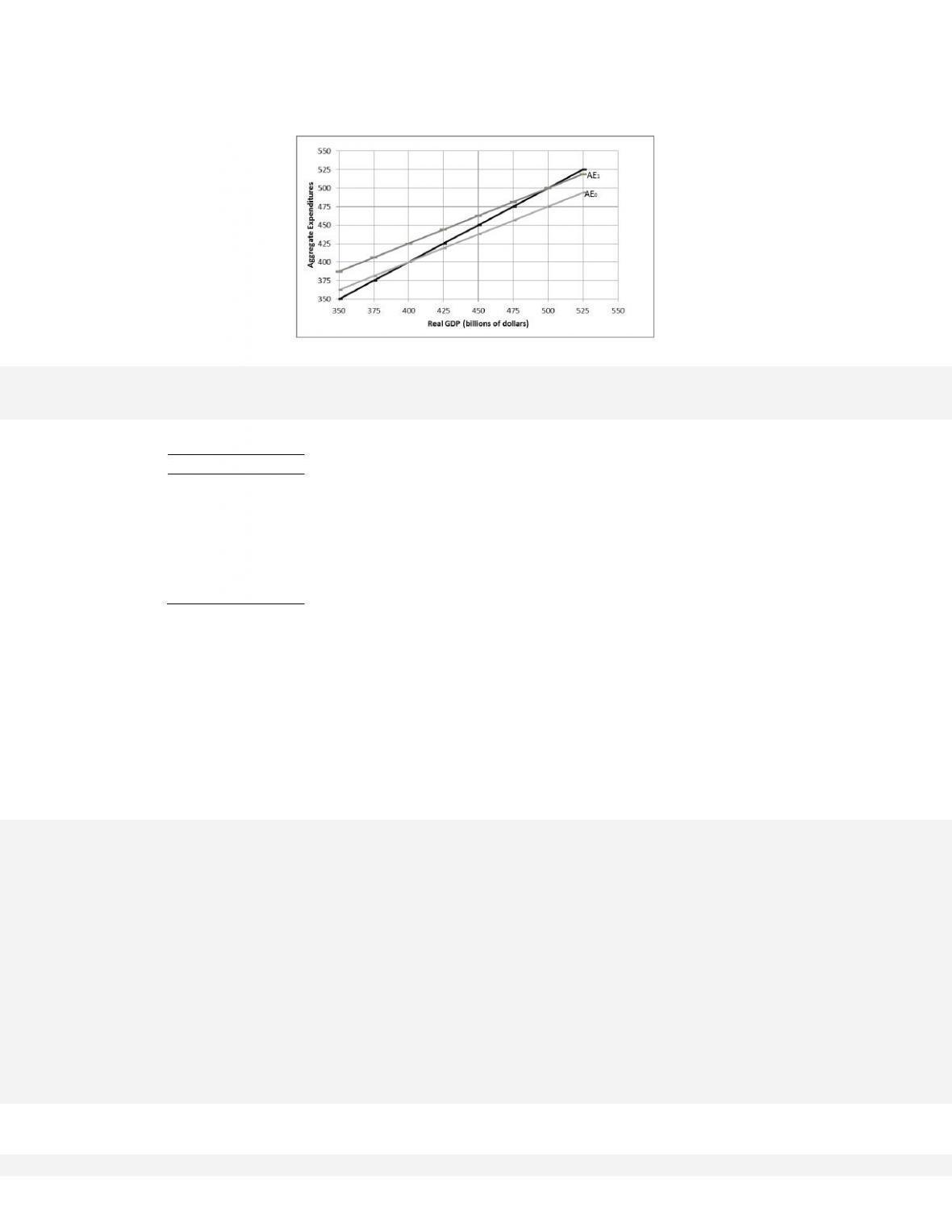

40. Assume the level of investment is $8 billion and independent of the level of total output. Complete the

following table and determine the equilibrium level of output and income which the private sector of this

closed economy would provide.

Possible employment

levels (millions)

(a) If this economy has a labor force of 110 million, will there be a recessionary or inflationary

expenditure gap? Explain the consequences of this gap.

(b) If the labor force is 80 million, will there be an inflationary or recessionary expenditure gap? Explain

the consequences of this gap.

(c) What are the sizes of the MPC, MPS, and multiplier in this economy?

(d) Using the multiplier concept, give the increase in equilibrium GDP that would occur if the level of

investment increased from $8 billion to $10 billion.

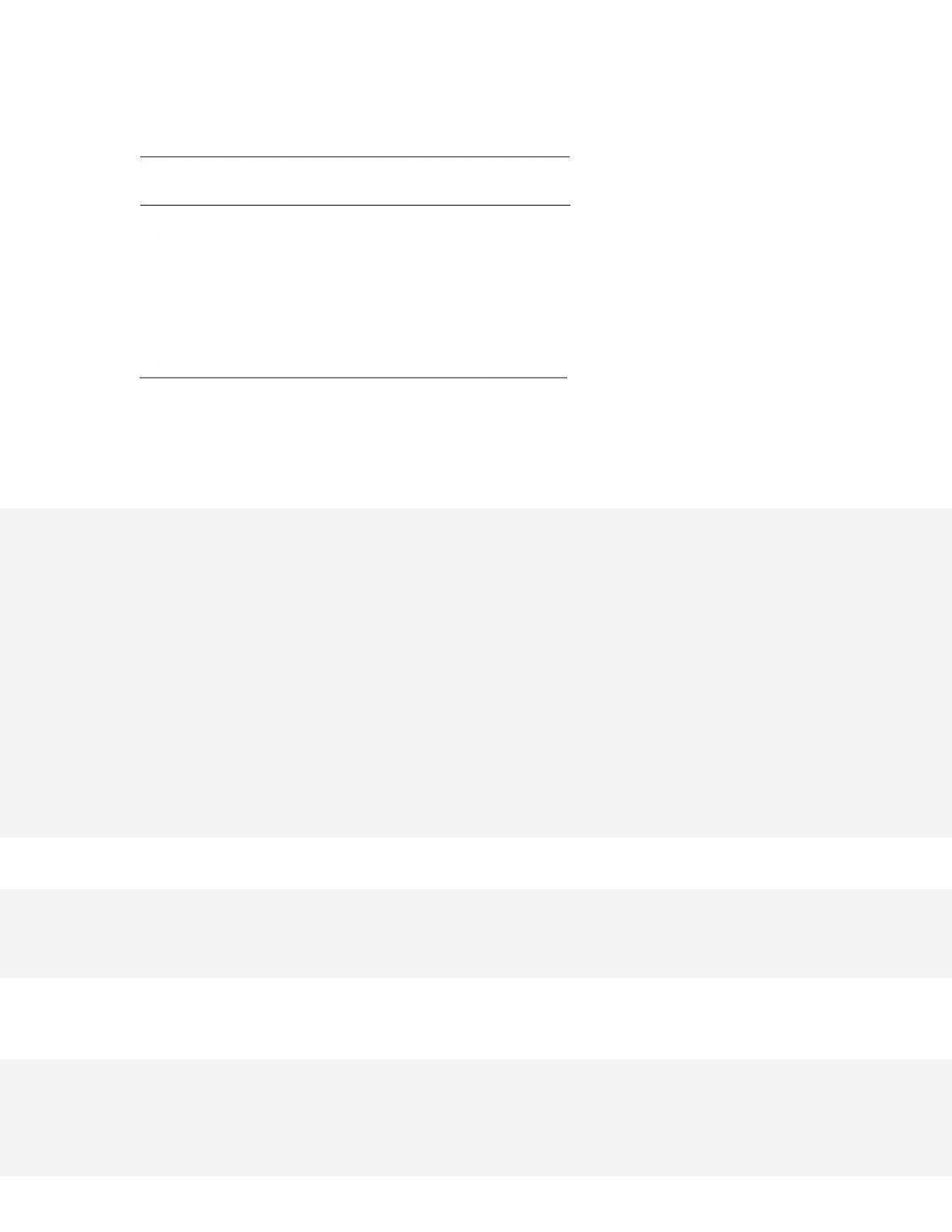

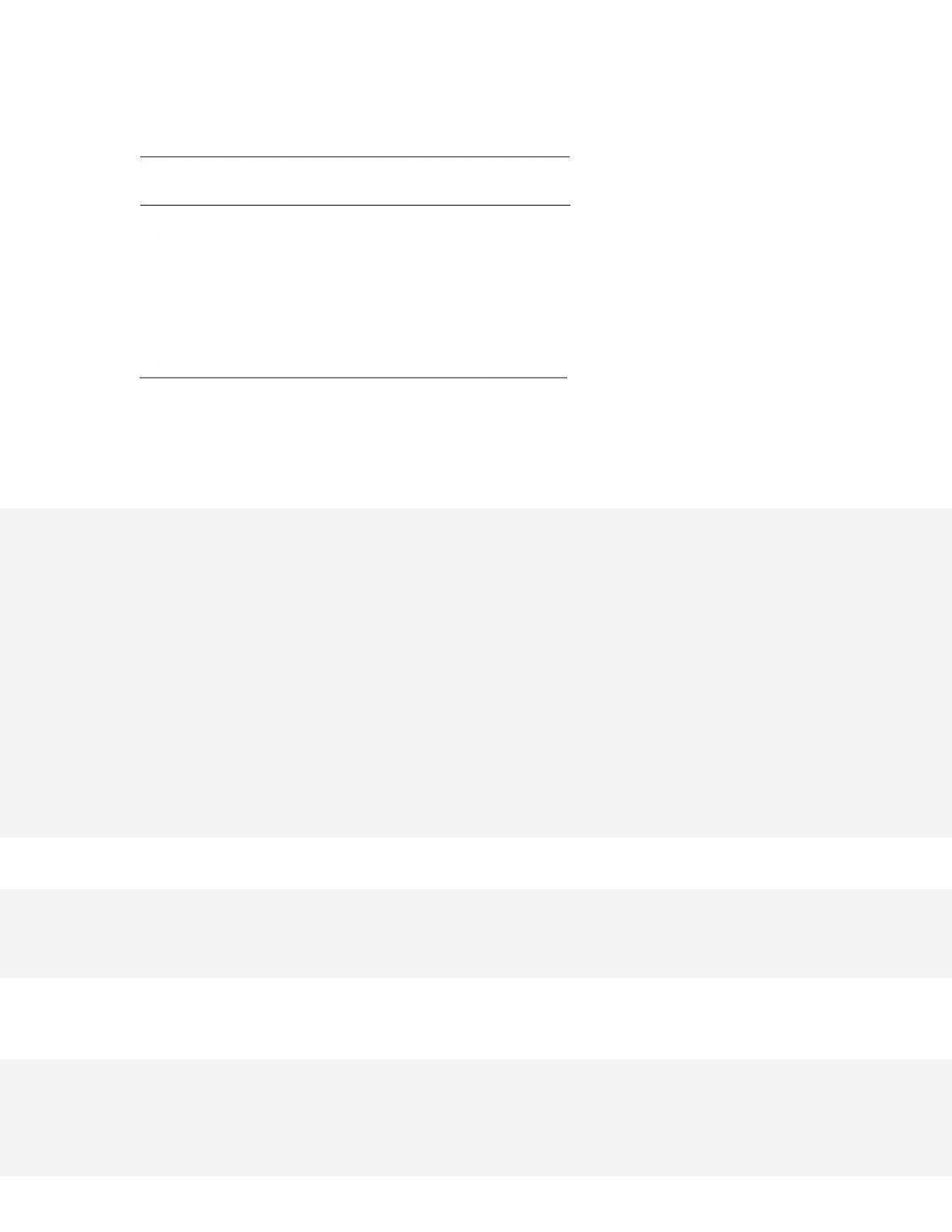

Possible employment

levels (millions)

(a) At the 110-million employment level, aggregate expenditures will be $132 billion and full-

employment output will be $140 billion. Therefore, there exists a recessionary expenditure gap of $7

billion. Producers plan output to match anticipated aggregate expenditures. If expenditures fall below

this level of $140 billion, then producer inventories will be greater than planned and they will reduce

output until the actual inventories equal planned inventories for that level of output.

(b) At the 80-million employment level, aggregate expenditures will be $112 billion and full-employment

output will be $110 billion. An inflationary expenditure gap exists because aggregate expenditures

exceed full-employment output and producers will attempt to expand output thinking full employment

has not been reached. Expansion takes place because the level of planned output was set to match

anticipated spending. Since aggregate spending exceeded this level of $110 billion, producer

inventories will be lower than planned and they will increase output to replenish these inventories.

(c) Consumption changes by $7 billion for every $10 billion change in DI. Therefore, the MPC is

7/10 or 0.7. MPS = 0.3, multiplier will be 1/.3 = 3 1/3.

(d) If investment spending rises by $2 billion, then equilibrium GDP should rise by 3 1/3 $2 billion or $6

2/3 billion.