20-431

CHAPTER 20

Public Finance: Expenditures and Taxes

A. Short-Answer, Essays, and Problems

1. Discuss how the government can use their influence to decide which goods and services are produced and

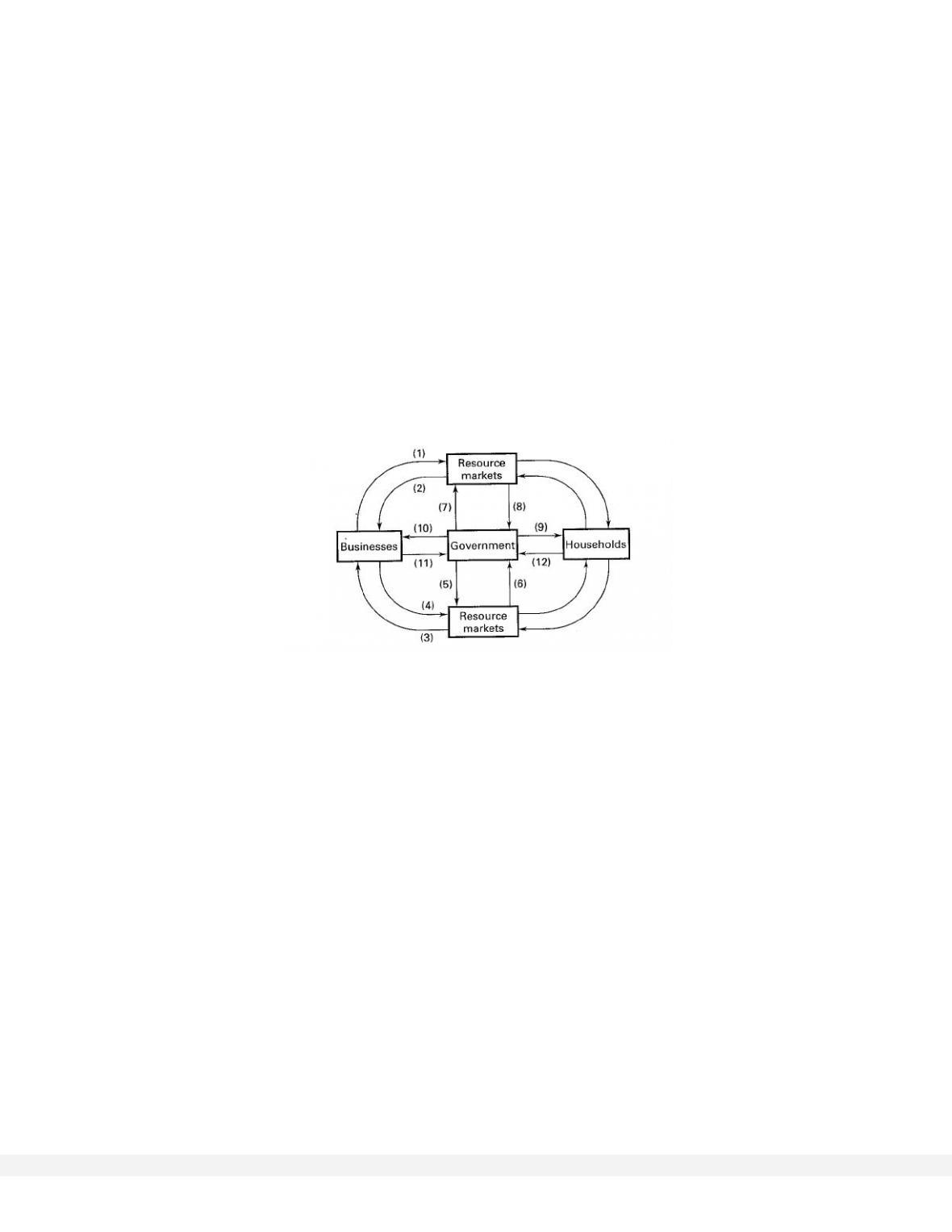

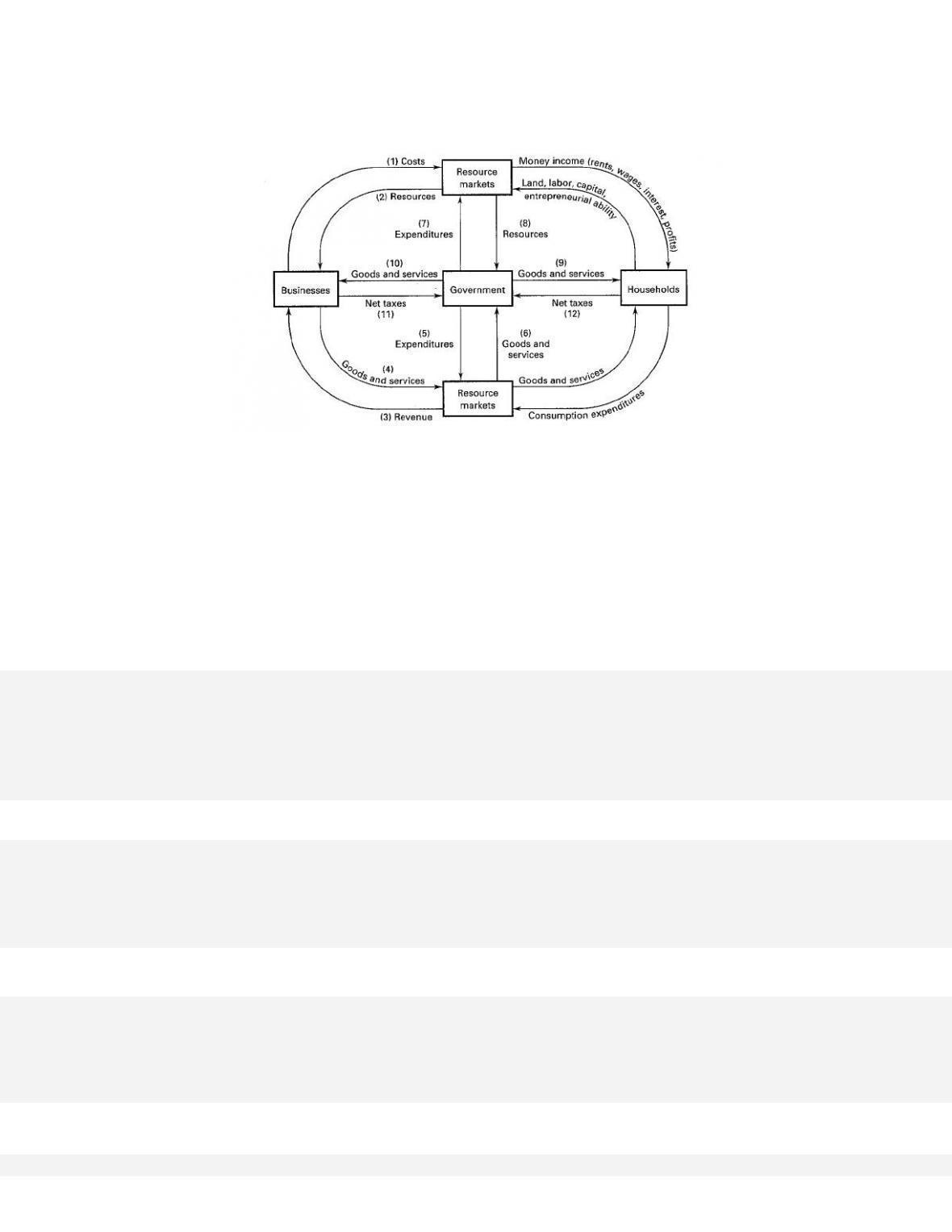

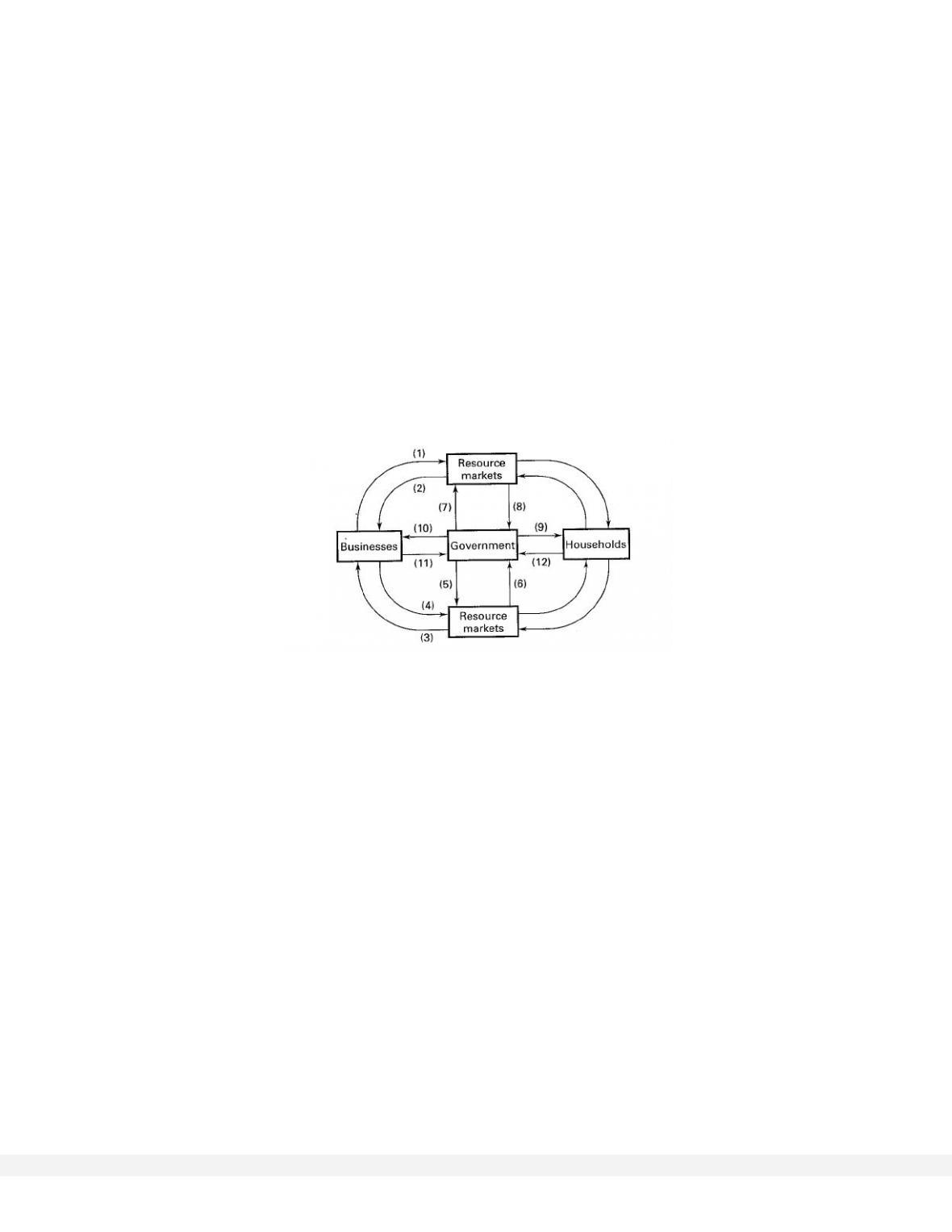

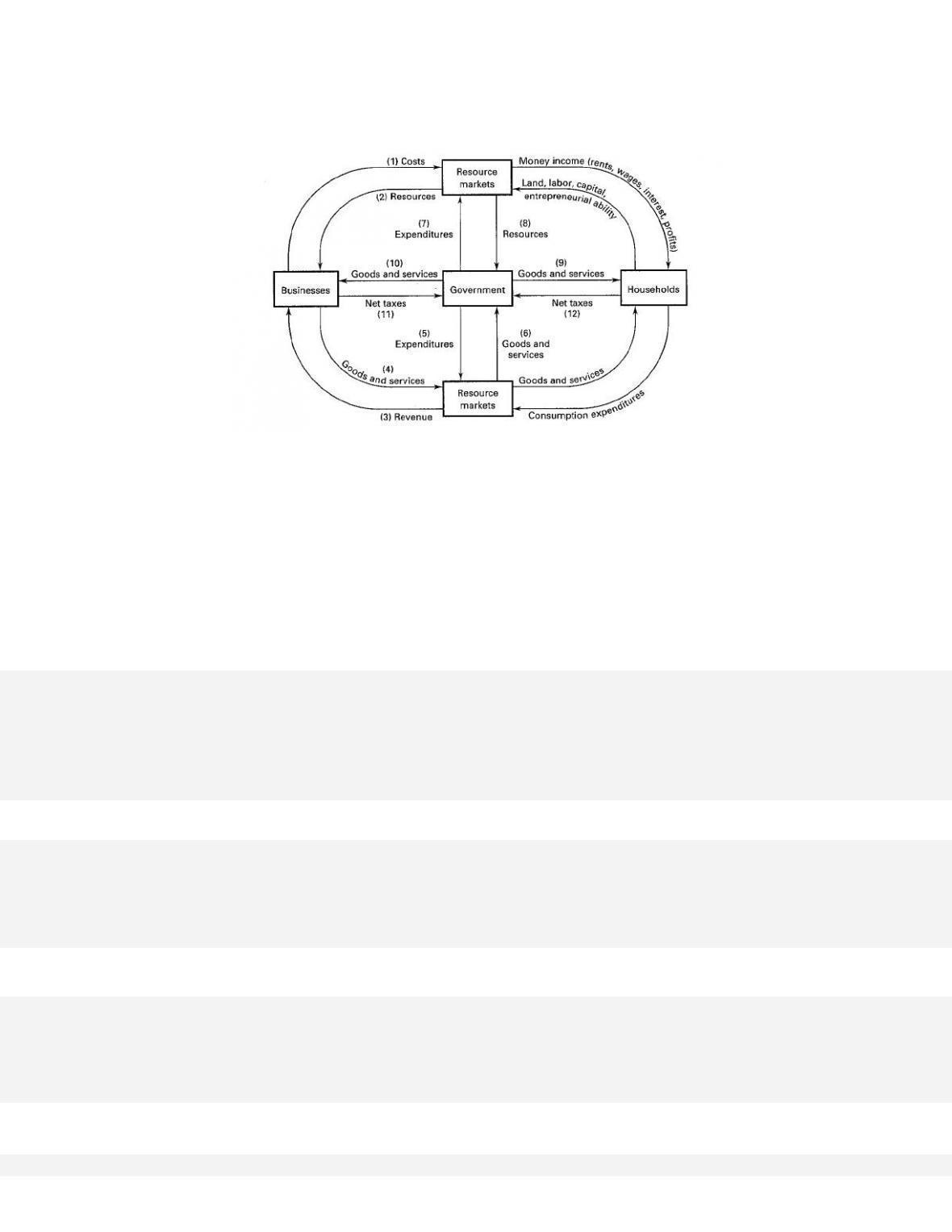

who consumes them.

2. Define proprietary income. List some examples.

3. Define public finance. What are the main sources of income and expenditures for the federal government?

4. Briefly describe the role of government in the economy. How are these government activities financed?

5. The circular flow diagram below includes business, household, and government sectors. Also shown are

the product and resource markets. Supply a label or an explanation for each of the twelve flows in the

model.

(1) ________________________

(2) ________________________

(3) ________________________

(4) ________________________

(5) ________________________

(6) ________________________

(7) ________________________

(8) ________________________

(9) ________________________

(10) ________________________

(11) ________________________

(12) ________________________

6. In which market does the following take place:

(a) Wages of farm workers

(b) The price of corn

(c) Rent on a plot of farm land

(d) The price of new farm equipment

(e) The price of milk

7. Differentiate between government purchases of goods and services and government transfer payments.

8. How is total government spending defined? What is its size in the economy?

9. List the four main categories of Federal spending.

10. List the four major sources of Federal revenues.