15) At a firm's quarterly dividend meeting held on December 5, the directors declared a $1.50

per share cash dividend to be paid to the holders of record on Monday, January 1. Before the

dividend was declared, the firm's accumulated retained earnings balance and cash balance were

$1,280,000 and $30,000 respectively. The firm has 10,000 shares of common stock outstanding.

On January 2, the cash, dividends payable, and retained earnings accounts had balances of

________.

A) $15,000, $0, and $1,265,000, respectively

B) $30,000, $15,000, and $1,280,000, respectively

C) $30,000, $0, and $1,265,000, respectively

D) $15,000, $0, and $1,280,000, respectively

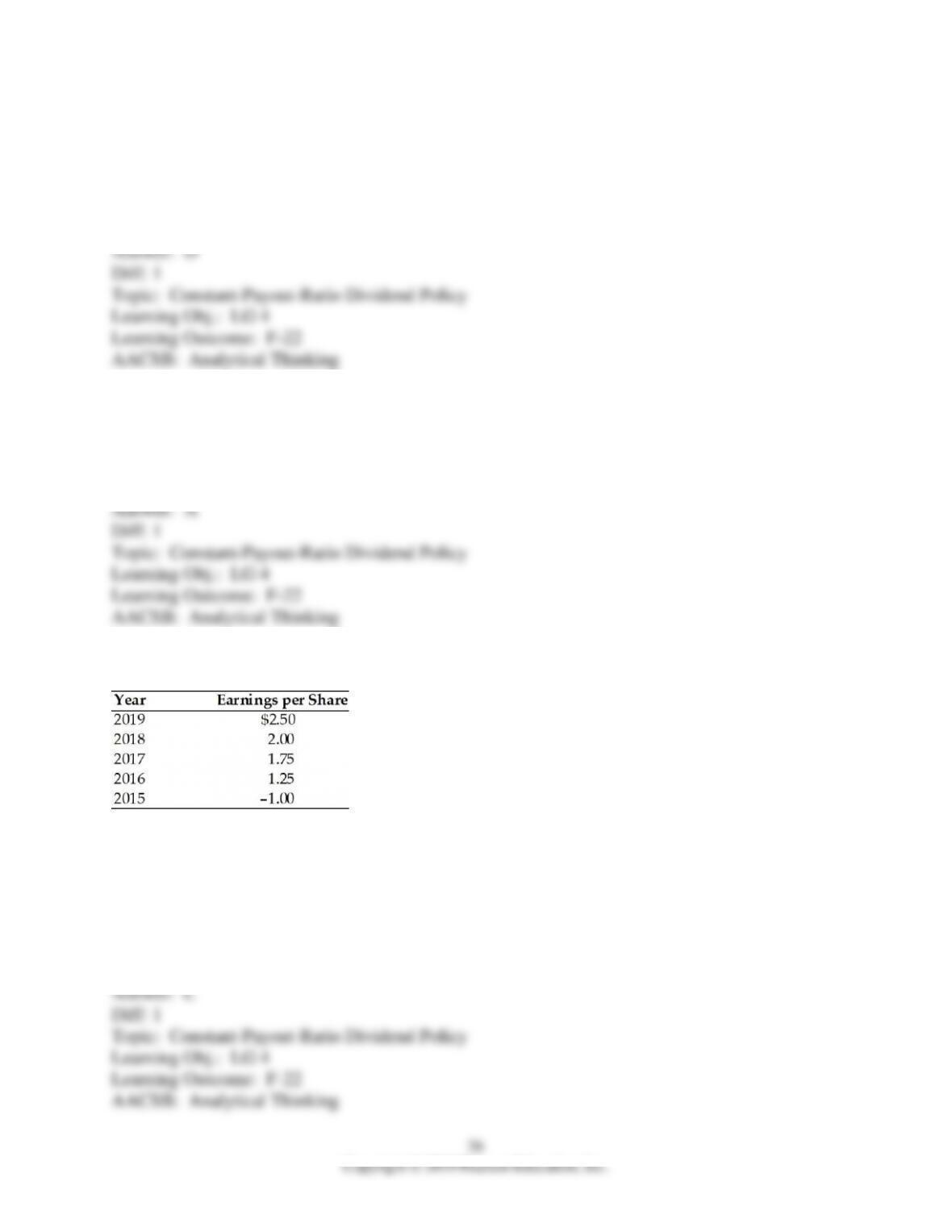

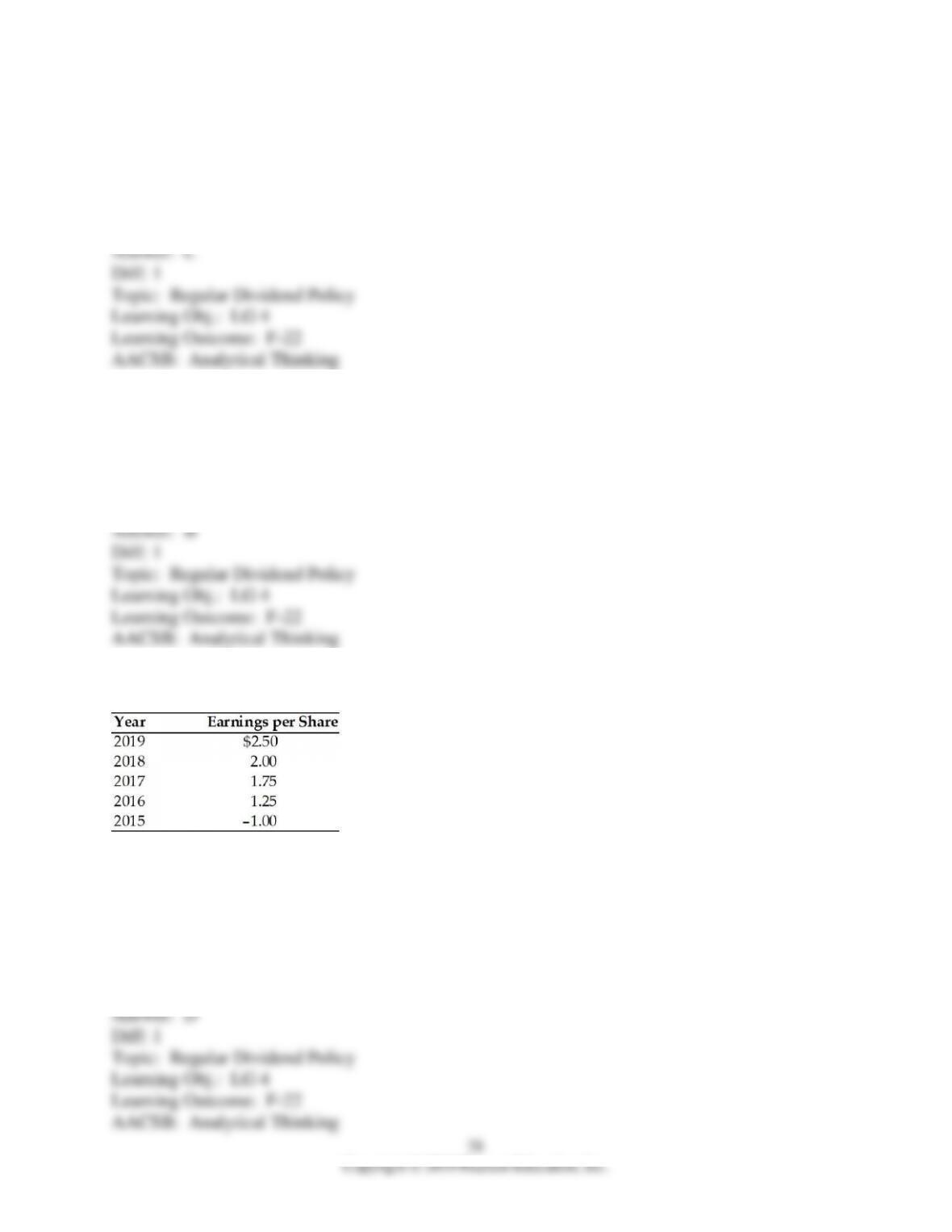

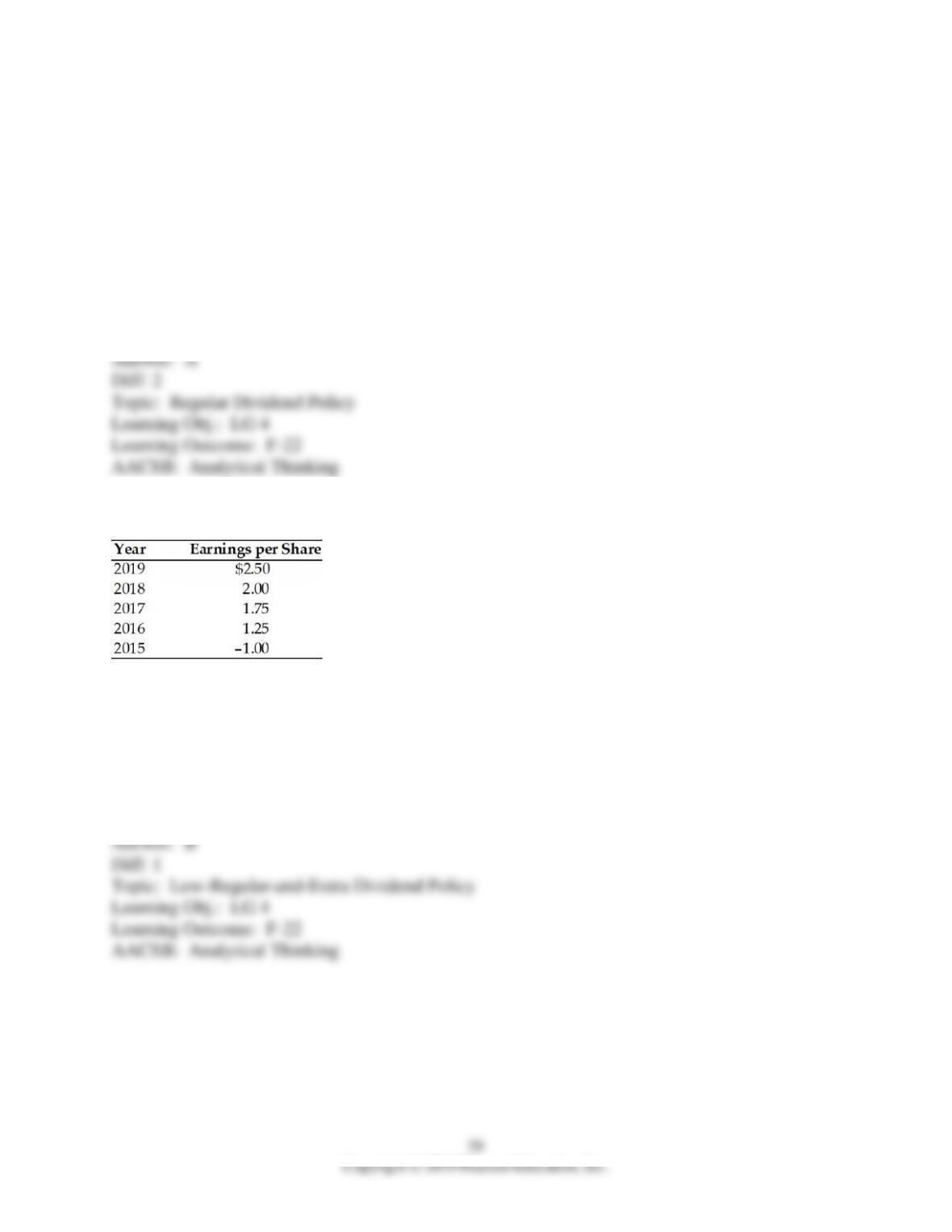

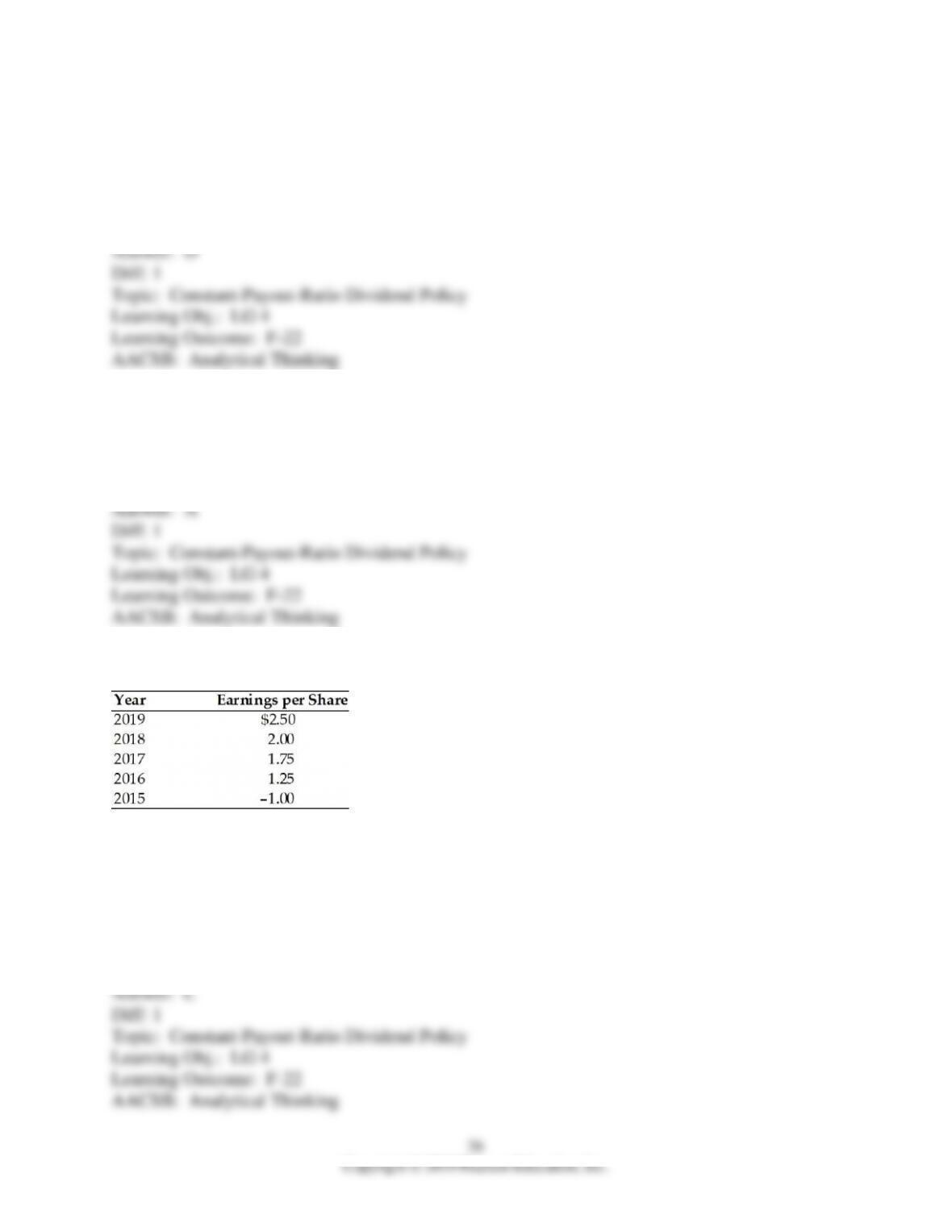

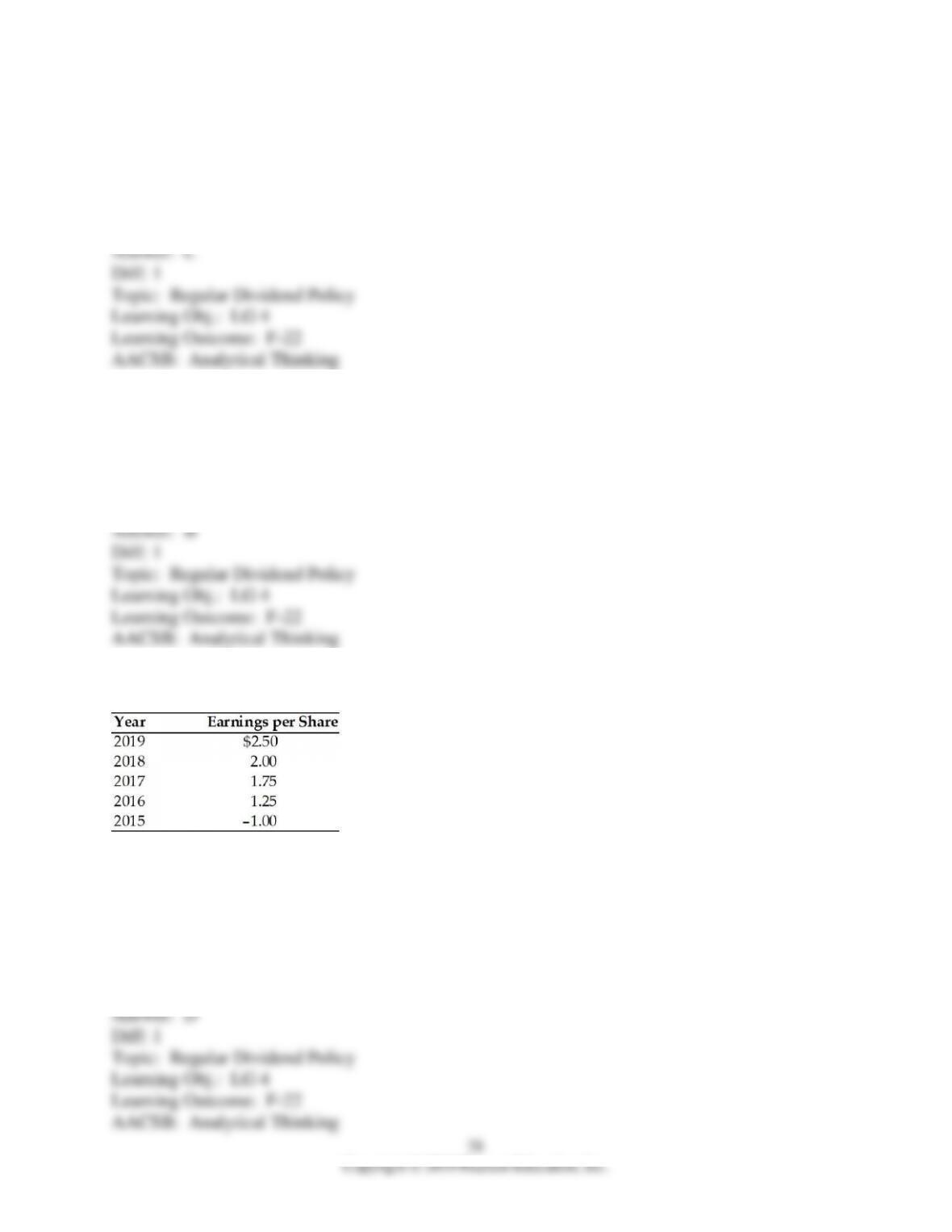

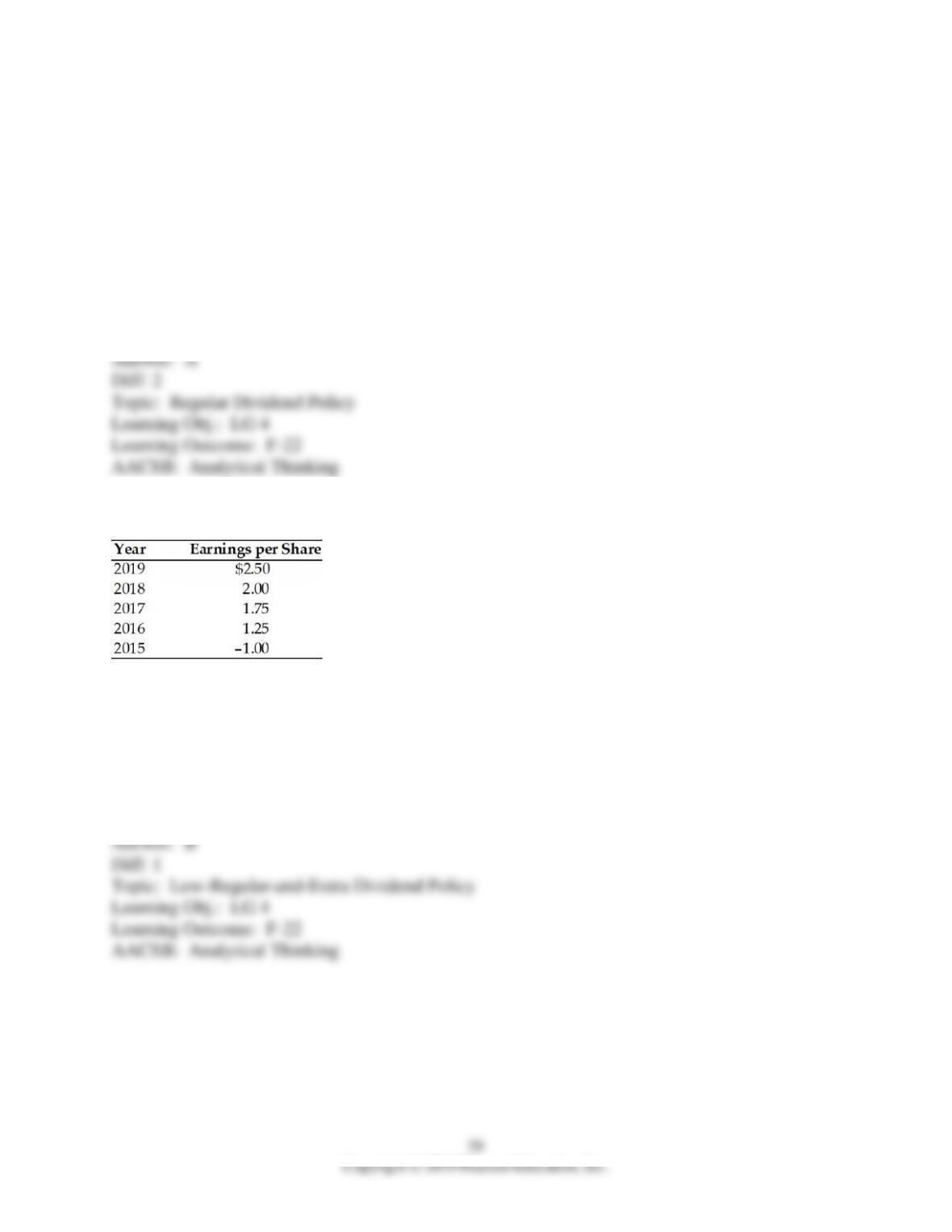

16) A firm has had the following earnings history over the last five years:

If the firm's dividend policy was to pay $0.25 per share each period, except that when earnings

exceed $1.50 the firm pays an extra dividend equal to 50 percent of the earnings above $1.50, the

annual dividends for 2016 and 2019 were ________.

A) $0.25 and $1.25, respectively

B) $0.25 and $0.75, respectively

C) $0 and $0.25, respectively

D) $0.25 and $0.25, respectively