You are considering implementing a lockbox system for your firm. The system is expected to reduce the average collection time by 1.3 days. On an average day, your firm receives 136 checks with an average value of $219 each. The daily interest rate on Treasury bills is 0.021 percent. The bank charge per check is $0.26. What is the anticipated daily cost of the lockbox system?

A. $3.48

B. $6.25

C. $12.60

D. $35.36

E. $36.17

Which one of the following is indicative of a short-term restrictive financial policy?

A. purchasing inventory on an as-needed basis

B. granting credit to all customers

C. investing heavily in marketable securities

D. maintaining a large accounts receivable balance

E. keeping inventory levels high

Which of the following are frequently used as sources of information when trying to ascertain the creditworthiness of a customer?

I. payment history with similar firms

II. credit reports

III. financial statements

IV. information provided by a bank

A. I and III only

B. II and IV only

C. I and II only

D. I, II, and III only

E. I, II, III, and IV

The Daily News published an ad today wherein it announced its desire to purchase shares of a competing newspaper, the Oil Town Gossip. Which one of the following terms is best described by this announcement?

A. merger request

B. consolidation

C. tender offer

D. spinoff

E. divestiture

The Pawn Shop loans money at an annual rate of 23 percent and compounds interest weekly. What is the actual rate being charged on these loans?

A. 25.16 percent

B. 25.80 percent

C. 26.49 percent

D. 26.56 percent

E. 26.64 percent

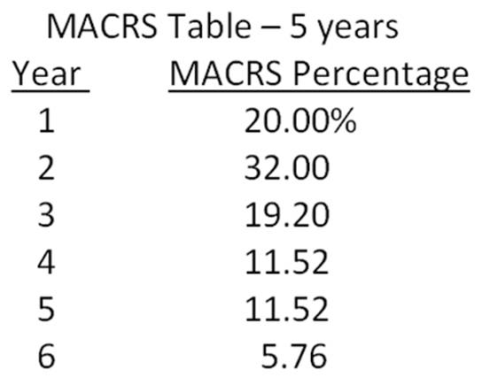

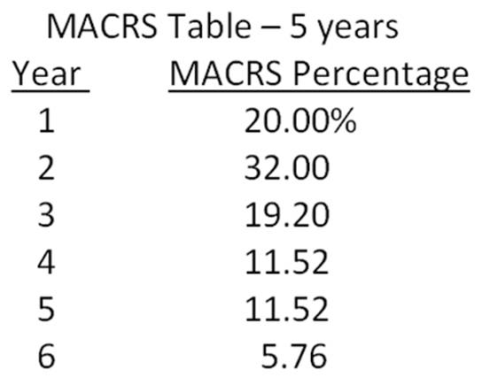

Chapman Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $576,000 is estimated to result in $192,000 in annual pretax cost savings. The press falls in the MACRS 5-year class, and it will have a salvage value at the end of the project of $84,000. The press also requires an initial investment in spare parts inventory of $24,000, along with an additional $3,600 in inventory for each succeeding year of the project. The inventory will return to its original level when the project ends. The shop’s tax rate is 35 percent and its discount rate is 11 percent. Should the firm buy and install the machine press? Why or why not?

A. no; The net present value is -$7,489.

B. no; The net present value is -$667.

C. yes; The net present value is $211.

D. yes; The net present value is $4,319.

E. yes; The net present value is $8,364.

Which of the following balance sheet accounts are affected by a small stock dividend?

I. cash

II. common stock

III. retained earnings

IV. capital in excess of par value

A. I and III only

B. II and III only

C. II and IV only

D. II, III, and IV only

E. I, II, III, and IV

Sensitivity analysis is based on:

A. varying a single variable and measuring the resulting change in the NPV of a project.

B. applying differing discount rates to a project’s cash flows and measuring the effect on the NPV.

C. expanding and contracting the number of years for a project to determine the optimal project length.

D. the best, worst, and most expected situations.

E. various states of the economy and the probability of each state occurring.

Which one of the following statements related to warrants is correct?

A. Warrants are generally issued as an attachment to publicly-issued bonds.

B. Warrants are excluded from trading on an organized exchange.

C. Warrants are structured as long-term put options.

D. Warrants are issued by individual investors.

E. Warrants are generally added as an incentive to a private debt issue.

You would like to establish a trust fund that will provide $120,000 a year forever for your heirs. The trust fund is going to be invested very conservatively so the expected rate of return is only 5.75 percent. How much money must you deposit today to fund this gift for your heirs?

A. $2,086,957

B. $2,121,212

C. $2,300,000

D. $2,458,122

E. $2,500,000

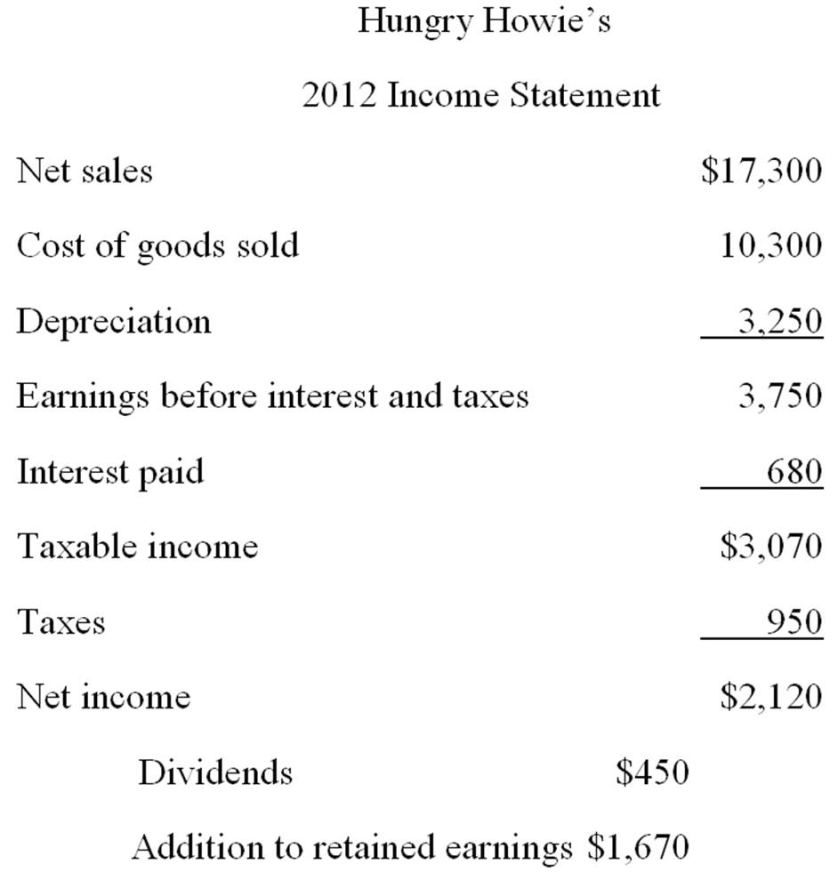

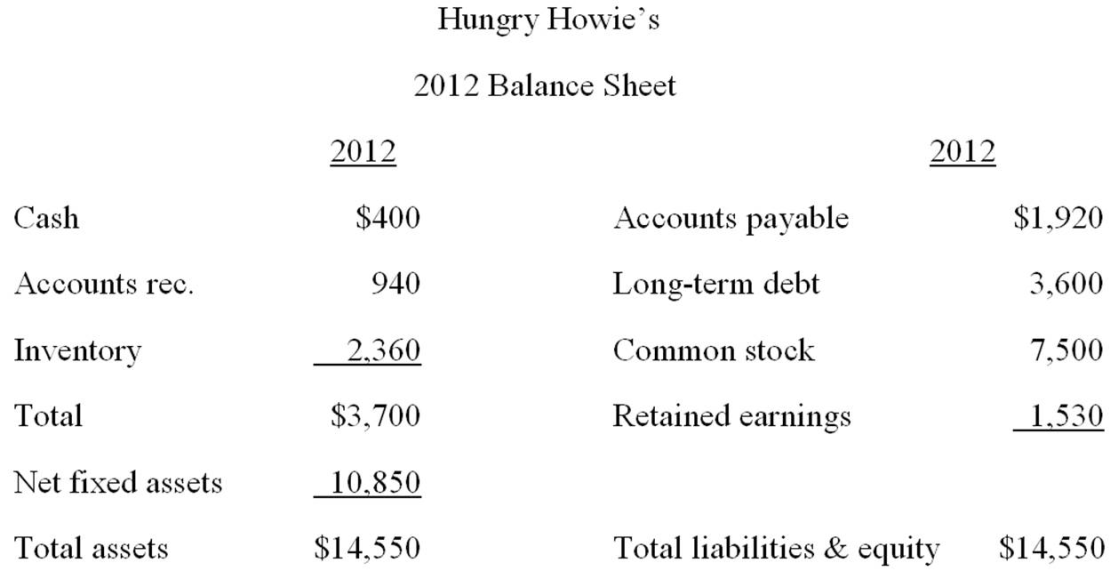

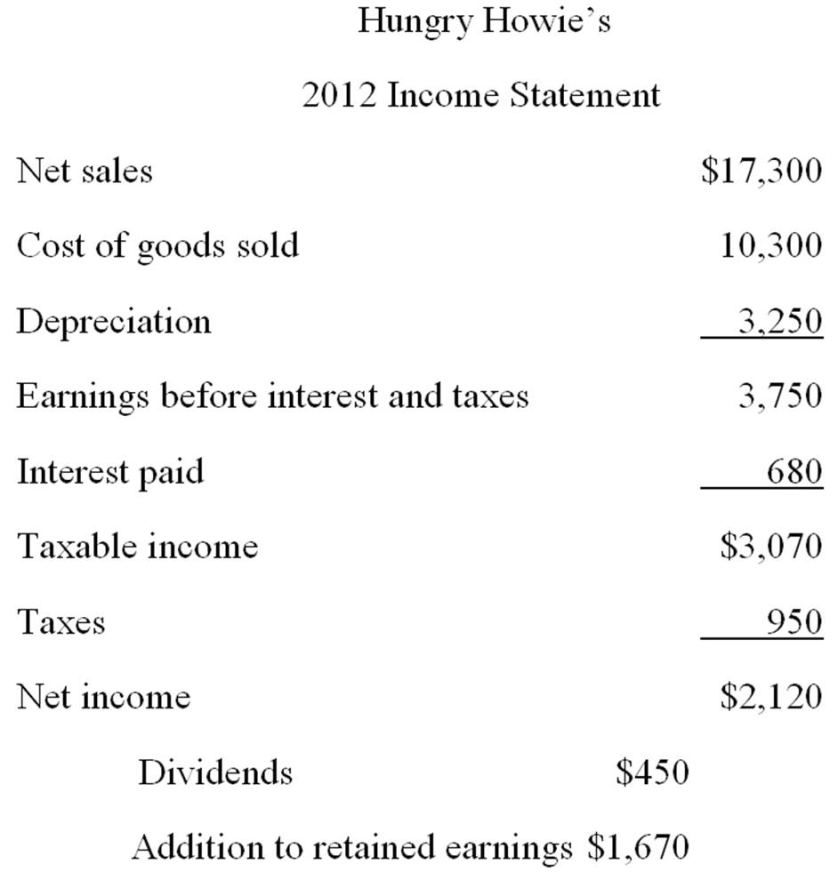

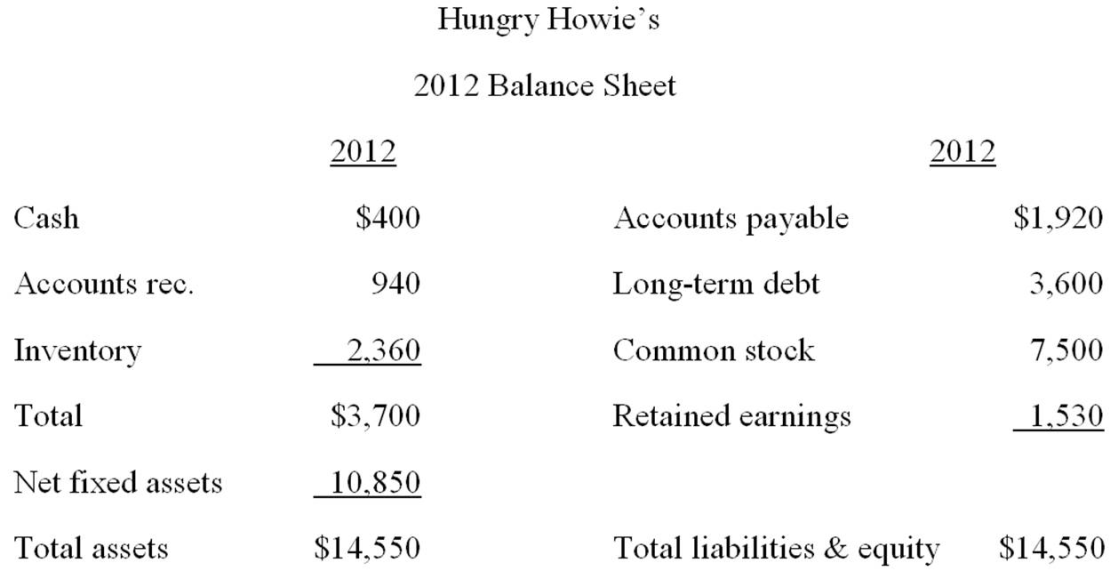

Hungry Howie’s is currently operating at 80 percent of capacity. What is the full-capacity level of sales?

A. $21,106.00

B. $21,580.62

C. $21,625.00

D. $24,506.17

E. $25,301.91

Kelso’s has a debt-equity ratio of 0.6 and a tax rate of 35 percent. The firm does not issue preferred stock. The cost of equity is 14.5 percent and the aftertax cost of debt is 4.8 percent. What is the weighted average cost of capital?

A. 10.46 percent

B. 10.67 percent

C. 10.86 percent

D. 11.38 percent

E. 11.57 percent

You own a bond that has a 6 percent annual coupon and matures 5 years from now. You purchased this 10-year bond at par value when it was originally issued. Which one of the following statements applies to this bond if the relevant market interest rate is now 5.8 percent?

A. The current yield-to-maturity is greater than 6 percent.

B. The current yield is 6 percent.

C. The next interest payment will be $30.

D. The bond is currently valued at one-half of its issue price.

E. You will realize a capital gain on the bond if you sell it today.

An increase in which one of the following is an indicator that an accounts receivable policy is becoming more restrictive?

A. bad debts

B. accounts receivable turnover rate

C. accounts receivable period

D. credit sales

E. operating cycle

Brown Trucking is buying a U.S. Treasury bill today with the understanding that the seller will buy it back tomorrow at a slightly higher price. This investment is known as a:

A. commercial paper transaction.

B. repurchase agreement.

C. private certificate of deposit.

D. revenue anticipation note.

E. bill anticipation note.

A project has an initial cost of $27,400 and a market value of $32,600. What is the difference between these two values called?

A. net present value

B. internal return

C. payback value

D. profitability index

E. discounted payback

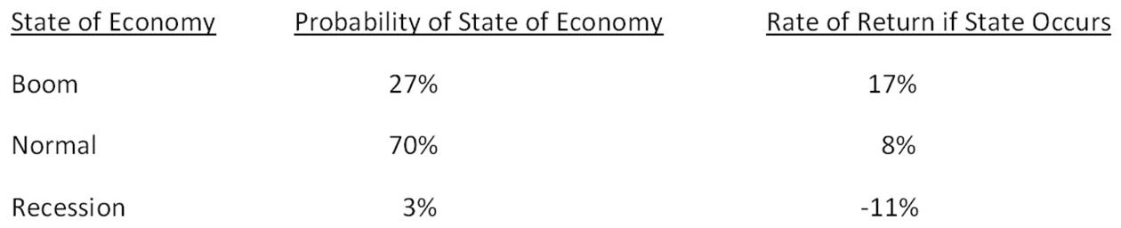

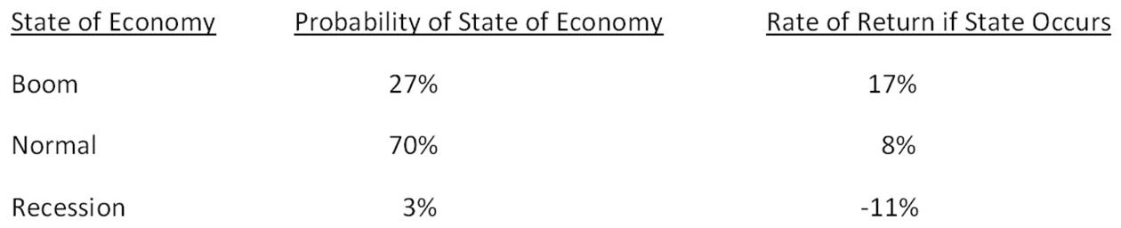

You own a portfolio with the following expected returns given the various states of the economy. What is the overall portfolio expected return?

A. 6.49 percent

B. 8.64 percent

C. 8.87 percent

D. 9.86 percent

E. 10.23 percent

The equity of Blooming Roses has a total market value of $16,000. Currently, the firm has excess cash of $1,400 and net income of $15,400. There are 750 shares of stock outstanding. What will be the percentage change in the stock price per share if the firm pays out all of its excess cash as a cash dividend?

A. -9.40 percent

B. -8.75 percent

C. -7.50 percent

D. -2.75 percent

E. 0.00 percent

Suppose that the first comic book of a classic series was sold in 1954. In 2000, the estimated price for this comic book in good condition was about $340,000. This represented a return of 27 percent per year. For this to be true, what was the original price of the comic book in 1954?

A. $5.00

B. $5.28

C. $5.50

D. $5.71

E. $6.00

Downtown Bank is offering 2.2 percent compounded daily on its savings accounts. You deposit $8,000 today. How much will you have in your account 11 years from now?

A. $10,190.28

B. $10,714.06

C. $11,204.50

D. $11,336.81

E. $11,414.14

Alpha is planning on merging with Beta. Alpha will pay Beta’s shareholders the current value of their stock in shares of Alpha. Alpha currently has 4,200 shares of stock outstanding at a market price of $40 a share. Beta has 2,500 shares outstanding at a price of $18 a share. The after-merger earnings will be $8,800. What will the earnings per share be after the merger?

A. $1.61

B. $1.65

C. $1.75

D. $1.81

E. $1.86

The absolute priority rule determines:

A. when a firm must be declared officially bankrupt.

B. how a distressed firm is reorganized.

C. which judge is assigned to a particular bankruptcy case.

D. how long a reorganized firm is allowed to remain under bankruptcy protection.

E. which parties receive payment first in a bankruptcy proceeding.

Which one of the following statements is correct for a firm that uses debt in its capital structure?

A. The WACC should decrease as the firm’s debt-equity ratio increases.

B. When computing the WACC, the weight assigned to the preferred stock is based on the coupon rate multiplied by the par value of the preferred.

C. The firm’s WACC will decrease as the corporate tax rate decreases.

D. The weight of the common stock used in the computation of the WACC is based on the number of shares outstanding multiplied by the book value per share.

E. The WACC will remain constant unless a firm retires some of its debt.

You want to import $147,000 worth of rugs from India. How many rupees will you need to pay for this purchase if one rupee is worth $0.0203?

A. Rs 6,887,424

B. Rs 7,238,911

C. Rs 7,241,379

D. Rs 8,367,594

E. Rs 8,415,096

Jasper Metals is considering installing a new molding machine which is expected to produce operating cash flows of $73,000 a year for 7 years. At the beginning of the project, inventory will decrease by $16,000, accounts receivables will increase by $21,000, and accounts payable will increase by $15,000. All net working capital will be recovered at the end of the project. The initial cost of the molding machine is $249,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. The equipment will be salvaged at the end of the project creating a $48,000 aftertax cash flow. At the end of the project, net working capital will return to its normal level. What is the net present value of this project given a required return of 14.5 percent?

A. $77,211.20

B. $79,418.80

C. $82,336.01

D. $84,049.74

E. $87,925.54

North Side Wholesalers has sales of $948,000. The cost of goods sold is equal to 68 percent of sales. The firm has an average inventory of $23,000. How many days on average does it take the firm to sell its inventory?

A. 12.30 days

B. 13.02 days

C. 16.48 days

D. 26.35 days

E. 29.68 days

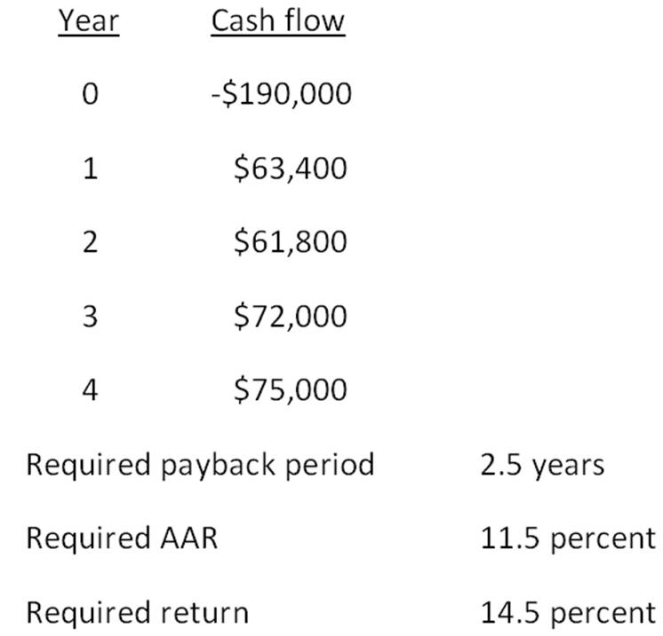

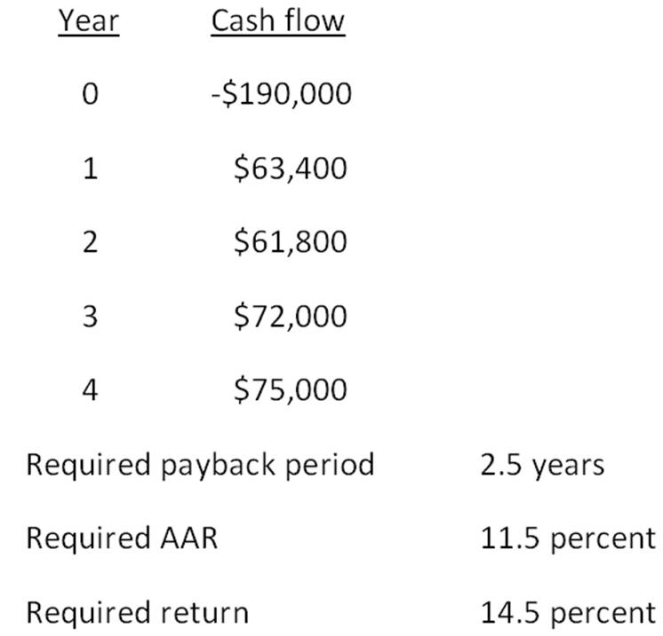

You are analyzing a project and have gathered the following data:

Based on the net present value of _____, you should _____ the project.

A. -$2,030.75; reject

B. -$1,995.84; reject

C. -$283.60; accept

D. $3,283.60; accept

E. $4,109.37; accept

Which one of the following statements is correct?

A. The value of a call decreases as the price of the underlying stock increases.

B. The value of a call increases as the exercise price decreases.

C. The value of a put increases as the price of the underlying stock increases.

D. The value of a put decreases as the exercise price increases.

E. The intrinsic value of a put must be zero on the expiration date.

Which one of the following best defines synergy given the following?

V

A = Value of firm A

V

B = Value of firm B

V

AB = Value of merged firm AB

A. (VA + VB) – VAB

B. VAB – (VA + VB)

C. greater of 0 or (VA + VB) – VAB

D. greater of 0 or VAB – (VA + VB)

E. greater of 0 or VAB

AA Tours is comparing two capital structures to determine how to best finance its operations. The first option consists of all equity financing. The second option is based on a debt-equity ratio of 0.45. What should AA Tours do if its expected earnings before interest and taxes (EBIT) are less than the break-even level? Assume there are no taxes.

A. select the leverage option because the debt-equity ratio is less than 0.50

B. select the leverage option since the expected EBIT is less than the break-even level

C. select the unlevered option since the debt-equity ratio is less than 0.50

D. select the unlevered option since the expected EBIT is less than the break-even level

E. cannot be determined from the information provided

The type of exchange rate risk known as translation exposure is best described as:

A. the risk that a positive net present value (NPV) project could turn into a negative NPV project because of changes in the exchange rate between two countries.

B. the problem encountered by an accountant of an international firm who is trying to record balance sheet account values.

C. the fluctuation in prices faced by importers of foreign goods.

D. the variance in relative pay rates based on the currency used to pay an employee.

E. the variance between the revenue of an exporter who uses forward rates and an equivalent exporter who does not use forward rates.

The current market value of the assets of Cristopherson Supply is $46.5 million. The market value of the equity is $28.7 million. The risk-free rate is 4.75 percent and the outstanding debt matures in 4 years. What is the market value of the firm’s debt?

A. $17.80 million

B. $19.80 million

C. $20.23 million

D. $22.66 million

E. $23.01 million

A stock has annual returns of 5 percent, 21 percent, -12 percent, 7 percent, and -6 percent for the past five years. The arithmetic average of these returns is _____ percent while the geometric average return for the period is _____ percent.

A. 3.89; 3.62

B. 3.89; 4.60

C. 3.62; 3.89

D. 4.60; 3.62

E. 4.60; 3.89