WESTERN MINDANAO STATE UNIVERSITY

ACCOUNTANCY DEPARTMENT

COLLEGE OF LIBERAL ARTS

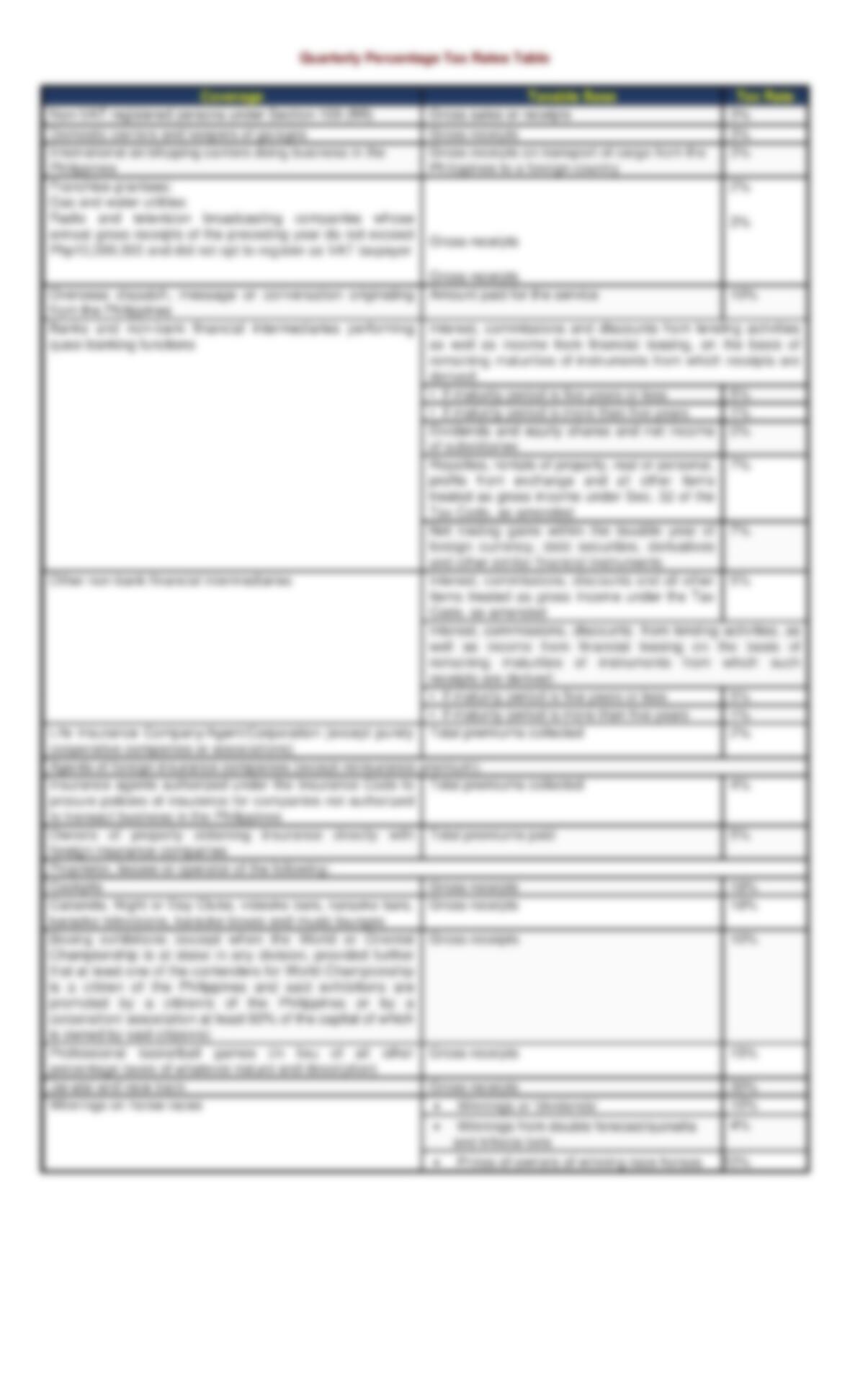

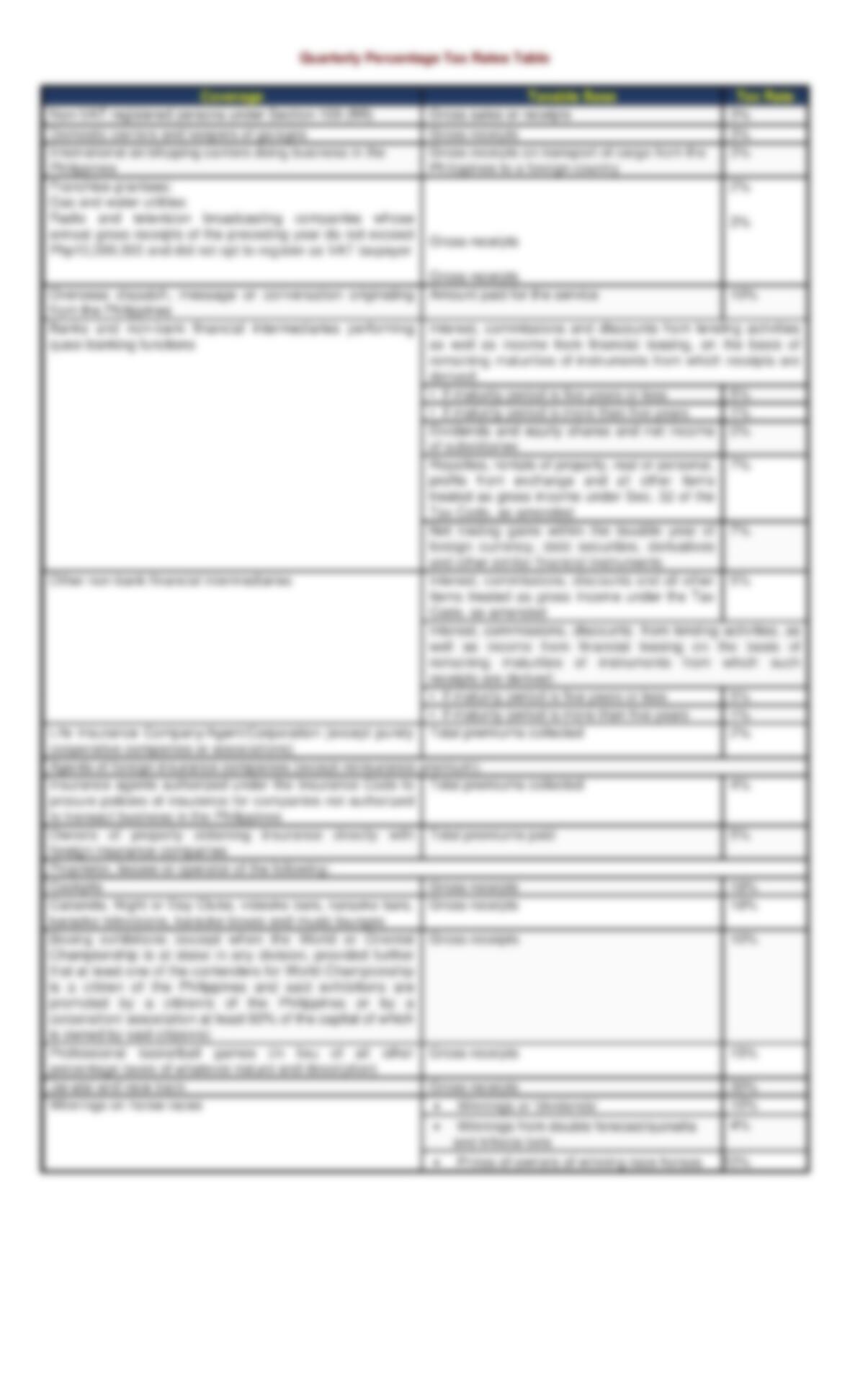

Business Taxes (Percentage tax)

Percentage tax is a business tax that is other than 12%. PT and VAT are mutually exclusive, meaning that if a

good/service is subject to VAT it can’t be subject to PT. Isa lang dapat But this doesn’t pertain to the

business itself. A business can have goods/services subject to VAT and as well as subject to PT.

Unlike VAT, PT is a direct tax to the seller. This means that PT is paid by the seller and is not allowed to shift it

to the buyer. You can see VAT as a breakdown in the invoices that you receive from VAT-registered

establishments but you can’t see PT as a breakdown right? This explains why.

Persons refer to individuals and non-individuals, which include, but are not limited to, estates, trusts,

partnerships, and corporations.

1. Persons, who are not VAT-registered, who sell goods, properties or services, whose annual gross sales

and/or receipts do not exceed three million pesos (Php3,000,000.00) and are exempt from value-added

tax (VAT) under Section 109 (BB) of the National Internal Revenue Code, as amended by Republic Act

(RA) No. 10963.

2. Persons who lease residential units where the monthly rental per unit exceeds fifteen thousand pesos

(Php15,000.00) but the aggregate of such rentals of the lessor during the year does not exceed three

million pesos (Php3,000,000.00)

3. Persons engaged in the following industries/transactions:

• Cars for rent or hire driven by the lessee, transportation contractors, including persons who

transport passengers for hire, and other domestic carriers by land for the transport of

passengers (except owners of bancas and owners of animal-drawn two-wheeled vehicle) and

keepers of garages

• International air/shipping carriers doing business in the Philippines on their gross receipts

derived from transport of cargo from the Philippines to another country