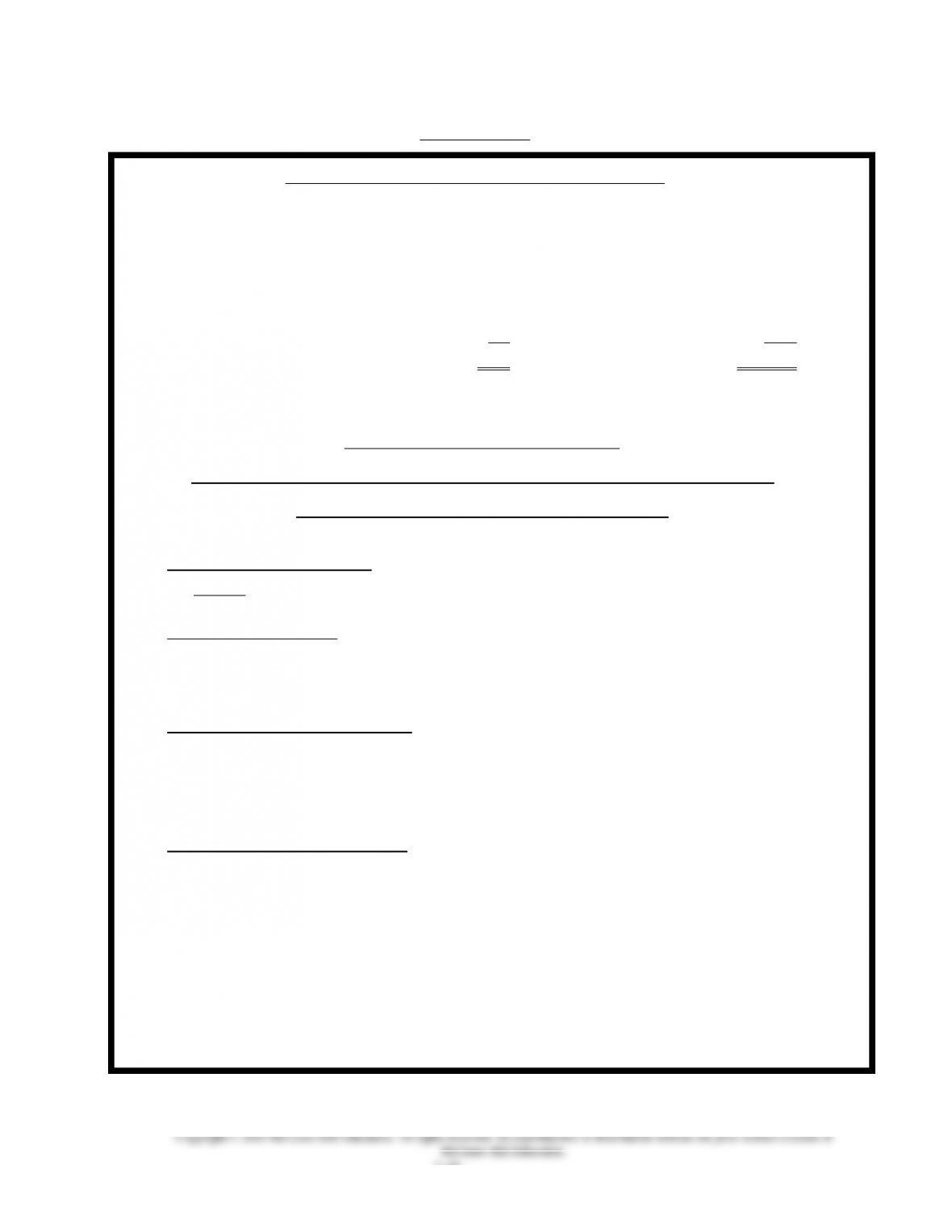

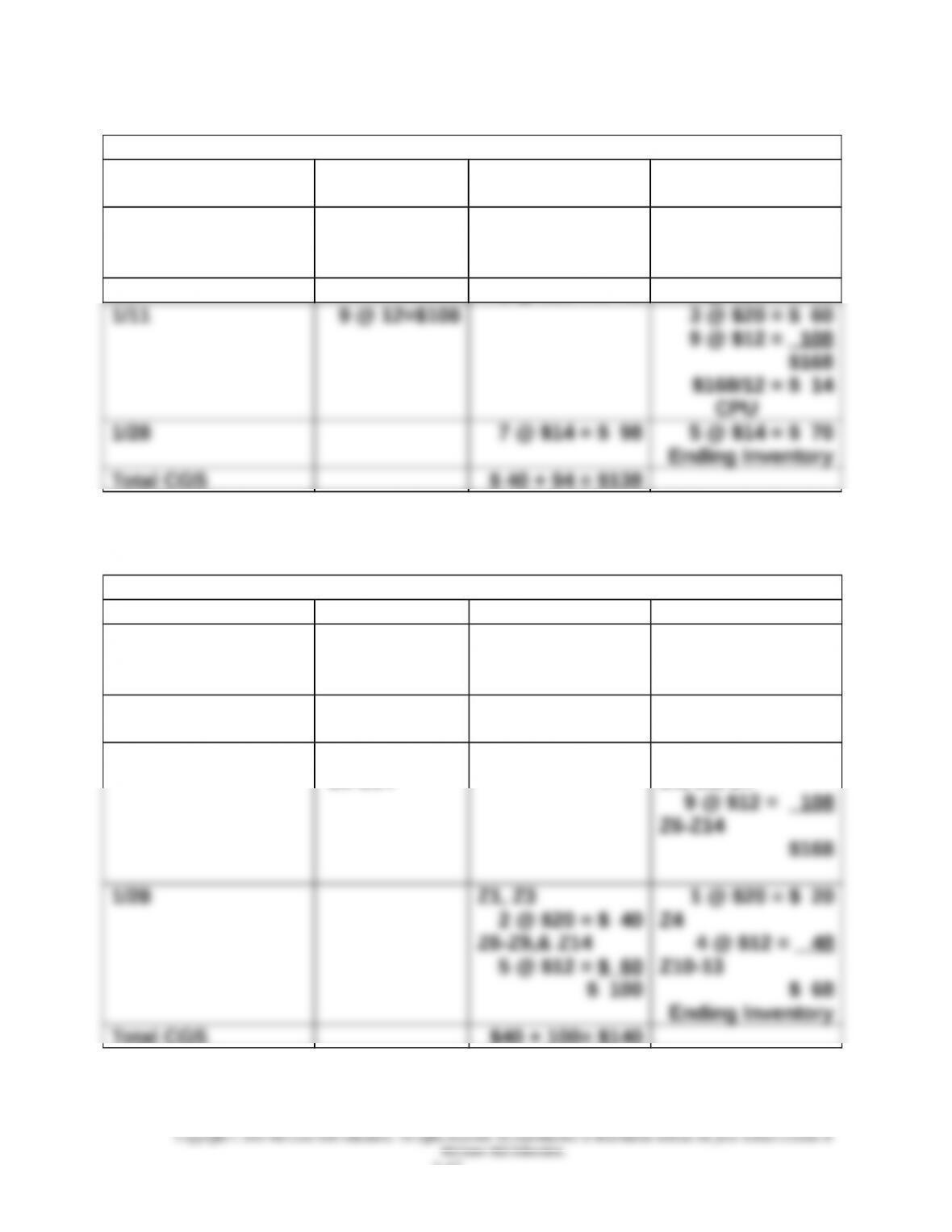

VISUAL #5-2

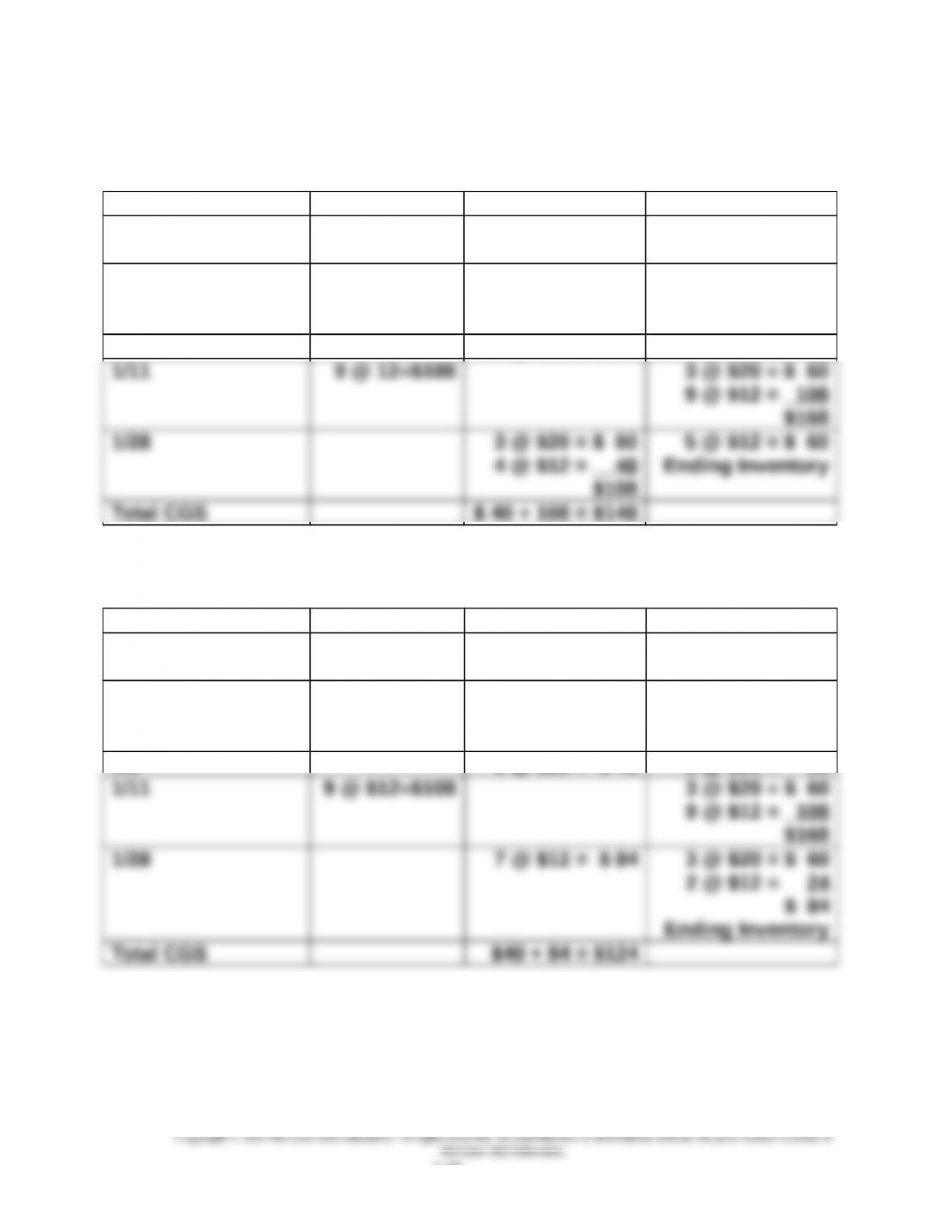

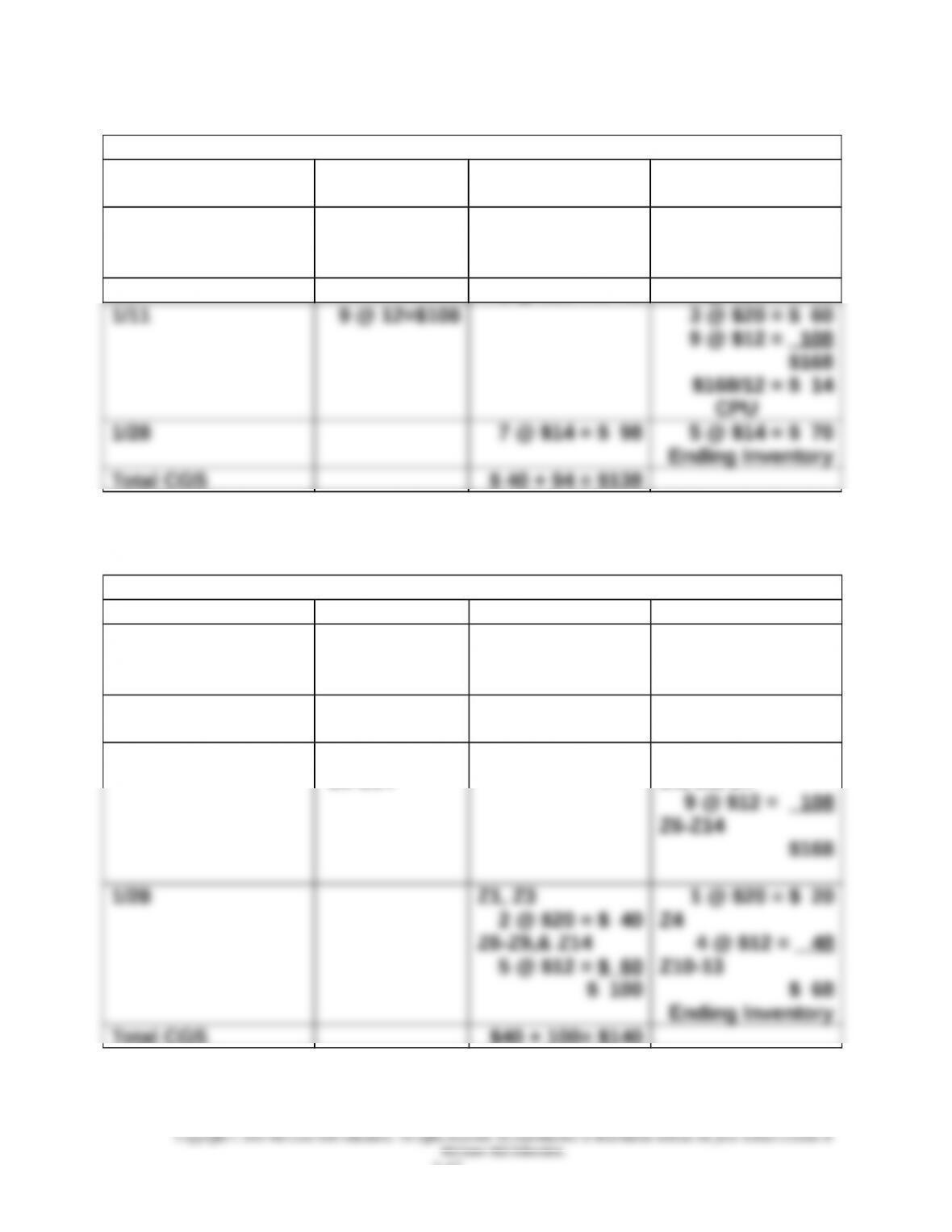

Schedule of Cost of Goods Available

Units Cost* Total

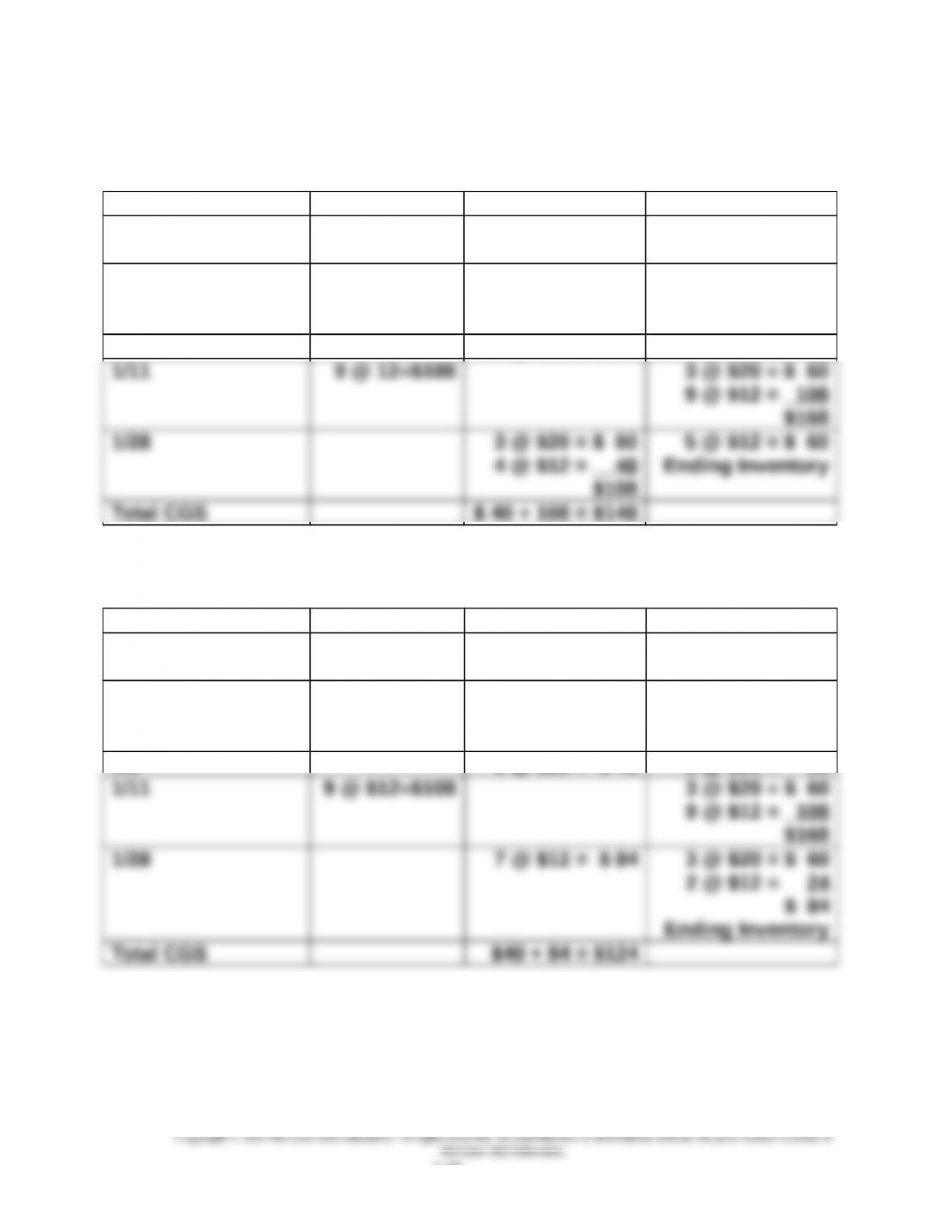

Jan. 1 Beginning Inventory 60 @ $10 = $ 600

Mar. 27 Purchase 90 @ 11 = 990

Aug. 15 Purchase 100 @ 13 = 1,300

Nov. 6 Purchase 50 @ 16 = 800

Goods available for sale 300 $3,690

Units in physical count at year end 70

*CPU= Cost per unit

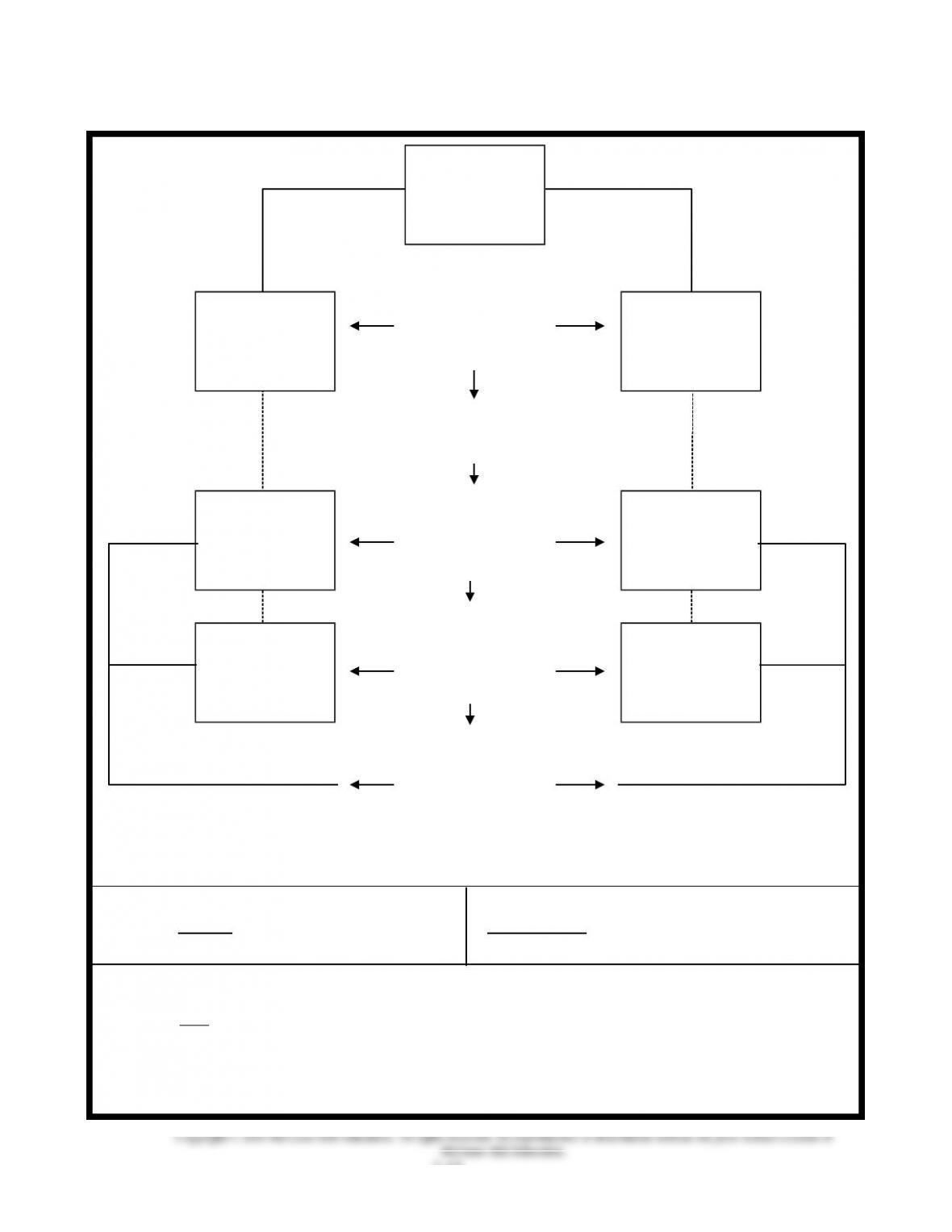

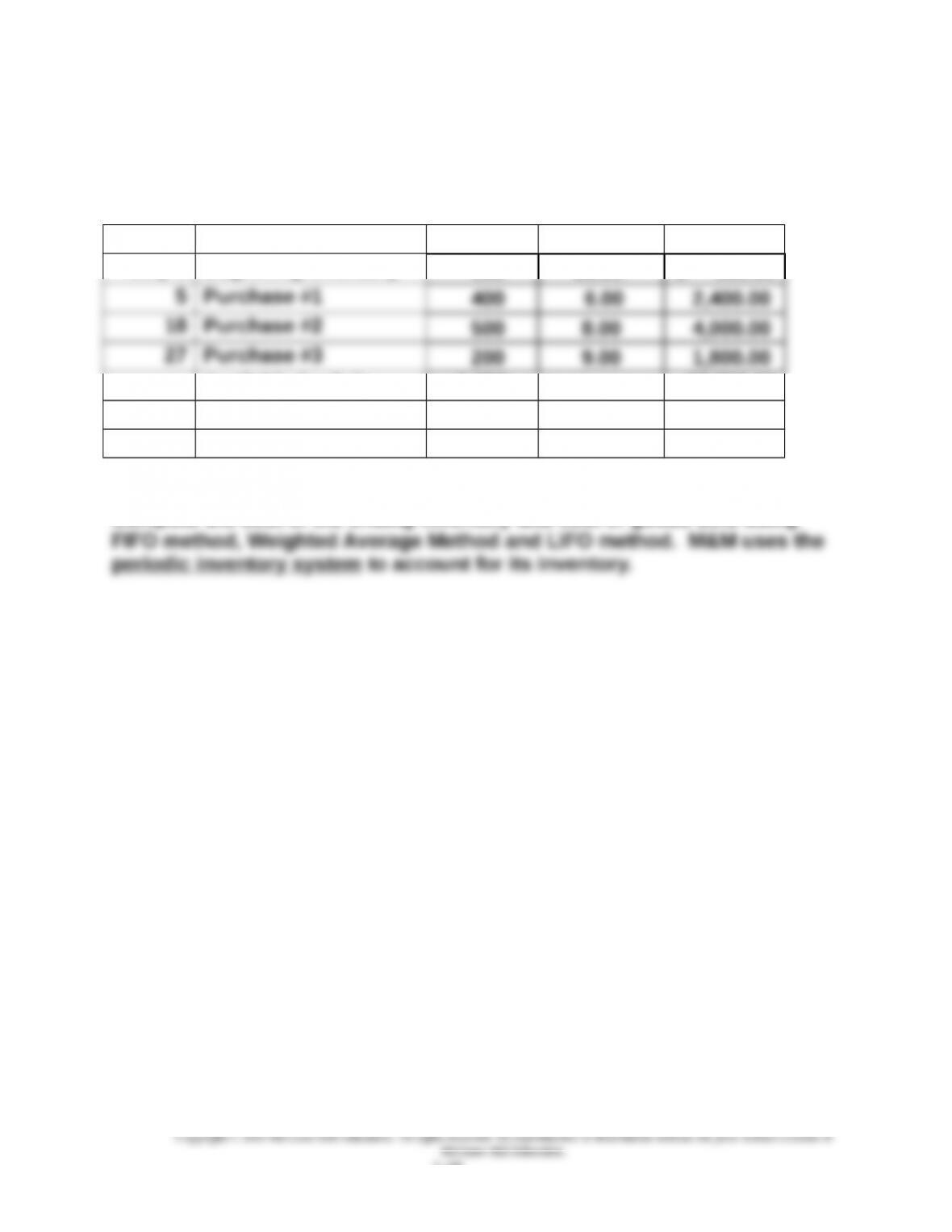

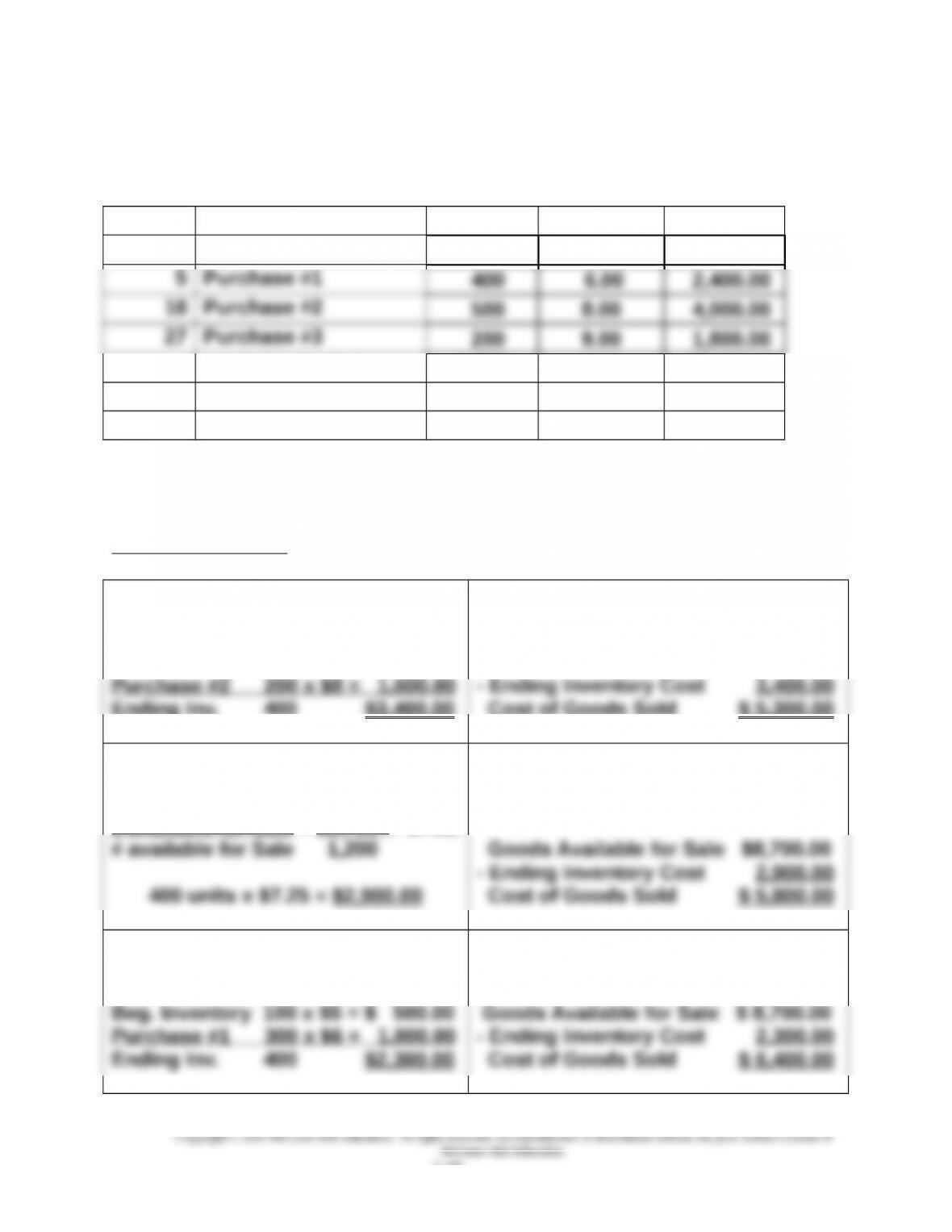

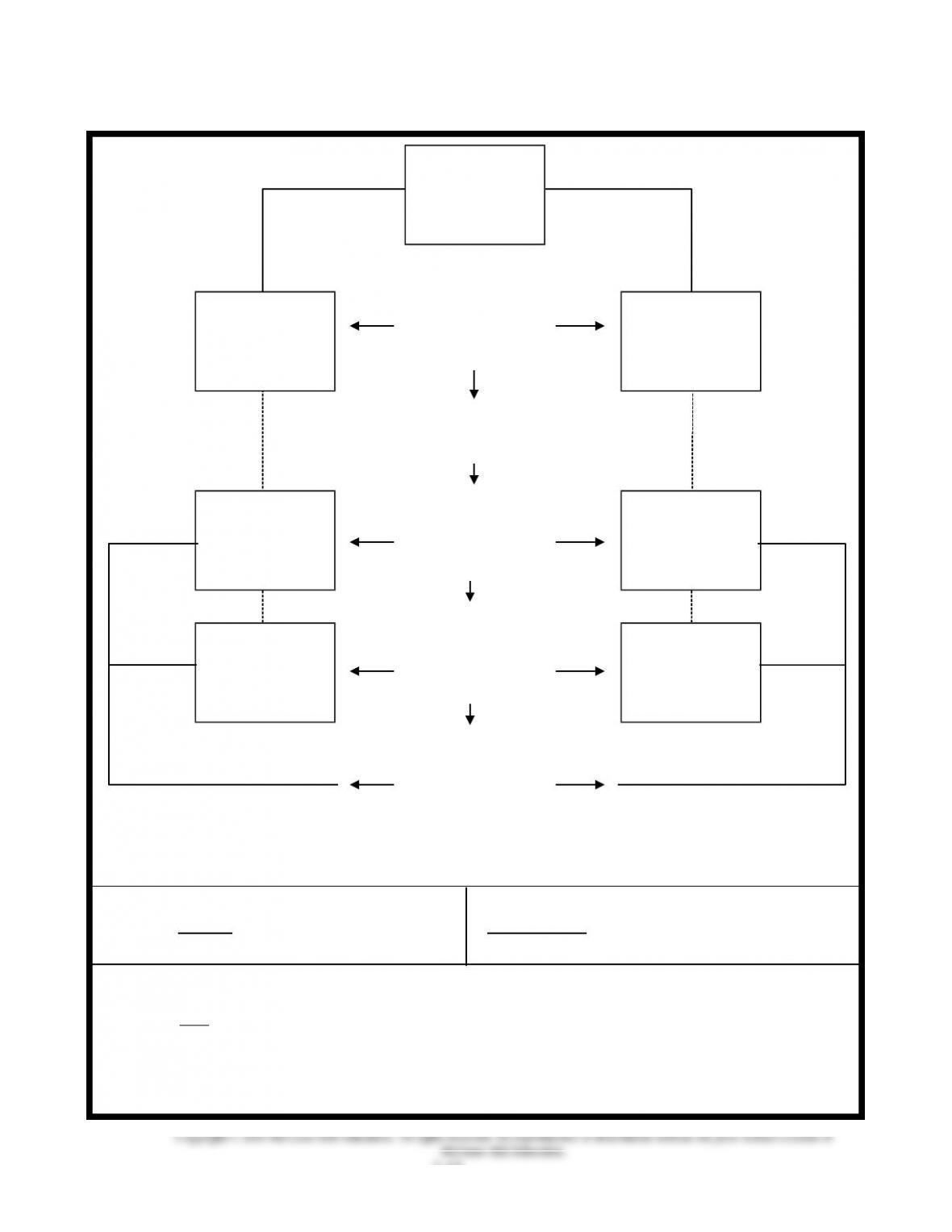

Cost Flow Assumptions or

Methods of Assigning Cost to Units in Ending Inventory

(Using a Periodic Inventory System)

(1) Specific Identification - requires that each item in an inventory be assigned

its actual invoice cost.

(2) Weighted Average - a weighted average cost per unit is determined based

on total cost and units of goods available for sale. This cost is assigned to

units in the ending inventory.

(3) First-in, First-out (FIFO) - assumes the first units acquired (beginning

inventory) are the first to be sold and that additional sales flow is in the order

purchased. Therefore, the costs of the last items received are assigned to the

ending inventory.

(4) Last-in, First-out (LIFO) - assumes the last units acquired (most recent

purchase) are the first units sold. Therefore, the cost of the first items

acquired (starting with beginning inventory) is assigned to the ending

inventory.

Note: In all methods, Cost of Good Sold equals Cost of Good Available minus

Ending Inventory (as computed by chosen method).

5-11