6) A permanent increase in the domestic money supply

A) must ultimately lead to a proportional decrease in E, and, therefore, the expected future

exchange rate must rise proportionally.

B) must ultimately lead to a proportional decrease in E, and, therefore, the expected future

exchange rate must decrease proportionally.

C) must ultimately lead to a proportional rise in E, and, therefore, the expected future exchange

rate must rise proportionally.

D) must ultimately lead to a proportional rise in E, and, therefore, the expected future exchange

rate must rise more than proportionally.

E) must ultimately lead to a proportional rise in E, and, therefore, the expected future exchange

rate must rise less than proportionally.

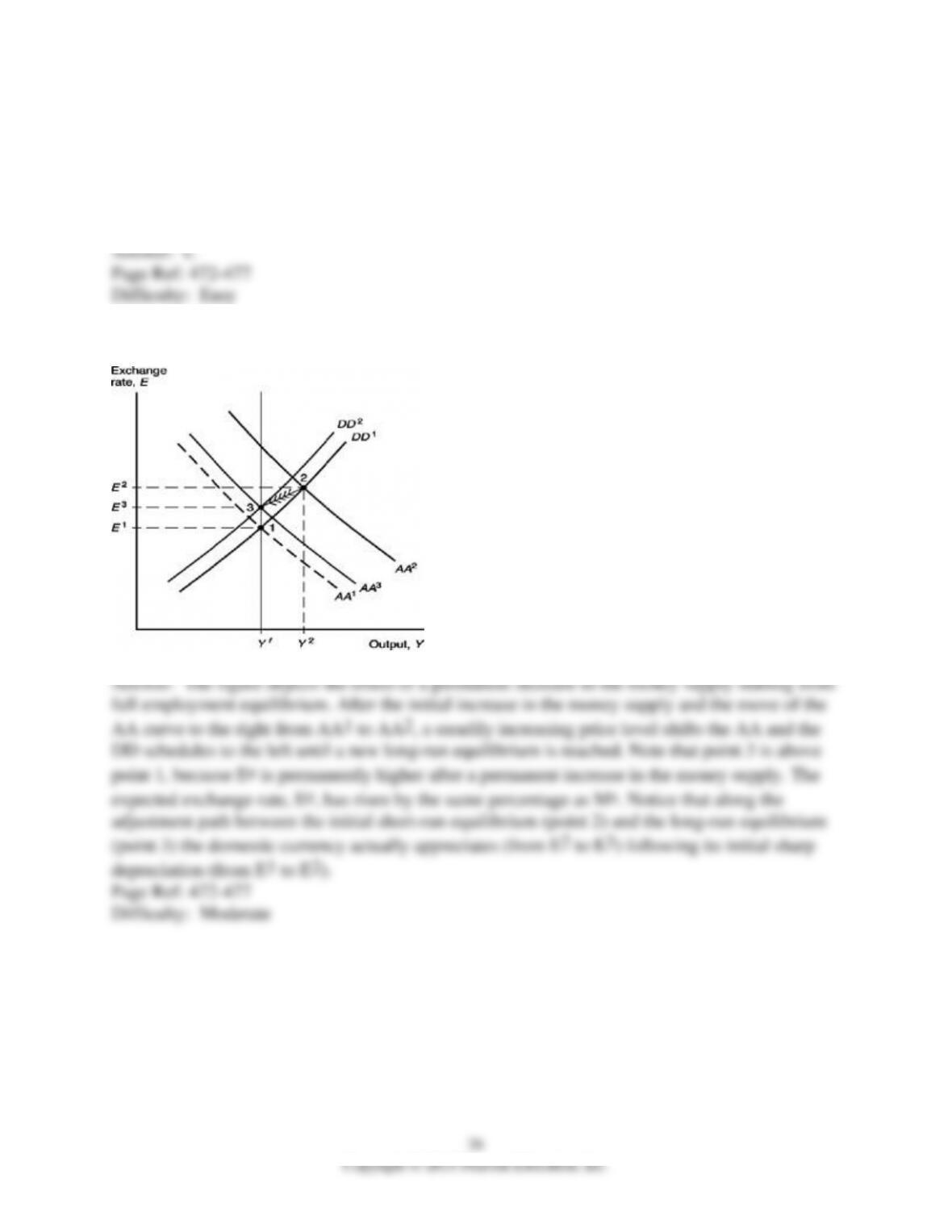

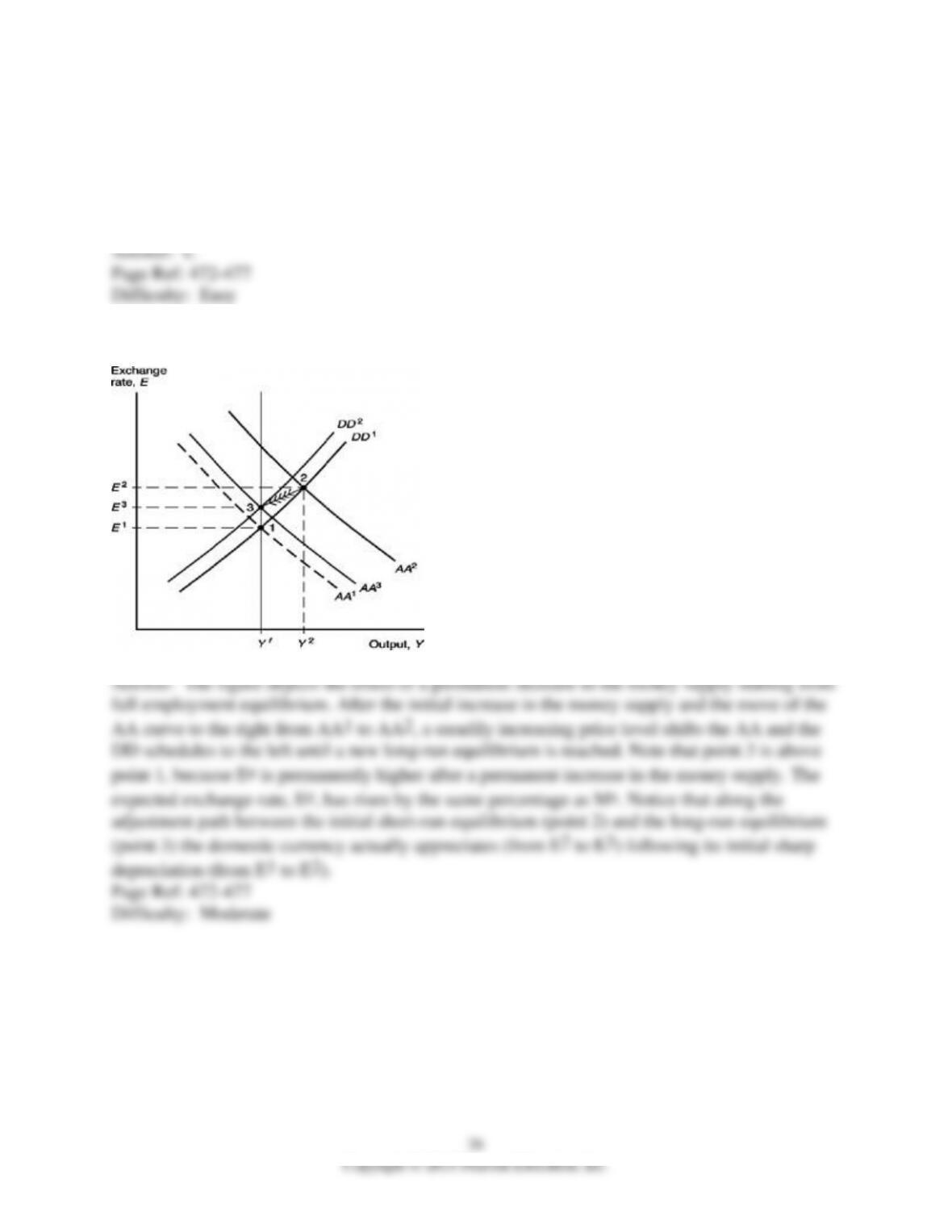

7) In the short run, a permanent increase in the domestic money supply causes

A) a greater upward shift in the DD curve than that caused by an equal, but transitory, increase.

B) a greater downward shift in the AA curve than that caused by an equal, but transitory,

increase.

C) an smaller upward shift in the AA curve than that caused by an equal, but transitory, increase.

D) a smaller downward shift in the AA curve than that caused by an equal, but transitory,

increase.

E) a greater upward shift in the AA curve than that caused by an equal, but transitory, increase.

8) In the short run, a permanent increase in the domestic money supply

A) has stronger effects on the exchange rate and output than an equal temporary increase.

B) has stronger effects only on the exchange rate but not on output than an equal temporary

increase.

C) has weaker effects on the exchange rate and output than an equal temporary increase.

D) has stronger effects on output, but lower effect the exchange rate than an equal temporary

increase.

E) has weaker effects only on the exchange rate than an equal temporary increase.