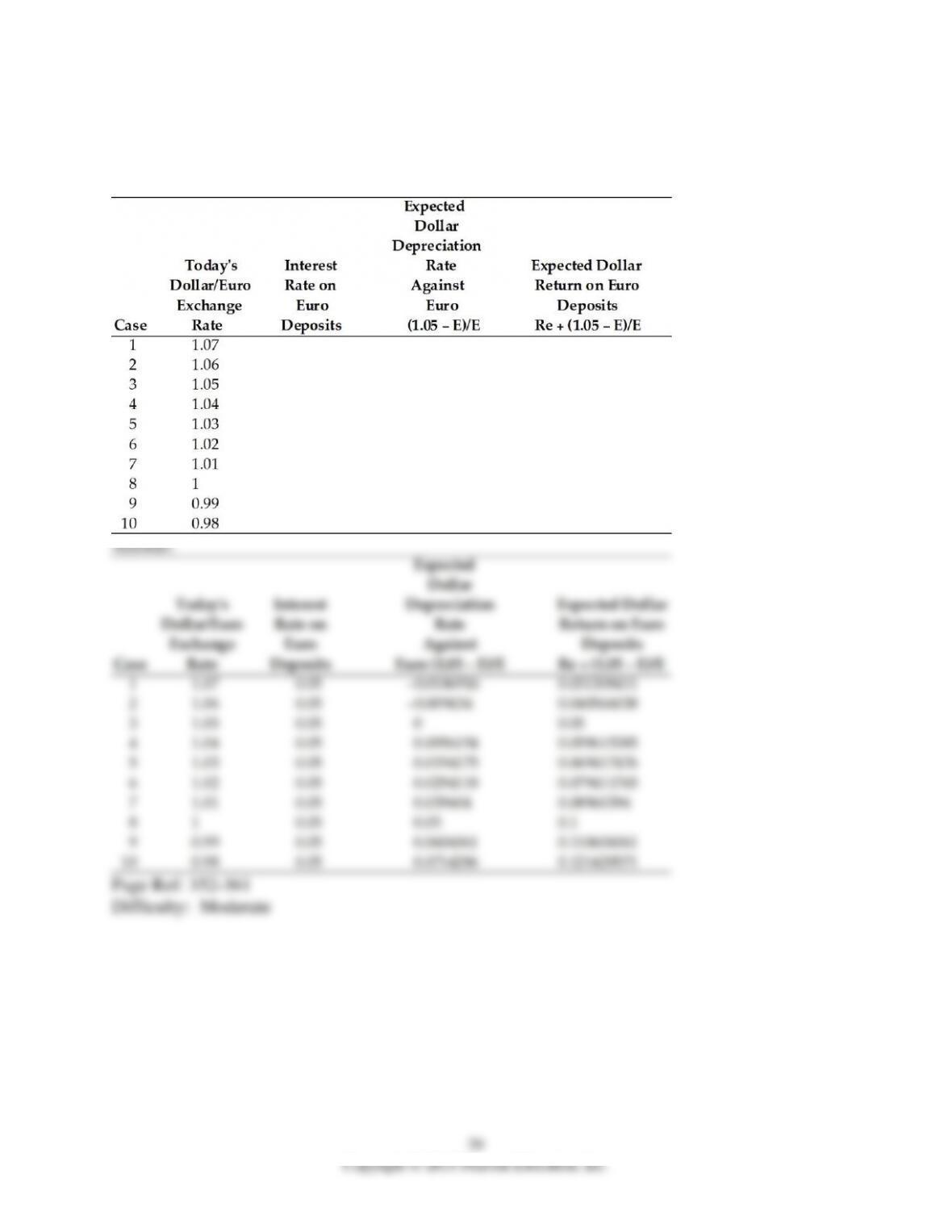

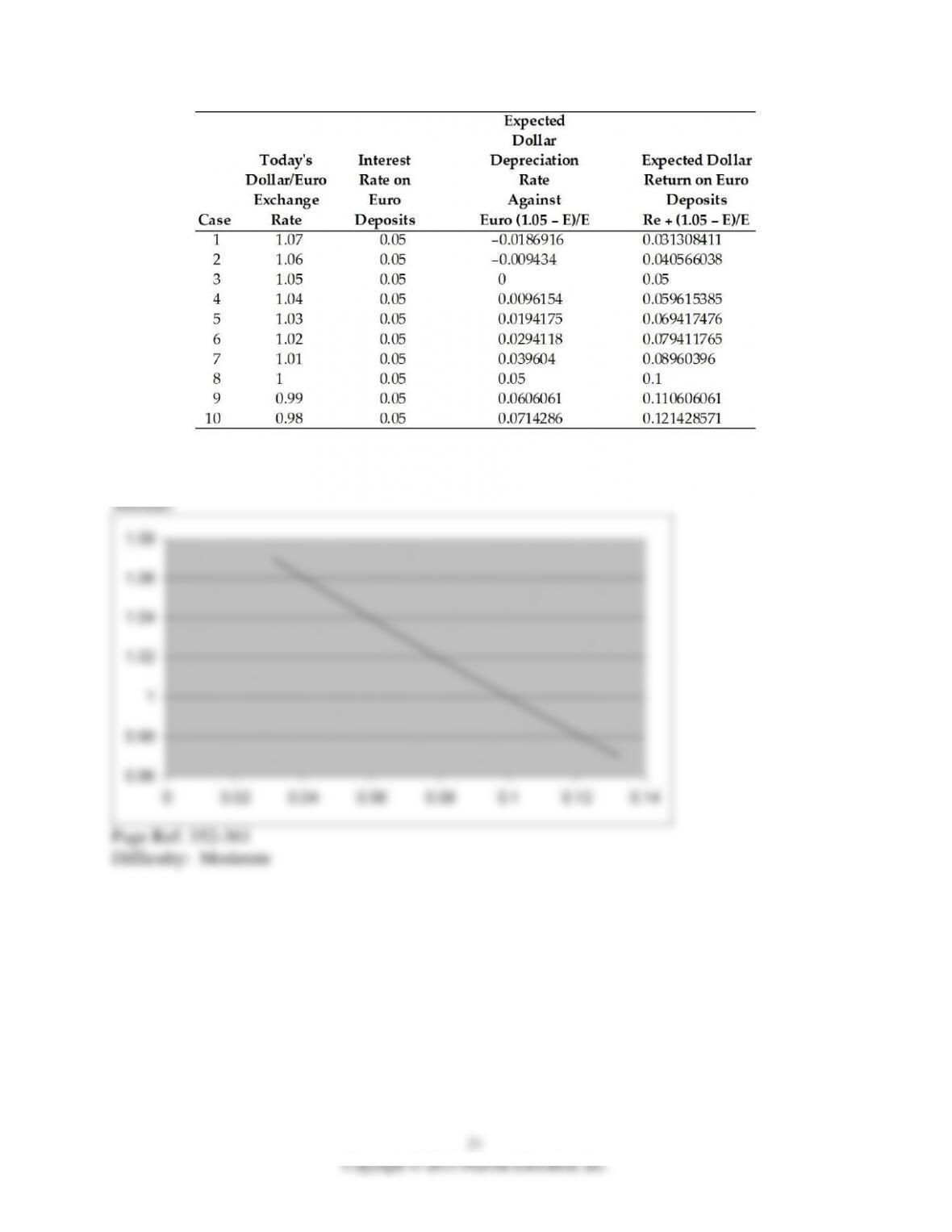

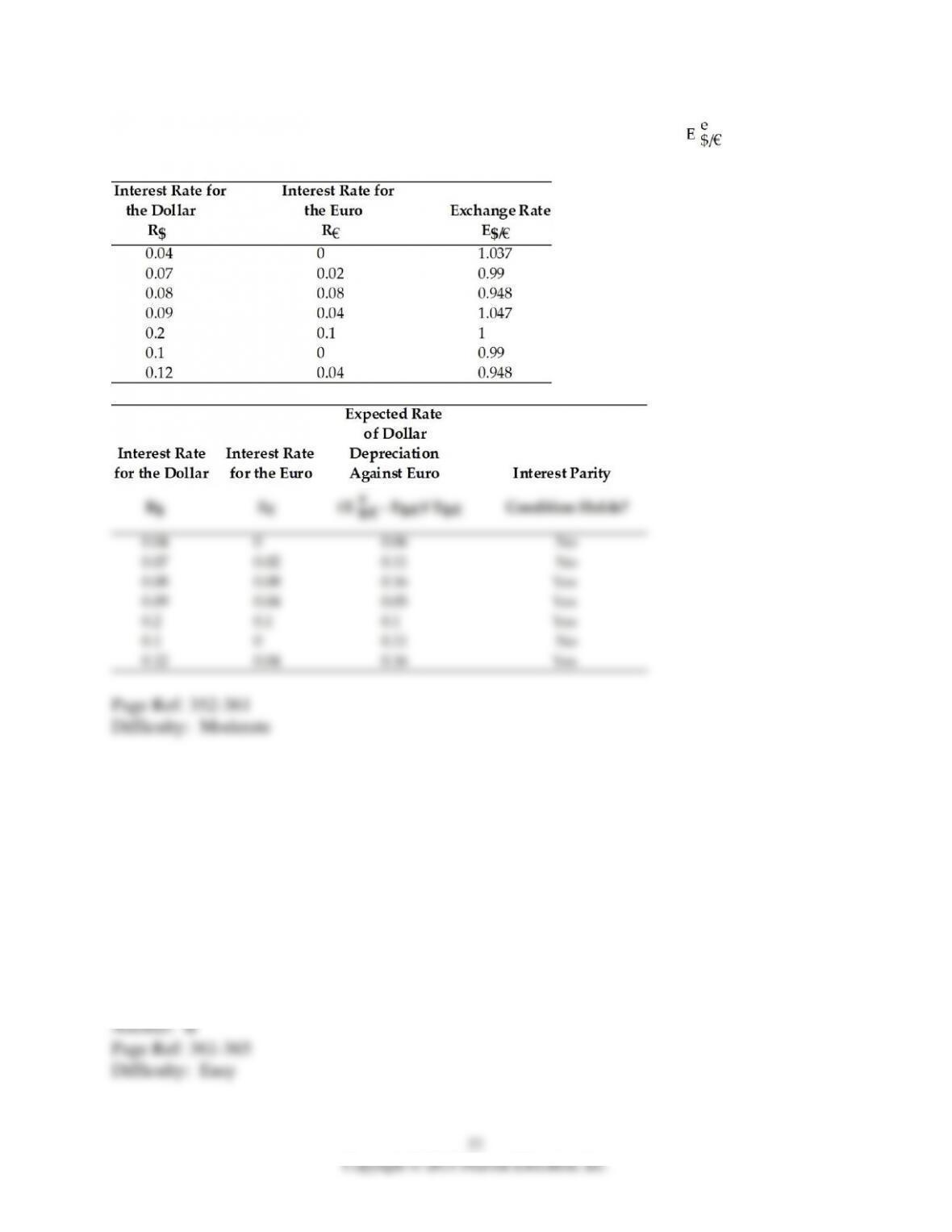

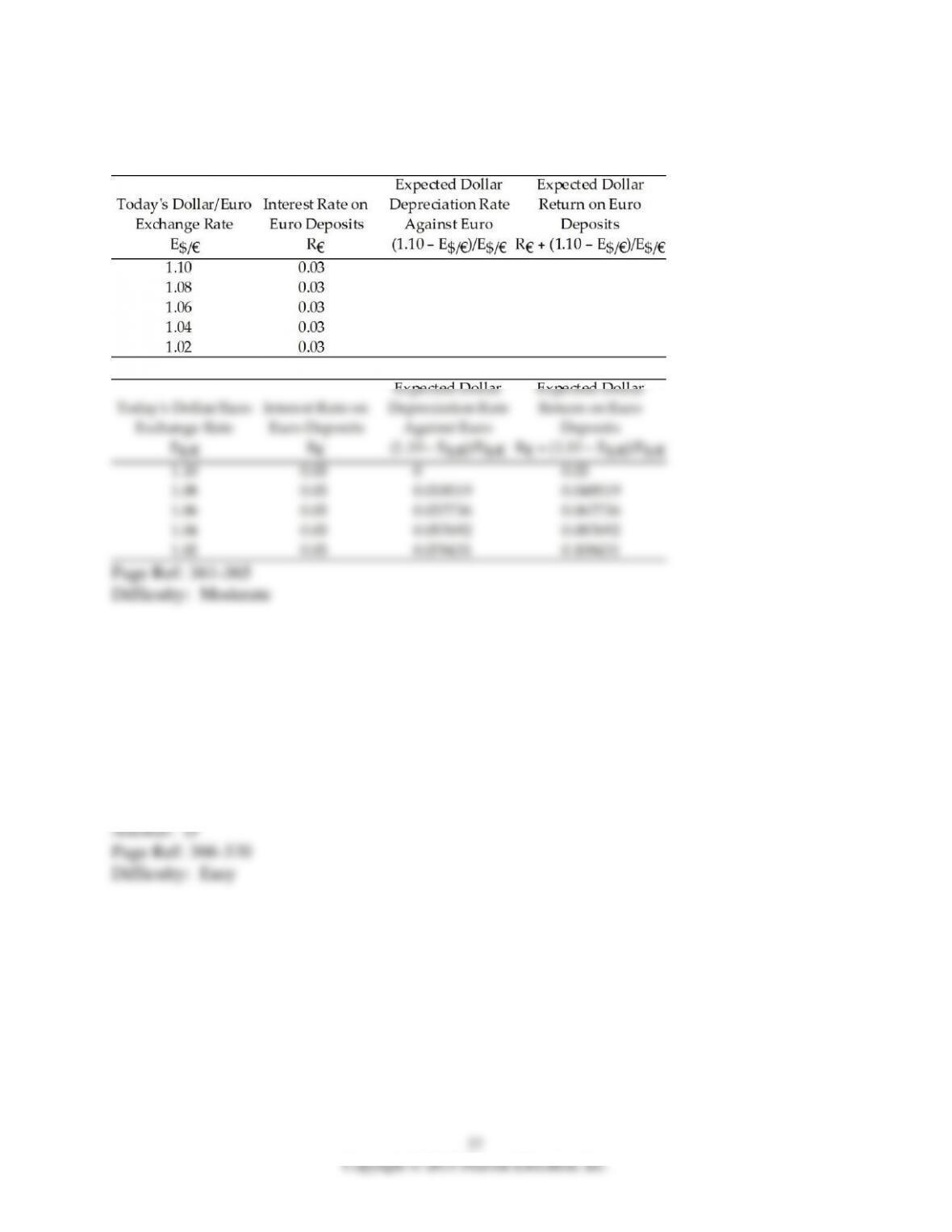

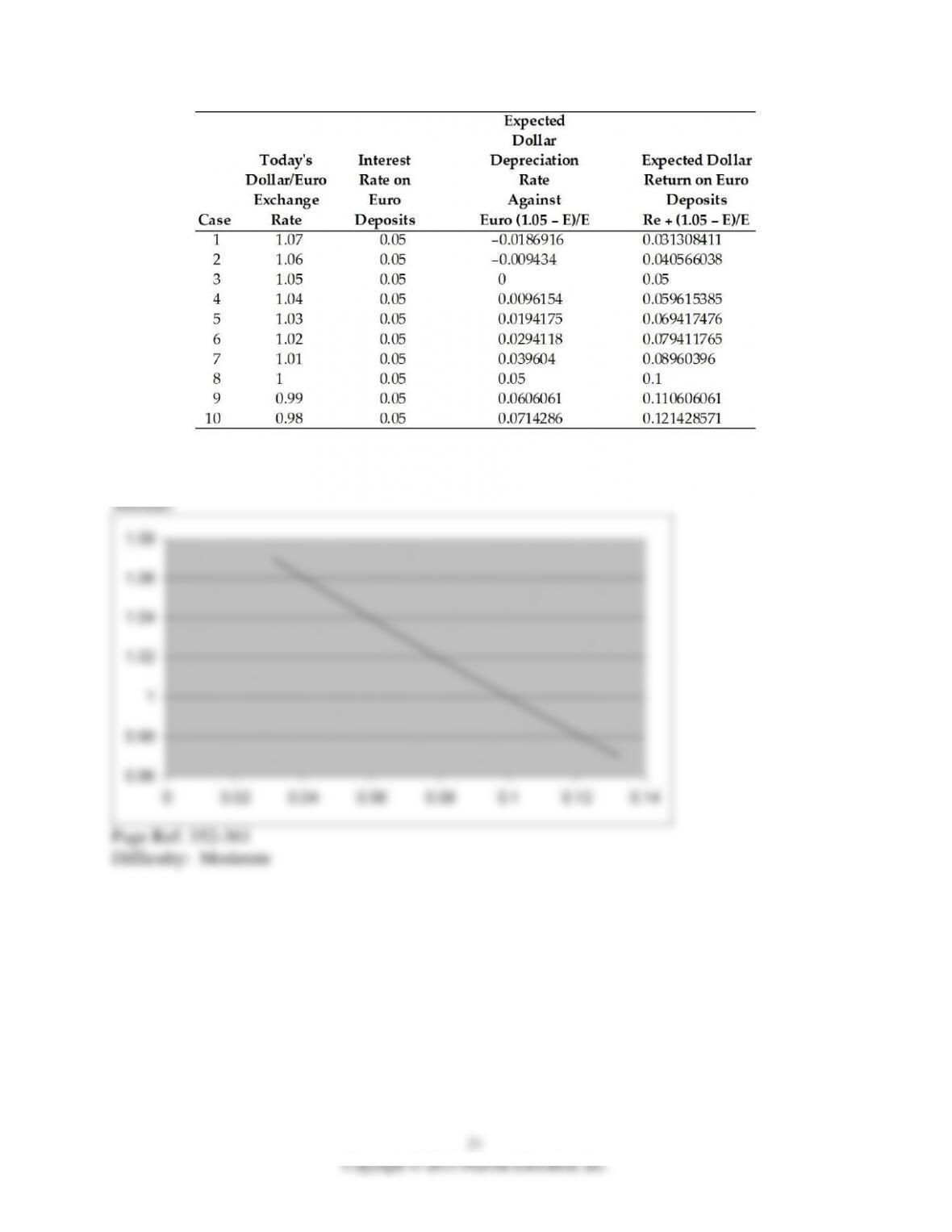

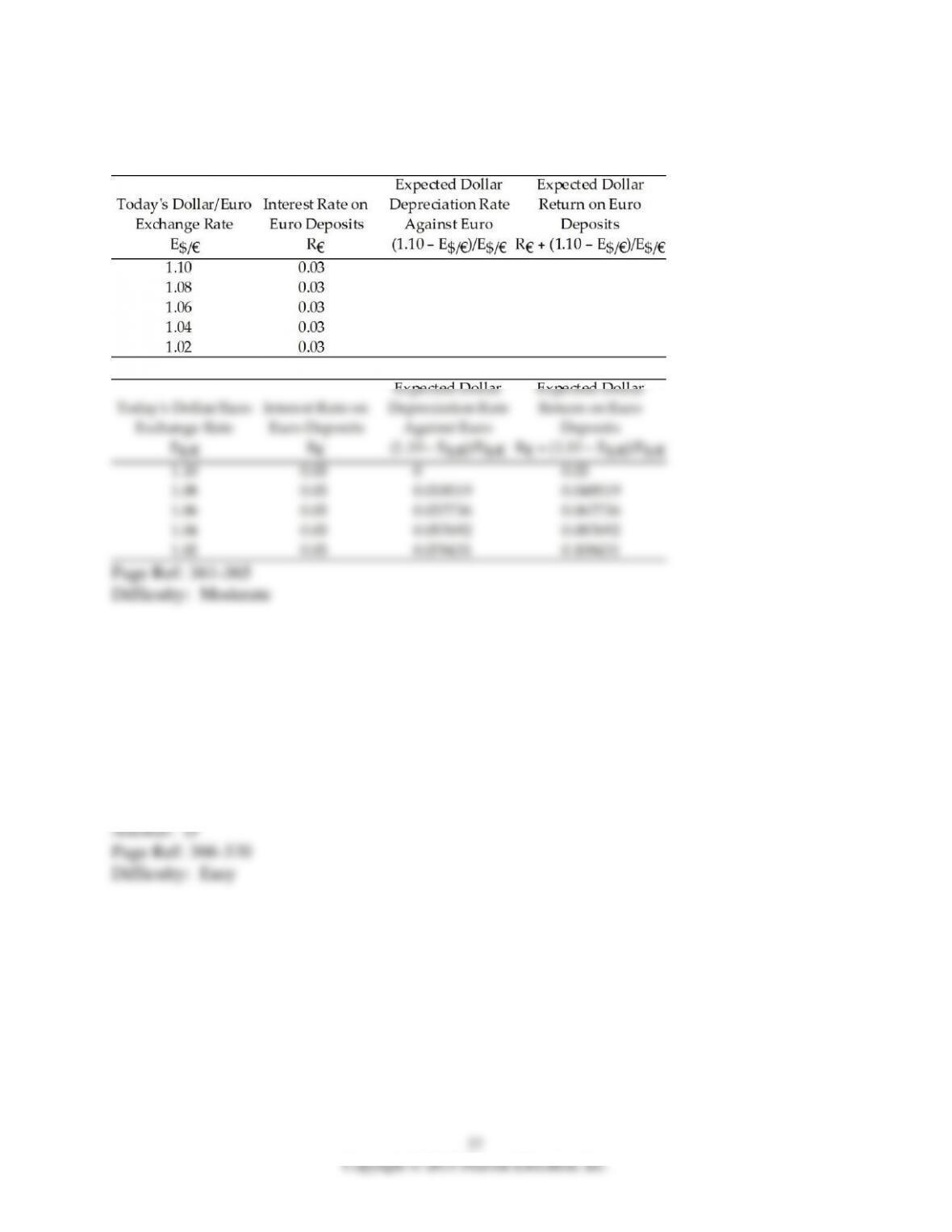

8) Calculate the Expected Dollar Depreciation Rate against the euro and the expected dollar

return on euro deposits if the expected exchange rate is $1.10 per euro.

Answer:

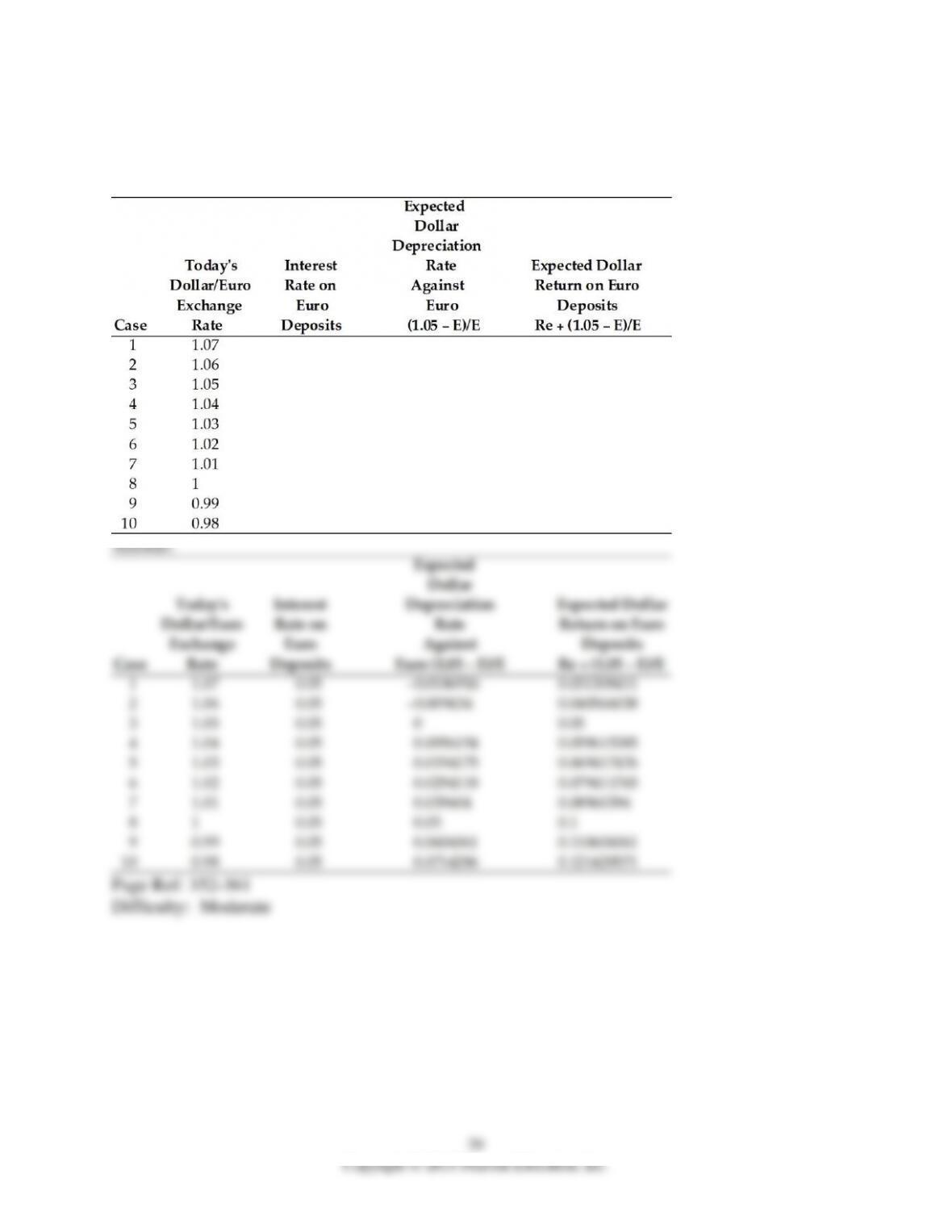

14.5 Interest Rates, Expectations, and Equilibrium

1) Which one of the following statements is the MOST accurate?

A) A rise in the interest rate offered by dollar deposits causes the dollar to appreciate.

B) A rise in the interest rate offered by dollar deposits causes the dollar to depreciate.

C) A rise in the interest rate offered by dollar deposits does not affect the U.S. dollar.

D) For a given euro interest rate and constant expected exchange rate, a rise in the interest rate

offered by dollar deposits causes the dollar to appreciate.

E) A rise in the interest rate offered by the dollar causes the euro to appreciate.