Assume the average vehicle selling price in the United States last year was $41,996. The average price 9 years earlier was $29,000. What was the annual increase in the selling price over this time period?

A. 3.89 percent

B. 4.20 percent

C. 4.56 percent

D. 5.01 percent

E. 5.40 percent

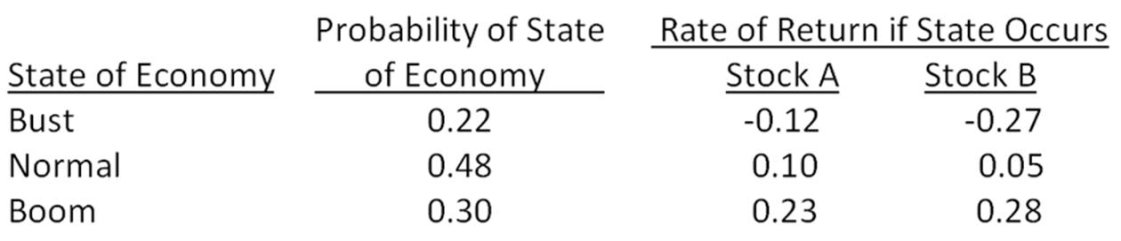

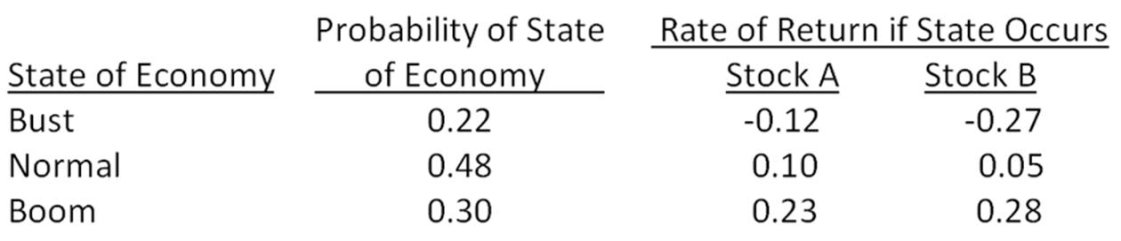

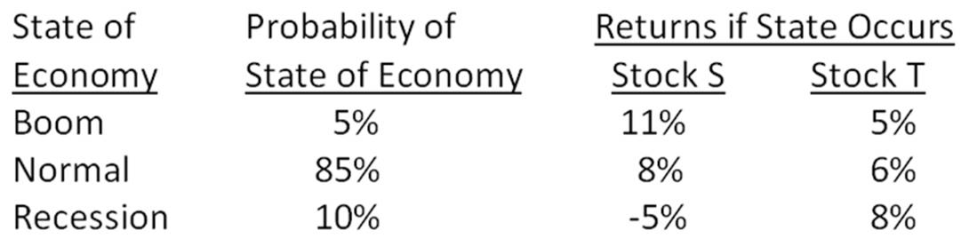

Suppose you observe the following situation:

Assume the capital asset pricing model holds and stock A’s beta is greater than stock B’s beta by 0.21. What is the expected market risk premium?

A. 8.8 percent

B. 9.5 percent

C. 12.6 percent

D. 17.9 percent

E. 20.0 percent

Bleakly Enterprises has a capital structure of 40 percent common stock, 10 percent preferred stock, and 50 percent debt. The flotation costs are 4.5 percent for debt, 7 percent for preferred stock, and 9.5 percent for common stock. The corporate tax rate is 34 percent. What is the weighted average flotation cost?

A. 5.8 percent

B. 6.2 percent

C. 6.4 percent

D. 6.6 percent

E. 6.8 percent

A stock has an expected return of 11 percent, the risk-free rate is 5.2 percent, and the market risk premium is 5 percent. What is the stock’s beta?

A. 1.08

B. 1.16

C. 1.29

D. 1.32

E. 1.35

What is the information content effect?

A. any type of new information that causes a firm to cease paying dividends

B. any news announcement that was anticipated and thus produces no reaction from investors

C. the primary contributing data that helps directors determine the amount of a particular dividend payment

D. any type of reaction from a shareholder in response to a news announcement related to the stock issuer

E. the financial market’s reaction to a change in the amount of a firm’s dividend

A sudden and severe decline in market prices is best described as a market:

A. crash.

B. revolver.

C. bubble.

D. limit.

E. mispricing.

A put option that expires in eight months with an exercise price of $57 sells for $3.85. The stock is currently priced at $59, and the risk-free rate is 3.1 percent per year, compounded continuously. What is the price of a call option with the same exercise price and expiration date?

A. $6.67

B. $7.02

C. $7.34

D. $7.71

E. $7.80

New York Deli has 7 percent preferred stock outstanding that sells for $34 a share. This stock was originally issued at $45 per share. What is the cost of preferred stock?

A. 13.68 percent

B. 14.00 percent

C. 18.29 percent

D. 20.59 percent

E. 20.80 percent

Jefferson & Daughter has a cost of equity of 14.6 percent and a pre-tax cost of debt of 7.8 percent. The required return on the assets is 13.2 percent. What is the firm’s debt-equity ratio based on M & M II with no taxes?

A. 0.26

B. 0.33

C. 0.37

D. 0.43

E. 0.45

Which one of the following is true according to Generally Accepted Accounting Principles?

A. Depreciation may or may not be recorded at management’s discretion.

B. Income is recorded based on the matching principle.

C. Costs are recorded based on the realization principle.

D. Depreciation is recorded based on the recognition principle.

E. Costs of goods sold are recorded based on the matching principle.

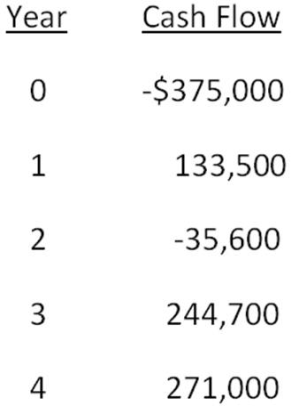

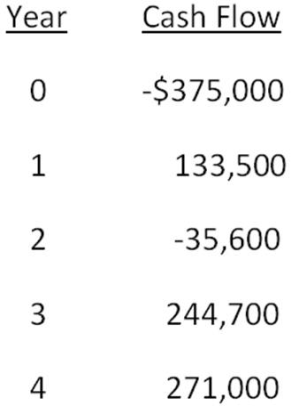

Home Décor & More is considering a proposed project with the following cash flows. Should this project be accepted based on the combination approach to the modified internal rate of return if both the discount rate and the reinvestment rate are 16 percent? Why or why not?

A. Yes; The MIRR is 14.78 percent.

B. Yes; The MIRR is 17.42 percent.

C. No; The MIRR is 12.91 percent.

D. No; The MIRR is 14.78 percent.

E. No; The MIRR is 17.42 percent.

Mountain Gear can manufacture mountain climbing shoes for $15.25 per pair in variable raw material costs and $18.46 per paid in variable labor costs. The shoes sell for $135 per pair. Last year, production was 170,000 pairs and fixed costs were $830,000. What is the minimum acceptable total revenue the company should accept for a one-time order for an extra 10,000 pairs?

A. $149,500

B. $287,600

C. $337,100

D. $380,211

E. $1,164,100

Which one of the following statements concerning stock exchanges is correct?

A. NASDAQ is a broker market.

B. The NYSE is a dealer market.

C. The exchange with the strictest listing requirements is NASDAQ.

D. Some large companies are listed on NASDAQ.

E. Most debt securities are traded on the NYSE.

Some Freight Line Express shareholders are very dissatisfied with the performance of the firm’s current management team. These shareholders want to gain control of the board of directors so they can have the power to oust current management. As a means of gaining control, these shareholders have select candidates for all of the open positions on the firm’s board of directors. Since they have insufficient votes to guarantee the election of these individuals, they are contacting other shareholders and asking them to vote with them on this important matter. Of course, the current management team is encouraging shareholders to vote for their candidates for the board. Which one of the following terms is best illustrated by this situation?

A. tender offer

B. proxy contest

C. going-private transaction

D. leveraged buyout

E. consolidation

Assume that an item costs $100 in the U.S. and the exchange rate between the U.S. and Canada is: $1 = C$1.27. Which one of the following concepts supports the idea that the item that sells for $100 in the U.S. is currently selling in Canada for $127?

A. unbiased forward rates condition

B. uncovered interest rate parity

C. international Fisher effect

D. purchasing power parity

E. interest rate parity

The weighted average cost of capital for a wholesaler:

A. is equivalent to the aftertax cost of the firm’s liabilities.

B. should be used as the required return when analyzing a potential acquisition of a retail outlet.

C. is the return investors require on the total assets of the firm.

D. remains constant when the debt-equity ratio changes.

E. is unaffected by changes in corporate tax rates.

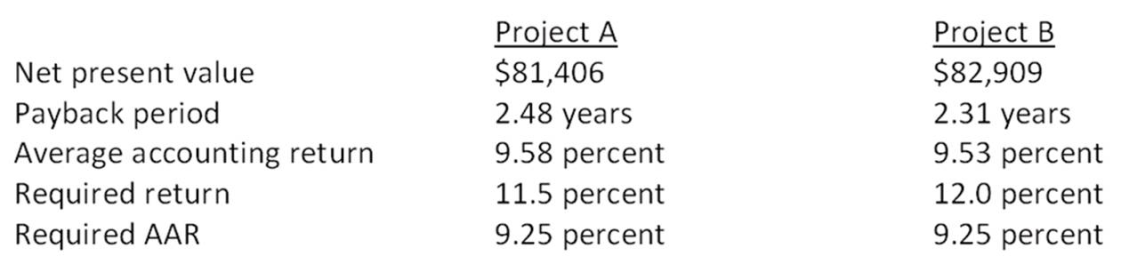

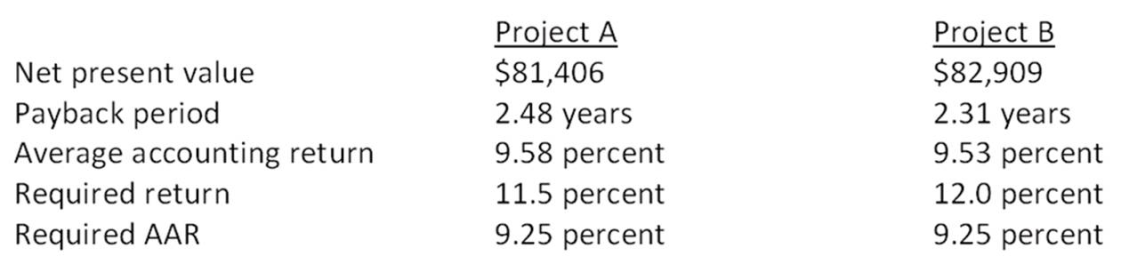

Isaac has analyzed two mutually exclusive projects of similar size and has compiled the following information based on his analysis. Both projects have 3- year lives.

Isaac has been asked for his best recommendation given this information. His recommendation should be to accept:

A. both projects.

B. project B because it has the shortest payback period.

C. project B and reject project A based on their net present values.

D. project A and reject project B based on their average accounting returns.

E. neither project.

Currently, The Toy Box sells 465 units a month at an average price of $42 a unit. The company thinks it can increase sales by an additional 130 units a month if it switches to a net 30 credit policy. The monthly interest rate is 0.4 percent and the variable cost per unit is $21. What is the incremental cash inflow of the proposed credit policy switch?

A. $2,120

B. $2,730

C. $2,760

D. $2,810

E. $5,070

Which one of the following events would be included in the expected return on Sussex stock?

A. The chief financial officer of Sussex unexpectedly resigned.

B. The labor union representing Sussex’ employees unexpectedly called a strike.

C. This morning, Sussex confirmed that its CEO is retiring at the end of the year as was anticipated.

D. The price of Sussex stock suddenly declined in value because researchers accidentally discovered that one of the firm’s products can be toxic to household pets.

E. The board of directors made an unprecedented decision to give sizeable bonuses to the firm’s internal auditors for their efforts in uncovering wasteful spending.

Roger’s Store begins each week with 150 phasers in stock. This stock is depleted each week and reordered. The carrying cost per phaser is $48 per year and the fixed order cost is $70. What is the optimal number of orders that should be placed each year?

A. 48.69

B. 51.71

C. 54.20

D. 61.10

E. 64.50

You purchase a bond with an invoice price of $1,460. The bond has a coupon rate of 7.5 percent, and there are 3 months to the next semiannual coupon date. What is the clean price of this bond?

A. $1,441.25

B. $1,452.17

C. $1,460.00

D. $1,467.83

E. $1,483.50

Precise Machinery is analyzing a proposed project. The company expects to sell 2,300 units, give or take 5 percent. The expected variable cost per unit is $260 and the expected fixed costs are $589,000. Cost estimates are considered accurate within a plus or minus 4 percent range. The depreciation expense is $129,000. The sales price is estimated at $750 per unit, plus or minus 3 percent. What is the sales revenue under the worst case scenario?

A. $1,686,825

B. $1,496,250

C. $1,589,588

D. $1,593,500

E. $1,620,675

When weighing a decision, Kate places greater emphasis on opinions that match her own than she does on opinions offered by others that disagree with her personal point of view. Kate illustrates which one of the following?

A. frame dependence

B. overconfidence

C. gambler’s fallacy

D. confirmation bias

E. overoptimism

Last year, you purchased 500 shares of Analog Devices, Inc. stock for $11.16 a share. You have received a total of $120 in dividends and $7,190 from selling the shares. What is your capital gains yield on this stock?

A. 26.70 percent

B. 26.73 percent

C. 28.85 percent

D. 29.13 percent

E. 31.02 percent

Collingwood Homes has a bond issue outstanding that pays an 8.5 percent coupon and matures in 16.5 years. The bonds have a par value of $1,000 and a market price of $944.30. Interest is paid semiannually. What is the yield to maturity?

A. 8.36 percent

B. 8.42 percent

C. 8.61 percent

D. 8.74 percent

E. 9.16 percent

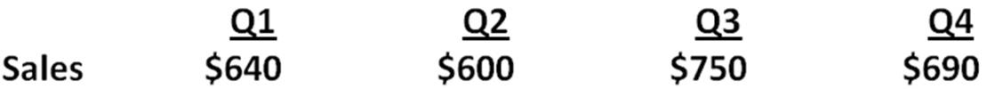

The Wake-Up Coffee Company has projected the following quarterly sales amounts for the coming year:

Accounts receivable at the beginning of the year are $200. Wake-Up has a 60-day collection period. What is the amount of the accounts receivable balance at the end of Quarter 3?

A. $375

B. $450

C. $500

D. $600

E. $700

Johnson Tire Distributors has debt with both a face and a market value of $12,000. This debt has a coupon rate of 6 percent and pays interest annually. The expected earnings before interest and taxes are $2,100, the tax rate is 30 percent, and the unlevered cost of capital is 11.7 percent. What is the firm’s cost of equity?

A. 22.46 percent

B. 22.87 percent

C. 23.20 percent

D. 23.59 percent

E. 25.14 percent

A pro forma statement indicates that both sales and fixed assets are projected to increase by 7 percent over their current levels. Given this, you can safely assume that the firm:

A. is projected to grow at the internal rate of growth.

B. is projected to grow at the sustainable rate of growth.

C. currently has excess capacity.

D. is currently operating at full capacity.

E. retains all of its net income.

You are comparing two annuities which offer quarterly payments of $2,500 for five years and pay 0.75 percent interest per month. Annuity A will pay you on the first of each month while annuity B will pay you on the last day of each month. Which one of the following statements is correct concerning these two annuities?

A. These two annuities have equal present values but unequal futures values at the end of year five.

B. These two annuities have equal present values as of today and equal future values at the end of year five.

C. Annuity B is an annuity due.

D. Annuity A has a smaller future value than annuity B.

E. Annuity B has a smaller present value than annuity A.

The entire repayment of which one of the following loans is computed simply by computing a single future value?

A. interest-only loan

B. balloon loan

C. amortized loan

D. pure discount loan

E. bullet loan

Steve recently sold an option that requires him to purchase 100 shares of Omega stock at $40 a share should the option owner decide to exercise the option. What type of option contract did Steve sell?

A. futures option

B. call option

C. put option

D. straddle

E. strangle

Which one of the following is a system for managing demand-dependent inventories that minimizes the inventory levels of a firm?

A. just-in-time inventory

B. turnover planning

C. net working capital planning

D. inventory scoring

E. inventory ranking

A proposed project has a contribution margin per unit of $13.10, fixed costs of $74,000, depreciation of $12,500, variable costs per unit of $22, and a financial break-even point of 11,360 units. What is the operating cash flow at this level of output?

A. $0

B. $12,500

C. $62,309

D. $74,816

E. $86,500

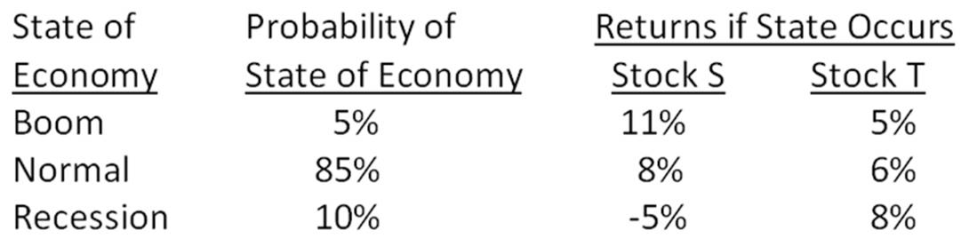

What is the standard deviation of the returns on a $30,000 portfolio which consists of stocks S and T? Stock S is valued at $21,000.

A. 2.07 percent

B. 2.61 percent

C. 3.36 percent

D. 3.49 percent

E. 3.63 percent