1) Supplies is a temporary account.

Answer:View Answer

2) Both merchandising and manufacturing businesses produce their own products, but service businesses do not.

Answer:View Answer

3) Expenses are increases in owner’s equity caused by providing goods or services for customers.

Answer:View Answer

4) Investors and management use the statement of cash flows to evaluate a firm’s profitability.

Answer:View Answer

5) The wages and benefits of the assembly line workers are included in manufacturing overhead.

Answer:View Answer

6) A sales allowance is recorded with a credit to Accounts receivable.

Answer:View Answer

7) A company urgently needs to repair its fire alarm system, which will cost $6,000. The two senior managers who are authorized to approve payments over $5,000 are both on holiday and cannot be reached. The office manager is only authorized to approve payments up to $5,000, but is concerned about the risks and safety factors involved, and wants to have the repair work done immediately. She asks if the contractor could split up the repair bill into two separate invoices, one for parts, and one for labor, so that she could approve both of them separately, and get the work done right away. This action would not be considered unethical, as long as the office manager does not violate specific company rules, or deliberately misrepresent the facts of the situation.

Answer:View Answer

8) The common-size statement percentages are the same percentages that appear in horizontal analysis.

Answer:View Answer

9) Archer Company and Zorro Company both have significant amounts of accounts receivable at any time, and both experience uncollectible accounts from time to time. Archer uses the aging method to account for uncollectible accounts, and Zorro uses the direct write-off method. Zorro Company’s method complies with GAAP and produces a better matching of revenues and expenses than does Archer Company’s method.

Answer:View Answer

10) The journal entry to open a new petty cash fund includes a debit to the petty cash account and a credit to cash in bank.

Answer:View Answer

11) A journal is a chronological record of transactions.

Answer:View Answer

12) A net loss for the year increases the balance in Retained earnings.

Answer:View Answer

13) A depreciable asset’s original cost is relevant when considering whether to replace the depreciable asset.

Answer:View Answer

14) Origami Company is considering a new project and needs to raise $800,000 of capital. Their after-tax net income would be $75,000 if they do not implement the new project. If the new project is implemented, it will add an additional $50,000 of profits before tax and interest. Origami’s income tax rate is 40%. If they use debt financing, the interest will be at 5%. Origami has 25,000 shares of common stock outstanding and no preferred stock. They would have to issue an additional 10,000 shares of common stock to finance the project with equity capital.

If Origami decides to use equity financing, their earnings per share will be higher than if they use debt.

Answer:View Answer

15) The net income for a company was $540,000 this year and $630,000 last year. Net income decreased by 17%.

Answer:View Answer

16) If fixed costs go up and all other factors remain the same, the company will have to sell fewer units to break even.

Answer:View Answer

17) LDR Manufacturing produces a pesticide chemical and uses process costing. There are three processing departments-Mixing, Refining, and Packaging. On January 1, 2012, the Refining Department had 2,000 liters of partially processed product in production. During January, 32,000 liters were transferred in from the Mixing Department and 29,000 liters were completed and transferred out. At the end of the month, there were 5,000 liters of partially processed product remaining in the Refining Department. See additional details below.

Refining Department, beginning balance at January 1, 2012

Quantity:2,000 units (partially processed)

Cost:$15,600 of costs transferred in

$1,900 of materials cost

$4,500 of conversion cost

$22,000 total account balance

Costs added during January

Cost of units transferred in:$222,400

Direct materials cost$45,000

Conversion cost$93,750

Refining Department, ending balance at January 31, 2012

Quantity:5,000 units (partially processed)

% completion for materials cost:90%

% completion for conversion cost:75%

Please perform a process costing analysis and answer the following question:

For the Refining Department in the month of January, what was cost per equivalent unit with respect to conversion costs? (Please round to nearest cent.)

A) $1.40

B) $3.00

C) $1.34

D) $2.86

Answer:View Answer

18) Which of the following accounts does NOT close at the end of the period?

A) Accumulated depreciation

B) Depreciation expense

C) Withdrawals

D) Sales revenues

Answer:View Answer

19) California Products Company has the following data as part of its budget for the 2nd quarter:

|

|

Apr |

May |

Jun |

|

Cash collections |

$30,000 |

$32,000 |

$36,000 |

|

Cash payments: |

|

|

|

|

Purchases of inventory |

4,500 |

4,600 |

3,800 |

|

Operating expenses |

7,200 |

7,600 |

8,000 |

|

Capital expenditures |

0 |

24,500 |

5,200 |

The cash balance at April 1 is forecast to be $8,200. Assume that there will be no financing transactions or costs during the quarter. Based on the above information only, what will the cash balance be at June 30?

A) $26,500

B) $40,800

C) $33,900

D) $21,800

Answer:View Answer

20) Which of the following is NOT considered a plant asset?

A) Copyright

B) Building

C) Land

D) Equipment

Answer:View Answer

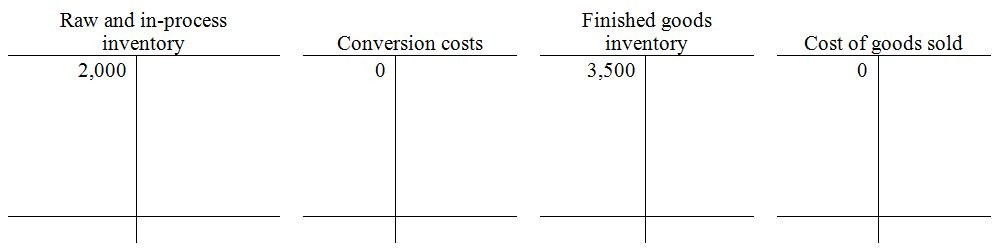

21) Archetype Fabrication makes pre-stressed concrete forms for the building industry. They use just-in-time production and accounting methodology. At the beginning of January, selected account balances are shown in the T-accounts below.

During January, the following 5 transactions take place:

1.Purchase $40,000 of materials on account.

2.Pay out $25,000 of direct labor costs.

3.Incur $9,000 of manufacturing overhead costs.

4.Complete 12 units. Each unit includes $1,500 of materials, $300 of direct labor, and $150 of manufacturing overhead costs.

5.Sell 10 of the 12 completed units at a price of $2,200.

Use the T-accounts shown above to record the transactions, and then answer the following question:

After transaction number 5, what was the balance in the Raw and in-process inventory account?

A) $25,400

B) $36,600

C) $22,000

D) $24,000

Answer:View Answer

22) Paid-in capital consists of:

A) amounts paid by customers

B) capital raised by issuing bonds

C) earnings generated by the corporation

D) amounts received from stockholders

Answer:View Answer

23) The Squash Company has 5,500 machine hours available annually to manufacture racquets.

The following information is available for the two different racquets produced by Squash:

|

Pro |

|

|

Unit sales price |

$200 |

|

Unit variable costs |

$120 |

|

Annual demand |

2,000 units |

|

Machine time |

2 hours per unit |

|

Mid |

|

|

Unit sales price |

$120 |

|

Unit variable costs |

$66 |

|

Annual demand |

4,000 units |

|

Machine time |

1.25 hours per unit |

How many units of each racquet should be manufactured for Squash to maximize its operating income?

A) 2,000 units of Pro and 1,200 units of Mid

B) 4,000 units of Mid and 250 units of Pro

C) 2,000 units of Pro and 4,000 units of Mid

D) 4,000 units of Mid and 500 units of Pro

Answer:View Answer

24) Which of the following describes the allocation base for allocating manufacturing overhead costs?

A) The factor that reflects the relationship between goods produced and the amount of overhead costs incurred

B) The estimated base amount of manufacturing overhead costs in a year

C) The percentage used to allocate direct labor to work in process

D) The formula for allocating depreciation expense over the life on an asset

Answer:View Answer

25) The bank charged a service fee of $20. How would this information be included on the bank reconciliation?

A) A deduction on the bank side

B) An addition on the book side

C) A deduction on the book side

D) An addition on the bank side

Answer:View Answer

26) On January 1, 2013, Thames Company purchases property and signs a 6-year mortgage note $60,000 at 4%. Please see the partial amortization schedule below.

|

Payment Number |

Date |

Payment |

Interest Expense |

Principal |

Balance |

|

|

1/1/2013 |

|

|

|

60,000.00 |

|

1 |

1/31/2013 |

980.00 |

200.00 |

780.00 |

59,220.00 |

|

2 |

2/28/2013 |

980.00 |

197.40 |

782.60 |

58,437.40 |

|

3 |

3/31/2013 |

980.00 |

194.79 |

785.21 |

57,652.19 |

|

4 |

4/30/2013 |

980.00 |

192.17 |

787.83 |

56,864.37 |

|

5 |

5/31/2013 |

980.00 |

189.55 |

790.45 |

56,073.91 |

|

6 |

6/30/2013 |

980.00 |

186.91 |

793.09 |

55,280.83 |

|

7 |

7/31/2013 |

980.00 |

184.27 |

795.73 |

54,485.10 |

|

8 |

8/31/2013 |

980.00 |

181.62 |

798.38 |

53,686.71 |

|

9 |

9/30/2013 |

980.00 |

178.96 |

801.04 |

52,885.67 |

|

10 |

10/31/2013 |

980.00 |

176.29 |

803.71 |

52,081.95 |

|

11 |

11/30/2013 |

980.00 |

173.61 |

806.39 |

51,275.56 |

|

12 |

12/31/2013 |

980.00 |

170.92 |

809.08 |

50,466.48 |

|

|

2013 totals |

11,760.00 |

2,226.48 |

9,533.52 |

|

|

13 |

1/31/2014 |

980.00 |

168.22 |

811.78 |

49,654.70 |

|

14 |

2/29/2014 |

980.00 |

165.52 |

814.48 |

48,840.22 |

|

15 |

3/31/2014 |

980.00 |

162.80 |

817.20 |

48,023.02 |

|

16 |

4/30/2014 |

980.00 |

160.08 |

819.92 |

47,203.09 |

|

17 |

5/31/2014 |

980.00 |

157.34 |

822.66 |

46,380.44 |

|

18 |

6/302014 |

980.00 |

154.60 |

825.40 |

45,555.04 |

|

19 |

7/31/2014 |

980.00 |

151.85 |

828.15 |

44,726.89 |

|

20 |

8/31/2014 |

980.00 |

149.09 |

830.91 |

43,895.98 |

|

21 |

9/30/2014 |

980.00 |

146.32 |

833.68 |

43,062.30 |

|

22 |

10/31/2014 |

980.00 |

143.54 |

836.46 |

42,225.84 |

|

23 |

11/30/2014 |

980.00 |

140.75 |

839.25 |

41,386.59 |

|

24 |

12/31/2014 |

980.00 |

137.96 |

842.04 |

40,544.55 |

|

|

2014 totals |

11,760.00 |

1,838.07 |

9,921.93 |

|

At the end of 2013, what amount would be shown on the balance sheet for mortgage payable (excluding the current portion)?

A) $40,544.55

B) $50,466.48

C) $9,533.52

D) $9,921.93

Answer:View Answer

27) Gnome Company is trying to decide whether to continue to manufacture a particular component or to buy the component from an outside supplier. Which of the following is RELEVANT to this decision?

A) The potential uses of the facilities that are currently used to manufacture the component

B) The insurance on the manufacturing facility which will continue regardless of the decision

C) Allocated corporate fixed costs which would have to be allocated to other products if the component is no longer manufactured

D) The cost of the equipment that is currently being used to manufacture the component

Answer:View Answer

28) Assume Division 1 of the XYZ Company had the following results last year.

|

Sales |

$5,000,000 |

|

Operating income |

1,000,000 |

|

Total assets (average) |

10,000,000 |

|

Current liabilities |

500,000 |

Management’s required rate of return is 8% and the weighted average cost of capital is 6%. Its effective tax rate is 30%. What is the division’s economic value added?

A) $60,000

B) $130,000

C) $270,000

D) $430,000

Answer:View Answer

29) DC Electronics uses a standard part in the manufacture of several of its radios. The cost of producing 30,000 parts is $90,000, which includes fixed costs of $33,000 and variable costs of $57,000. The company can buy the part from an outside supplier for $2.50 per unit, and avoid 30% of the fixed costs. Assume that factory space freed up by purchasing the part from an outside source can be used to manufacture another product that can earn profit of $11,600. If DC outsources, what will the effect on operating income be?

A) Up $15,000

B) Down $13,300

C) Down $24,900

D) Up $3,400

Answer:View Answer

30) Allbrand Company uses standard costs for their manufacturing division. Standards specify 0.1 direct labor hours per unit of product. At the beginning of the year, the static budget for variable overhead costs included the following data:

Production volume: 5,000 units

Estimated variable overhead costs:$12,500

Estimated direct labor hours:500 hours

At the end of the year, actual data were as follows:

Production volume:4,000 units

Actual variable overhead costs:$11,760

Actual direct labor hours:480 hours

How much is the standard price per hour for variable overhead?

A) $25.00 per direct labor hour

B) $20.50 per direct labor hour

C) $28.00 per direct labor hour

D) $26.88 per direct labor hour

Answer:View Answer

31) Abba Accounting expects its accountants to work a total of 24,000 direct labor hours per year. Abba’s estimated total indirect costs are $240,000. The direct labor rate is $75 per hour. If Abba does a job requiring 40 hours of direct labor, what is the total job cost?

A) $7,000

B) $400

C) $3,400

D) $3,000

Answer:View Answer

32) Which of the following should the purchasing agent NOT be able to do?

A) Prepare the purchase order

B) Receive the goods

C) Contact the supplier of the goods

D) Negotiate prices with suppliers

Answer:View Answer

33) Which of the following is the party borrowing funds on a note?

A) The maker of the note

B) The drawer of the note

C) The principal of the note

D) The payee of the note

Answer:View Answer

34) The taxable income of a proprietorship is:

A) combined with the personal income of the proprietor on a single return

B) reported on a separate return from the proprietor’s personal income

C) not taxable

D) handled similarly to that of a corporation

Answer:View Answer

35) Which of the following is TRUE?

A) Accrual accounting is required by generally accepted accounting principles

B) Accrual accounting records expenses when incurred. Cash-basis accounting records expenses when cash is paid

C) Accrual accounting records revenue when services are rendered. Cash-basis accounting records revenue when cash is received

D) All of the above are true

Answer:View Answer

36) A proprietor makes a cash withdrawal from the proprietorship. How does this affect the accounting equation?

A) This has no effect on assets, liabilities, or owner’s equity

B) Assets decrease; owner’s equity decreases

C) Assets increase; liabilities decrease

D) Assets decrease; owner’s equity increases

Answer:View Answer

37) The days’ sales in receivables measures:

A) how well a company can pay its current liabilities with its current assets

B) how many days it takes, on average, to collect receivables

C) how many days it takes, on average, to sell the inventory

D) the number of times per year a company sells goods and collects receivables

Answer:View Answer

38) Johnson Production Company uses just-in-time production and accounting methods. On June 1, Johnson paid $6,000 for factory repair and maintenance costs in cash. Which of the following journal entries correctly records this transaction?

A) Debit $6,000 to Cash, credit $6,000 to Manufacturing overhead

B) Debit $6,000 to Raw and in-process inventory, credit $6,000 to Cash

C) Debit $6,000 to Conversion costs, credit $6,000 to Cash

D) Debit $6,000 to Manufacturing overhead, credit $6,000 to Cash

Answer:View Answer

39) Which of the following statements is TRUE about the capital expenditures budget?

A) It is a part of the financial budget

B) It must be completed before the budgeted income statement is prepared

C) It includes the sales budget

D) It must be completed before the cash budget can be prepared

Answer:View Answer

40) On June 30, 2013, Stephans Company showed the following data on the equity section of their balance sheet:

|

Stockholders’ equity |

|

|

|

Common stock, $1 par |

100,000 shares authorized |

$40,000 |

|

|

40,000 shares issued |

|

|

Paid-in capital in excess of par |

|

260,000 |

|

Retained earnings |

|

940,000 |

|

Total stockholder’s equity |

|

$1,240,000 |

On July 1, 2013, Stephans distributed a 5% stock dividend. The market value of the stock at that time was $13 per share. Following this transaction, what would be the new balance in Paid-in capital in excess of par?

A) $286,000

B) $284,000

C) $260,000

D) $234,000

Answer:View Answer

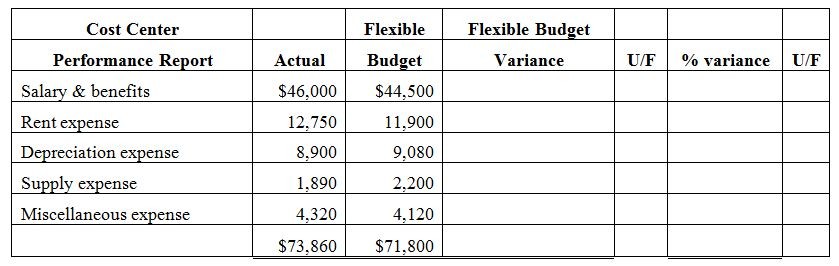

41) Union Company’s corporate payroll department is a cost center, and submits monthly performance reports. In the report below, there are both budgeted and actual data. Please use the format below and complete the report. The percentage amounts should be rounded to the nearest one-tenth of a percent.

Answer:View Answer

42) The following pertains to periodic inventory: Compute the Net purchases.

|

Net sales |

$198,000 |

|

Purchases |

92,000 |

|

Purchases returns and allowances |

1,800 |

|

Purchases discounts |

1,250 |

|

Freight in |

1,590 |

|

Beginning merchandise inventory |

63,000 |

|

Ending merchandise inventory |

37,000 |

A) $25,950

B) $87,360

C) $88,950

D) $106,000

Answer:View Answer

43) On March 1, 2014, Bayonne Services made a loan to one of its officers. The officer signed a 6-month note for $4,000 at 8%. Bayonne generally accrues interest at year-end only, so at the time the note matured, Bayonne had not accrued any interest revenue. On August 1 when the note matured, the officer settled in full with the company. How much interest revenue did Bayonne record?

A) $320

B) $4,160

C) $160

D) $4,000

Answer:View Answer

44) Nordin Avionics makes aircraft instrumentation. Their basic navigation radio requires $80 in variable costs and requires $2,000 per month in fixed costs. If they process the radio further to enhance its functionality, it will require an additional $25 per unit of variable costs, plus an increase in fixed costs of $800 per month. The marketing manager believes they would be able to boost their price of the radio from $260 to $300. Nordin sells 30 radios per month. If they decide to process further, what would the impact be on monthly operational income?

A) It would increase by $1,050

B) It would increase by $250

C) It would decrease by $350

D) It would decrease by $750

Answer:View Answer

45) Which of the following would appear on the income statement of a company that uses the periodic inventory method, but would NOT appear on the income statement of a company that uses the perpetual inventory method?

A) Net sales

B) Cost of goods sold

C) Cost of goods available for sale

D) Insurance expenses

Answer:View Answer

46) Lindsey Smith decided to start her own CPA practice as a professional corporation, Smith CPA PC. Her corporation purchased an office building for $35, 000 which her real estate agent said was worth

$50,000 in the current market. The corporation records the building as a $50,000 asset because Lindsey believes that is the real value of the building. Which of the following concepts or principles of accounting is being violated?

A) Cost principle

B) Entity concept

C) Stable monetary unit concept

D) Going-concern concept

Answer:View Answer

47) A company received a bank statement showing a balance of $62,300. Reconciling items were outstanding checks of $1,450 and a deposit in transit of $8,500. What is the company’s adjusted bank balance?

A) $72,250

B) $60,850

C) $69,350

D) $70,850

Answer:View Answer

48) Which of the following describes the internal control procedure assignment of responsibilities?

A) To validate their accounting records, a company should have an audit by an external accountant

B) The company should separate the custody of assets from accounting

C) The external auditors will monitor internal controls

D) Have clearly assigned responsibilities for each position

Answer:View Answer

49) A company that uses the perpetual inventory method purchases inventory of $1,000 on account with terms of 2/10, n/30. Defective inventory of $200 is returned 2 days later and the accounts are appropriately adjusted. If the company paid the vendor within 10 days, which of the following entries would be made to record the payment?

A) $800 debit to Accounts payable and an $800 credit to Cash

B) $784 debit to Accounts payable, a $16 debit to Inventory and an $800 credit to Cash

C) $16 debit to Inventory, an $800 debit to Accounts payable and an $816 credit to Cash

D) $800 debit to Accounts payable, a $16 credit to Inventory and a $784 credit to Cash

Answer:View Answer

50) Jarvis Foods produces a gourmet condiment which sells for $10.00 per unit. Variable costs are $7.50 per unit, and fixed costs are $18,000 per month. Jarvis is currently selling 8,000 units per month. If Jarvis is forced to reduce the selling price down to $9.00 per unit, and volume remains constant, how will that affect its breakeven point in dollars?

A) Breakeven will go down by $36,000 of sales revenues

B) Breakeven will go down by $4,800 of sales revenues

C) Breakeven will go up by $36.000 of sales revenues

D) Breakeven will go up by $8,000 of sales revenues

Answer:View Answer

51) Which of the following describes the control environment?

A) Internal auditors monitor company controls to safeguard assets, and external auditors monitor the controls to ensure that the accounting records are accurate

B) The control environment is the “tone at the top” of the business

C) The control environment is designed to ensure that the business’s goals are achieved

D) A company must identify its risks

Answer:View Answer

52) Navajo Mining Company purchased a mine in 2013 for $3,400,000. It was estimated that the mine contained 200,000 tons of ore and that the mine would be worthless after all of the ore was extracted. The company extracted 25,000 tons of ore in 2013 and 30,000 tons of ore in 2014.

What is depletion expense for 2013?

A) $340,000

B) $680,000

C) $510,000

D) $425,000

Answer:View Answer

53) Which of the following is NOT a relevant performance indicator for the balanced scorecard’s financial perspective?

A) Earnings per share

B) Revenue growth

C) Return on investment

D) Number of repeat customers

Answer:View Answer