Answer at the bottom of the page

1) The general ledger and reporting system consists of the ________ involved in ________ the general ledger and ________ reports.

A) business transactions; updating; processing

B) data processing; business transactions for; printing

C) information processing; updating; creating

D) business transactions; data processing; preparing

2) Which item below is not considered a major input to the general ledger and reporting system?

A) summary entries from the major subsystems

B) reports from managers

C) adjusting entries

D) financing and investing activities

3) Who provides the adjusting entries for a well-designed general ledger and reporting system?

A) various user departments

B) the treasurer’s area

C) the other major AIS subsystems

D) the controller’s area

4) The general ledger and reporting system is designed to provide information for which of the following user groups?

A) internal users

B) external users

C) inquiry processing by internal or external users

D) all of the above

5) The general ledger system of an organization should be designed to serve the information requirements of both internal and external users. This means that the system should support

A) producing expansive regular periodic reports to cover all information needs.

B) the real-time inquiry needs of all users.

C) producing regular periodic reports and respond to real-time inquiry needs.

D) access by investors and creditors of the organization to general ledger balances.

6) How is general ledger updating accomplished by the various accounting subsystems?

A) Individual journal entries for each accounting subsystem transaction update the general ledger every 24 hours.

B) Summary journal entries that represent the results of all transactions for a certain time period are used to update the general ledger.

C) The controller or treasurer must approve accounting subsystem journal entries before any updating may occur.

D) Nonroutine transactions are entered into the system by the treasurer’s office.

7) When updating the general ledger, sales, purchases, and production are examples of ________ entries, and issuance or retirement of debt and the purchase or sale of investment securities are examples of ________ entries.

A) adjusting; controller originated

B) accounting subsystem; treasurer originated

C) adjusting; special journal

D) controller generated; special journal

8) Entries to update the general ledger are often documented by which of the following?

A) general journal

B) subsidiary journal

C) subsidiary ledgers

D) journal vouchers

9) Adjusting entries that reflect events that have already occurred, but for which no cash flow has taken place are classified as

A) accruals.

B) deferrals.

C) revaluations.

D) corrections.

10) Recording interest earned on an investment is an example of which type of adjusting journal entry?

A) accrual entry

B) deferral entry

C) revaluation entry

D) correcting entry

11) An adjusting entry made at the end of an accounting period that reflects the exchange of cash prior to performance of a related event is classified as a(n)

A) accrual entry.

B) deferral entry.

C) revaluation entry.

D) correcting entry.

12) Depreciation expense and bad debt expense are examples of which type of adjusting journal entry?

A) deferrals

B) accruals

C) revaluations

D) estimates

13) Adjusting entries that are made to reflect differences between the actual and recorded value of an asset or a change in accounting principle are called

A) reconciliations.

B) revaluations.

C) estimates.

D) accruals.

14) Adjusting entries that are made to counteract the effects of errors found in the general ledger are called

A) accruals.

B) corrections.

C) deferrals.

D) estimates.

15) Corrections are entries made to correct errors found in ________.

A) all journals

B) special journals

C) the general ledger

D) the financial statements

16) Immediately after the adjusting entries are posted, the next step in the general ledger and reporting system is to prepare

A) an adjusted trial balance.

B) closing entries.

C) financial statements.

D) an unadjusted trial balance.

17) Financial statements are prepared in a certain sequence. Which statement is prepared last in the sequence?

A) the adjusted trial balance

B) the income statement

C) the balance sheet

D) the statement of cash flows

18) A listing of journal vouchers by numerical sequence, account number, or date is an example of

A) a general ledger control report.

B) a budget report.

C) a batch to be processed.

D) responsibility accounting.

19) If you believe not all adjusting entries were posted in the general ledger, you should prepare a general ledger control report listing journal vouchers in

A) numerical sequence.

B) chronological order.

C) general ledger account number order.

D) any order, since you have to review them all anyway.

20) If you believe a general ledger account was not adjusted properly or at all, you should prepare a general ledger control report listing journal vouchers in

A) numerical sequence.

B) chronological order.

C) general ledger account number order.

D) any order, since you have to review them all anyway.

21) The managerial report that shows planned cash inflows and outflows for major investments or acquisitions is the

A) journal voucher list.

B) statement of cash flows.

C) operating budget.

D) capital expenditures budget.

22) The operating budget

A) compares estimated cash flows from operations with planned expenditures.

B) shows cash inflows and outflows for each capital project.

C) depicts planned revenues and expenditures for each organizational unit.

D) is used to plan for the purchase and retirement of property, plant, and equipment.

23) Budgets and performance reports should be developed on the basis of

A) responsibility accounting.

B) generally accepted accounting principles.

C) financial accounting standards.

D) managerial accounting standards.

24) Performance reports for cost centers should compare actual versus budget ________ costs.

A) controllable

B) uncontrollable

C) fixed

D) variable

25) Performance reports for sales deparments should compare actual versus budget

A) revenue.

B) cost.

C) return on investment.

D) profit.

26) Departments that mostly provide services to other units and charge those units for services rendered should be evaluated as ________ centers.

A) cost

B) profit

C) investment

D) revenue

27) As responsibility reports are rolled up into reports for higher level executives, they

A) become less detailed.

B) become more detailed.

C) become narrower in scope.

D) look about the same.

28) Variances for variable costs will be misleading when the planned output differs from budgeted output. A solution to this problem would be

A) calling all costs fixed.

B) to use flexible budgeting.

C) better prediction of output.

D) to eliminate the budgeting process.

29) Concerning XBRL, which of the following statements is not true?

A) XBRL is a variant of XML.

B) XBRL is specifically designed for use in communicating the content of financial data.

C) XBRL creates unique tags for each data item.

D) XBRL’s adoption will require accountants and systems professionals tag data for their clients.

30) The benefits of XBRL include:

A) organizations can publish financial information only once, using standard XBRL tags.

B) tagged data is readable and interpretable by computers, so users don’t need re-enter data into order to work with it.

C) Both are benefits of XBRL.

D) Neither are benefits of XBRL.

31) Communications technology and the Internet can be used to reduce the time and costs involved in disseminating financial statement information. Users of such financial information still struggle in that many recipients have different information delivery requirements and may have to manually reenter the information into their own decision analysis tools. The ideal solution to solve these problems and efficiently transmit financial information via the Internet is to use

A) HTML code.

B) XML.

C) pdf file.

D) XBRL.

32) Which of the following statements is not true about an XBRL instance document?

A) An instance document includes instruction code as to how the document should be physically arranged and displayed.

B) An instance document contains facts about specific financial statement line items.

C) An instance document uses separate tags for each specific element.

D) An instance document can be used to tag financial and nonfinancial elements.

33) Which of the following are appropriate controls for the general ledger and reporting system?

A) using well-designed documents and records

B) online data entry with the use of appropriate edit checks

C) prenumbering documents and accounting for the sequence numbers

D) All of the above are appropriate.

34) A type of data entry control that would ensure that adjusting entries are posted to existing general ledger accounts is called a(n) ________ check.

A) validity

B) existence

C) closed loop verification

D) reasonableness

35) One way of ensuring that recurring adjusting journal entries are made each month would be to

A) make all the entries a month in advance.

B) rotate the responsibility among the accounting staff.

C) program the entries to be made automatically.

D) create a standard adjusting journal entry file.

36) Which of the following tasks are facilitated by maintaining a strong and secure audit trail?

A) tracing a transaction from original source document to the general ledger to a report

B) tracing an item in a report back through the general ledger to the original source document

C) tracing changes in general ledger accounts from beginning to ending balances

D) All of the above are facilitated by the audit trail.

37) Which of the following balanced scorecard dimensions provides measures on how efficiently and effectively the organization is performing key business processes?

A) financial

B) internal operations

C) innovation and learning

D) customer

38) Which of the following is not one of the principles of proper graph design for bar charts?

A) Include data values with each element.

B) Use 3-D rather than 2-D bars to make reading easier.

C) Use colors or shades instead of patterns to represent different variables.

D) Use titles that summarize the basic message.

39) Information about financing and investing activities for use in making general ledger entries is typically provided by the

A) budget department.

B) controller.

C) treasurer.

D) chief executive officer.

40) Adjusting entries that are made to recognize revenue that has been received but not yet earned are classified as

A) estimates.

B) deferrals.

C) accruals.

D) revaluations.

41) Adjusting entries that reflect a change in accounting principle used to value inventories are classified as

A) corrections.

B) estimates.

C) deferrals.

D) revaluations.

42) Cheryl Liao is an accountant at Folding Squid Technologies. While making an adjusting entry to the general ledger, she received the following error message, “The account number referenced in your journal entry does not exist. Do you want to create a new account?” This message was the result of a

A) validity check.

B) closed loop verification.

C) zero-balance check.

D) completeness test.

43) Cheryl Liao is an accountant at Folding Squid Technologies. While making an adjusting entry to the general ledger, she received the following error message, “Your journal entry must be a numeric value. Please reenter.” This message was the result of a

A) validity check.

B) field check.

C) zero-balance check.

D) completeness test.

44) Cheryl Liao is an accountant at Folding Squid Technologies. While making an adjusting entry to the general ledger, she received the following error message when she tried to save her entry, “The amounts debited and credited are not equal. Please correct and try again.” This message was the result of a

A) validity check.

B) field check.

C) zero-balance check.

D) completeness test.

45) Cheryl Liao is an accountant at Folding Squid Technologies. While making an adjusting entry to the general ledger, she received the following error message when she tried to save her entry, “The data you have entered does not include a source reference code. Please enter this data before saving.” This message was the result of a

A) validity check.

B) field check.

C) zero-balance check.

D) completeness test.

46) IFRS is an acronym for what?

A) International Financial Reporting Standards

B) Internal Forensic Response System

C) Input and Financial Reporting Standards

D) Internal Fault Recovery System

47) Which of the following is true about IFRS?

A) Financial statements likely must be prepared using IFRS beginning in 2015.

B) The switch to IFRS is required by the Sarbanes-Oxley Act.

C) IFRS is only slightly different than US GAAP.

D) The switch to IFRS is cosmetic onlythere isn’t any real impact on AIS.

48) Which of the following scenarios will not be allowed under IFRS?

A) A landscaping and garden retail store keeps piles of river rock, gravel, paving stones, and small decorative rocks in a fenced area on the side of the store. The store uses the most recent inventory costs when calculating cost of goods sold, since new inventory is piled on top of the older inventory.

B) A grocery store strictly enforces a shelf rotation policy, so that older inventory is always at the front and sold first. The store uses the oldest inventory costs to calculate cost of goods sold.

C) A farm chemical supplier maintains a large holding tank of chemicals, into which deliveries are periodically combined with the older chemicals. The supplier averages the cost of all inventory to calculate cost of goods sold.

D) All of the above are acceptable under IFRS.

49) Which of the following is true about accounting for fixed assets?

A) Depreciation expense under IFRS will likely be higher than under GAAP, because acquisitions of assets with multiple components must be separately depreciated under IFRS, whereas under GAAP assets could be bundled and depreciated over the longest of the useful life for any of the components.

B) IFRS doesn’t allow capitalization of any asset that separately accounts for less than 20% of total assets.

C) Depreciation expense under IFRS will likely be less than under GAAP, because standards for depreciable lives on asset classes are much longer than under GAAP.

D) IFRS and GAAP account for fixed assets in much the same way.

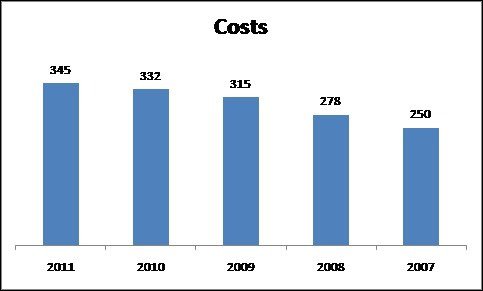

50) Which of the following statements is true about the chart below?

A) The x-axis is in reverse chronological order, which violates a principle of proper graph design.

B) The chart appears to conform to the principles of proper graph design.

C) The vertical axis doesn’t appear to start at the origin (zero).

D) The chart used 2-D bars instead of 3-D, which violates a principle of proper graph design.

51) Explain the purpose of a journal voucher file.

52) What is responsibility accounting?

53) How is a balanced scorecard used to assess organizational performance?

54) How is an audit trail used in the general ledger and reporting system?

55) Explain the benefits of XBRL.

56) Discuss the value and role of budgets as managerial reports.

57) Describe three threats in the general ledger and reporting system and identify corresponding controls for each threat.

THREAT 1: Errors in updating the general ledger because of inaccurate/incomplete journal entries or posting of journal entries Controls: (1) Input, edit, and processing controls over summary entries from subsystems. (a) Validity check over existence of general ledger accounts. (b) Field check over numeric data in amount field. (c) Zero-balance check ensures equality of debits and credits (d) Completeness test all pertinent data are entered (e) Redundant data check closed loop verification to see if on account numbers and descriptions, to ensure that the correct general ledger account is being accessed (f) Standard adjusting entry file for recurring entries improves accuracy of the process (g) Sign check on debit and credit entries (h) Calculation of run-to-run totals can verify the accuracy of journal voucher batch processing (2) Reconciliation and control reports can detect errors made during updating and processing; trial balances, clearing, and suspense accounts are examples (a) Balancing of control and subsidiary accounts (b) Control reports can help identify the source of errors in the general ledger update process listings of journal vouchers and general journal entries will show entries posted to the general ledger and ensures equality of debits and credits (3) The audit trail the path of transactions through the system-should be able to perform the following tasks: (a) Trace any transaction from its original source document to the general ledger; any other document or report using that data (b) Trace any item from a report or an output document to the general ledger and thence to the source document (c) Trace all changes in the general ledger balances from their beginning balance to their ending balance.

THREAT 2: Loss or unauthorized disclosure or alteration of financial data Controls: (1) User IDs, passwords, and access controls should be used (2) Enforce segregation of duties (3) Adjusting entries only from the controller’s area (4) Valid authorization for journal voucher submission.

THREAT 3: Loss or destruction of the general ledger Controls: (1) Use of internal and external file labels to protect from accidental data loss (2) Make regular backup copies of the general ledger, one copy stored off-site (3) A good disaster recovery plan and (4) access and processing integrity controls to ensure confidentiality and accuracy of data transmitted to branch offices or externally.

THREAT 4: Poor performance Controls: (1) XBRL, (2) redesign business processes, and (3) redesign metrics used to report results of business activities.